Kevin Davey – Strategy Factory Workshop (2021)

$3,449.00 Original price was: $3,449.00.$12.00Current price is: $12.00.

Kevin Davey Strategy Factory Workshop Course [Instant Download]

What is Kevin Davey Strategy Factory Workshop?

Kevin Davey’s Strategy Factory Workshop teaches you how to build multiple profitable algorithmic trading strategies.

The course covers everything from finding trading ideas to testing, evaluating, and implementing strategies in live markets.

Created by a three-time World Cup Championship of Futures Trading winner, this workshop shows you how to develop a continuous “factory” of trading systems that can perform in real market conditions.

👉 Read more out Top Quantitative Trading Courses:

- StatOasis – Algo Trading Masterclass

- The Wall Street Quants BootCamp

- The Python Quants – CPF PROGRAM (2024)

- Rajandran R – QuantZilla

- Quantra Quantinsti – All Courses Bundle

📚 PROOF OF COURSE

What you’ll learn in Strategy Factory Workshop:

The Strategy Factory Workshop gives you the key skills needed for successful algorithmic trading. Here’s what you’ll learn:

- Complete strategy development process from finding ideas to trading live

- Advanced testing methods like walkforward testing and Monte Carlo simulation

- Professional evaluation techniques with 10+ ways to check if your trading system works

- Portfolio management skills for spreading risk and sizing positions correctly

- Strategy monitoring practices to know when to keep or quit a trading system

- Error prevention to avoid expensive mistakes in algorithmic trading

When you finish this workshop, you’ll know how to create, test, and use profitable trading strategies in a systematic way.

