Rajandran R – QuantZilla

$335.00 Original price was: $335.00.$29.00Current price is: $29.00.

[Instant Download] Rajandran R QuantZilla Course

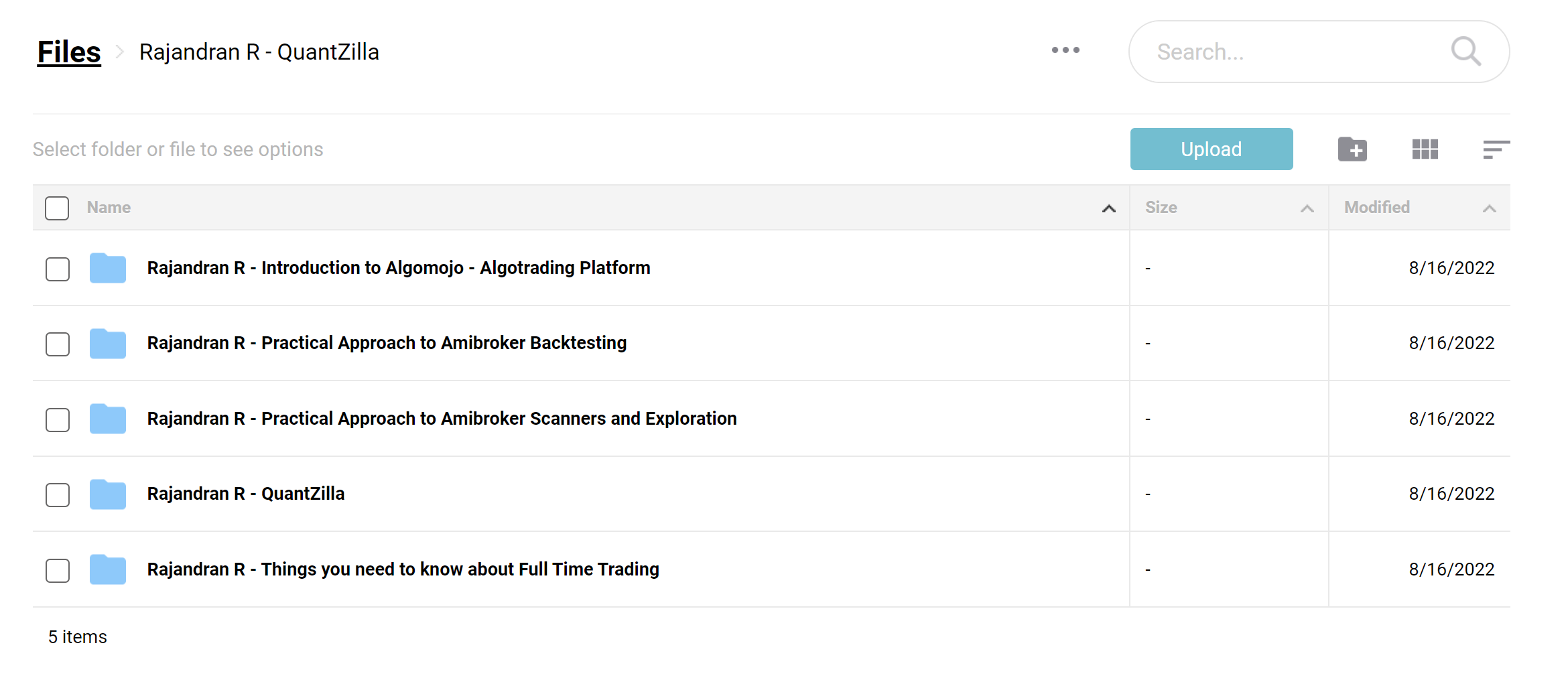

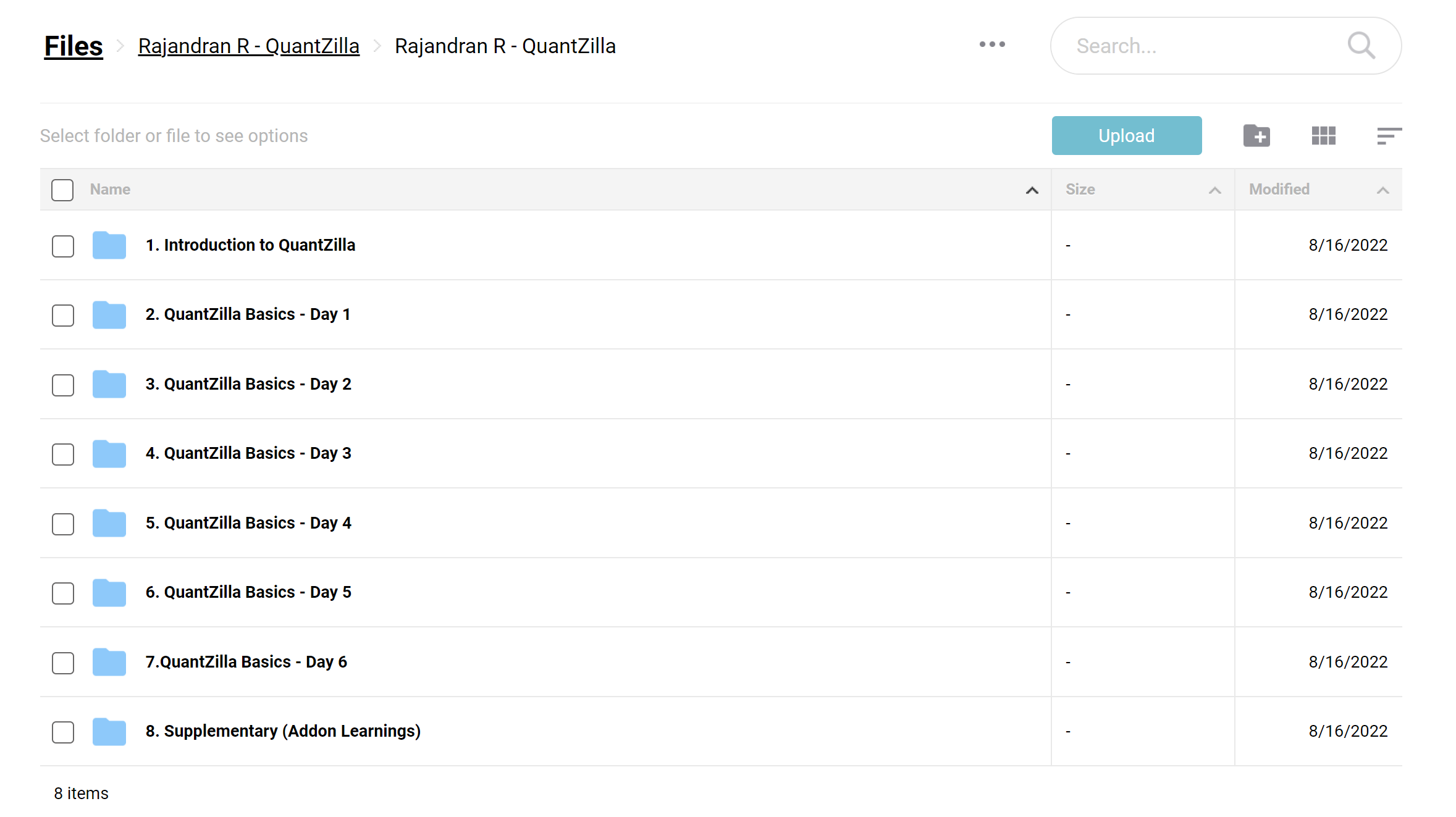

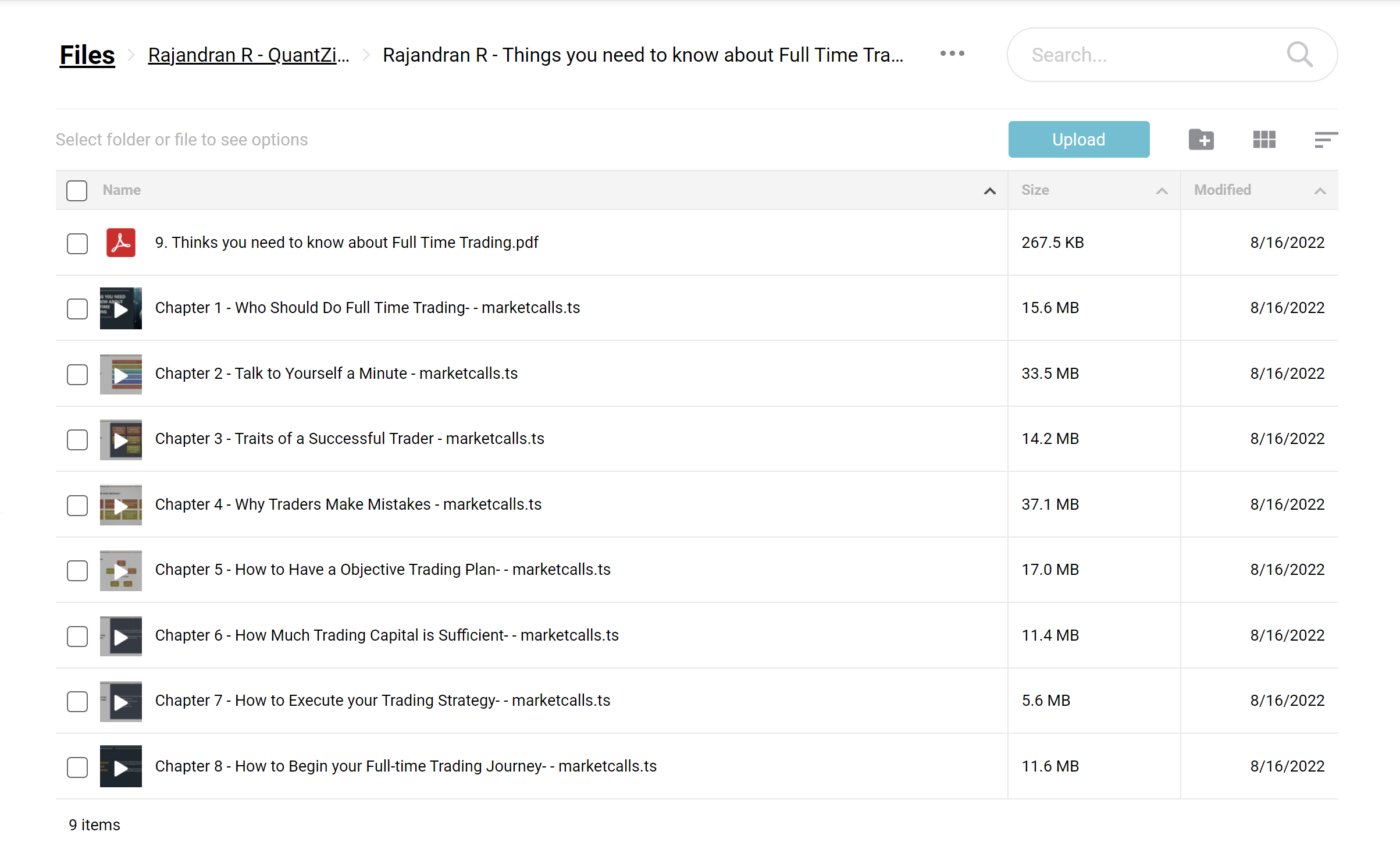

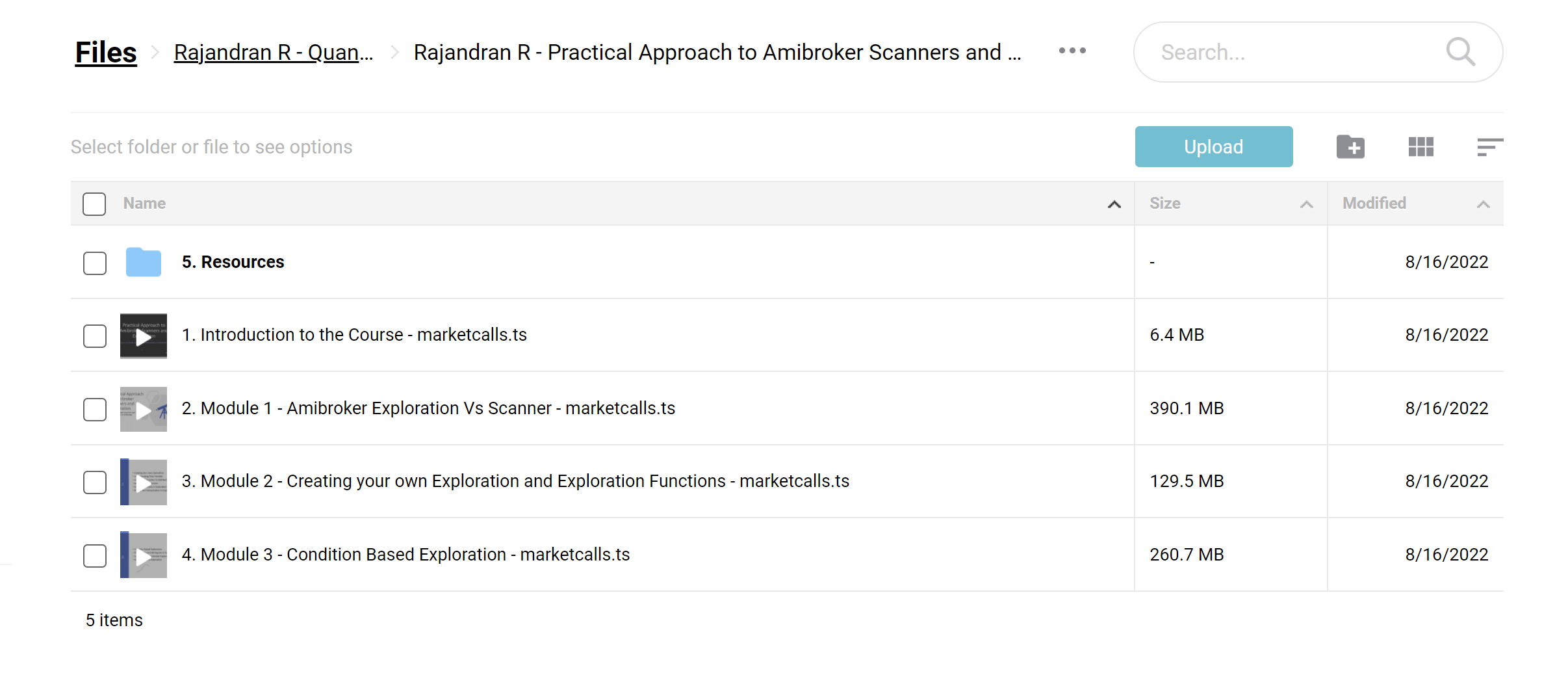

📚 PROOF OF COURSE

What is Rajandran R QuantZilla:

QuantZilla Trading is a comprehensive course created by Rajandran R, focusing on quantitative trading. It’s tailored for beginners and experienced traders, aiming to develop their skills in creating effective trading systems.

This course teaches you how to develop unique trading strategies, turn your ideas into practical trading indicators, and automate your trading for better performance. QuantZilla simplifies complex trading concepts, making them easy to understand, even for those new to coding.

