Options Mastery 32 DVDs (Copy)

$497.00 Original price was: $497.00.$26.00Current price is: $26.00.

Options Mastery 32 DVDs Course [Instant Download]

1️⃣. What is Options Mastery 32 DVDs?

Options Mastery 32 DVDs by Alan Knuckman is a complete options trading program that helps you go from total beginner to expert trader.

The course shows you how to find winning trades using the exact methods that professional floor traders use every day. You’ll learn how to look at any options situation and know exactly what to do.

Created by Options University, this program teaches you everything about option theory basics, understanding the Greeks, volatility strategies, and powerful techniques that work when markets go up, down, or sideways.

With 32 lessons divided into four modules. By the end, you’ll have the skills to make consistent profits trading options – just like thousands of students who took this course before you.

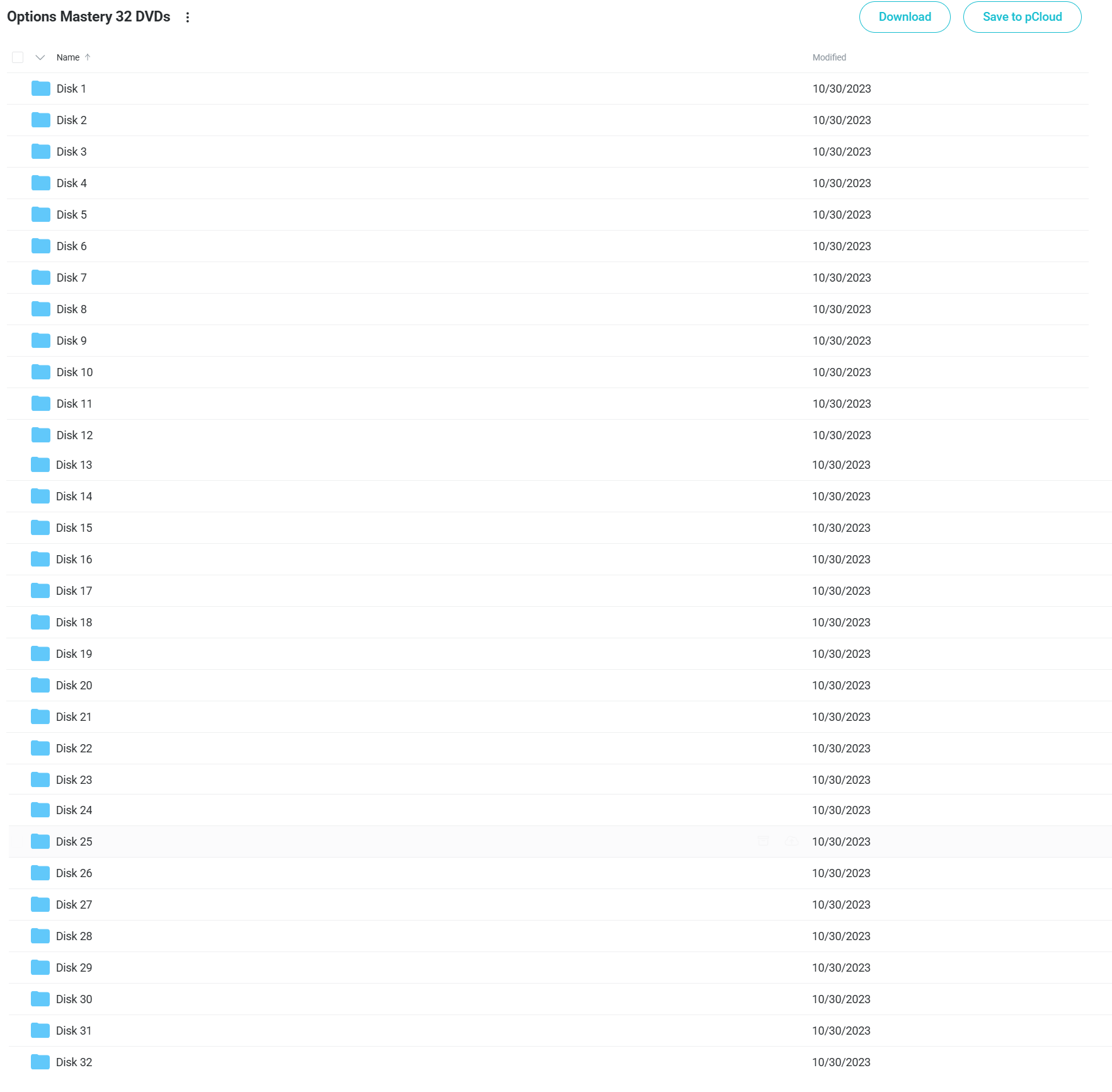

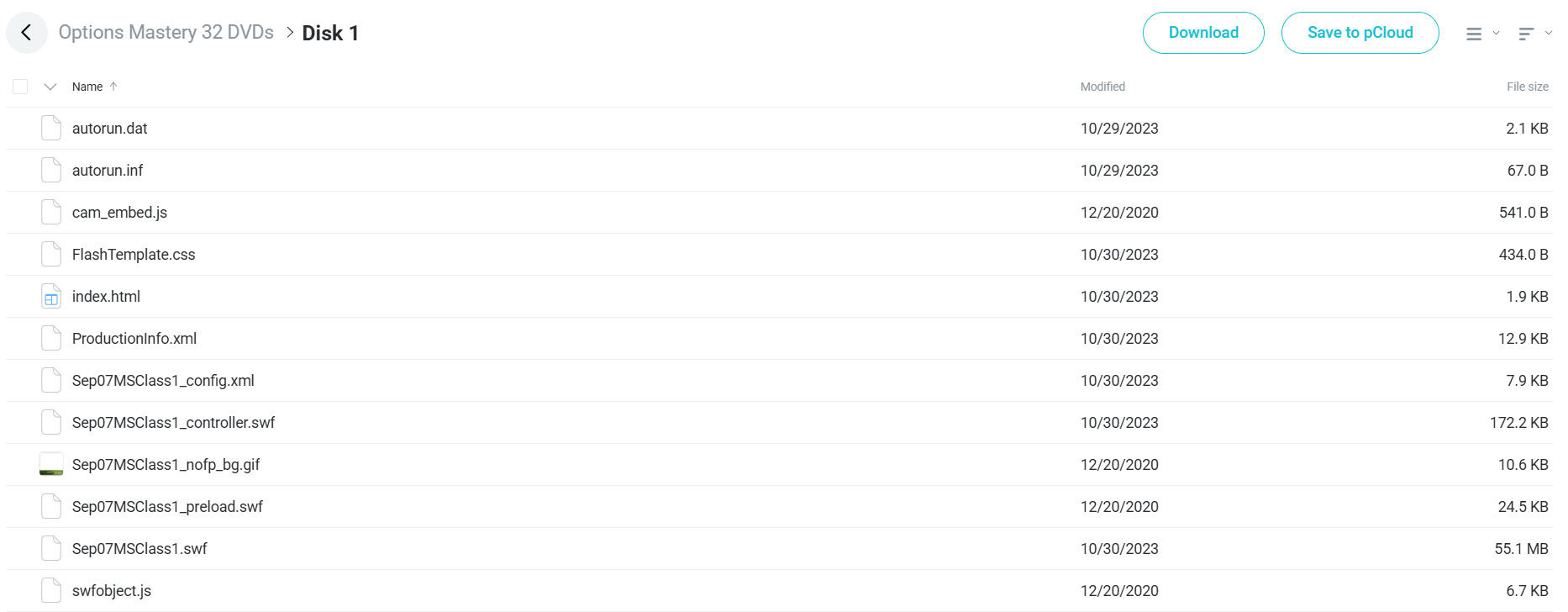

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Options Mastery 32 DVDs:

Options Mastery 32 DVDs gives you complete options trading skills, from basics to advanced methods. Here’s what you’ll learn:

- Options fundamentals: Understand how options work, their pricing, and market behavior

- The Greeks: Master delta, gamma, theta, and vega to control risk better

- Trading strategies: Learn covered calls, spreads, condors, and other pro techniques

- Volatility analysis: Find profit chances when markets become more or less volatile

- Risk management: Protect your money in any market – up, down, or sideways

- Professional techniques: Use the same methods floor traders use to make money

This program is for traders who want steady profits. When finished, you’ll know how to analyze any options trade and make smart money decisions on your own.

3️⃣. Options Mastery 32 DVDs Course Curriculum:

✅ Disks 1-8: Fundamentals and Basic Strategies (September)

These first disks teach the basic building blocks of options trading that you’ll need for the entire course. You’ll learn the key terms, how options work, and how to think about risk when trading options.