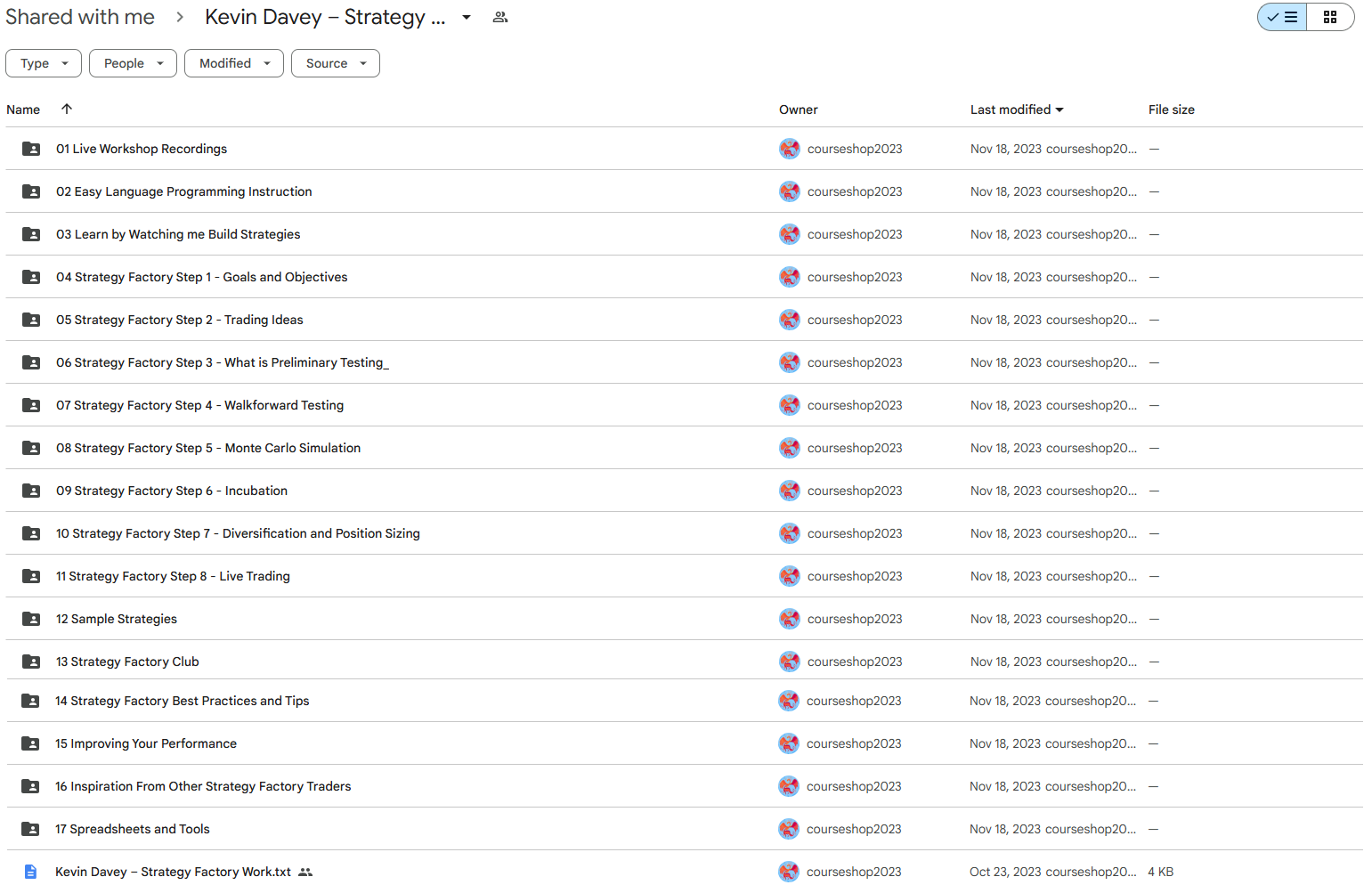

Strategy Factory Workshop Course Curriculum:

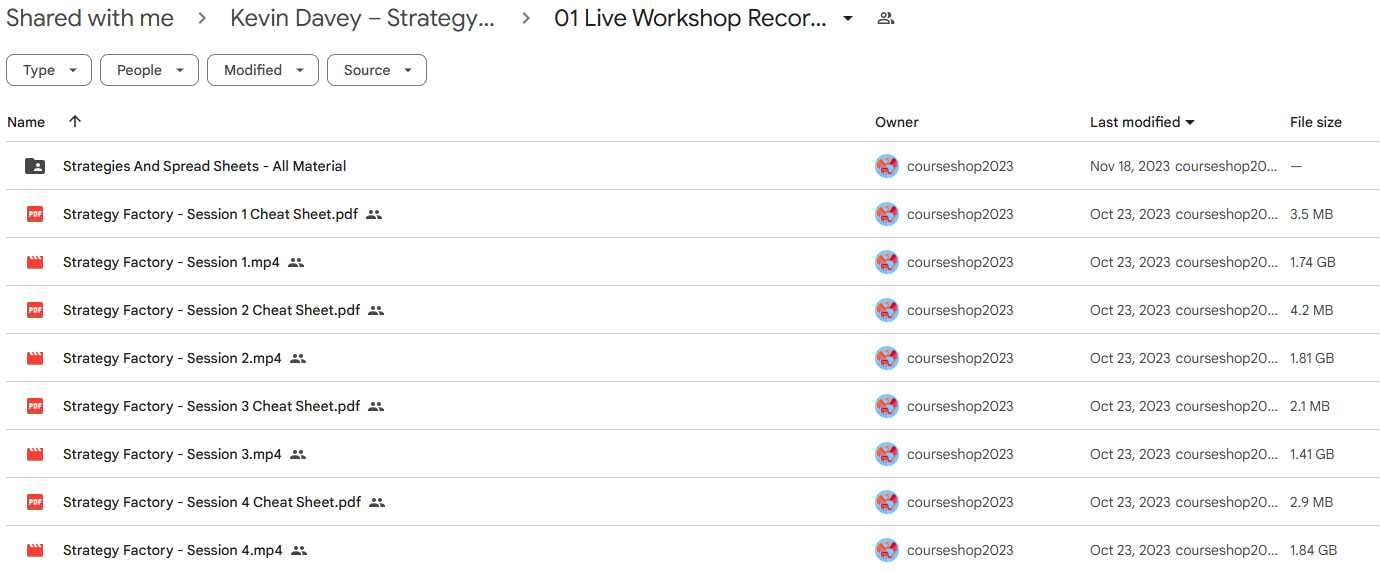

✅ Section 1: Live Workshop Recordings

The core workshop content delivered in four comprehensive sessions. Each session includes video recordings and cheat sheets designed to build your algorithmic trading foundation step by step.

