Jerry Norton – Commercial Revolution System

$1,297.00 Original price was: $1,297.00.$97.00Current price is: $97.00.

Jerry Norton Commercial Revolution System Course [Instant Download]

What is Jerry Norton Commercial Revolution System:

Jerry Norton’s Commercial Revolution System is a comprehensive course that teaches you how to master commercial real estate investment and flip properties for significant profits.

The course covers basic and advanced strategies, including deal analysis, funding methods, and property management.

Whether you’re a beginner or an experienced investor, this course provides practical insights to help you succeed in the lucrative world of commercial real estate.

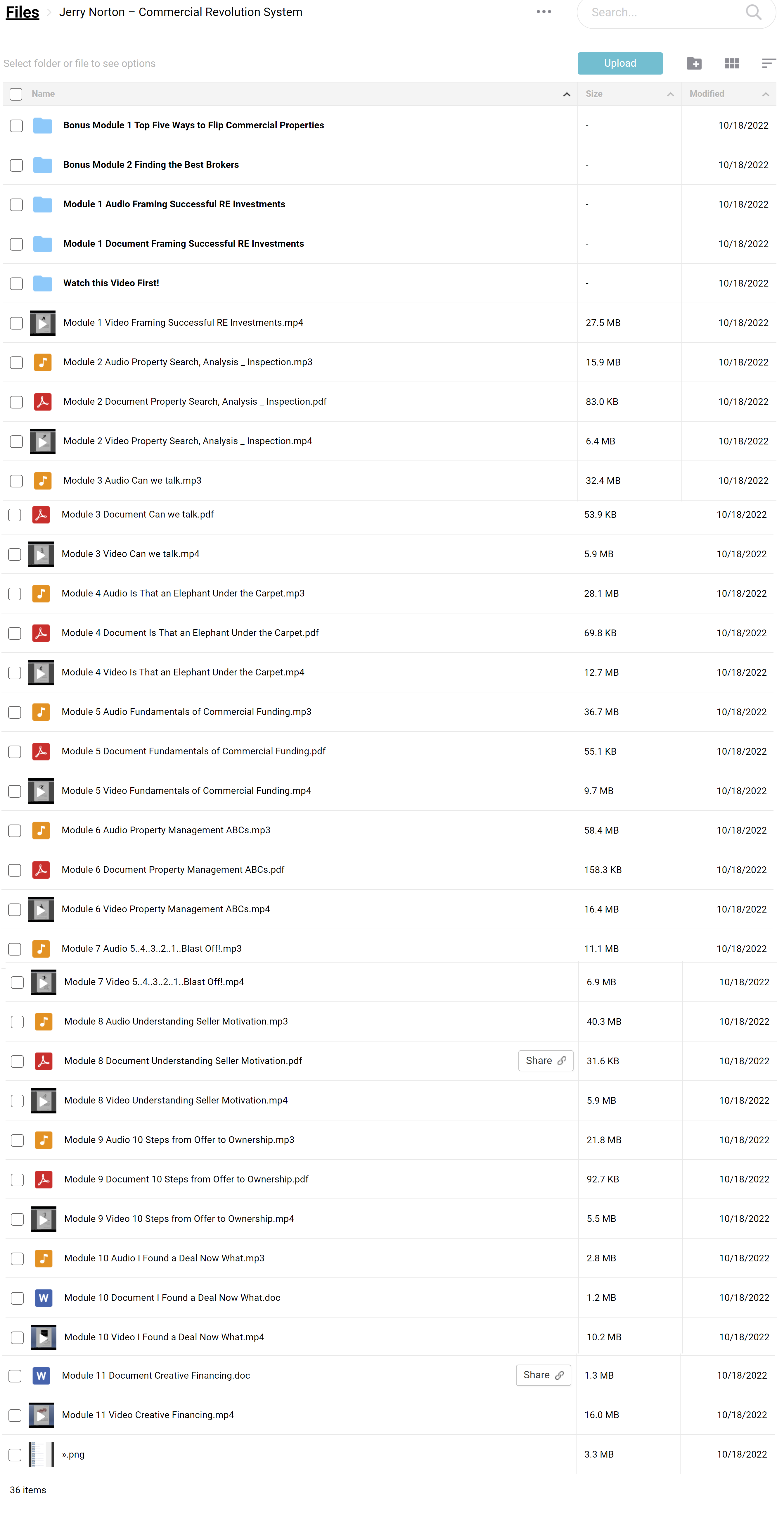

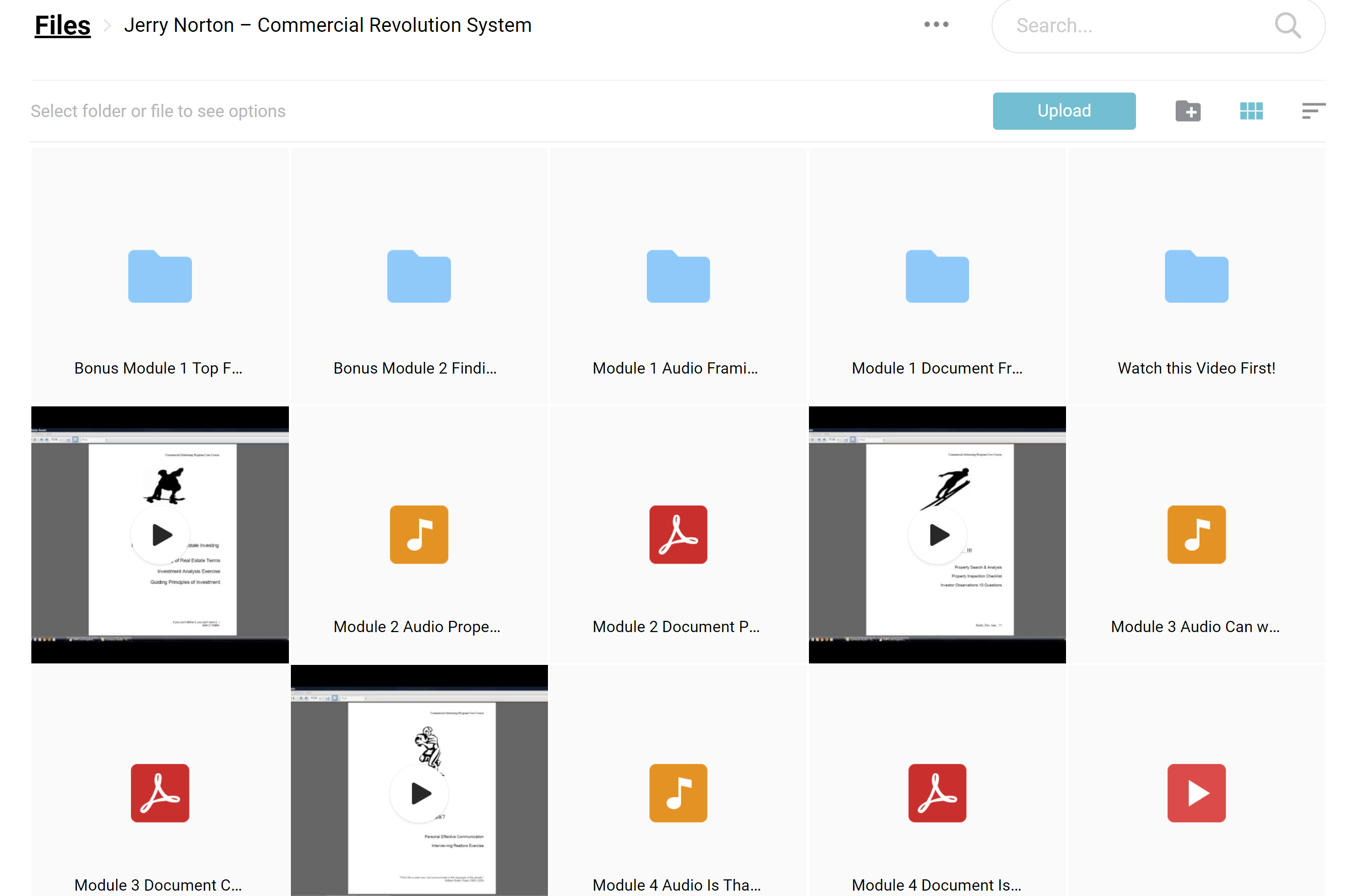

📚 PROOF OF COURSE

What you will learn in Commercial Revolution System:

- Understanding Commercial Real Estate: Grasp the fundamentals of commercial property investment.

- Deal Analysis: Learn to evaluate potential investments effectively.

- Flipping Strategies: Discover proven methods for flipping properties for profit.

- Funding Techniques: Explore various ways to finance your commercial real estate ventures.

- Property Management: Gain insights into effective property management for sustained income.

- Market Trends: Stay ahead with knowledge of current and future real estate market trends.

The Commercial Revolution System Course Curriculum:

- Bonus Module 1: Top Five Ways to Flip Commercial Properties

- Bonus Module 2: Finding the Best Brokers

- Module 1: Framing Successful Real Estate Investments: Audio, Document, and Video: Understanding the foundations of profitable real estate investing.

- Module 2: Property Search, Analysis, and Inspection: Comprehensive tools and techniques for property evaluation.

- Module 3: Effective Communication in Real Estate: Strategies for negotiating and closing deals.

- Module 4: Uncovering Hidden Challenges in Properties

- Identifying and addressing potential investment pitfalls.

