Raising Private Money 2.0 with Lance Edward

$697.00 Original price was: $697.00.$49.00Current price is: $49.00.

Lance Edward Raising Private Money 2.0 [Instant Download]

What is Raising Private Money 2.0 Course

Lance Edward’s Raising Private Money Home Study System 2.0 is a course teaching how to finance real estate deals using private money.

It covers strategies for securing funding without personal cash, credit, or experience.

The course aims to help students achieve financial independence through real estate investing by leveraging private capital.Copy

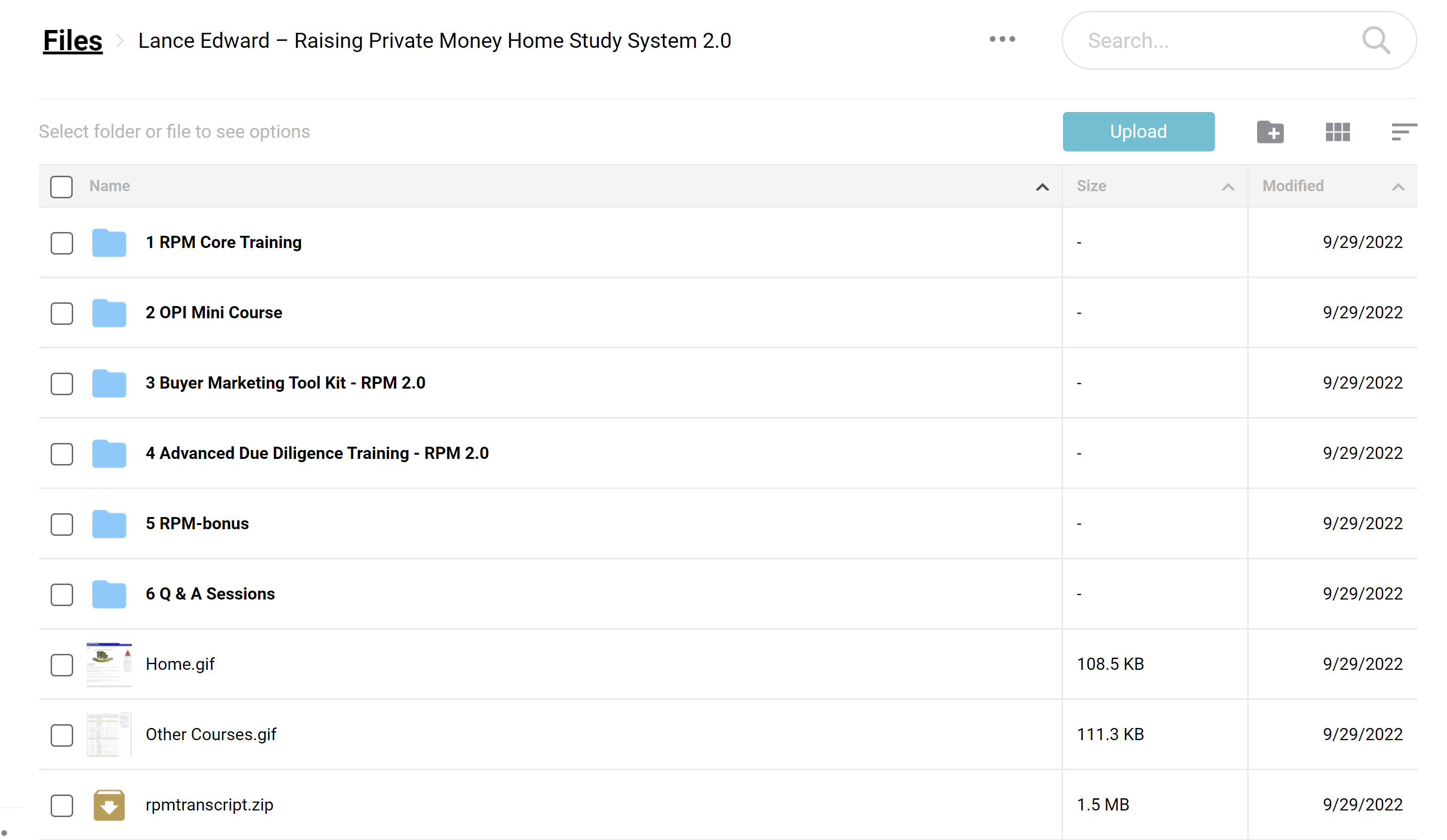

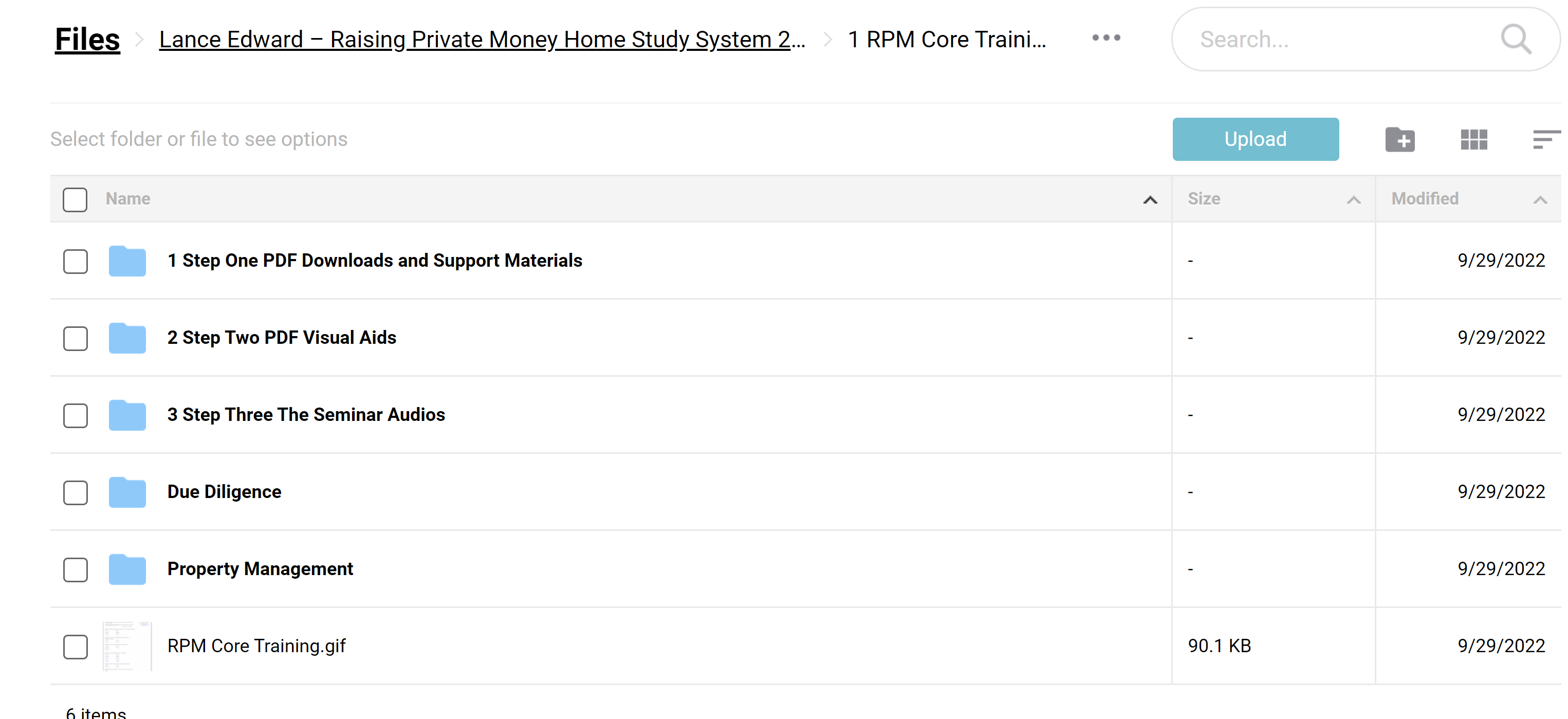

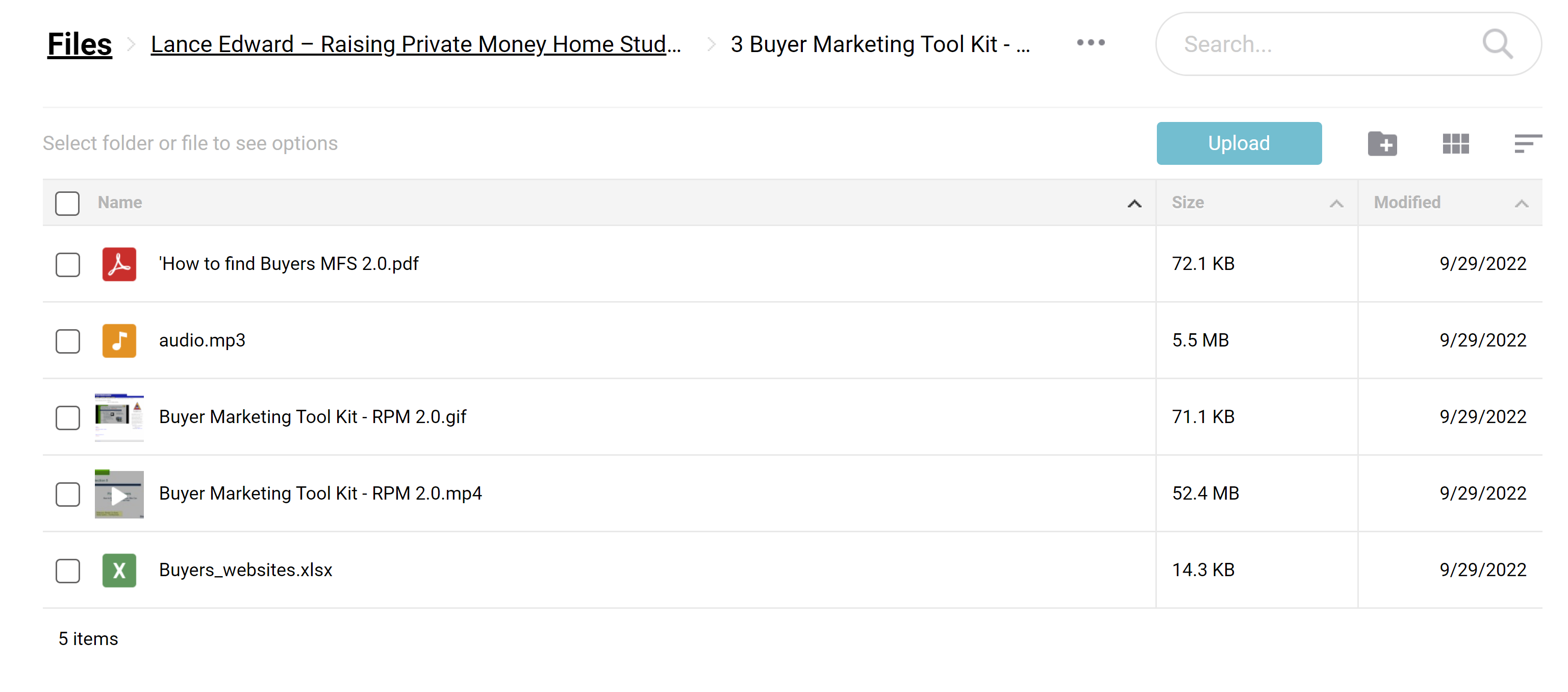

📚 PROOF OF PRODUCTS

What You Will Learn in Raising Private Money 2.0:

- Mastery Over Private Money: Understand the principles of wealth creation and financial freedom of the New Rich, and learn how to achieve it in a significantly shorter time by comprehending and applying new rules.

- Leverage and Velocity: Explore the rapid ability of leverage and velocity to create substantial wealth in real estate using other people’s money.