Module 1.1: Strategy And Spreadsheets Materials

Essential tracking tools and analytical spreadsheets that support the Strategy Factory methodology. These resources help you monitor performance, analyze equity curves, and conduct Monte Carlo simulations for your trading strategies.

Session Recordings:

- Strategy Factory – Session 1 (Video & Cheat Sheet)

- Strategy Factory – Session 2 (Video & Cheat Sheet)

- Strategy Factory – Session 3 (Video & Cheat Sheet)

- Strategy Factory – Session 4 (Video & Cheat Sheet)

✅ Section 2: Easy Language Programming Instruction

Comprehensive training on TradeStation’s Easy Language programming for algorithm development. This section takes you from basic concepts to advanced techniques needed for strategy creation.

Module 2.1: 2 Minute Tip Series

Quick, actionable programming tips that solve common challenges in strategy coding. Each video addresses specific aspects of Easy Language implementation for more efficient strategy development.

Module 2.2: Helpful Guides and Reference Materials

Complete documentation on Easy Language functions, keywords, and implementation guidelines. These resources serve as your programming reference library during strategy development.

Programming Lessons:

- Introduction and Roadmap

- Getting the Correct TradeStation Version

- Insert A Chart

- Build a Strategy

- Add Stop Loss to Strategy

- Add Profit Target to Strategy

- Profit-Loss Keywords to Avoid

- Adding an IF Statement

- Using the Easy Language Help File

- Let’s Add Momentum and Moving Averages

- Incorporating RSI into a Strategy

- Using Dates and Market Position

- Using BarSinceEntry

- Understanding Variables

- Understanding Inputs

- Plotting

- Basics of Optimizing

- Understanding Out of Sample

- Strategy Performance Report

- Advanced Concept – Using Data2

- Advanced Concept – Using a Custom Session

- Using Built in Strategies

- Using Kevin’s Strategies

- Getting Even More Help

- What’s Next

✅ Section 3: Learn by Watching Me Build Strategies

Observe the entire strategy development process in action through step-by-step demonstrations. This section shows real-world application of the Strategy Factory methodology.

Module 3.1: Watch Me Build a Strategy

Complete walkthroughs of strategy creation from concept to completed code. These videos demonstrate practical implementation of trading ideas using the systematic approach taught in the course.

Module 3.2: Create Your First Strategy

Guided exercises with supporting materials to develop your first trading strategy. These resources provide step-by-step instructions for applying what you’ve learned to create your own system.

✅ Section 4: Strategy Factory Step 1 – Goals and Objectives

The foundational phase of the Strategy Factory process focusing on establishing clear trading goals. This module helps you define realistic objectives that guide your entire strategy development journey.

- Building Blocks – What are your Goals and Objectives (Video)

✅ Section 5: Strategy Factory Step 2 – Trading Ideas

Comprehensive exploration of methods for generating viable trading concepts. This section reveals techniques for identifying potential market edges and converting them into testable strategy ideas.

Module 5.1: 9 Terrific Entries, 7 Sensible Exits

Practical entry and exit techniques for various market conditions with complete code examples. These proven methods form the building blocks for creating robust trading strategies.

Trading Idea Resources:

- Can Automated Strategy Building Software Give You Trading Ideas (Video)

- How to Use Data Mining To Unearth Trading Ideas (Video)

- Data Mining Reference (PDF)

- Nine Different Entries I Use – My 5 Favorite Entries (Video)

- Nine Different Entries I Use – 4 Automated Entries (Video)

- Entry and Exit Confessions – 52 Entry and Exit Ideas (PDF)

- KJD – Optimal Exits (PDF)

✅ Section 6: Strategy Factory Step 3 – Preliminary Testing

Introduction to initial strategy evaluation techniques to quickly assess viability. This section teaches efficient methods for determining which strategy ideas deserve further development.

- Preliminary Testing Primer (Video)

✅ Section 7: Strategy Factory Step 4 – Walkforward Testing

Advanced validation methodologies that prevent curve-fitting and ensure strategy robustness. This critical section covers techniques for creating strategies that perform well in changing market conditions.

