Joseph Griffin – Tax Deed Wolf Academy

$1,500.00 Original price was: $1,500.00.$58.00Current price is: $58.00.

Joseph Griffin Tax Deed Wolf Academy Course [Instant Download]

What is Joseph Griffin Tax Deed Wolf Academy?

Joseph Griffin Tax Deed Wolf Academy is a real estate investing course that teaches you how to buy real estate at tax deed auctions for under $3,000.

The program shows how to research properties, bid at auctions, and flip houses without needing money down or good credit.

Griffin’s step-by-step system helps beginners start their first auction within 14 days and make $5,000-$15,000 profit on their first property deal.

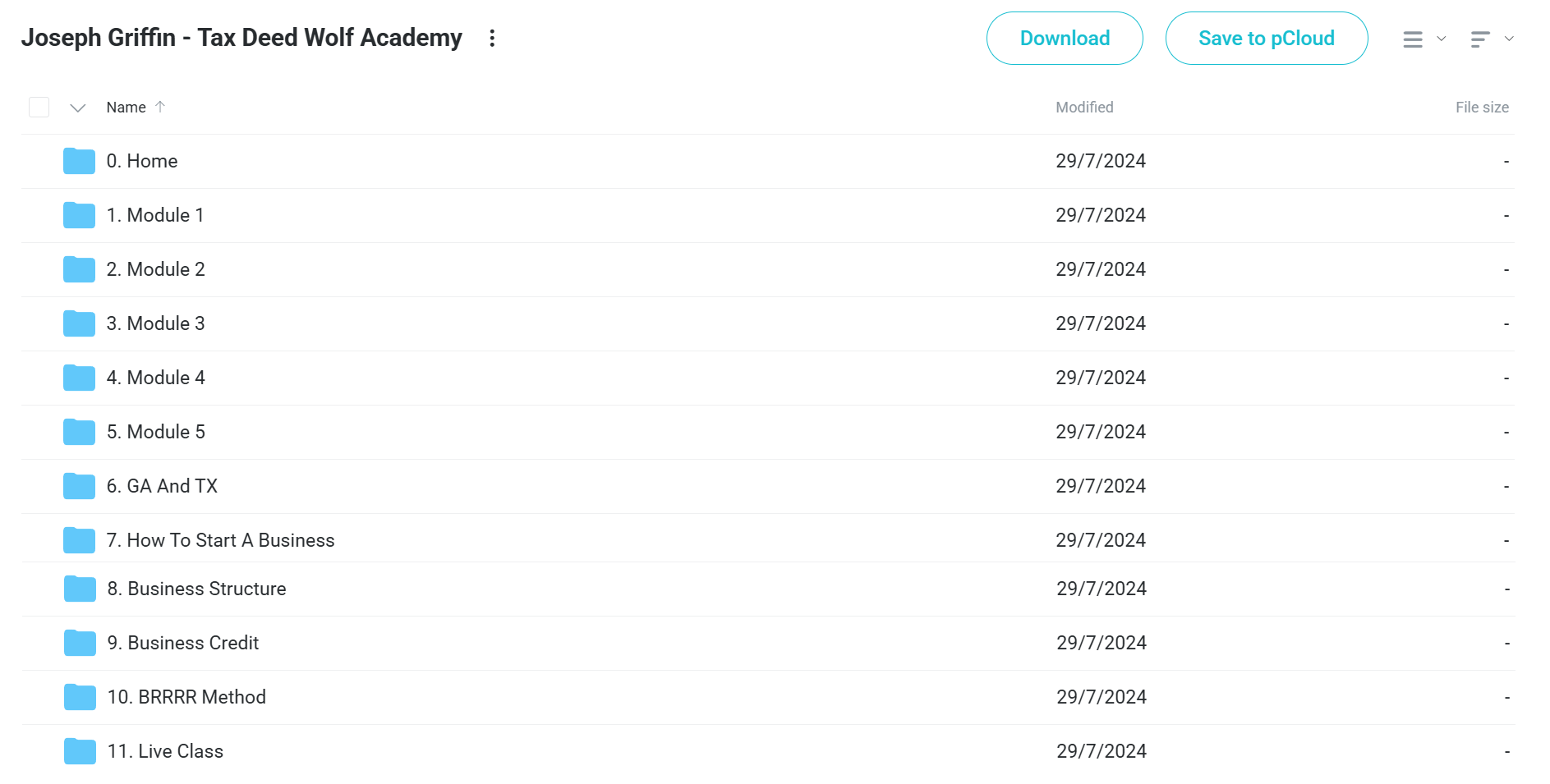

📚 PROOF OF COURSE

What you’ll learn in Tax Deed Wolf Academy:

Tax Deed Wolf Academy teaches you everything to start investing in tax deed properties and build wealth. Here’s what you’ll learn:

- Property research: Master due diligence techniques to find profitable tax deed opportunities

- Auction participation: Learn to enter and bid at tax deed auctions within 14 days

- Business structure: Understand LLC formation, asset protection, and business credit strategies

- Property selling: Discover exit strategies including seller financing and quick flips

- State-specific strategies: Get bonus resources for Florida, Texas, and Georgia markets

- BRRRR method: Learn buy, rehab, rent, refinance, repeat strategies for long-term wealth

This training helps both beginners and experienced investors. You’ll learn to purchase properties for under $3,000 and create consistent passive income streams.

Tax Deed Wolf Academy Course Curriculum:

✅ Foundation & Mindset (Home Module)

Students start with mindset training focused on success principles in tax deed investing. This starting module sets the mental framework needed to approach tax deed investing with confidence and determination.

The content sets realistic expectations and mental preparation for the challenges and opportunities in tax deed investing.

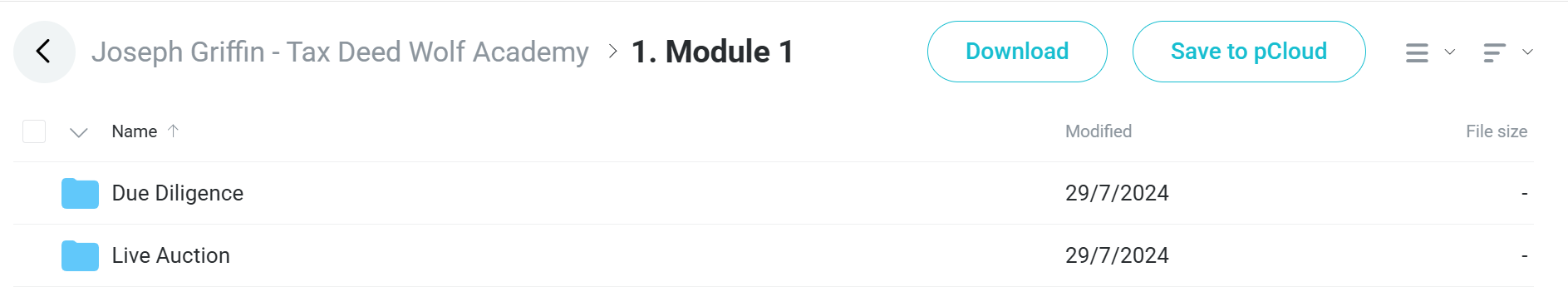

✅ Module 1: Due Diligence & Research

This module teaches students how to properly research properties before bidding at tax deed auctions. Students learn to use Florida Property Search tools and the Official Tax Sale Software with Skiptrace Pro for complete property analysis.

The module includes practical worksheets and county-by-county auction calendars to help students organize their research process. Students learn how to check property values, debts, and ownership history to make smart bidding decisions.

Live auction training provides real-world experience watching actual tax deed auctions happen, helping students understand bidding patterns and auction rules.