- Formulating Your Own Rules: Learn how to formulate rules with private investors that can pave the way to financial freedom in just one deal.

Raising Private Money 2.0 Course Curriculum:

✅ Module 1: Why Private Money?:

Learn the principles of wealth creation and financial freedom of the New Rich. Explore the rapid ability of leverage and velocity to create substantial wealth in real estate using other people’s money. Understand how to formulate rules with private investors to pave the way to financial freedom in just one deal.

✅ Module 2: Formula for Success:

Discover the Raising Private Money Formula not taught in other real estate courses. Through the creative application of this formula, combined with your integrity, you’ll have access to substantial funds for your real estate deals.

✅ Module 3: Accessing the Source:

Learn where to look for funding sources already familiar with real estate. By targeting predisposed sources, you won’t waste time selling prospects on the merits of real estate – they are already sold.

✅ Module 4: Structuring the Deal:

Dive into the psychology of your private investors and learn how to address their needs explicitly in your deals. Understand common entity structures in real estate transactions with private money sources and explore legal documents drawn from actual deals.

✅ Module 5: 50 Creative Applications

Gain insights into over 50 precise and creative applications for applying the Raising Private Money Formula for your next big ticket deal. An index of 50 private money techniques will be reviewed, arming you with many personal money financing strategies for your sales.

✅ Module 6: Playing in Bounds (with the SEC)

Understand the rules of the Securities and Exchange Commission (SEC) and learn how to identify and safely play within the boundaries to ensure your financial freedom is secured and legal.

✅ Module 7: Marketing for Money

Learn how to target the market to private money sources motivated to see you become financially free. Craft a simple yet captivating message that will differentiate you from others and ensure your offers get noticed and grabbed.