The course offers a balanced learning curve, guiding you through the essentials of quantitative trading. By the end of this program, you’ll be equipped with the knowledge and skills to excel in the fast-paced trading world.

This course is centred around the principles of quantitative trading, ensuring that the content is straightforward and beneficial for learners.

What is Quantitative Trading?

Quantitative trading, often referred to as ‘quant trading’, is a method of trading that uses mathematical and statistical models to identify and execute trading opportunities. This approach relies heavily on technology and data analysis, making it different from traditional trading strategies that might focus more on fundamental analysis or manual chart review.

In quant trading, traders develop algorithms and models to analyse vast market data quickly. These models look for patterns, trends, and anomalies indicating profitable trading opportunities. Once a potential trade is identified, the system can automatically execute trades, often at a speed and frequency that is impossible for a human trader.

One of the critical advantages of quantitative trading is its ability to remove emotional decision-making from the trading process, as trades are based on data and predefined rules. This method is popular among hedge funds, investment banks, and individual traders with a strong mathematics, statistics, and computer programming background.

Quant trading encompasses various strategies, including high-frequency trading, statistical arbitrage, and algorithmic trading. It’s a field that requires continuous learning and adaptation, as financial markets are always evolving. For those interested in a data-driven approach to trading, learning about quantitative trading can be a valuable step in their trading journey.”

What you will learn in QuantZilla course:

In the QuantZilla course, you will gain comprehensive knowledge and practical skills in the following areas:

- Fundamentals of Quantitative Trading Development and Analysis.

- Mastery of Amibroker AFL Programming for effective trading signal generation.

- Techniques for building robust Trading Systems and Strategies.

- Skills in Backtesting Strategies to evaluate performance and reliability.

- Insights into Real-time Scanners and Trading Signals for market opportunities.

- Understanding of Portfolio Backtesting for diversified investment strategies.

- Knowledge of Key Performance Indicators (KPI) for measuring trading success.

- Expertise in Automated Trading for efficient and timely market execution.

- Strategies for effective Trading System Optimization and improvement.

Each module is crafted to provide you with a deep understanding of trading system development, ensuring you are well-equipped to create and implement successful trading strategies.

