John Boik – Historical Analysis Masterclass

$999.00 Original price was: $999.00.$19.00Current price is: $19.00.

John Boik Historical Analysis Masterclass [Instant Download]

What is John Boik Historical Analysis Masterclass?

John Boik’s Historical Analysis Masterclass is a stock trading course teaching investors how to profit from market history patterns.

The system includes 10 detailed webinars and a 230-page textbook showcasing Boik’s research from 20+ years studying legendary traders.

Boik’s unique “time-traveling” approach helps you identify monster stocks and predict market cycles by studying the strategies that made legendary traders successful.

📚 PROOF OF COURSE

What you’ll learn in Historical Analysis Masterclass:

John Boik’s Historical Analysis Masterclass transforms how you understand markets through history and proven trading methods. Here’s what you’ll learn:

- Monster stock identification: Learn the patterns that show which stocks might become market giants

- Market cycle analysis: Spot repeating patterns in market history to predict future trends

- Legendary trader strategies: Learn what the most successful traders did and how to use their methods today

- Historical pattern recognition: Develop skills to spot market situations that have happened before

- Technical analysis methods: Master charting techniques that work across market history

- Practical application: Use history to make better trading decisions in today’s market

After taking this masterclass, you’ll see market behavior in ways most traders don’t, helping you make smarter investment choices based on what worked in the past.

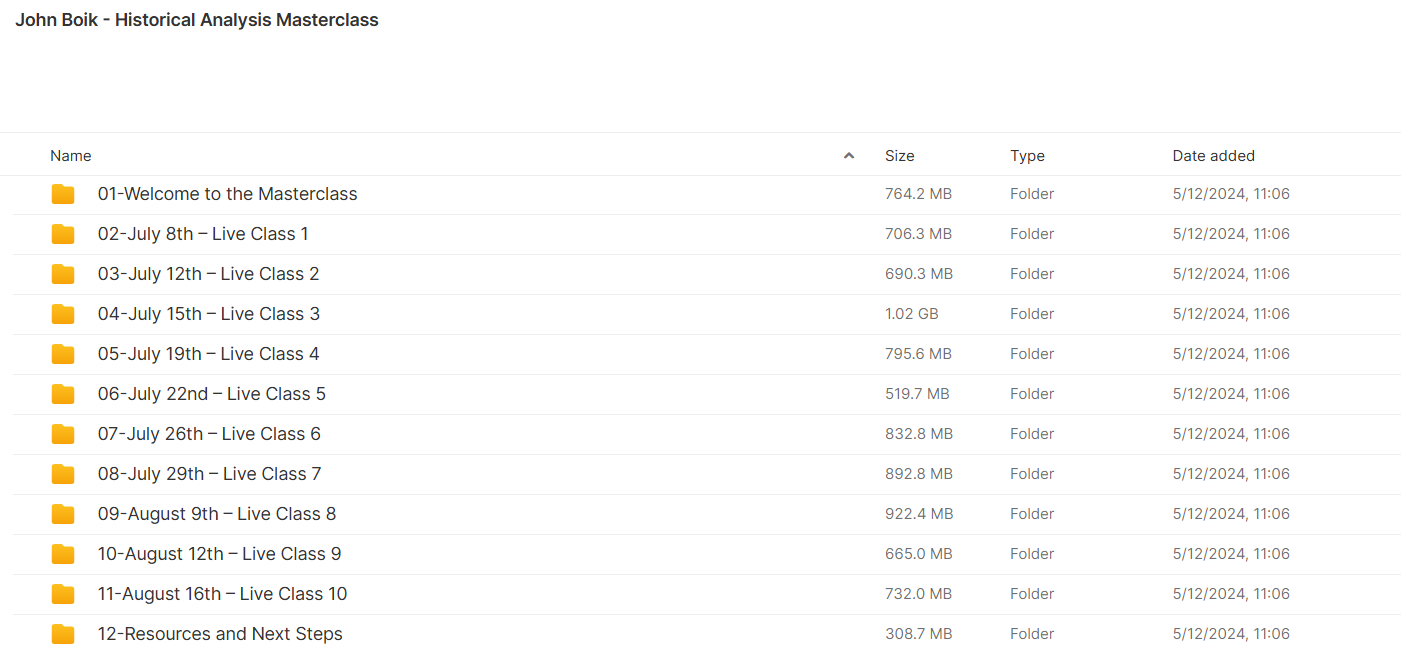

Historical Analysis Masterclass Course Curriculum:

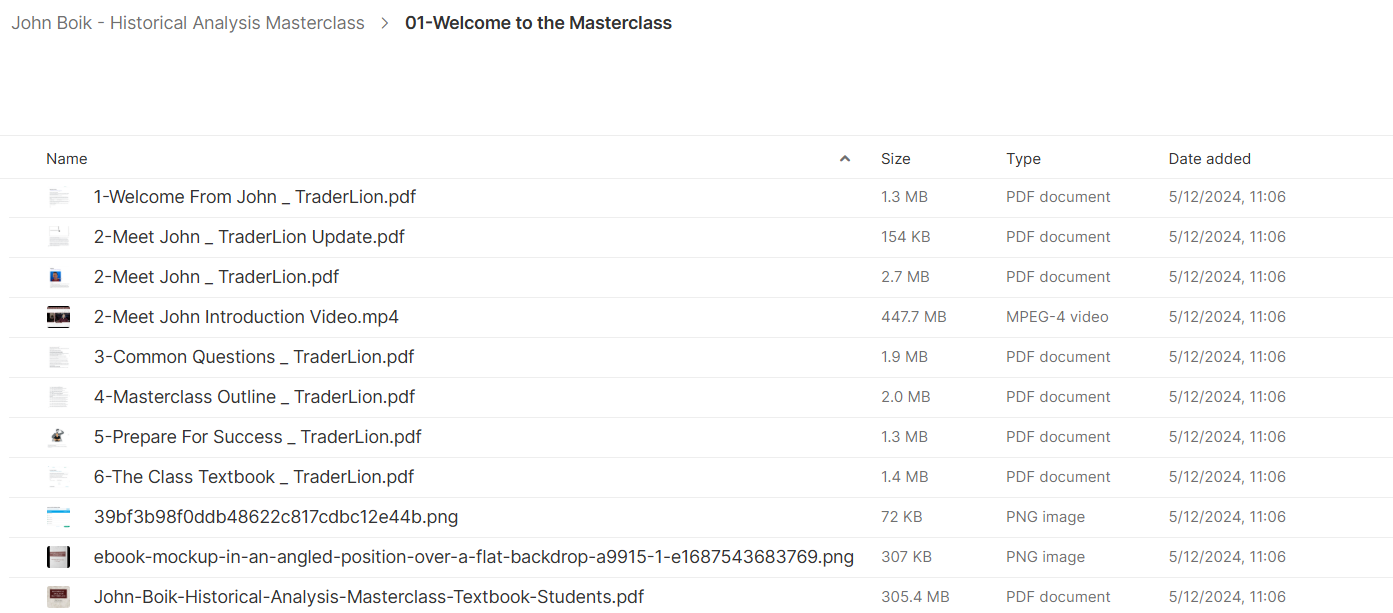

✅ Module 1: Welcome to the Masterclass

This first module introduces students to John Boik’s background and sets clear expectations for the course. It includes a course textbook, outline, and tips to help students get ready to learn the material well.

The module answers common questions about studying market history and explains how to get the most from the course. John’s intro video helps students connect with him while showing his knowledge as an experienced trader and market expert.

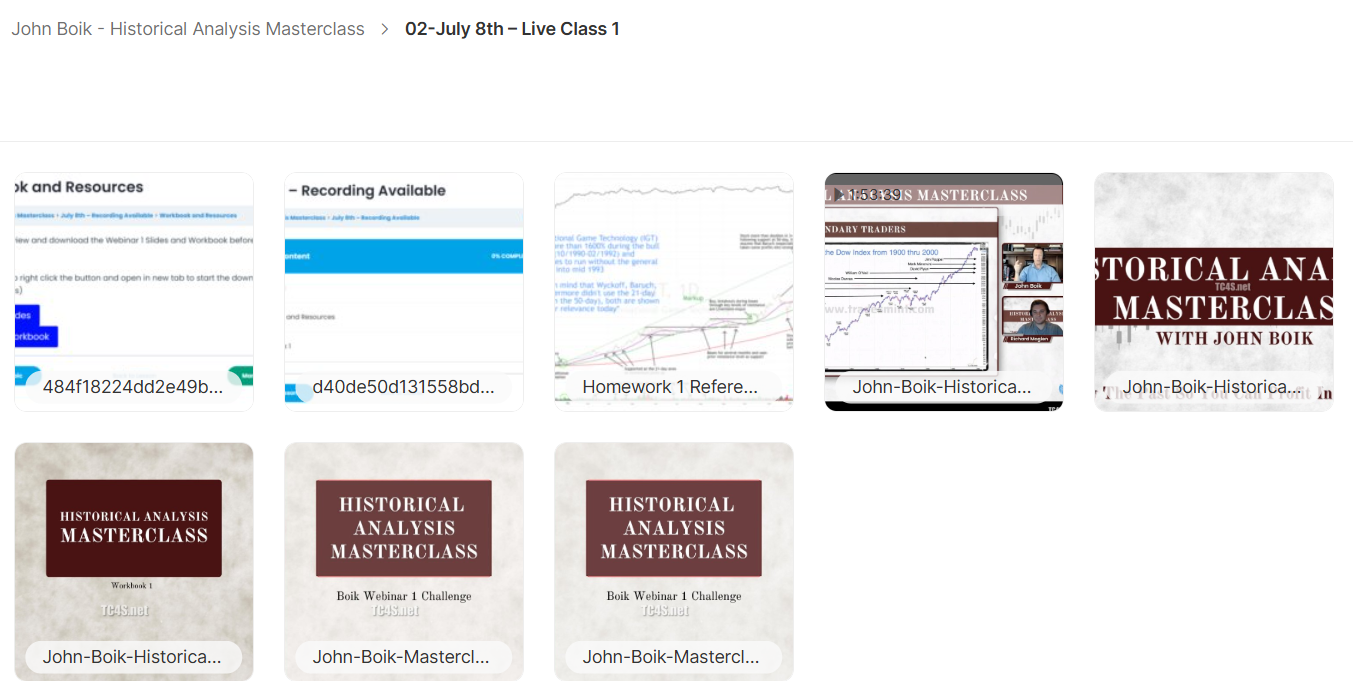

✅ Module 2: Live Class 1 (July 8th)

The first live class covers the basics of studying past stock market patterns. Students get a detailed workbook and slides that teach key ideas for finding winning stocks and spotting good trading setups.

