Wall Street Prep – Self Study Programs Premium Package

$19.00

Wall Street Prep Self Study Programs Premium Package [Instant Download]

1️⃣. What is Self Study Programs Premium Package?

Wall Street Prep’s Premium Package teaches you how to build investment banking financial models from scratch using Excel.

The program covers key skills: financial statement modeling, DCF valuation, trading comps, M&A modeling, and LBO analysis. Each topic uses real company case studies and actual financial data.

This self-paced training includes step-by-step video lessons and Excel practice files. It’s the same comprehensive program used by top investment banks to train their analysts.

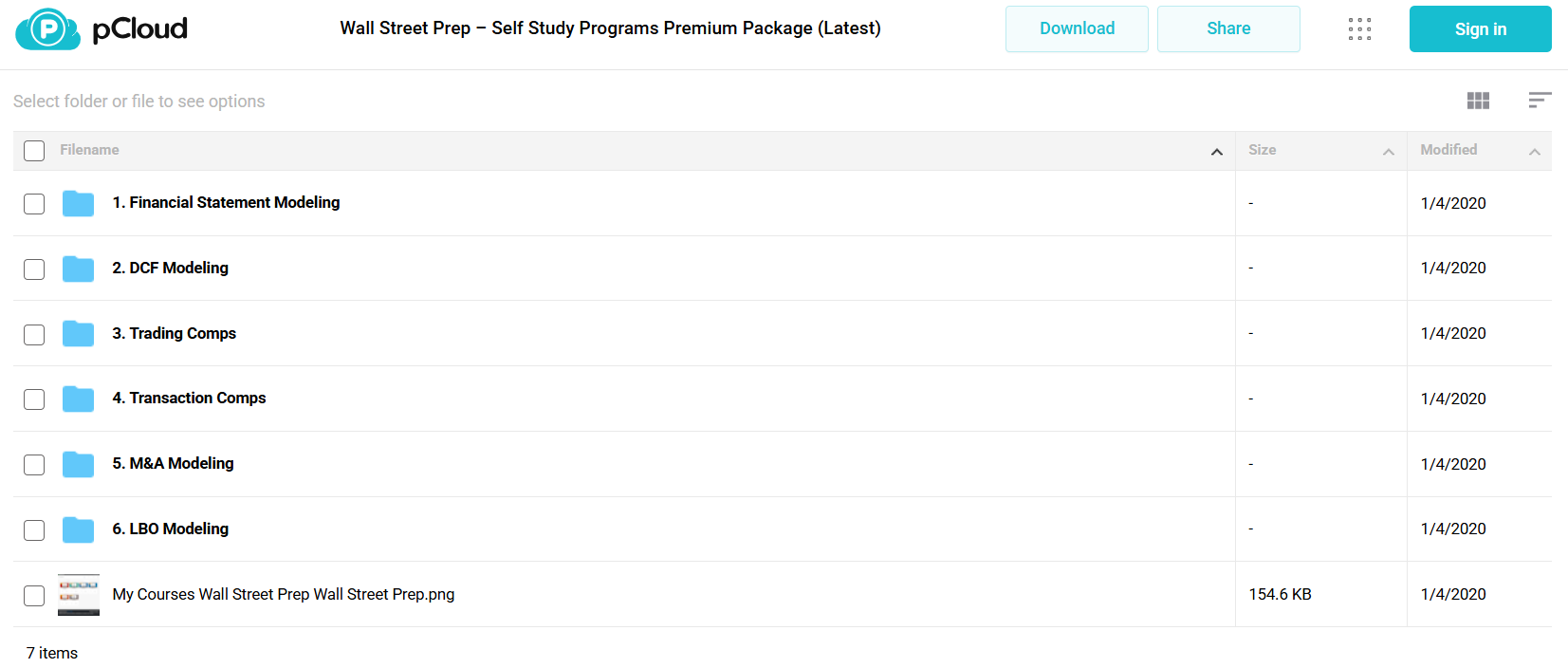

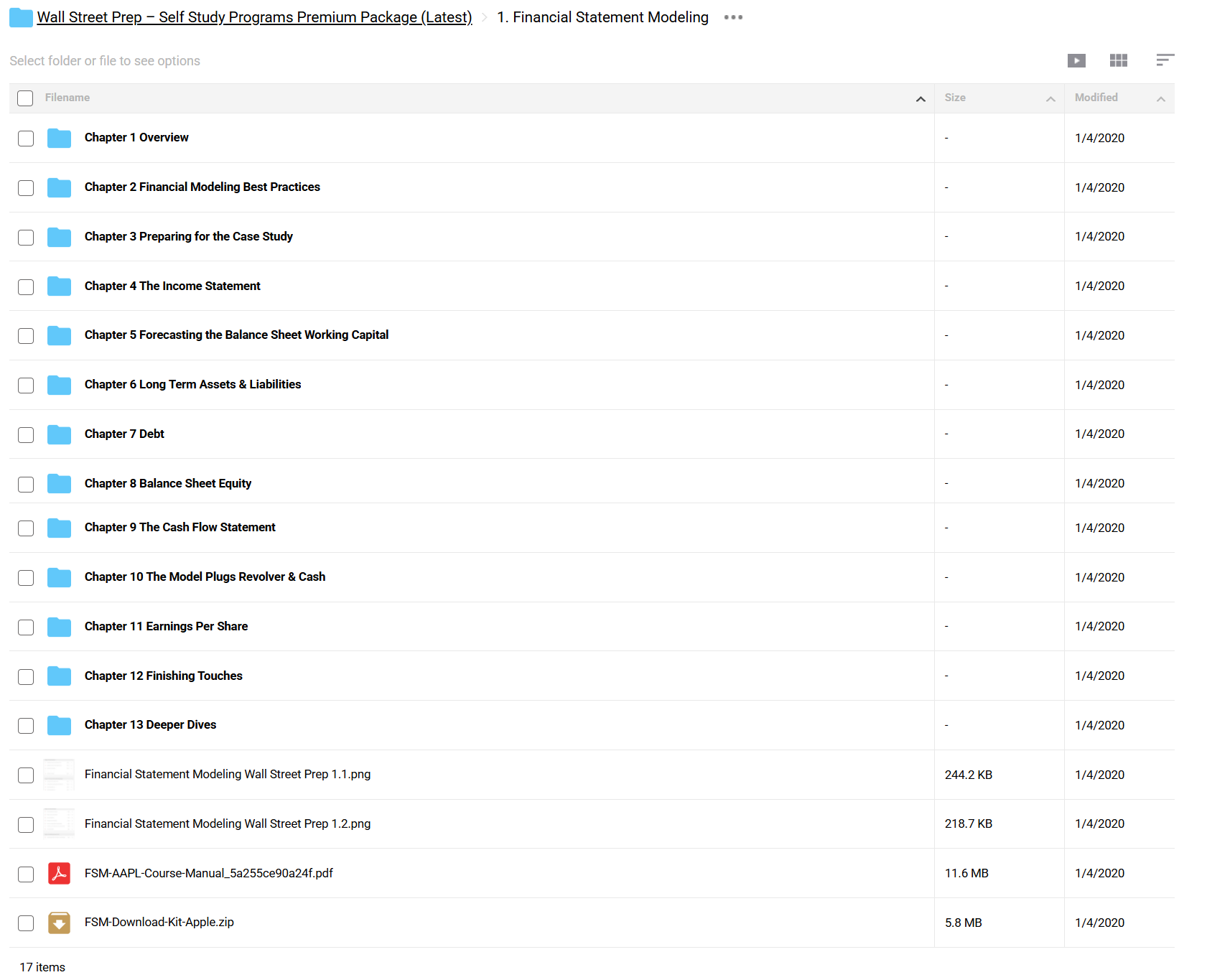

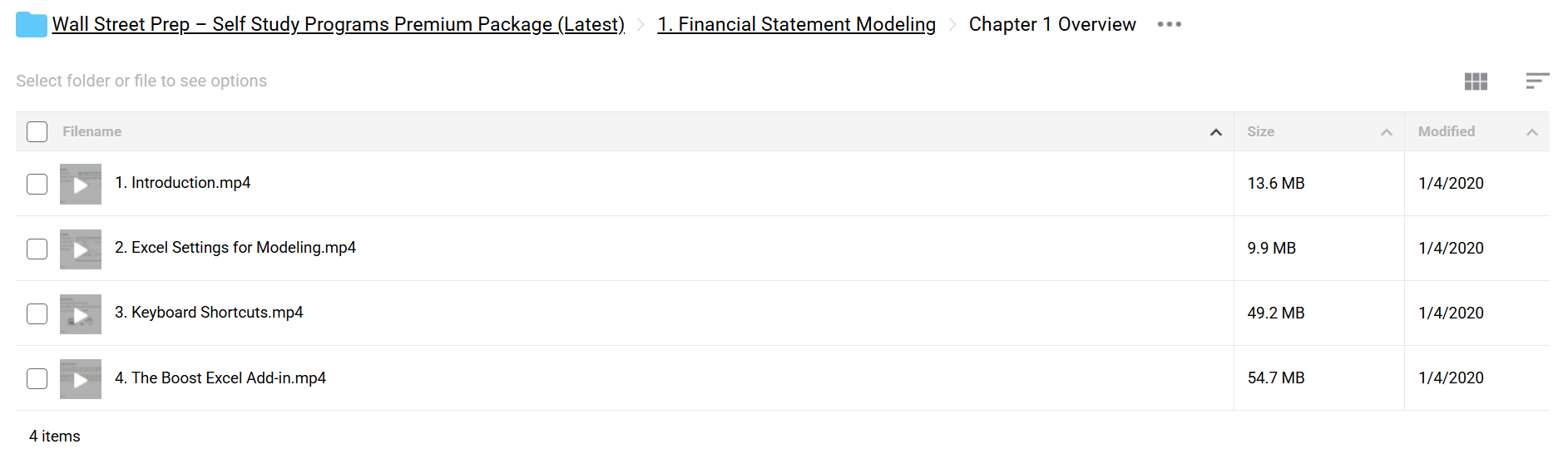

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Self Study Programs Premium Package:

Learn the core investment banking skills needed to succeed in the industry. Here’s what you’ll master:

- Financial Statement Modeling – Create income statements, balance sheets, and cash flow models using real company data

- Valuation Analysis – Build DCF models and learn how to value companies using market comparables

- M&A Modeling – Create merger models and analyze how deals affect company earnings

- LBO Modeling – Build leveraged buyout models used in private equity deals

- Excel Skills – Learn professional shortcuts and modeling techniques used by investment bankers

You’ll practice with real company data and case studies, giving you practical experience for your career.