QuantZilla Course curriculum:

Introduction to QuantZilla

- Preview of QuantZilla 75+ hours of Code Mentoring Program

- Preview of RSI Momentum Trading Strategy – Amibroker AFL Code

- Preview of Resources

QuantZilla Basics – Day 1

- Introduction to Quant Trading and Detailed Introduction to Amibroker (195:17)

- Simple Trading System – Amibroker AFL Code

- Volatility Exploration – Amibroker AFL Code

- Resources

QuantZilla Basics – Day 2

- Introduction to Amibroker AFL Programming and Importing CSV Data (202:51)

- AFL Code Blocks

- Arrays and Reserved Variables

- Color Changing Candlesticks based on MACD

- Heikin-Ashi Candles

- My First Indicator

- RSI with Overbought and Oversold Levels Plot

- Resources

QuantZilla Basics – Day 3

- Introduction to Amibroker Exploration and Scanners (187:25)

- Two Day Price Consolidation Exploration Code

- ADX Exploration Code

- Bollinger Band and Stoch Exploration Code

- EMA Exploration

- High Turnover Exploration

- PDH and PDL Plot

- RSI Text Interpretation

- Simple Exploration

- Volume Breakout Exploration

- Resources

QuantZilla Basics – Day 4

- Introduction to Backtesting – Part 1 (81:52)

- Introduction to Backtesting – Part 2 (69:03)

- Different Scaling for RSI

- EMA Crossover Trading System

- EMA Crossover Trading System – Non Repainting Code

- EMA Crossover Trading System with Trading Module

- Momentum Trading System

- Momentum Trading System with Investing Module

- Investing Module – Backtesting Template

- Trading Module – Backtesting Template

- Unequal Allocation – Backtesting Template

- Resources

QuantZilla Basics – Day 5

- Introduction to Trading System Development (169:12)

- Donchian Channel Trading System – EOD System

- Donchian Channel Trading System – First Bar High-Low Breakout

- Donchian Channel Trading System – High Low Breakout

- Doncian Channel Trading System – Touch Based

- Doncian Channel Trading System – Touch Based with Gap Criteria

QuantZilla Basics – Day 6

- Introduction to Trading System Optimization and Backtesting Metrics (175:20)

- Chandelier Exit

- Nifty and Bank Nifty Chandlier Exit Strategy

- Resources

Supplementary (Addon Learnings)

- Amibroker AFL Programming Part 1 (109:45)

- Amibroker AFL Programming Part 2 (94:03)

- Amibroker AFL Programming Part 3 (105:41)

- Amibroker AFL Programming Part 4 (103:08)

- Amibroker AFL Programming Part 5 (99:48)

- Amibroker AFL Programming Part 6 (100:03)

- Amibroker AFL Programming Part 7 (108:40)

- Amibroker AFL Programming Part 8 (92:53)

- Amibroker AFL Programming Part 9 (97:13)

- Amibroker AFL Programming Part 10 (134:28)

- Amibroker AFL Programming Part 11 (69:48)

- Amibroker AFL Programming Part 12 (60:34)

- Amibroker AFL Programming Part 13 (23:12)

- Amibroker AFL Programming Part 14 (84:38)

- Resources and Amibroker AFL Codes

This comprehensive curriculum covers a wide range of topics essential for mastering quantitative trading and Amibroker AFL programming. Each module is designed to provide in-depth knowledge and practical skills.

Who is Rajandran R?

Rajandran R is a distinguished figure in the trading world, renowned for his quantitative trading and system development expertise. As a full-time trader and trading system developer, he has contributed, particularly to market profiles, trading sentiment analysis, and timing models. His proficiency extends to a variety of trading software, including Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst (Optuma), Metatrader, Tradingview, and programming languages like Python, R, and Matlab.

Rajandran’s educational background includes a BE in Electronics and Communications from a college in Chennai, providing him with a solid foundation in technical analysis. His role as the founder of Marketcalls and co-creator of Algomojo has established him as a thought leader in algorithmic trading models. He is not just a mentor to professional traders, full-time traders, and those aspiring to be full-time traders but also a guide who simplifies complex trading concepts for beginners.

His broad understanding of trading software and individual trader needs, combined with his hands-on approach to teaching, makes his courses, especially QuantZilla, highly sought after. Rajandran’s courses are more than just educational material; they are a gateway to understanding the dynamic world of trading through the eyes of an experienced professional.

Be the first to review “Rajandran R – QuantZilla” Cancel reply

Related products

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Reviews

There are no reviews yet.