Oz Konar Business Lending Blueprint Course [Instant Download]

1️⃣. What is Oz Konar Business Lending Blueprint?

Oz Konar Business Lending Blueprint is a loan broker training program that teaches you how to become a loan broker connecting businesses with funding they can’t get from banks.

You’ll get direct access to lenders, done-for-you marketing systems, and all tools needed to close deals quickly.

The course shows exactly how to earn $10,000+ monthly in commissions by helping businesses secure alternative financing like merchant cash advances, equipment leasing, and SBA loans.

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Business Lending Blueprint:

Business Lending Blueprint gives you all the tools to start and grow a profitable loan brokerage. Here’s what you’ll learn:

- Funding options: Learn about SBA loans, equipment leasing, merchant cash advances, and real estate lending

- Finding clients: Use LinkedIn, email, and Facebook to attract business owners who need funding

- Closing deals: Get proven scripts and techniques to turn leads into funded deals

- Setting up shop: Get legal templates, simple CRM systems, and step-by-step workflows

- Lender network: Connect directly with funding partners who will process your deals

- Growing bigger: Learn how to expand from solo broker to building a team with steady income

This ready-to-use system works for complete beginners and experienced brokers who want to offer more funding options.

3️⃣. Business Lending Blueprint Course Curriculum:

✅ Section 1: Program Foundations and Business Framework

This section introduces the fundamental concepts and overall structure of the business funding program. It establishes the big picture perspective and introduces key methodologies for success in the business funding industry. Students learn how to set up their business properly and create a professional foundation to build upon.

Module 1.1: Blueprint Fundamentals

The foundational module introduces the core concepts, establishes the big picture perspective, and introduces the BAMOS methodology for achieving success in the business funding industry.

Module 1.2: Business Setup and Infrastructure

This module covers business setup essentials, professional resource guides, and key operational frameworks. Students learn how to properly establish their business entity and create necessary infrastructure.

Module 1.3: Fast Track Implementation

Students learn accelerated implementation strategies to quickly establish their business funding practice and begin generating revenue efficiently.

✅ Section 2: Funding Options and Product Knowledge

This comprehensive section covers the various funding products students can offer clients. It details different loan types, their characteristics, and how to match client needs with appropriate funding solutions.

Module 2.1: Understanding Funding Models

Students learn the differences between direct access and done-for-you lending approaches, with training on how to leverage both models effectively.

Module 2.2: Personal and Term Loans

This module covers personal and startup funding mechanisms, including secured lines of credit through various lending partners.

Module 2.3: Fast Business Funding

Students learn about merchant cash advances, working capital loans, and short-term lending options, including higher rate, higher commission models.

