Peter Diamandis – Fund Your Purpose

$1,969.00 Original price was: $1,969.00.$18.00Current price is: $18.00.

Peter Diamandis Fund Your Purpose Course [Instant Download]

1️⃣. What is Peter Diamandis Fund Your Purpose?

Peter Diamandis Fund Your Purpose is a fundraising program that teaches entrepreneurs how to secure million-dollar investments in just 14 days.

The program includes access to 1,000+ investor contacts and proven pitch strategies developed from Diamandis’s experience raising over one billion dollars.

You’ll learn through practical lessons, watch real pitch analyses, and study successful pitch decks from companies like Airbnb and Uber to master the art of fundraising for your purpose-driven projects.

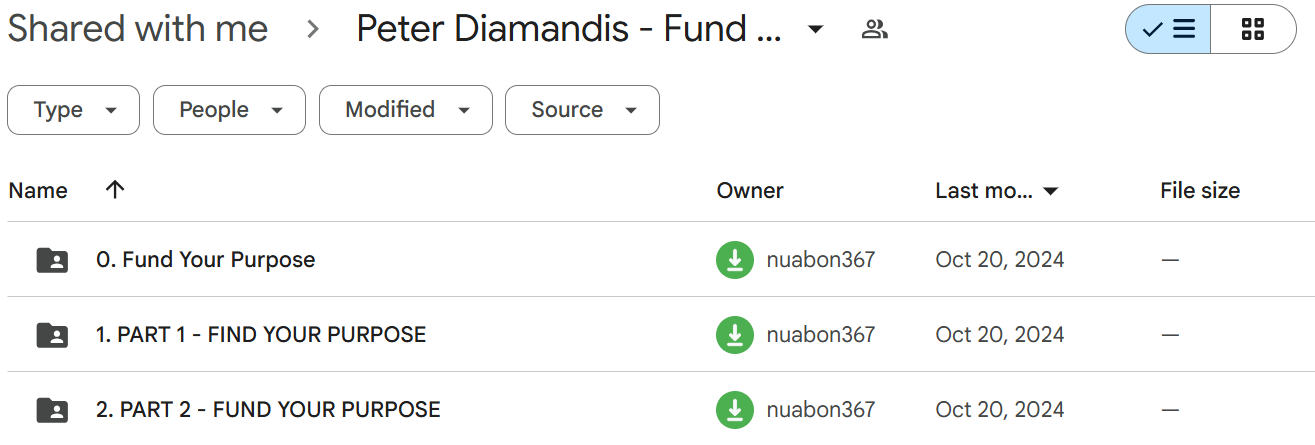

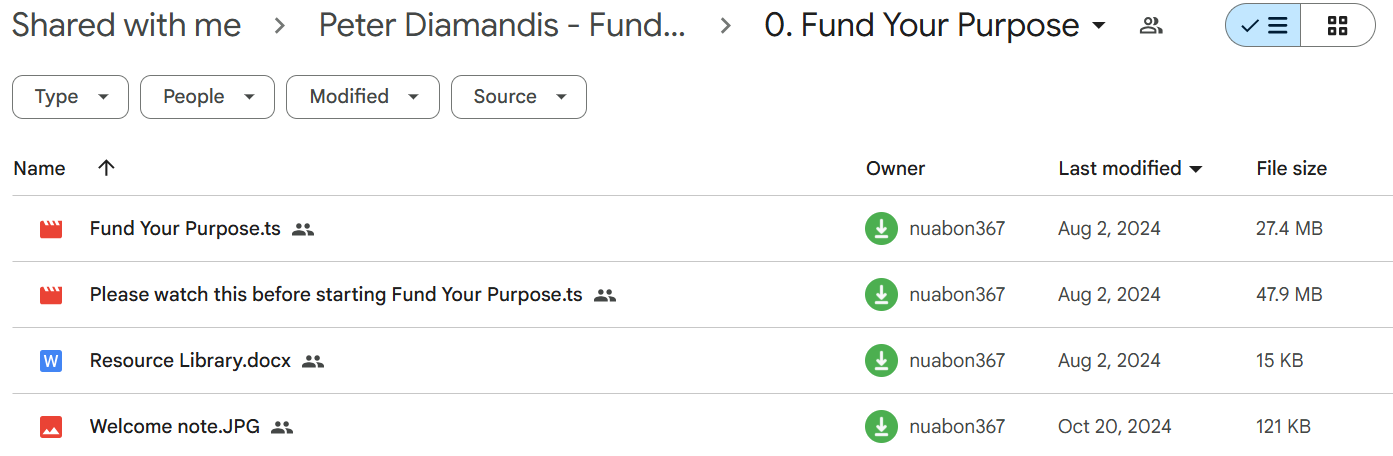

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Fund Your Purpose:

Fund Your Purpose gives you all the tools to raise money for your purpose-driven projects. Here’s what you’ll learn:

- Fundraising strategy: Learn the full process from preparing to closing million-dollar deals

- Investor targeting: Get access to 1,000+ organized investors you can reach out to right away

- Pitch development: Build powerful presentations that grab investor attention

- Objection handling: Master proven ways to address investor concerns

- Networking tactics: Learn how to build key relationships with potential investors

- Closing techniques: Discover how to successfully finalize investment deals

The course blends Peter’s billion-dollar fundraising know-how with practical tools you can use immediately. When you finish, you’ll have everything you need to fund your purpose-driven venture.

