REIClub Foreclosure Academy

$497.00 Original price was: $497.00.$29.00Current price is: $29.00.

REIClub Foreclosure Academy Course [Download]

📚 PROOF OF COURSE

What is REIClub Foreclosure Academy:

REIClub Foreclosure Academy is a comprehensive course designed to equip real estate investors with the knowledge and skills needed to succeed in foreclosure investing. This course offers a wealth of insider information, revealing the strategies and techniques used by top investors in the field. Whether you’re a seasoned investor or just starting, this course will provide you with the tools to navigate the complexities of foreclosure investing with confidence.

The REIClub Foreclosure Academy covers a wide range of topics, from mastering short sales to crafting effective contracts. You’ll learn how to identify the best foreclosure properties, negotiate with lenders, and close deals successfully. The course also delves into the intricacies of marketing, business multiplication, and asset protection, giving you a well-rounded understanding of the foreclosure investing landscape.

With over 21 hours of valuable content, the REIClub Foreclosure Academy is your ticket to unlocking the wealth-building potential of foreclosure investing. Get ready to take your real estate investing career to new heights with this game-changing course

What you will learn in REIClub Foreclosure Academy:

In the REIClub Foreclosure Academy, you will gain a deep understanding of:

- Short sales, including crafting effective packages, designing HUD1 forms, and navigating bank preferences

- Contracts, addendums, and disclosures, with a focus on innovative and unique contract strategies

- Marketing strategies to keep your pipeline full, from working with Realtors to dominating online

- Business multiplication techniques to systematize your investing and create a wealth-building business

- Asset protection strategies to safeguard your wealth and minimize legal challenges