✅ Module 8: Getting It Done

Knowledge without a game plan is worthless. This module details EXACTLY what action steps to take daily and weekly to ensure that you WILL achieve at a high level. Learn the same systems that Lance uses to run his full-time real estate business part-time.

✅ Bonus Module: Ask the Expert

Engage in an interactive session between Lance and a student with a big ticket mini-warehouse deal. Listen to Lance critique the contract and answer questions concerning cash flow and private money options.

Who is Lance Edward?

Lance Edward, renowned as the author of the best-selling book, “How to Make Big Money in Small Apartments,” has carved a niche in real estate investing, particularly in small apartment investing. His journey, which began in 2002, has been transformative for him and paved the way for numerous aspiring investors through his teachings and mentorship.

- Best-Selling Author: Wrote “How to Make Big Money in Small Apartments,” which has guided many in real estate investment.

- Founder of First Cornerstone Group, LLC: A company dedicated to education and marketing, aiding novice and seasoned real estate investors.

- Recognized Success: Houston Business Journal acknowledged Lance’s company as the 13th fastest-growing private company in Houston, Texas.

Journey into Real Estate:

- Initial Steps: Lance invested in real estate in 2002 as a supplementary income to his demanding corporate job.

- First Purchase: A four-unit small apartment building, acquired nothing-down and with 100% seller-financing, without involving any bank.

- Impressive Track Record: Over the subsequent 2 ½ years, he flipped 50 more properties, part-time, all utilizing other people’s money.

Transition to Full-Time Investing:

- Retirement from Corporate: Within three years of his part-time start in small apartments, Lance retired from his 20-year corporate job in 2005.

- Deal Experiences: He has personally navigated apartment deals ranging from three units to nearly 300 units.

Educator and Mentor:

- Teaching Since 2007: Lance has been imparting knowledge and strategies on small apartment investing (2-30 units) to thousands nationwide.

- Focus on Scaling: His teachings emphasize starting small and progressively scaling to mid-size and large apartments.

- Student Success Stories: Lance has mentored everyday individuals, predominantly beginners, whose first real estate deal was a small apartment building.

Lance Edward‘s story is not just about his financial freedom. Still, it is also about enabling others to carve a path through the often complex world of real estate investing, using strategies proven through his own experiences.

Is the Raising Private Money 2.0 Course a Scam?

After conduct in-depth analysis on all 9 modules of the course, here are what our though:

Course Offerings and Claims:

- As per its description, the course provides a comprehensive guide to raising private money, offering strategies, templates, and insights into navigating real estate deals without utilizing personal finances.

- It promises to provide theoretical knowledge and practical tools and strategies that have been proven in real-world scenarios.

Instructor’s Background:

- Lance Edward, the instructor, shares his journey from starting in real estate in 2002 to flipping over 50 properties part-time in the next 2 ½ years, all using other people’s money, and eventually retiring from his corporate job within three years of starting in real estate.

Reviews and Testimonials

Positive Outcomes:

- The course has showcased numerous testimonials and success stories on its official page, indicating that several students have found value and success through the system.

- Another method, seemingly similar but by Amy Mahjoory, has been reviewed here, where it was noted that Amy had helped many, like David and Amanda Fornelli, who raised $3 million and bought a hotel in Palm Springs, and others who raised substantial amounts for their projects.

Transparency and Costs:

- The course does not shy away from showcasing its modules, curriculum, and what it offers transparently on its sales page, providing a clear insight into what one can expect.

- However, it’s crucial to note that the exact pricing and additional costs, if any, are not explicitly mentioned, which might be a point to consider for potential enrollees.

A Personal Take

My Experience:

- Diving into the course, it offers a wealth of information, strategies, and practical insights that can be applied in real-world investing scenarios.

- The modules are well-structured, and the additional resources like templates and scripts add tangible value to the learning experience.

Considerations:

- While the course does provide valuable insights and strategies, it’s crucial for potential students to weigh the investment against their financial capacity and to approach it with realistic expectations.

- Engaging in due diligence, exploring additional reviews, and reaching out to past students could provide a more rounded perspective before investing in the course.

While my experience with the “Raising Private Money” course has been insightful and educational, it’s paramount that potential students approach it (and, indeed, any investment) with a critical eye, ensuring it aligns with their financial goals and investment strategy. The course does provide a structured learning path and practical tools, but ensuring it is the right fit for your investment journey is crucial.

Be the first to review “Raising Private Money 2.0 with Lance Edward” Cancel reply

Related products

Real Estate Finance

Real Estate Finance

Real Estate

Real Estate Finance

Real Estate

Reviews

There are no reviews yet.