Kirk du Plessis – Signals (Option Alpha)

$19.00

[Download] Kirk Du Plessis Signals Course

📚 PROOF OF COURSE

What is Kirk Du Plessis Signals:

Kirk Du Plessis Signals is a straightforward, beginner-friendly online course designed to teach you the essentials of options trading. Led by Kirk Du Plessis, an expert in the field, this course breaks down complex trading strategies into simple, easy-to-understand lessons.

It’s based on extensive research, analyzing over 17 million stock trades to find what techniques work. With an impressive 82% success rate, the course offers strategies that help you make smarter, winning trades. It’s not just about learning the basics but equipping you with the proper knowledge to succeed in options trading.

What you will learn in Kirk Du Plessis Signals:

In the Option Alpha Signals course, you’ll learn important skills and knowledge in a simple way:

We Backtested More Than 17.34 Million Stock Trades Over 20 Years to See What Really Works…

- Discover specific indicators that led to winning trades 82% of the time and outperformed the market by an average of 2,602%.

- Read the Entire Report in Just 30 Minutes. Gain insights from 12 months of backtesting research covering more than 1,476 different technical analysis indicator variations.

- Option Alpha’s TOP 5 Indicators. Unveil our Top 5 indicators, with specific settings that delivered the highest overall returns, safety, and long-term consistency.

- 6 Optimal Settings Cheat Sheets. Designed as your “quick reference” guide, these cheat sheets provide the optimal settings for each of the eight key performance metrics we tracked.

- 25 Real-World Portfolio Simulations. Observe how various simulated portfolios managed to outperform the market by more than 2,602% on average.

And So Much More… We’re barely scratching the surface.

This course makes complex ideas simple and gives you practical tips to confidently trade in the options market.