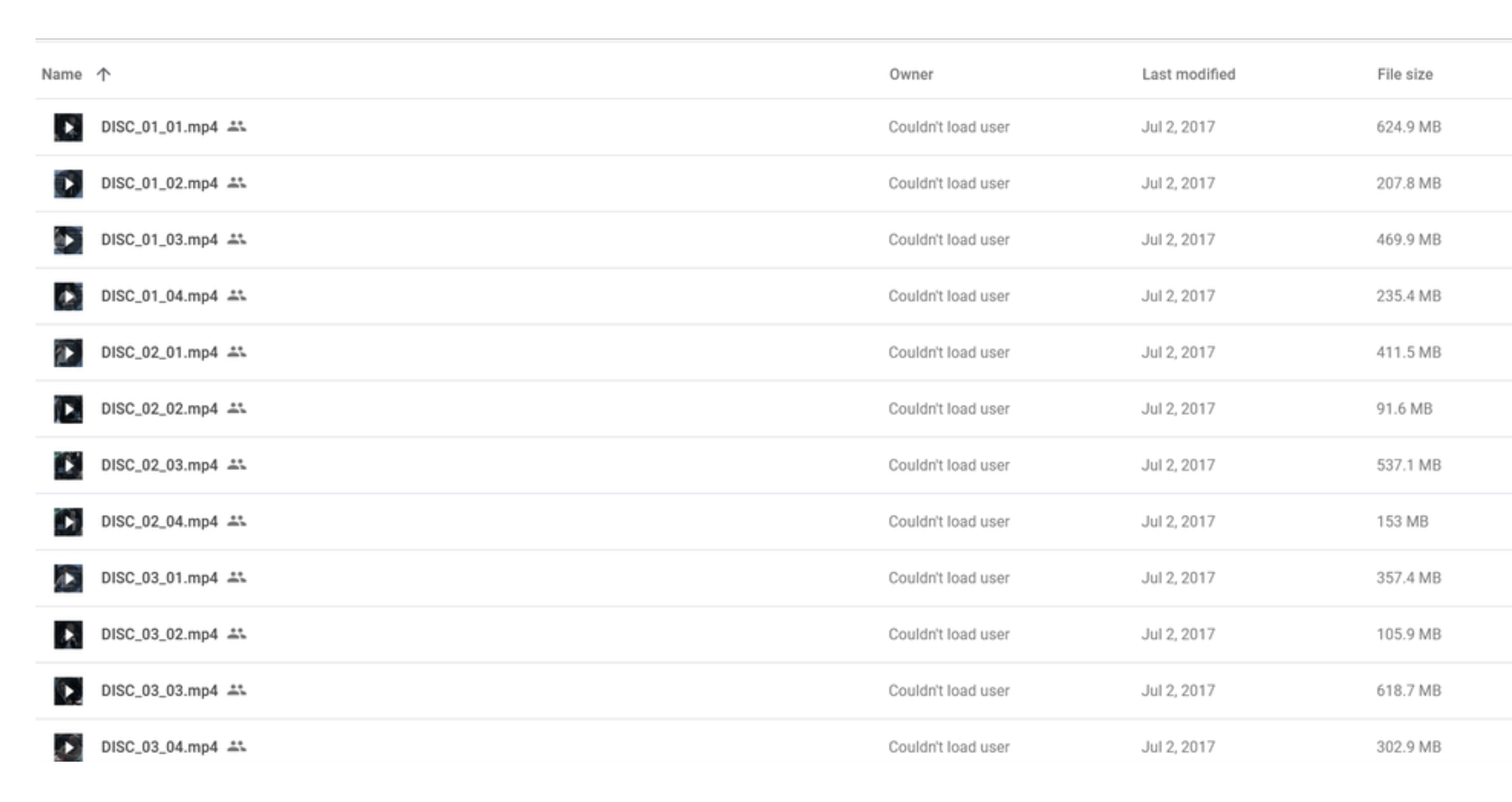

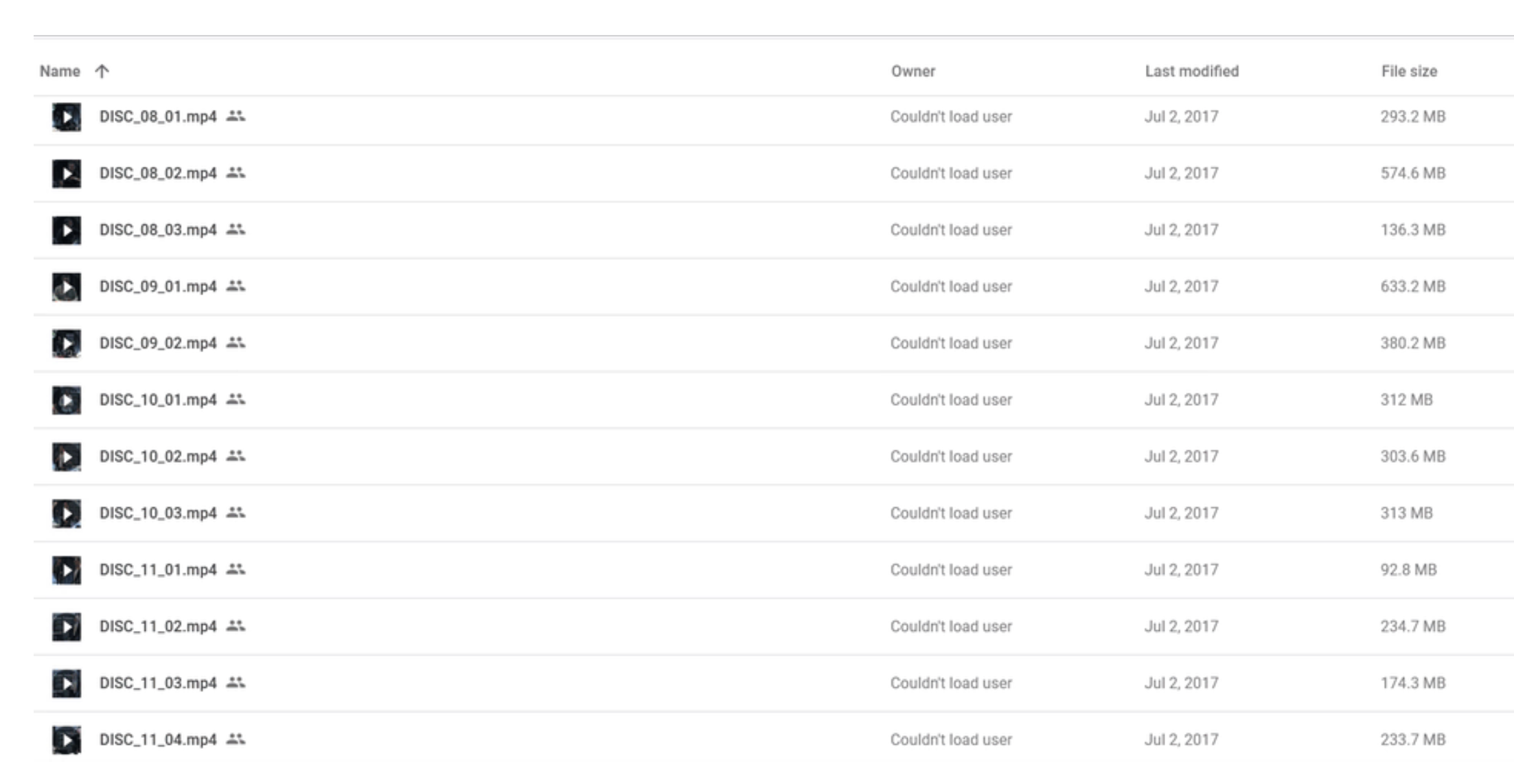

REIClub Foreclosure Academy Course Curriculum:

The REIClub Foreclosure Academy course is divided into five main sections:

✅ SHORT SALE-ANOMICS (4 hours, 12 minutes)

- Crafting effective Short Sale packages

- Designing the perfect HUD1

- Bank preferences and navigating the process

- Broker Price Opinions (BPOs) and their impact on transactions

- Short Sale Purchase Agreements and essential clauses

✅ CONTRACTS-A-GO-GO (4 hours, 55 minutes)

- Innovative and unique contract strategies

- Navigating Freddie Mac property flipping waivers and seasoning

- Legally conducting same-day A-B, B-C sales with FHA loans

- Selecting and qualifying title companies or closing attorneys

- Countering offers and essential clauses

- Notice of Option contracts and their importance

✅ MARKETING MACHINES (5 hours, 49 minutes)

- Working with Realtors to list and sell properties quickly

- Dominating online marketing strategies

- Blogging and Twitter for lead generation

- Defining your target market and marketing campaigns

- Referral engine setup and lead monetization

✅ BUSINESS MULTIPLICATION (5 hours, 59 minutes)

- Differentiating between a business owner and an investor

- Systemizing your business for success

- Outsourcing, delegation, and hiring best practices

- Commission-based compensation and its benefits

- Managing in-house negotiators effectively

✅ ASSET PROTECTION (47 minutes)

- Top legal and wealth challenges for Real Estate Investors

- Maintaining accurate records

- Proper wealth shields and determining the best fit