This module gives students practical homework challenges to use what they’ve learned. The homework answer key helps students check their work and see how well they understand the basics of pattern spotting.

✅ Module 3: Live Class 2 (July 12th)

Building on the first class, this session looks deeper at specific market patterns that have worked well in the past. Students learn to spot market cycles and see how certain stock patterns tend to repeat over time.

The workbook for this session guides students through more advanced ideas with real examples. The homework asks students to use these pattern spotting skills with current market stocks.

✅ Module 4: Live Class 3 (July 15th)

This module expands students’ knowledge of trading patterns with more detailed real examples. The session explores how markets behave through careful study of past examples shown in the workbook and slides.

As a bonus, this module features a special class with Eve Boboch, a top modern trader who shares insights on trading new stocks (IPOs). This real-world view shows how the history-based methods work in today’s markets.

✅ Module 5: Live Class 4 (July 19th)

The fourth class focuses on using market history to know when to buy and sell stocks. Students learn how to time their trades based on past patterns and current market conditions by studying detailed examples.

This module emphasizes practice through workbook exercises that help students create their own trading plans based on historical patterns. The class builds on earlier sessions by combining pattern spotting with smart trading decisions.

✅ Module 6: Live Class 5 (July 22nd)

This session explores advanced pattern spotting methods and how to use them in different market conditions. Students learn to find subtle clues that have often come before major price moves.

The workbook and homework continue the hands-on learning approach, challenging students to find patterns in today’s market. This module helps students tell the difference between high-chance setups and false signals based on market history.

✅ Module 7: Live Class 6 (July 26th)

The sixth class focuses on ways to manage risk using lessons from market history. Students study both winning and losing trades to understand the importance of position size and where to place stop-losses.

This module includes an answer key for McDonald’s (MCD) stock analysis, showing a detailed example of using course ideas on a specific stock. The session combines pattern spotting with practical ways to reduce risk that have worked over time.

✅ Module 8: Live Class 7 (July 29th)

This session focuses on building a trading portfolio based on insights from market history. Students learn how to create a mix of trades using the patterns and methods covered in earlier classes.

The workbook guides students through exercises that help turn single trade analysis into a complete portfolio plan. This module shows how to use historical analysis across several stocks at once.

✅ Module 9: Live Class 8 (August 9th)

The eighth class explores how to analyze market sectors using history as a guide. Students learn how sector changes and broader market trends affect individual stocks and how to use this knowledge in their trading.

This module teaches ways to judge whether past patterns are likely to repeat in today’s market. The workbook helps students develop a step-by-step approach to checking market conditions when using historical analysis.

✅ Module 10: Live Class 9 (August 12th)

This session focuses on the mental side of trading and how understanding market history helps keep trading discipline. Students explore how looking at history can prevent common emotional trading mistakes and build confidence.

The workbook guides students through exercises designed to strengthen their mental approach to trading. Real examples show how historical analysis provides the background needed for confident decisions during wild market swings.

✅ Module 11: Live Class 10 (August 16th)

The final live class brings together all previous lessons into a complete trading method. John shows how to create personal trading plans that use historical analysis with each student’s unique trading style and goals.

This final session focuses on practical use and long-term application of course ideas. The workbook helps students create action plans for continuing to improve their historical analysis skills after the course ends.

✅ Module 12: Resources and Next Steps

This closing module provides helpful resources for continued learning, including the full class textbook for future reference. It offers a special deal on Oliver Kell’s Swing Trading Masterclass as an extra learning opportunity.

Students are asked to share feedback about their learning experience to help improve the course for future students. This module helps bridge the gap between formal teaching and using historical analysis in real trading.

Who is John Boik?

John Boik is a stock market historian who has studied trading patterns and market cycles for over 20 years.

He analyzes past markets to find trading strategies that work. Boik wrote “Monster Stocks,” “Lessons from the Greatest Stock Traders of All Time,” and “How Legendary Traders Made Millions” – books that serious traders value.

Boik finds patterns across different market periods. He studies how legendary traders succeeded and adapts these lessons for today’s markets.

His approach mixes technical analysis with historical context to see how market cycles repeat over time. He’s known for making historical market wisdom practical for today’s traders.

Through his work, Boik has helped thousands of traders understand markets better. He teaches pattern recognition and how to apply historical insights to current markets.

Be the first to review “John Boik – Historical Analysis Masterclass” Cancel reply

Related products

Stock Trading

Stock Trading

Stock Trading

Day Trading

Stock Trading

Crypto Trading

Stock Trading

Stock Trading

Reviews

There are no reviews yet.