QuantFactory – Become A Quant Trader Bundle

$299.00 Original price was: $299.00.$17.00Current price is: $17.00.

QuantFactory Become A Quant Trader Bundle Course [Instant Download]

1️⃣. What is QuantFactory Become A Quant Trader Bundle?

QuantFactory Become A Quant Trader Bundle is a trading program teaching you how to create profitable algorithms with Python.

The course takes you from basic Python coding to advanced quant trading methods used by professionals. You’ll learn to build, test, and launch your own trading strategies step-by-step.

Taught by hedge fund expert Luke Haralampiev, who shares real techniques from his experience creating 35+ profitable strategies and trading bots that make money in today’s markets.

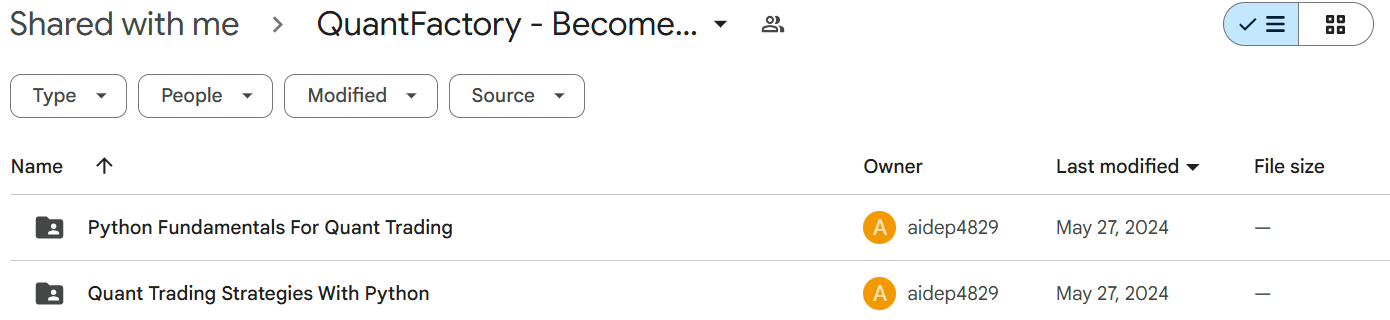

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Become A Quant Trader Bundle:

This bundle takes you from beginner to algorithmic trading professional with clear, step-by-step lessons. Here’s what you’ll learn:

- Python programming basics focused on finance and trading

- Advanced backtesting methods to test strategies before using real money

- Strategy development processes used by actual quant traders at hedge funds

- Data extraction and analysis techniques to find profitable trading opportunities

- Optimization approaches to improve your strategy performance

- Risk management tools to protect your money during market ups and downs

By the end, you’ll have the skills to create, test, and run your own trading algorithms or qualify for high-paying jobs at financial firms.

3️⃣. Become A Quant Trader Bundle Course Curriculum:

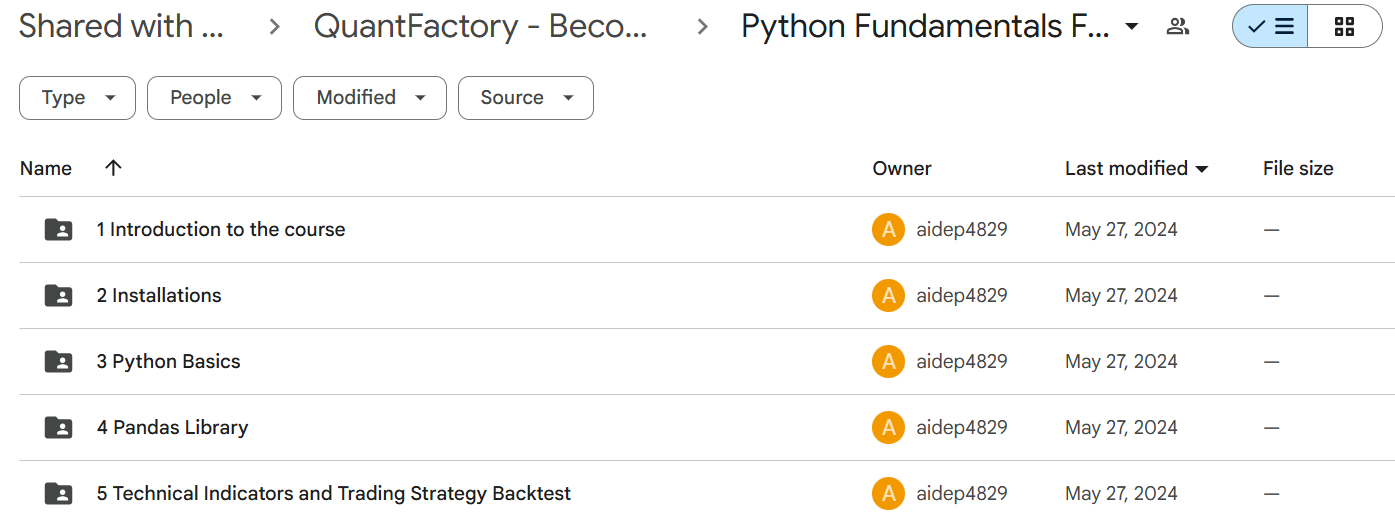

✅ Course 1: Python Fundamentals For Quant Trading

This course teaches you basic Python programming for trading. You’ll learn how to work with numbers, create simple programs, and use the Pandas tool to handle financial data. The course shows you how to load stock prices, calculate trading indicators, and test simple trading strategies. By the end, you’ll be able to write basic code that can analyze market data and make trading decisions.

Introduction and Setup

This initial section welcomes students to the world of quantitative trading and ensures they have the proper technical environment set up. Students are guided through installing Anaconda and exploring Jupyter Notebook, establishing the foundation for all programming work in the course.

Python Basics

This module covers essential Python programming concepts critical for quantitative analysis, including data types, variables, arithmetic operations, and comparison operators. Students gain hands-on experience with conditional statements, loops, functions, and classes—core programming constructs that will be used throughout their quant trading journey.

Pandas Library

Students dive into the powerful Pandas library, a cornerstone tool for financial data analysis. Key lessons include loading financial data from various sources, manipulating datasets, working with datetime indices, and applying rolling functions—skills essential for time-series analysis in trading applications.

Technical Indicators and Trading Strategy Backtest

The culminating section bridges theory and practice by teaching students how to calculate technical indicators and implement them in trading strategies. Highlights include downloading financial data, building trading signals, backtesting strategies, and calculating performance metrics to evaluate strategy effectiveness.

✅ Course 2: Quant Trading Strategies With Python

This course takes your skills to the next level with real trading strategy development. You’ll learn to use Backtrader, a tool that helps test trading ideas properly. The course teaches you how to create trading signals, improve your strategies, and check if they work on new data. You’ll build complete trading systems that include realistic costs and ways to protect your money when trades go wrong.

Course Overview and Introduction

The advanced course begins by introducing the instructor and outlining the practical skills students will develop. This section highlights the practical trading systems students will build, setting expectations for the more sophisticated content ahead.

Backtesting Principles

This module explores the importance of proper backtesting methodology in trading strategy development. Students learn the advantages and limitations of backtesting, along with essential rules and metrics that separate professional backtests from amateur approaches.

Technical Setup

Building on the first course, this section ensures students have all necessary tools installed, including Anaconda and specialized Python packages. The Jupyter Notebook environment is revisited with a focus on using it for more complex strategy development.