- Multiple identities and their importance

- Visibility as a threat to wealth

Who is Reiclub?

Prompt 4: Step 1: Who is Reiclub? REIClub, short for Real Estate Investors Club, has been a leading force in the real estate investing community since 2002. With over 200,000 active members, REIClub is dedicated to connecting and equipping real estate investors of all experience levels with the knowledge, tools, and resources they need to succeed.

As a member-driven organization, REIClub understands the unique challenges and opportunities that real estate investors face in today’s market. Whether you’re looking to flip houses, invest in rental properties, or explore other real estate investing strategies, REIClub has the expertise and network to support your goals.

One of REIClub’s core strengths is its extensive library of educational resources. From comprehensive courses like the REIClub Foreclosure Academy to webinars, articles, and guides, REIClub provides a wealth of information to help investors stay informed and ahead of the curve.

In addition to educational content, REIClub also offers a robust platform for networking and collaboration. Members can connect with investor-friendly Real Estate Agents, lenders, and other professionals who can provide valuable support and services for their investing endeavors.

With a strong commitment to empowering real estate investors, REIClub continues to be a trusted partner and go-to resource for anyone looking to build wealth through real estate investing.

Be the first to review “REIClub Foreclosure Academy” Cancel reply

Related products

Real Estate

Reviews

There are no reviews yet.