-

×

AXIA Futures – Elite Trader Blueprint

1 × $23.00

Apteros Trading – NADRO Methodology by Merritt Black

$2,995.00 Original price was: $2,995.00.$143.00Current price is: $143.00.

Merritt Black NADRO Methodology Course [Instant Download]

1️⃣. What is Merritt Black NADRO Methodology?

NADRO Methodology is a course developed by Merritt Black, it teaches you how to trade futures like professionals do. It works in real markets every day.

The course shows you a complete system using Narrative, Acceptance, Developing Value, Rhythm, and Order Flow to help you trade consistently and profitably.

Created on an actual trading desk using real money, this approach helps you join the successful 10% of traders who make consistent profits.

📚 PROOF OF COURSE

2️⃣. What you’ll learn in NADRO Methodology:

NADRO Methodology teaches you how to trade like the pros. Here’s what you’ll learn:

- Mental Framework: Build the right trading mindset and beat common thinking traps

- Market Framework: Learn how markets really work with auction theory and 10 key market laws

- Execution & Trade Management: Know exactly when to enter and exit trades with proper risk control

- Long-Term VWAPs: Use price and volume data to plan your trades on different timeframes

- The Work: Master the daily habits of successful traders through prep, journaling, and review

- Order Flow Trading: Read the market’s buying and selling pressure to spot opportunities

This course closes the gap between struggling and successful trading using the same methods used by Apteros Trading professionals every day.

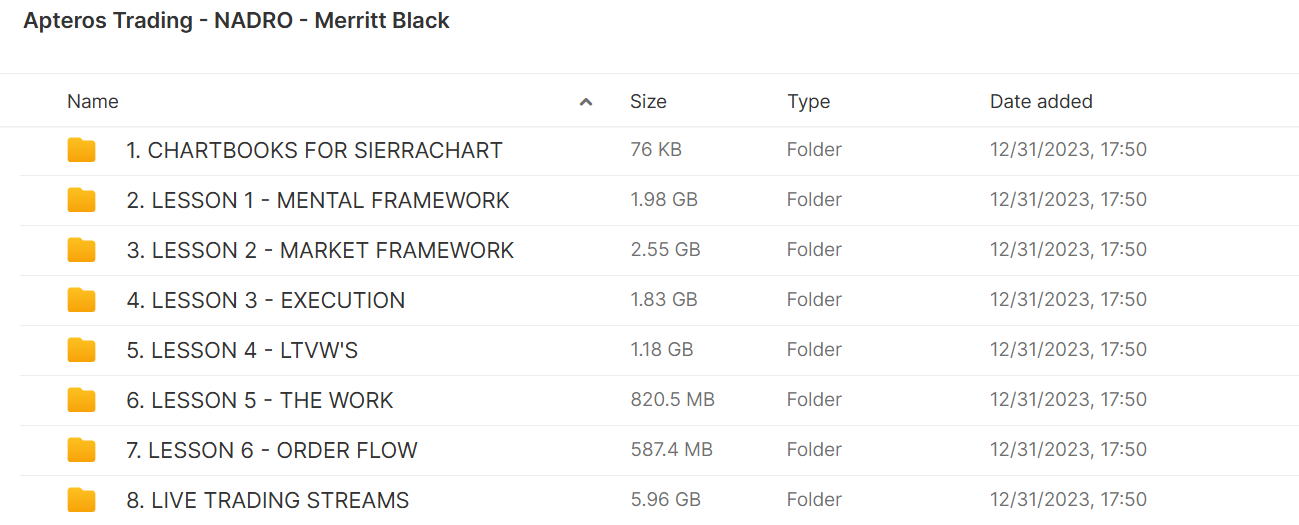

3️⃣. NADRO Methodology Course Curriculum:

✅ Chartbooks for SierraChart

This section provides essential Chart Templates specifically designed for the SierraChart platform, focusing on Crude Oil (CL) and E-mini S&P 500 (ES) futures markets. These Chartbooks establish the Technical Foundation for implementing the NADRO methodology across different Market Instruments.