You’ll start with simple strategies like covered calls (selling options while owning stock) and protective puts (buying insurance for your stocks). Each lesson builds on what you learned before, adding slightly more complex ideas as you go.

By the end of Disk 8, you’ll understand not just how to place trades, but why certain trades make sense in different market situations. These lessons use clear examples and plenty of practice to build your confidence.

✅ Disks 9-15: Intermediate Techniques (Late September to Mid-October)

In this section, you’ll learn how to combine multiple options together to create better trading opportunities. These combined positions help you make money in specific market conditions while limiting your risk.

You’ll likely learn about strategies like iron condors (profiting when a stock stays in a range), butterflies (targeting a specific price), and calendar spreads (taking advantage of time decay). The lessons also cover how timing and market movement expectations affect your strategy choices.

By Disk 15, you’ll be able to look at options prices, spot good trade setups, and build positions that match what you think the market will do. You’ll also learn what to do when trades don’t go as planned.

✅ Disks 16-23: Market Analysis and Trading Decisions (Late October to Mid-November)

These disks focus on how to read the market to find the best trading opportunities. You’ll learn to understand price movement patterns, how stocks in different sectors behave, and market signals that help you choose better options trades.

The lessons cover chart reading techniques and indicators that work specifically for options trading. You’ll learn how to spot high-chance setups and decide how much money to put into each trade.

The November sessions (Disks 19-23) teach you how to trade during earnings announcements, how to use index options, and possibly how to trade specific market sectors. By now, you’ll work with complete trading plans that include when to enter, when to take profits, and when to exit.

✅ Disks 24-32: Professional Money Management (Late November to December)

The final section teaches you to think like a professional trader by managing multiple positions and your overall account risk. You’ll learn how to balance your trades across different market sectors and manage key risk factors.

December sessions (Disks 28-32) cover advanced ways to protect your money, how to add to winning positions, and what to do during extreme market conditions like sudden price drops or surprising news. You’ll learn to think strategically while working within your account limits.

The course ends with lessons on creating your own trading system that fits your personal risk comfort level and goals. Final classes focus on long-term success, mental discipline, and how to keep improving after the course ends.

4️⃣. Who is Alan Knuckman?

Alan Knuckman is a Senior Options Instructor at Options University with decades of trading experience. He started on Chicago’s trading floors where he mastered options trading firsthand.

With 25+ years in the markets, Alan is known for making complex options concepts simple and actionable. He focuses on risk management and volatility analysis to find high-probability trades.

Alan appears on CNBC, Bloomberg, and Fox Business to share market insights. His analysis has been featured in Barron’s and The Wall Street Journal.

He has taught thousands of students how to trade better through his programs. Alan combines technical analysis with real floor trading experience to give practical skills.

In the Options Mastery Series, Alan shares the exact strategies from his successful career. Students love how he simplifies complex ideas and focuses on practical trading applications.

5️⃣. Who should take Options Mastery 32 DVDs Course?

The Options Mastery 32 DVDs course gives complete options training for serious traders. This course is perfect for:

- Beginner traders who want to build a strong foundation in options trading without making expensive mistakes.

- Intermediate traders looking to grow beyond basic calls and puts into more powerful, profitable strategies.

- Advanced traders seeking pro-level methods to create steady income in all market conditions.

- Portfolio managers wanting to use options to protect investments and boost returns.

- Full-time professionals looking to build a side income through options trading.

This course is for people serious about using options trading to build wealth. If you’re willing to learn professional options strategies and use them regularly, this program gives you everything you need.

6️⃣. Frequently Asked Questions:

Q1: What’s the difference between call and put options?

Q2: How do beginners start trading options?

Q3: What are the Greeks in options trading?

Q4: Can you lose more than you invest with options?

Q5: How does volatility affect options pricing?

Be the first to review “Options Mastery 32 DVDs (Copy)” Cancel reply

Related products

Best 100 Collection

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Anton Kreil – Professional Options Trading Masterclass (POTM)

![[Bundle] Best 14 Dan Sheridan Courses](https://coursehuge.com/wp-content/uploads/2023/09/Bundle-Best-14-Dan-Sheridan-Courses-300x300.jpg)

Reviews

There are no reviews yet.