3️⃣. Fund Your Purpose Course Curriculum:

✅ Part 1: Find Your Purpose

This first module focuses on developing the right mindset for entrepreneurial success and identifying your meaningful purpose. It explores various mindsets crucial for raising capital, including the Curiosity, Abundance, Exponential, Purpose-Driven, and Moonshot mindsets.

The module begins with an emphasis on why mindset matters, teaching participants how to shape their thinking through surrounding themselves with the right people and consuming purposeful content. Peter shares personal insights about maintaining a positive mindset and finding your community.

Participants learn to develop their Massive Transformative Purpose (MTP) through lessons like “Developing Your MTP” and “How to Create Your Moonshot.” Peter provides real-world examples, including his experience with asteroid mining, to demonstrate how purpose-driven thinking leads to groundbreaking ventures.

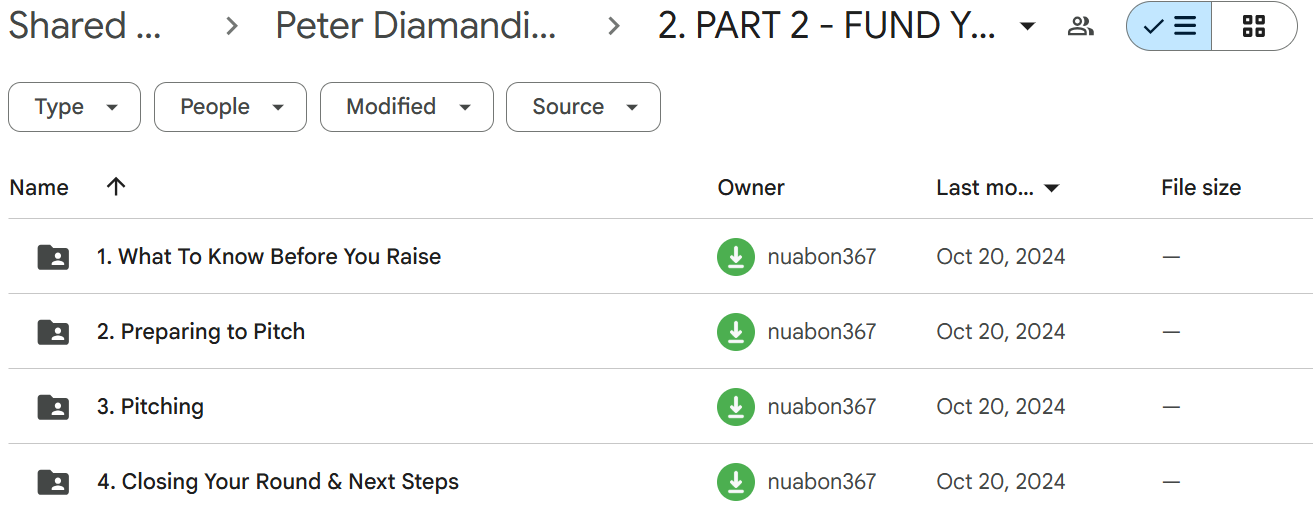

✅ Part 2: Fund Your Purpose

Module 1: What To Know Before You Raise

This module lays the foundation for effective fundraising by covering essential knowledge every entrepreneur needs before seeking investment. It begins with Peter sharing his personal experience of raising his first million dollars.

Participants learn to answer critical questions: “Why Me?”, “Why This?”, and “Why Now?” – the fundamental questions investors will ask. The module explains key fundraising terms and concepts including term sheets, employee option pools, pro-rata shares, and SAFE notes in accessible language.

Special attention is given to the differences between non-profit and for-profit fundraising models, helping entrepreneurs choose the right structure for their purpose. The module concludes with an honest look at fundraising realities and provides a comprehensive resource guide.

Module 2: Preparing to Pitch

This module focuses on creating compelling pitches and building relationships with potential investors. It starts with the concept of “Launching Above The Line of Supercredibility” and guides entrepreneurs on determining how much funding to seek and when.

Participants learn about valuation principles and wealth creation strategies while gaining insights into different investor types, from friends and family to venture capitalists. Peter explains what each investor category looks for and how to approach them effectively.