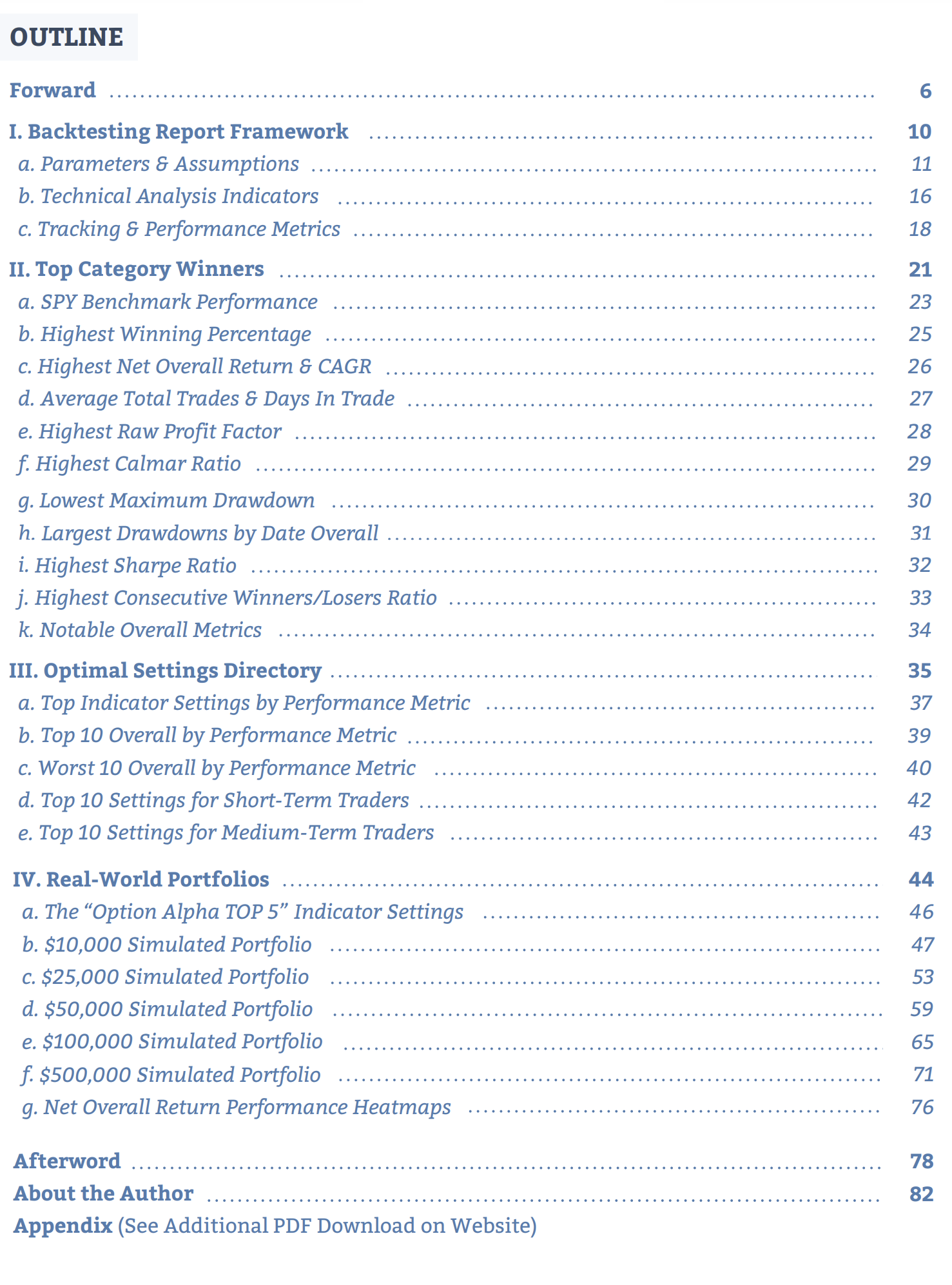

Kirk Du Plessis Signals Course curriculum:

Option Alpha Signals is meticulously designed to encompass a broad spectrum of essential trading concepts and strategies:

- Part I: Backtesting Report Framework: Sets the foundation with a detailed overview of the backtesting process, including the parameters and assumptions used for consistency.

- Part II: Top Performance Category Winners: Highlights the most effective indicators, enabling you to focus on what truly works in the market.

- Part III: Optimal Settings Directory: Offers a “quick reference” guide with optimal settings for each indicator, tailored to enhance your trading strategy.

- Part IV: Backtested Model Portfolios: Demonstrates the real-world application of the top 5 indicator settings through various portfolio simulations.

- Part V: Stock Indicator Summaries: Provides step-by-step examples and summaries for setting up each indicator, ensuring you’re ready to trade.

- Part VI: Extended Backtesting Results: Includes a comprehensive appendix with detailed backtesting results for those who wish to delve deeper.

This curriculum is designed to equip you with the tools and knowledge to excel in options trading, backed by empirical evidence and Kirk Du Plessis’ expert insights.

Who is Kirk Du Plessis?

Kirk Du Plessis is a seasoned options trader with a rich background in finance. His journey began at Deutsche Bank in New York, focusing on Mergers and Acquisitions, and expanded into Real Estate Investment Trust analysis at BB&T Capital Markets in Washington, D.C. This diverse experience laid a strong foundation for his later achievements in the trading world.

2007, Kirk founded Option Alpha, rapidly transforming it into a leading authority in options trading. The platform now boasts over 5.4 million yearly visitors and 47,000 active members globally, underscoring Kirk’s impact on the trading community.

Recognized as a thought leader, Kirk has been featured in numerous financial publications and interviews, including a notable contribution to Barron’s Magazine. Beyond his professional endeavours, he enjoys spending time with his family and working on his classic 1974 Pontiac GTO, reflecting his well-rounded personality and dedication to his career and hobbies.

Be the first to review “Kirk du Plessis – Signals (Option Alpha)” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Options Trading

Best 100 Collection

Options Trading

Options Trading

![[Bundle] Best 14 Dan Sheridan Courses](https://coursehuge.com/wp-content/uploads/2023/09/Bundle-Best-14-Dan-Sheridan-Courses-100x100.jpg)

![[Bundle] Best 14 Dan Sheridan Courses](https://coursehuge.com/wp-content/uploads/2023/09/Bundle-Best-14-Dan-Sheridan-Courses-300x300.jpg)

Reviews

There are no reviews yet.