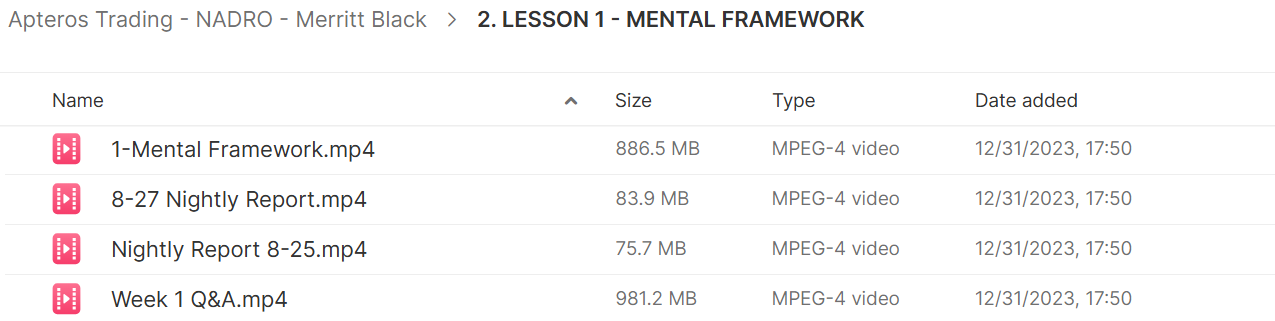

✅ Lesson 1: Mental Framework

The course begins with the critical Psychological Foundation of successful trading. Students learn how to develop the Proper Mindset, Manage Emotions, and Establish Realistic Expectations in trading. The module includes practical applications through Nightly Market Reports that demonstrate how Mental Discipline translates to actual Trading Decisions.

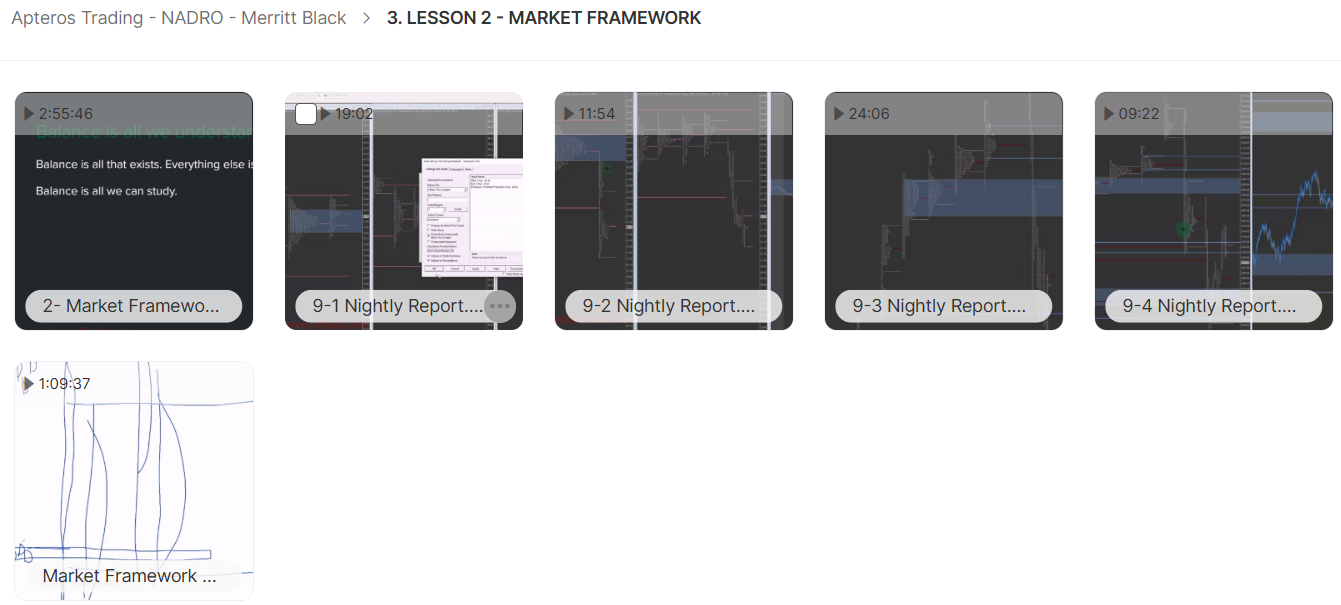

✅ Lesson 2: Market Framework

This module explores how markets function structurally, teaching students to identify Key Price Levels, Market Phases, and Significant Patterns. Through daily Nightly Reports spanning a full Trading Week, Merritt demonstrates how to apply this framework to Real-Time Market Conditions, identifying Opportunities and Managing Risk across different Market Environments.

✅ Lesson 3: Execution

Execution Strategies form the tactical component of the methodology, covering Entry and Exit Techniques, Position Sizing, and Risk Management. This practical module bridges Theoretical Knowledge with Real-World Application, teaching students how to efficiently translate Analysis into precise Trading Actions while minimizing Slippage and maximizing Profit Potential.

✅ Lesson 4: LTVW’s

The LTVW module introduces Specialized Trading Techniques unique to the NADRO methodology. Through Lesson Content and corresponding Nightly Reports, students learn to identify these High-Probability Trade Setups within current Market Conditions and implement them effectively.

✅ Lesson 5: The Work

This module focuses on the Consistent Practice and Application required to master trading. It emphasizes developing Daily Routines, Preparation Rituals, and Self-Assessment Processes that lead to Continuous Improvement. The Nightly Reports demonstrate how Disciplined Work Habits translate into Consistent Trading Performance.