- Comparison of 2 Different Walkforward Approaches (Video)

- Example Walkforward Demo – StratOpt WFP Software (Video)

- Example Walkforward Demo – MultiOpt Software (Video)

- Re-Optimizations – How Do You Do It (PDF)

- Fitness Functions – Which One Is Best (PDF)

✅ Section 8: Strategy Factory Step 5 – Monte Carlo Simulation

Statistical methods for understanding strategy performance variability and true risk profiles. This section teaches how to assess strategy stability and expected performance ranges.

- Basics of Monte Carlo Testing Pt 1 – Single Strategy (Video)

- Basics of Monte Carlo Testing Pt 2 – Two Strategies (Video)

✅ Section 9: Strategy Factory Step 6 – Incubation

Methodology for monitoring strategy performance in real-time before committing capital. This crucial risk management phase helps identify strategies likely to fail before trading real money.

- Basics of Incubation (Video & PDF)

✅ Section 10: Strategy Factory Step 7 – Diversification and Position Sizing

Techniques for building effective strategy portfolios and managing position risk. This section covers methods for combining multiple strategies to create more stable returns.

- Checking for Correlation (Video)

- SF Class Correlation Checker (Spreadsheet)

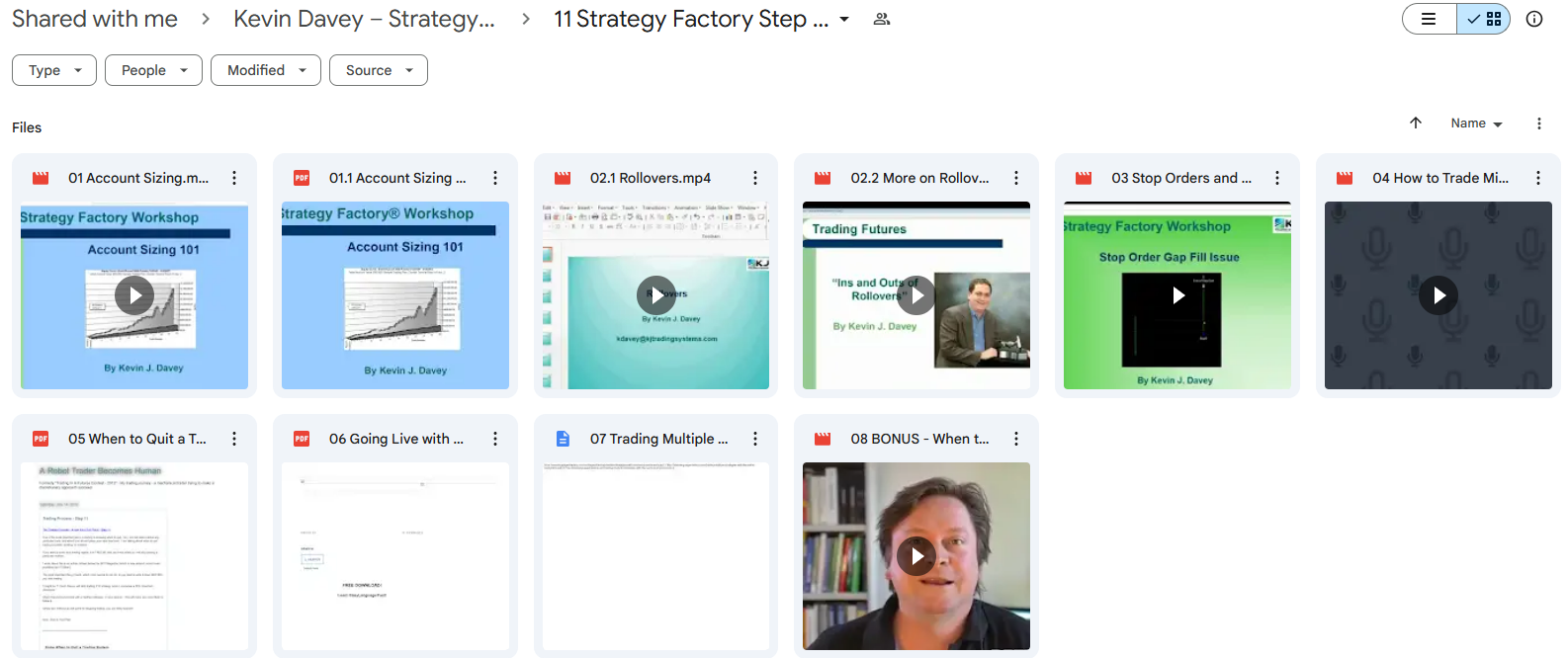

✅ Section 11: Strategy Factory Step 8 – Live Trading

Practical implementation guidance for transitioning strategies from testing to live markets. This section addresses the challenges of real-world trading and ongoing strategy maintenance.

