Scott Carson – Note Buying Blueprint – Note Genius Suite [Real Estate]

$997.00 Original price was: $997.00.$19.00Current price is: $19.00.

Scott Carson Note Buying Blueprint Note Genius Suite [Real Estate] Course [Instant Download]

What is Scott Carson Note Buying Blueprint?

Scott Carson’s Note Buying Blueprint teaches you how to buy distressed mortgage notes at deep discounts and turn them into profitable investments.

The course shows you exactly how to find notes from banks, secure funding using IRAs or private money, and flip them for substantial profits. You’ll learn nine proven exit strategies that Carson personally uses in his note business.

Drawing from over 1,000 successful deals, Carson reveals step-by-step how to evaluate note deals, negotiate with banks, and build a profitable note investing business from scratch. The training includes real case studies, templates, and scripts that you can use immediately.

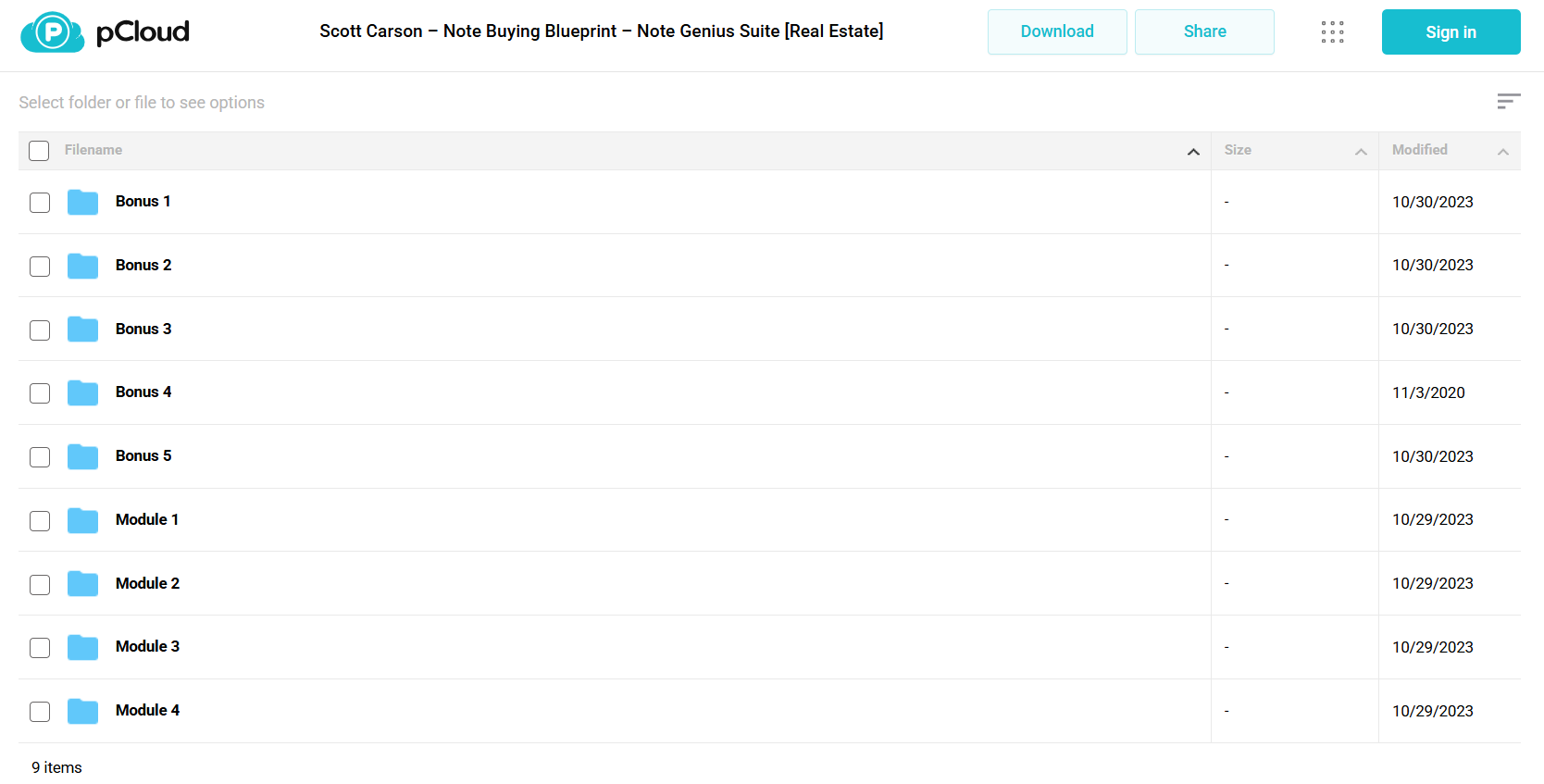

📚 PROOF OF COURSE

What you’ll learn in Note Buying Blueprint:

The course teaches you how to build and grow a profitable note investing business. Here’s what’s covered:

- Note Market Mastery: Learn how to spot opportunities in today’s note market and predict future trends

- Finding Deals: Get access to Scott’s proven sources for finding discounted notes from banks and asset managers

- Deal Evaluation: Learn the exact checklists and criteria to pick winning note deals

- Money Raising: Master how to attract investors and use IRAs to fund your deals

- Profit Strategies: Get step-by-step training on 9 ways to make money with notes

- Portfolio Building: Learn to manage multiple note deals like a professional

The course includes Scott’s blueprint for closing your first 20 deals, with all the templates and scripts you need to start your note investing business.

Note Buying Blueprint Course Curriculum:

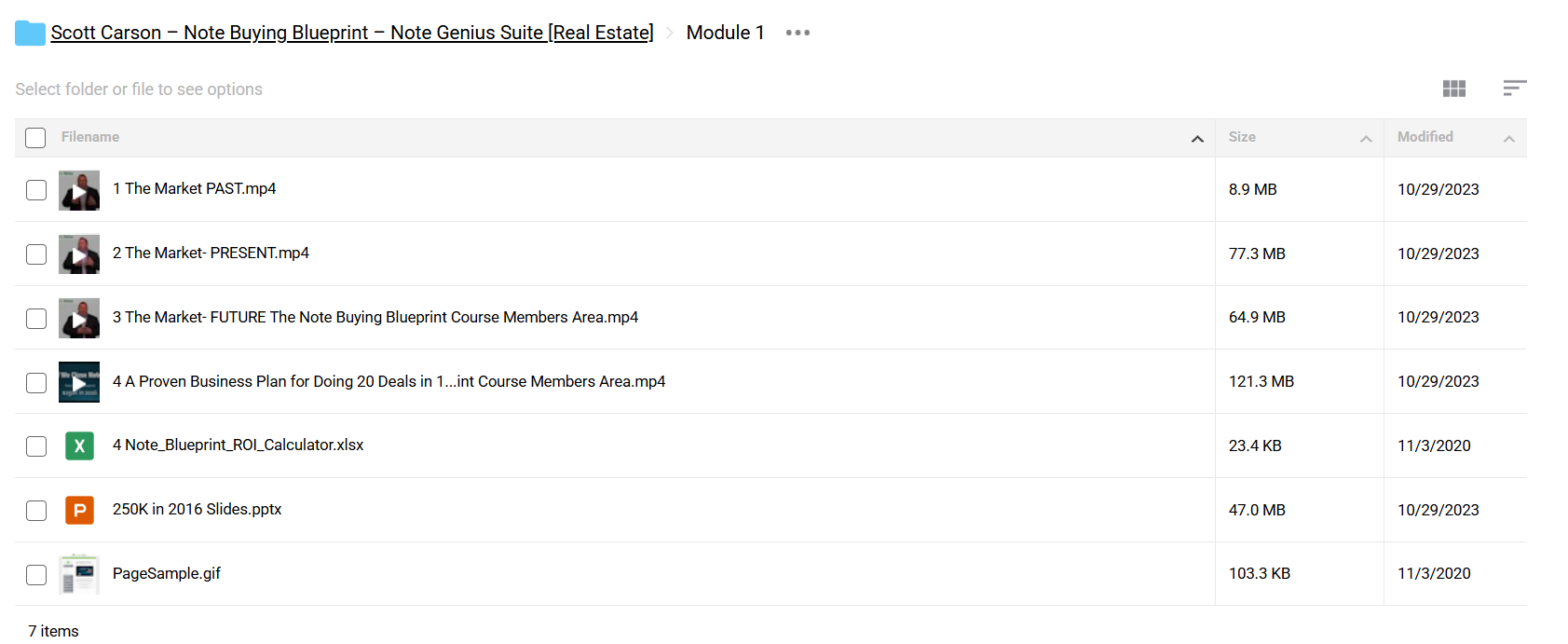

✅ Section 1: Market Analysis And Business Planning

This section provides a comprehensive overview of the note buying market’s past, present, and future trends. Students learn to develop effective business plans for executing multiple deals, supported by ROI calculation tools and proven strategies.