✅ Lesson 6: Order Flow

Order Flow Analysis represents an advanced component of the methodology, teaching students to interpret Market Microstructure and Real-Time Buying/Selling Pressure. This technical module shows how to read the actual Flow Of Orders in the market to gain an edge in Timing Entries and Exits with greater precision.

✅ Live Trading Streams

The curriculum culminates with five Live Trading Sessions where Merritt demonstrates the complete NADRO methodology in Real Market Conditions. These unfiltered Trading Sessions show how all previous modules integrate into a Cohesive Trading Approach, revealing how a Professional Trader manages Live Positions, adapts to Changing Conditions, and implements the System Holistically.

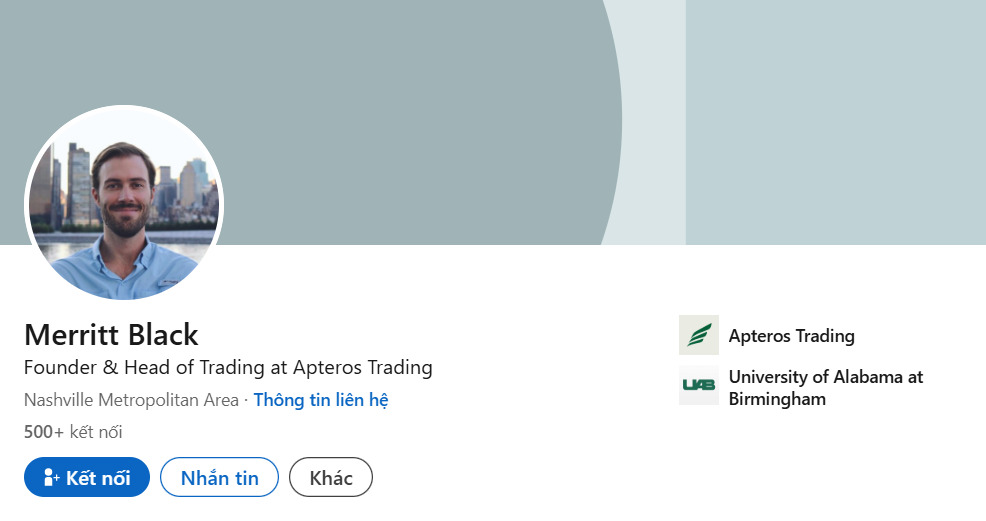

4️⃣. Who is Merritt Black?

Merritt Black has traded futures, currencies, commodities, and stocks for over 15 years. He founded Apteros Trading, a firm that gives futures traders the money, training, and tools they need to succeed.

Before Apteros, Merritt was Head of Futures and Commodities at SMB Capital. His trading advice appears on Futures Radio Show, AlphaMind Podcast, SMB Training Blog, and Amplify Trading.

Merritt created the NADRO Methodology from his work on professional trading desks. This system tackles why 90% of traders fail. He teaches both technical skills and mental approaches to help traders avoid common mistakes.

Merritt teaches practical frameworks, not theory. He stresses preparation, risk management, and using performance data to steadily improve.

5️⃣. Who should take Merritt Black Course?

The NADRO Methodology course is for traders who want real professional results. This course is perfect for:

- Aspiring professional traders who want to learn high-level skills for consistent profits.

- Proprietary trading desk candidates looking to master techniques that help pass firm evaluations.

- Fund managers wanting better approaches to improve their trading results.

- Serious retail traders ready to go beyond basic strategies and trade like professionals.

- Futures specialists trading currencies, commodities, indices, and other futures markets.

This isn’t a beginner course on trading basics – it’s advanced training for those serious about trading as a profession. If you want quick profits without doing the work, this course isn’t for you.

6️⃣. Frequently Asked Questions:

Q1: How do professionals trade futures successfully?

Professionals trade futures by following a structured plan, managing risk, and analyzing market conditions. They use data-driven strategies and strict discipline to ensure consistent profitability.

Q2: What is order flow trading?

Order flow trading analyzes the buying and selling activity in the market to predict short-term price movements. It helps traders understand market sentiment and liquidity in real-time.

Q3: How does the futures market auction process work?

The futures market operates through continuous auctioning, where buyers and sellers match orders at the best available prices. Market participants influence price discovery based on supply and demand dynamics.

Q4: Why is order flow important in trading?

Order flow provides insights into market strength, liquidity, and momentum. By analyzing order book data, traders can identify key support and resistance levels and improve trade execution.

Q5: How do you develop an edge in futures trading?

Developing an edge requires mastering market structure, risk management, and execution. Traders refine their skills through backtesting strategies, reviewing past trades, and adapting to evolving market conditions.

Be the first to review “Apteros Trading – NADRO Methodology by Merritt Black” Cancel reply

Related products

Futures Trading

Futures Trading

Futures Trading

Futures Trading

Futures Trading

Futures Trading

Futures Trading

AXIA Futures – Elite Trader Blueprint

AXIA Futures – Elite Trader Blueprint

Reviews

There are no reviews yet.