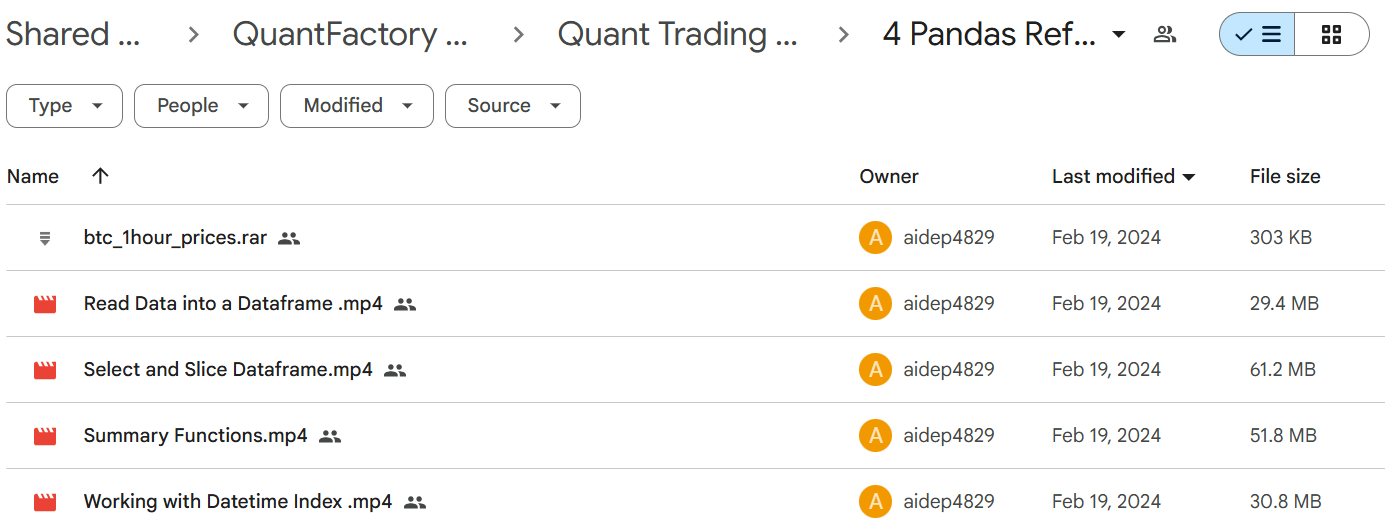

Pandas Refresher

Students revisit and extend their Pandas skills with a focus on handling time-series financial data. The section covers reading data into dataframes, selecting and slicing data, summary functions, and working with datetime indices—all with examples using real cryptocurrency price data.

Backtrader Fundamentals

This comprehensive module introduces the Backtrader platform for professional-grade strategy backtesting. Students learn to add data feeds, create strategies, implement order types, set commissions, add trade notifications, and incorporate analyzers—establishing a complete backtesting workflow.

Strategy Development Principles

Moving beyond mechanics, this section explores the art of strategy creation. Students learn idea generation methods, indicator selection, and how to develop strategies that make logical sense. The module also introduces machine learning applications in strategy development.

Data Extraction and Feature Preparation

This advanced section teaches students to build sophisticated feature sets for trading strategies. Through multiple parts covering technical indicators, options data modeling, and regime feature modeling, students learn to create robust datasets that capture different market conditions and signals.

Backtesting Implementation

Students apply their knowledge to build complete backtesting systems. Key lessons include constructing custom backtesters, implementing pandas data feeds, and visualizing backtest results for strategy evaluation and refinement.

Strategy Optimization

This crucial module covers methods to improve strategy performance through parameter optimization. Students explore dynamic stop-loss implementations and multiple intraday price action patterns, learning how to systematically enhance their trading strategies while avoiding overfitting.

Out-of-Sample Testing

The final section covers the essential practice of validating strategies on unseen data. Students learn to properly conduct out-of-sample testing to confirm strategy robustness before real-world deployment, completing their journey from Python basics to advanced strategy validation.

4️⃣. Who is Lachezar “Luke” Haralampiev?

Lachezar “Luke” Haralampiev is an algorithmic trader and co-founder of QuantFactory with deep experience in quant finance.

Luke worked at top hedge funds where he built trading strategies that make consistent money. He knows multiple markets and asset types well.

He has created 35+ profitable trading strategies and completed over 350 projects – including backtesting tools, stock screeners, alert systems, and trading bots. His algorithms trade in the markets now and make real profits.

At QuantFactory, Luke uses his experience from working with elite trading teams to teach others. His time in high-pressure trading environments shaped how he teaches.

Luke wants to make quant trading knowledge available to everyone. He teaches practical methods, not just theory, so students learn skills they can use right away.

5️⃣. Who should take QuantFactory Course?

The QuantFactory Become A Quant Trader Bundle helps motivated people master algorithmic trading. This course is perfect for:

- Finance professionals who want to boost their careers with quant skills.

- Computer science graduates looking to use their coding skills in finance.

- Self-taught traders ready to improve with algorithmic strategies and backtesting.

- Career changers wanting to enter the high-paying field of quant finance.

- Financial analysts looking to automate research and build data-driven trading systems.

This program connects theory with real practice, making it ideal for anyone serious about creating profitable trading algorithms or getting $170,000+ jobs at hedge funds, prop firms, and investment banks.

6️⃣. Frequently Asked Questions:

Q1: What is algorithmic trading?

Q2: What is Python in algorithmic trading?

Q3: How much money do I need to start algorithmic trading?

Q4: What’s the difference between algorithmic and manual trading?

Q5: Can a beginner learn algorithmic trading?

Be the first to review “QuantFactory – Become A Quant Trader Bundle” Cancel reply

Related products

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Reviews

There are no reviews yet.