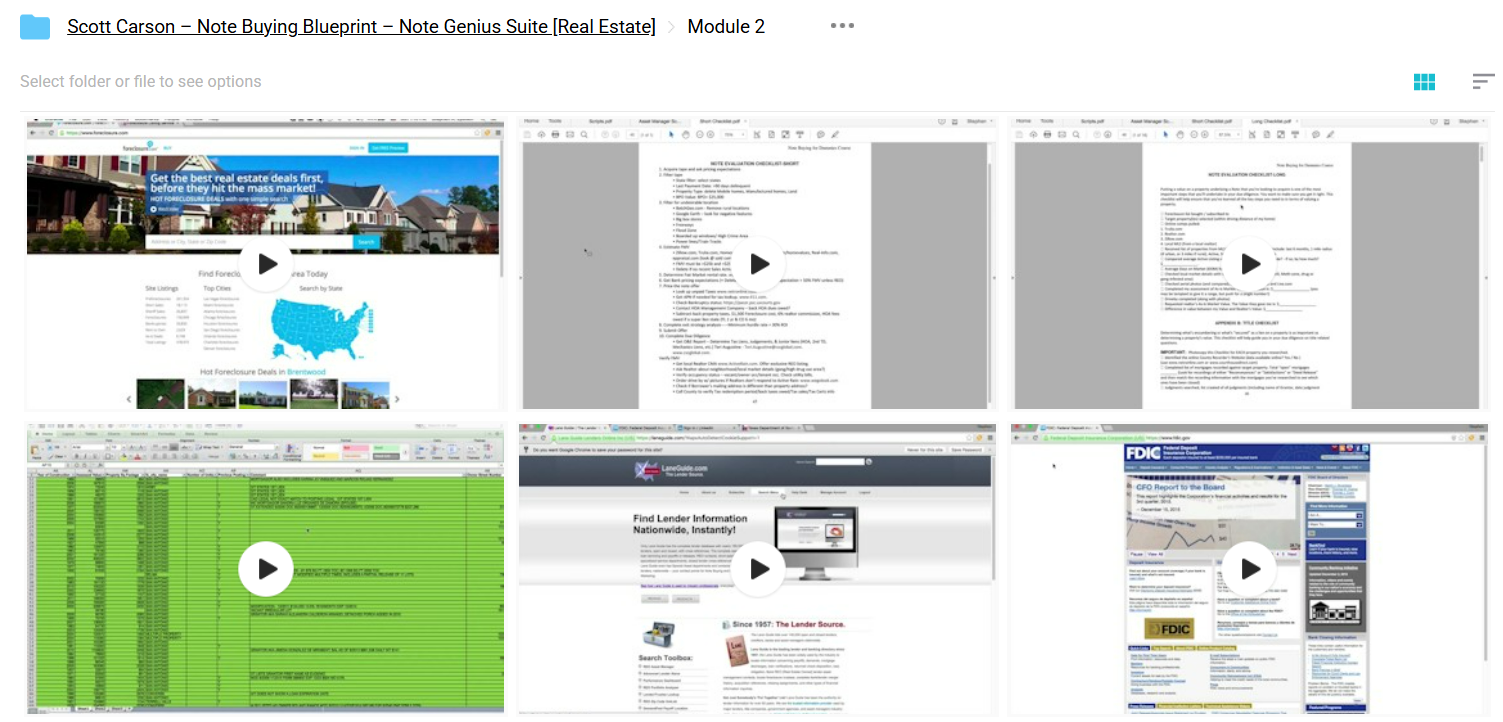

✅ Section 2: Deal Sourcing And Evaluation

Module 2.1: Source Development

Detailed instruction in identifying and approaching note sources, including banks, FDIC resources, and industry networks. Students learn professional communication strategies and script implementation.Module 2.2: Due Diligence

Comprehensive framework for evaluating potential deals using both short and long-form checklists. The module includes practical guidance for utilizing online resources in due diligence processes.