- Account Sizing (Video & Reference PDF)

- Rollovers (Video)

- More on Rollovers (Video)

- Stop Orders and Gaps – Watch Out (Video)

- How to Trade Minis and Micros Based on Big Contracts (Video)

- When to Quit a Trading Strategy (PDF)

- Going Live with Automation (PDF)

- Trading Multiple Strategies with the Same Instrument (Text)

- BONUS – When to Quit when your Strategy is Failing (Video)

✅ Section 12: Sample Strategies

Complete, ready-to-use trading strategies with full code disclosure. These proven systems demonstrate the Strategy Factory principles and can be traded immediately or used as templates.

- Strategy #1 – ES (Zip)

- Strategy #2 – ES (Zip)

- Strategy #3 – Sys (Zip)

- Strategy #4 – JY (Zip)

- Strategy #5 – CL (Zip)

- Strategy #6 – S (Zip)

- Strategy #7 – NG (Zip)

- Strat Factory Spreadsheets (Zip)

✅ Section 13: Strategy Factory Club

Information about the ongoing community and support program for course graduates. This section explains the benefits of continued learning and collaboration with other strategy developers.

- Strategy Factory Club – Bounty Program (Video)

- Strategy Factory Club (PDF)

✅ Section 14: Strategy Factory Best Practices and Tips

Essential guidelines for maximizing your success with the Strategy Factory methodology. These resources highlight key principles and practical applications derived from years of experience.

- Best Practices For Strategy Factory Students (PDF)

- 2 Minute Trading Tips #1-12 (Video Series)

✅ Section 15: Improving Your Performance

Advanced techniques for enhancing strategy profitability and consistency. This section builds on core concepts to refine your systems for optimal performance.

- Improve Your Performance – Part 1 (Video & Cheat Sheet)

- Improve Your Performance Part 2 – Entry Ratio (Video & PDF)

- Improve Your Performance – Part 2 – Ratio Workshop (Zip)

- Improve Your Success Rate (Video)

✅ Section 16: Inspiration From Other Strategy Factory Traders

Case studies and interviews with successful Strategy Factory practitioners. These real-world examples demonstrate how others have implemented the methodology for tangible results.

- Student Survey and Questions (Text)

- Trader Interviews – Al, CJ, Dave, Eric, Simon (Audio/Video)

✅ Section 17: Spreadsheets and Tools

Comprehensive collection of analytical resources for strategy development and monitoring. These practical tools support every phase of the Strategy Factory process from idea to implementation.

- Daily Tracking Worksheet (Excel)

- Development Worksheet (Excel)

- Equity/Drawdown Curve Builder (Excel)

- Equity Monaco (PDF)

- Monte Carlo Fixed Fract Version (Excel)

- Monte Carlo (Excel)

- Monthly Summary Sheets (Excel)

- Multiple Systems Example (Excel)

- Random Generator (Excel)

Who is Kevin Davey?

Kevin Davey is an algorithmic trading expert with over 25 years of market experience. He’s a three-time winner of the World Cup Championship of Futures Trading, a rare achievement in the industry.

Since 2001, Davey has become a leading expert in systematic trading strategy development. He founded KJ Trading Systems and created the Strategy Factory Workshop.

As a best-selling author, he’s written key books on trading systems and algorithmic strategies. His teaching combines theory with practical experience, giving traders useful insights from real-world trading.

Davey shares his actual trading strategies and methods. His goal is helping traders avoid mistakes he encountered in his own trading journey.

He also built the Strategy Factory Club, a community where algorithmic traders work together and share ideas to improve in the competitive world of automated trading.

Be the first to review “Kevin Davey – Strategy Factory Workshop (2021)” Cancel reply

Related products

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Reviews

There are no reviews yet.