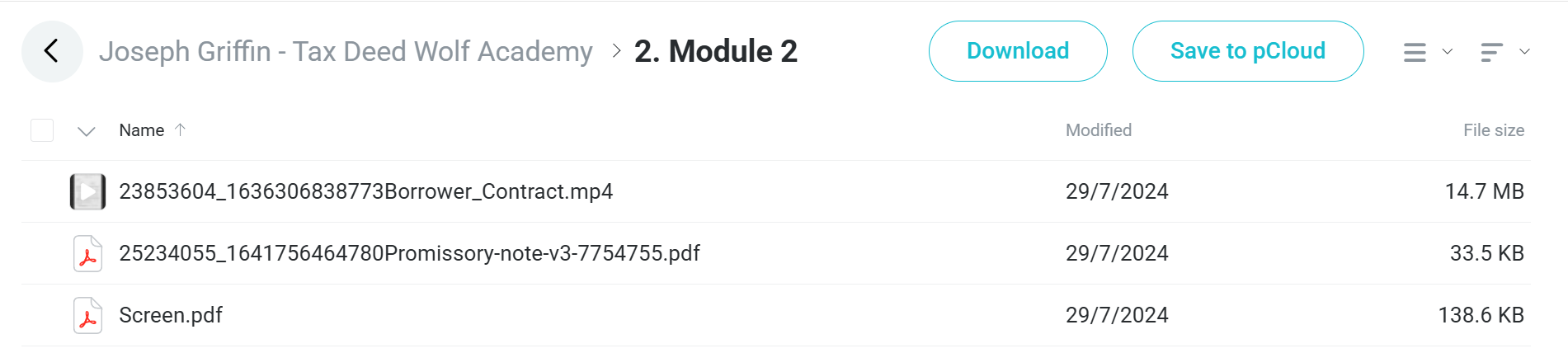

✅ Module 2: Financing & Contracts

Students learn different financing strategies for tax deed investments, including how to set up borrower contracts and promissory notes. This module covers creative financing techniques that allow investors to buy properties with limited money.

The content focuses on legal paperwork and proper contract structures to ensure all financing deals are properly written and legally binding.

✅ Module 3: Communication & Documentation

This module teaches students how to communicate well with property owners, government offices, and other people involved in tax deed deals. Students get template letters and learn proper writing techniques for tax deed situations.

The training covers how to handle title problems, communicate with previous owners, and manage the paperwork side of tax deed purchases.

✅ Module 4: Advanced Strategies

Students explore more advanced tax deed investment techniques and deeper market analysis. This module builds on the basic knowledge to help students find higher-value opportunities and complex deals.

✅ Module 5: Exit Strategies & Sales

This complete module teaches students multiple ways to make money from tax deed properties, including regular sales, seller financing deals, and creative selling strategies. Students learn how to maximize profits through different selling methods.

The content covers quit claim deeds, purchase and sale agreements, and how seller financing works to create multiple income streams from bought properties.

✅ Module 6: Geographic Expansion (Georgia & Texas)

Students learn how to expand their tax deed investing beyond Florida into Georgia and Texas markets. This module provides specific resources and auction information for the Dallas-Fort Worth area and Georgia tax deed procedures.

The content helps students understand the differences in state laws and procedures when expanding to new markets.

✅ Module 7: Business Formation

Students learn how to properly set up their tax deed investing business by forming an LLC. This module covers the legal requirements and benefits of formal business setup.

The training ensures students understand the importance of separating personal and business assets through proper business structure.

✅ Module 8: Asset Protection

Advanced training on protecting bought assets and business interests through proper legal structures. Students learn from asset protection expert Tariq about advanced protection strategies.

This module helps students protect their growing real estate portfolio from potential legal challenges and creditor problems.

✅ Module 9: Credit & Financing Systems

A three-part series covering personal credit improvement, business credit building, and turning credit into investment money. Students learn to boost personal credit scores while also building business credit profiles.

The “leaked” business credit strategies reveal insider techniques for building strong business credit quickly. Students also learn methods to turn available credit into cash for investment purposes.

✅ Module 10: BRRRR Method Integration

Students learn how to combine the Buy, Rehab, Rent, Refinance, Repeat (BRRRR) method with tax deed purchases. This module shows how to create long-term wealth through rental property strategies using tax deed properties.

The content shows how tax deed properties can serve as the foundation for a rental property portfolio.

✅ Module 11: Live Training & Application

Real-world practice through live training sessions held in Orlando, giving students hands-on experience and direct access to Joseph Griffin for personal guidance.

These live sessions allow students to ask specific questions about their deals and get expert feedback on their investment strategies.

Who is Joseph Griffin?

Joseph Griffin, known as the “Tax Deed Wolf,” is an Army veteran with 11 years of service including two combat tours. He worked as an ICU manager in nursing before retiring at age 29 to focus on real estate investing.

Griffin founded Tax Deed Wolf Academy and is CEO of Quality Trade Group LLC. He has helped hundreds of students reach their financial goals using his proven tax deed strategies.

He wrote “Tax Deed Investing,” a guide that teaches people how to buy properties at very low prices. Griffin shares his knowledge on YouTube and other platforms with educational content about tax deed investing.

His academy teaches students to buy real estate through tax deed and tax lien auctions with little money and no credit requirements. Griffin’s methods focus on creating passive income and financial freedom through property investments.

Be the first to review “Joseph Griffin – Tax Deed Wolf Academy” Cancel reply

Related products

Best 100 Collection

Real Estate

Real Estate

Real Estate

Commercial Real Estate

![[Bundle] Best 28 Tai Lopez Courses](https://coursehuge.com/wp-content/uploads/2024/01/Bundle-Best-28-Tai-Lopez-Courses-300x300.jpg)

Reviews

There are no reviews yet.