3️⃣. Self Study Programs Premium Package Course Curriculum:

✅ Section 1: Financial Statement Modeling Fundamentals

This foundational section introduces essential financial modeling concepts and best practices. Students learn proper Excel techniques, modeling conventions, and core financial statement structures using real-world case studies.

Module 1.1: Model Setup and Best Practices

This introductory module establishes proper modeling techniques and Excel proficiency. Students learn essential shortcuts, formatting conventions, and model structure principles needed for professional financial modeling.

- Excel Configuration and Tools (Video)

- Modeling Best Practices (Video)

- Case Study Introduction (Video, PDF)

Module 1.2: Financial Statement Construction

Comprehensive coverage of financial statement modeling, including detailed income statement, balance sheet, and cash flow statement construction. Students learn both historical analysis and forecasting techniques.

- Income Statement Modeling (Video)

- Balance Sheet Components (Video)

- Cash Flow Mechanics (Video)

✅ Section 2: Valuation Methodologies

This section covers fundamental valuation approaches, with particular focus on Discounted Cash Flow (DCF) analysis. Students learn to build comprehensive valuation models incorporating multiple methodologies.

Module 2.1: DCF Analysis

In-depth exploration of DCF valuation principles and implementation. Students learn to construct robust DCF models incorporating industry best practices.

- DCF Mechanics and Theory (Video)

- WACC Calculation (Video)

- Terminal Value Analysis (Video)

✅ Section 3: Comparative Analysis

This section focuses on market-based valuation approaches through comparable company analysis. Students learn to select, analyze, and present trading comparables effectively.

Module 3.1: Trading Comparables

Detailed instruction on building and interpreting trading comparable analyses. Students learn to spread financial statements and calculate relevant metrics.

- Comparable Selection (Video)

- Financial Statement Spreading (Video)

- Multiples Analysis (Video)

✅ Section 4: Transaction Analysis

This section covers advanced modeling techniques used in M&A and LBO scenarios. Students learn to evaluate complex transaction structures and their financial implications.

Module 4.1: M&A Modeling

Comprehensive coverage of merger modeling including accretion/dilution analysis and purchase accounting. Students learn to evaluate transaction impacts across multiple scenarios.

- Deal Structure Analysis (Video)

- Purchase Price Allocation (Video)

- Synergy Modeling (Video)

Module 4.2: LBO Modeling

Detailed exploration of leveraged buyout analysis and modeling. Students learn to evaluate transaction returns and sensitivity analysis.

- LBO Structure and Returns (Video)

- Debt Schedules (Video)

- Exit Analysis (Video)

The curriculum includes comprehensive case studies, modeling templates, and detailed technical guides to support hands-on learning. Each section builds upon previous concepts while maintaining focus on practical application in real-world scenarios.

4️⃣. What is Wall Street Prep?

Wall Street Prep was founded in 2004 by investment bankers to teach practical financial modeling skills.

They train over 50,000 professionals each year and are trusted by top investment banks, private equity firms, and business schools.

Wall Street Prep’s instructors are experienced investment bankers who share real-world knowledge. Their training materials are used by major banks to prepare new analysts for the job.

5️⃣. Who should take Wall Street Prep Course?

The Self Study Programs Premium Package helps you build the skills needed for a career in finance. This course is for:

- Investment Banking Professionals – Learn the core skills needed for investment banking roles

- Private Equity Analysts – Master LBO modeling and learn how to analyze deals

- Corporate Finance Teams – Build better financial models for your company

- Equity Research Analysts – Learn how to value companies and analyze industries

- Finance Students – Get practical skills that complement your classroom learning

Whether you’re just starting out or already working in finance, the course teaches you step-by-step how to build professional financial models.

6️⃣. Frequently Asked Questions:

Q1: How do I start a career in investment banking?

Q2: What is the best way to learn financial modeling?

Q3: Do I need a certification for investment banking?

Q4: How long does it take to master financial modeling?

Q5: What are the essential skills for investment banking?

Be the first to review “Wall Street Prep – Self Study Programs Premium Package” Cancel reply

Related products

Best 100 Collection

Personal Development

Business & Finance

Business & Finance

Scott Carson – Note Buying Blueprint – Note Genius Suite [Real Estate]

Business & Finance

Business & Finance

Business & Finance

![[Bundle] Best 28 Tai Lopez Courses](https://coursehuge.com/wp-content/uploads/2024/01/Bundle-Best-28-Tai-Lopez-Courses-300x300.jpg)

Reviews

There are no reviews yet.