Module 2.4: Equipment Leasing

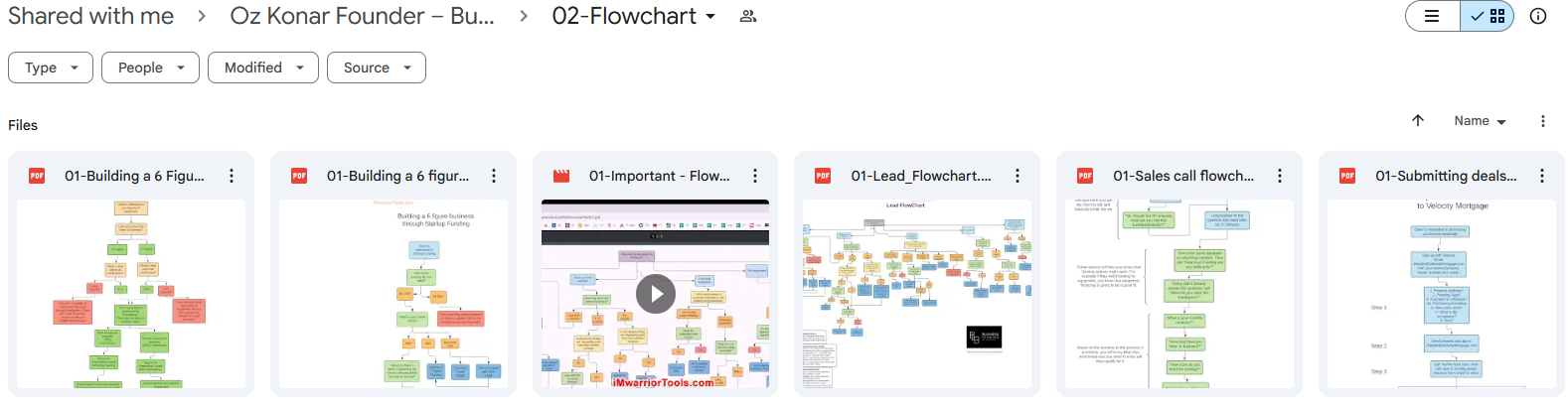

This module teaches students how to build a six-figure business through equipment financing and leasing, covering fundamentals and submission processes.

Module 2.5: Real Estate Based Lending

Students learn about real estate funding options, fix and flip loans, renovation financing, and wholesale lending partnerships.

Module 2.6: SBA and Specialized Lending

This module focuses on SBA loan programs, invoice factoring, and other specialized lending options that create diverse revenue streams.

✅ Section 3: Lender Relationships and Deal Submission

This section focuses on establishing and maintaining relationships with lending partners across different regions and learning proper deal submission procedures to maximize approval rates.

Module 3.1: Lender Networks

This module introduces students to exclusive lender partnerships across the US, Canada, Australia, and the UK, helping establish strong funding connections.

Module 3.2: Submission Procedures

Students learn specific submission requirements for various lenders, including proper documentation and application processes.

Module 3.3: Partner Management

This module covers relationship management techniques for maintaining productive partnerships with lending institutions.

✅ Section 4: Online Presence and Authority Building

This section teaches students how to establish a professional online presence through website development, professional email systems, and digital branding strategies.

Module 4.1: Website Development

Students learn to create a professional website in ten simple steps to showcase their funding services and build credibility.

Module 4.2: Professional Communications

This module covers business email setup, proper signature creation, and professional communication standards.

Module 4.3: Digital Branding

Students learn to develop a consistent brand presence across digital channels to enhance market recognition.

✅ Section 5: Client Applications and Data Management

This section covers the development and management of client applications, documentation processes, and customer relationship management systems for tracking client information.

Module 5.1: Application Development

Students learn to develop and customize funding applications in both paper and digital formats.

Module 5.2: Customer Relationship Management

This module covers CRM systems implementation for effectively tracking client information throughout the funding process.

Module 5.3: Documentation Standards

Students learn proper documentation requirements for different funding types to ensure smooth submission processes.

✅ Section 6: LinkedIn Marketing and Lead Generation

This comprehensive section teaches LinkedIn profile optimization, network building, and lead generation techniques through this powerful business platform.

Module 6.1: LinkedIn Profile Optimization

Students learn to create professional LinkedIn profiles and company pages that attract potential clients.

Module 6.2: Network Building Strategies

This module covers techniques for building a massive network of qualified prospects on LinkedIn.

Module 6.3: Automation and Lead Generation

Students learn to use tools like DuxSoup and Sales Navigator to automatically generate leads on LinkedIn.

Module 6.4: Conversion Techniques

This module teaches students how to convert LinkedIn connections into funding clients through proven messaging strategies.

✅ Section 7: Email and Multi-Channel Marketing

This section teaches implementation of email automation systems, campaign development, and integration with other marketing channels to create comprehensive outreach strategies.

Module 7.1: Email System Setup

Students learn to implement email automation platforms and integrate them with lead generation systems.

Module 7.2: Campaign Development

This module covers email copywriting, sequence development, and campaign optimization techniques.

Module 7.3: Multi-Channel Integration

Students learn to integrate text messaging, email, and social media into a cohesive marketing strategy.

Module 7.4: Technical Implementation

This module provides technical guidance for tools like Gmass to ensure proper email delivery and campaign tracking.

✅ Section 8: Social Media and Paid Advertising

This section focuses on creating effective social media presence and paid advertising campaigns, particularly on Facebook, to generate qualified leads.

Module 8.1: Facebook Business Foundation

Students learn to create and optimize Facebook business pages as the foundation for digital marketing efforts.