The core of this module centers on pitch deck development, featuring analysis of successful pitch decks from companies like Daily.ai, Colossal, and JUST Egg. Participants learn storytelling techniques, pitch mastery, and strategies for building investor networks and reaching out to potential funders.

Module 3: Pitching

This module provides advanced pitching techniques drawn from Peter’s extensive fundraising experience, including how he raised $141 million for one venture. It offers practical advice on closing pitch meetings and navigating challenging situations.

Participants learn specialized approaches for different investor types, with dedicated lessons on pitching to friends and family, angels, incubators, accelerators, and venture capitalists. Special attention is given to non-profit fundraising and raising non-dilutive capital.

Peter shares his most memorable pitching experiences, including “The Craziest Pitch Of My Life” and “How I Raised $100 Million To Solve Climate Change,” providing real-world examples and lessons. The module also covers handling common objections and pitching effectively over Zoom.

Module 4: Closing Your Round & Next Steps

The final module focuses on successfully closing funding rounds and managing relationships with investors. It teaches participants how to track and nurture potential investors through a systematic pipeline approach.

The module concludes with parting notes that summarize key lessons and provide guidance on next steps after securing funding, ensuring participants can maintain momentum and leverage their newly acquired capital effectively.

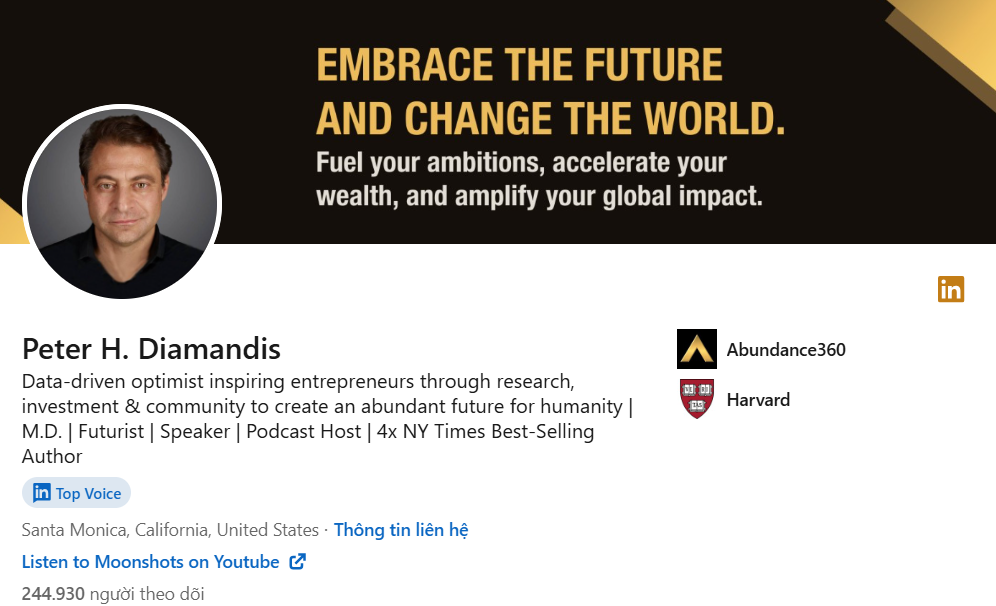

4️⃣. Who is Peter Diamandis?

Peter Diamandis is an entrepreneur and expert in raising money for big ideas. He founded the XPRIZE Foundation, which has given over $140 million in prizes to solve major world problems.

In 30+ years, Diamandis has raised more than $1 billion for projects including Singularity University, which teaches about future technologies. His work covers space exploration, longevity research, and advanced tech companies.

With degrees from Harvard Medical School and MIT, Diamandis wrote bestselling books “Abundance” and “Bold.” He’s been named among Fortune’s “World’s 50 Greatest Leaders” and won the Heinlein Prize for his work in space.

He regularly speaks to Fortune 500 companies about innovation and fundraising. His wide network of investors and business leaders makes him perfect for teaching how to get funding for big projects.

In Fund Your Purpose, Diamandis shares his fundraising secrets in a practical way that has already helped thousands of entrepreneurs fund their ideas.

5️⃣. Who should take Peter Diamandis Course?

Fund Your Purpose is made for purpose-driven entrepreneurs who want to secure major funding. This course is for:

- First-time fundraisers who need a clear plan to navigate the fundraising world.

- Established founders wanting to improve their pitch and secure bigger investment rounds.

- Purpose-driven innovators with ideas that can make a big impact but need serious money.

- Current fundraisers struggling to get investor meetings or close deals.

- Entrepreneurs with big visions who want to learn from someone who has raised billions.

This program works best if you’re ready to put time into your fundraising plan and build relationships with investors. If you want quick results or aren’t willing to use the strategies taught, this course might not be right for you.

Reviews

There are no reviews yet.