✅ Section 3: Investment Capital Acquisition

Module 3.1: Funding Strategies

Strategic approaches to raising capital through crowdfunding, private investors, and family offices. Students learn to structure and present investment opportunities effectively.

Module 3.2: IRA Investment Framework

Specialized instruction in utilizing self-directed IRAs for note investing. Includes systems for identifying and approaching IRA investors with proven communication templates.

✅ Section 4: Exit Strategy Implementation

Module 4.1: Core Exit Strategies

Comprehensive coverage of primary exit strategies including wholesaling, reinstatement, modification, and loan assumption. Students learn to identify and execute the most appropriate strategy for each situation.

Module 4.2: Advanced Exit Options

Advanced instruction in implementing complex exit strategies such as foreclosure, bankruptcy management, and reperforming note sales. Includes guidance on building professional networks and vendor relationships.

✅ Section 5: Supplementary Training Programs

Module 5.1: Intensive Training Series

Three comprehensive 30-day training programs providing daily instruction in various aspects of note investing. Each series builds upon core concepts with practical applications.

Module 5.2: Advanced Topics

Specialized workshops and webinars covering due diligence techniques and market opportunities. Includes additional resources for professional development and market analysis.

The curriculum integrates practical tools including ROI calculators, document templates, and professional scripts throughout each section. Students develop comprehensive skills in note buying through progressive learning modules and hands-on application.

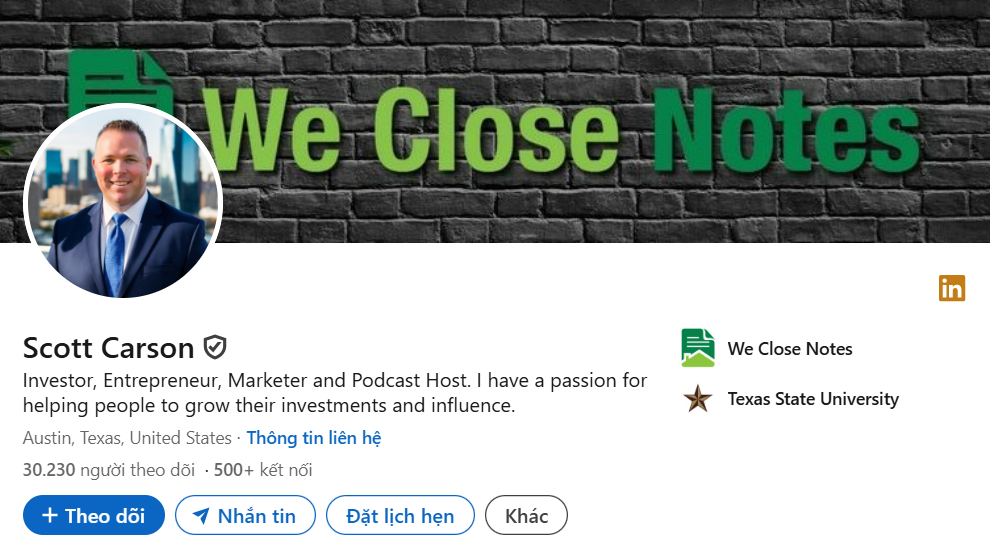

Who is Scott Carson?

Scott Carson has been investing in distressed notes since 2001. As founder and CEO of We Close Notes in Austin, he has closed over 1,000 note deals and helped thousands of investors succeed in this market.

Since 2005, Carson has specialized in buying non-performing notes on residential and commercial properties. His company, We Close Notes, teaches investors how to profit from distressed debt investing.

He shares his knowledge through “The Note Closers Show” podcast, where he interviews industry experts and teaches strategies that work for both investors and property owners.

Beyond teaching, Carson actively buys and sells notes through his company, proving that his strategies work in today’s market. He’s known for creating simple systems that help new investors succeed in note investing.

Be the first to review “Scott Carson – Note Buying Blueprint – Note Genius Suite [Real Estate]” Cancel reply

Related products

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Reviews

There are no reviews yet.