Module 8.2: Campaign Development

This module focuses on creating effective advertising campaigns with proper targeting and creative elements.

Module 8.3: Performance Optimization

Students learn to track campaign performance, optimize for better results, and scale successful campaigns.

✅ Section 9: Strategic Partnerships and Referral Networks

This section teaches students how to develop referral partnerships and strategic alliances to create consistent deal flow without direct marketing costs.

Module 9.1: Partnership Models

This module distinguishes between different partnership levels and teaches strategic alliance development.

Module 9.2: Relationship Development

Students learn how to approach and secure partnerships with professionals in complementary fields.

Module 9.3: Partnership Management

This module provides contracts, agreements, and management techniques for maintaining productive partnerships.

✅ Section 10: Sales Techniques and Client Conversion

This comprehensive section covers the sales process, script implementation, objection handling, and closing techniques specific to business funding services.

Module 10.1: Sales Framework

This module outlines the stages of proper sales engagement and provides a structured approach to the funding sales process.

Module 10.2: Script Implementation

Students receive proven sales scripts and learn how to effectively use them in client conversations.

Module 10.3: Specialization Strategy

This module teaches students how to position themselves as experts in specific funding niches to increase conversions.

Module 10.4: Objection Handling

Students learn effective questioning methods and powerful rebuttals to overcome common client objections.

✅ Section 11: Auxiliary Services and Revenue Streams

This section covers additional service offerings that complement the core funding business, including credit repair, monitoring, and other financial services.

Module 11.1: Credit Services

Students learn about credit monitoring, reports, and repair programs they can offer clients as additional services.

Module 11.2: Complementary Financial Services

This module explores other financial service offerings that create additional revenue streams and client value.

✅ Section 12: Ongoing Support and Business Growth

This section provides continuing education, coaching, and resources to help students grow their businesses over time and adapt to changing market conditions.

Module 12.1: Coaching Resources

Students gain access to recorded weekly coaching calls providing implementation guidance and answering questions.

Module 12.2: Partner Webinars

This module includes recorded partner webinars providing deeper insights into specific lending programs.

Module 12.3: Business Scaling Strategies

Students learn techniques for hiring virtual assistants, increasing productivity, and consistently growing their funding businesses.

Module 12.4: International Operations

This module provides specialized training for operating across borders, particularly for Canadian students funding deals in the USA market.

4️⃣. Who is Oz Konar?

Oz Konar is a New York entrepreneur and founder of Business Lending Blueprint. He specializes in alternative lending and teaching people how to build profitable loan brokerages.

Oz discovered that banks reject 80% of small business loan applications. This created a huge opportunity for loan brokers to connect these businesses with alternative funding.

In 2018, he launched Business Lending Blueprint to share his proven system. His company, Massive Action Consulting, made the Inc. 5000 list of fastest-growing companies in America.

Oz has written books on marketing for small businesses. His teaching focuses on practical strategies that get fast results.

Through his program, Oz has helped thousands of students in 47 countries build loan brokerages. Many students report earning five and six-figure monthly commissions. He provides weekly coaching calls and maintains an active community.

5️⃣. Who should take Oz Konar Course?

Business Lending Blueprint is for people who want to start or grow in the business lending industry. This course is perfect for:

- Beginners with no lending experience who want a step-by-step system to build a profitable business without big startup costs.

- Sales professionals who can use their skills to earn repeat commissions from high-value deals.

- Financial services professionals looking to add alternative lending options and create new income streams.

- Entrepreneurs and business owners who want a side business that could replace their main income while working fewer hours.

This program is great if you want a business with no inventory, low costs, and the freedom to work from anywhere. The weekly coaching calls and community support help newcomers succeed.

6️⃣. Frequently Asked Questions:

Q1: What is a loan broker?

Q2: How much money can loan brokers make?

Q3: Do I need lending experience to become a business funding broker?

Q4: What’s the difference between loan brokers and traditional bank lending?

Q5: How much does it cost to start a business funding brokerage?

Be the first to review “Oz Konar – Business Lending Blueprint” Cancel reply

Related products

Business Credit

Reviews

There are no reviews yet.