- Module 5: Fundamentals of Commercial Funding: Exploring diverse funding options for your investments.

- Module 6: Property Management ABCs: Essential skills for managing commercial properties effectively.

- Module 7: Launching Your Real Estate Venture: Practical steps to kickstart your investment journey.

- Module 8: Understanding Seller Motivation: Insights into seller psychology and leveraging it for better deals.

- Module 9: From Offer to Ownership: Navigating the process from making an offer to owning the property.

- Module 10: Finding and Sealing the Deal: Tactics for locating the best deals and closing them successfully.

- Module 11: Creative Financing: Innovative financing strategies for commercial real estate.

This curriculum is designed to provide a thorough understanding of the commercial real estate market, from the basics to advanced strategies, ensuring a well-rounded education for the participants.

Who is this course for?

This course is ideal for:

- Aspiring Real Estate Investors: Individuals looking to enter the world of commercial real estate investment will find this course a valuable starting point.

- Experienced Property Investors: Seasoned investors aiming to expand their knowledge and delve into commercial properties.

- Real Estate Professionals: Agents and brokers seeking deeper insights into commercial real estate to enhance their professional services.

- Entrepreneurs: Business owners interested in diversifying their investment portfolio with commercial real estate.

- Financial Advisors: Professionals advising clients on investment opportunities in the real estate sector.

Be the first to review “Jerry Norton – Commercial Revolution System” Cancel reply

Related products

Commercial Real Estate

Systems For Success 7.0 (SFS 7.0): Commercial Real Estate Mastery

Commercial Real Estate

Commercial Real Estate

Business & Finance

Commercial Real Estate

Commercial Real Estate

Flipping

Reviews

There are no reviews yet.