Jason Paul Rogers – From Zero Idea to 7-Figure Acquisition

$2,222.00 Original price was: $2,222.00.$15.00Current price is: $15.00.

Jason Paul Rogers From Zero Idea to 7-Figure Acquisition Course [Instant Download]

What is From Zero Idea to 7-Figure Acquisition?

Jason Paul Rogers From Zero Idea to 7-Figure Acquisition is a course that teaches you how to buy profitable businesses without using your own money.

This course shows exactly how to buy 7-figure companies using seller financing and SBA loans, even if you don’t have money or experience.

You’ll learn how to build a professional deal team, find ideal businesses to buy, arrange creative financing, and close deals just like Rogers did with his own successful purchases.

This program helps regular people become business owners by showing them how to skip the startup phase and jump directly into owning established companies that already make money.

📚 PROOF OF COURSE

What you’ll learn in Zero Idea to 7-Figure Acquisition Course:

From Zero Idea to 7-Figure Acquisition gives you a clear roadmap to buy established businesses without using your own money. Here’s what you’ll learn:

- Business acquisition framework: Learn the full M&A process from finding good industries to closing deals and taking over as owner.

- Investment thesis development: Discover how to pick profitable industries and create attractive plans that win partners and financing.

- World-class team building: Learn how to recruit skilled board members, lawyers, and accountants who work on success-fees instead of charging upfront.

- Creative financing methods: Master deal structures using seller financing, SBA loans, and private money without needing much personal money.

- Deal valuation and negotiation: Learn to correctly value businesses, find eager sellers, and negotiate better terms.

- Operational excellence: Understand how to take over ownership smoothly and grow your newly bought business.

This course gives both beginners and experienced professionals the tools to build wealth by buying existing businesses instead of starting new ones from scratch.

From Zero Idea to 7-Figure Acquisition Course Curriculum:

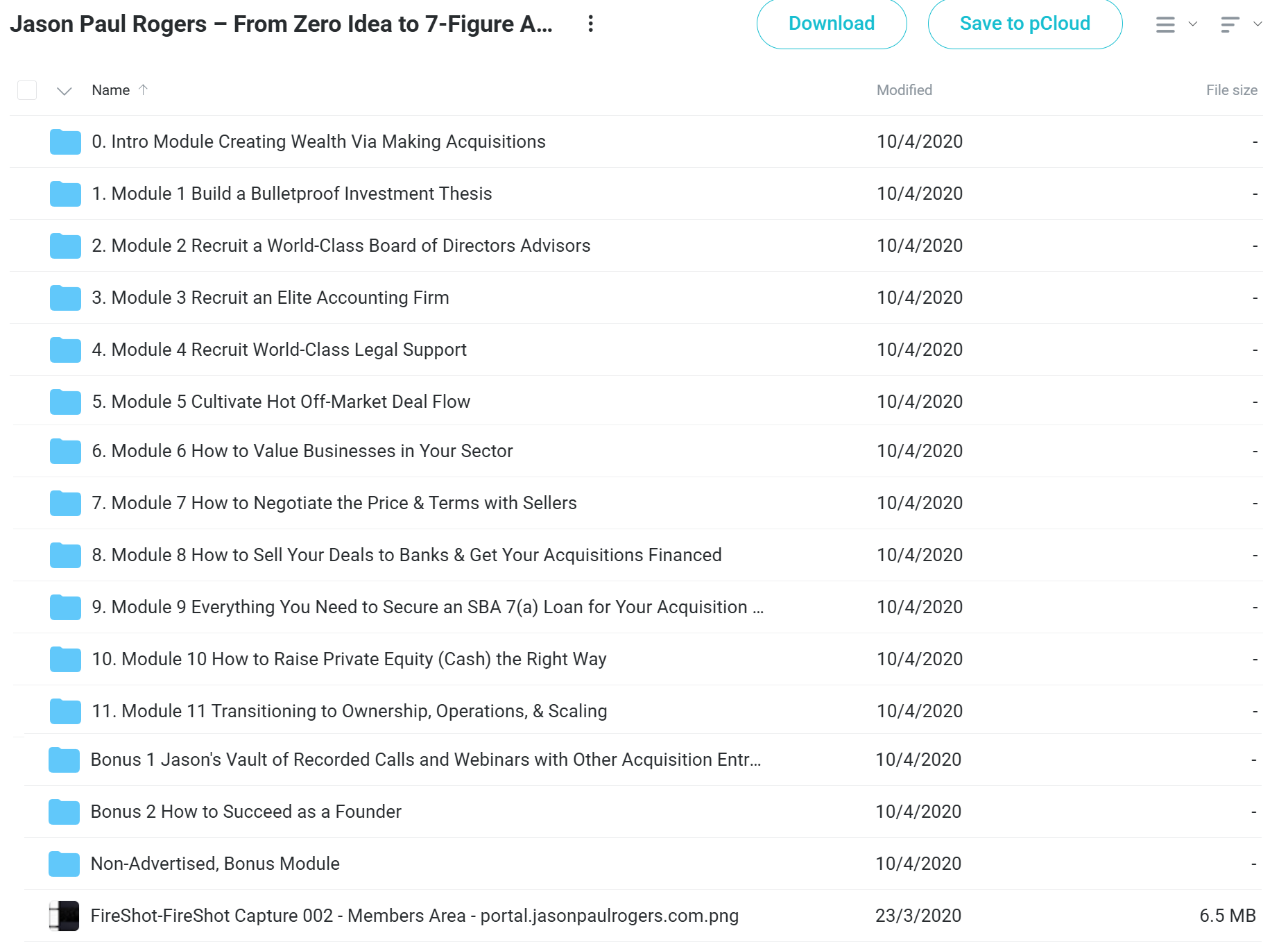

✅ Module 0: Introduction to Creating Wealth Via Making Acquisitions

This first module builds the right mindset for buying businesses. Jason explains why buying existing businesses is better than starting new ones, addresses worries about not having experience, and shows how dressing professionally helps you gain trust in business meetings.

The module shows how talking with successful business owners, even billionaires, can speed up your learning. You’ll discover practical ways to overcome lack of experience and learn how many businesses you can realistically buy and run at the same time.

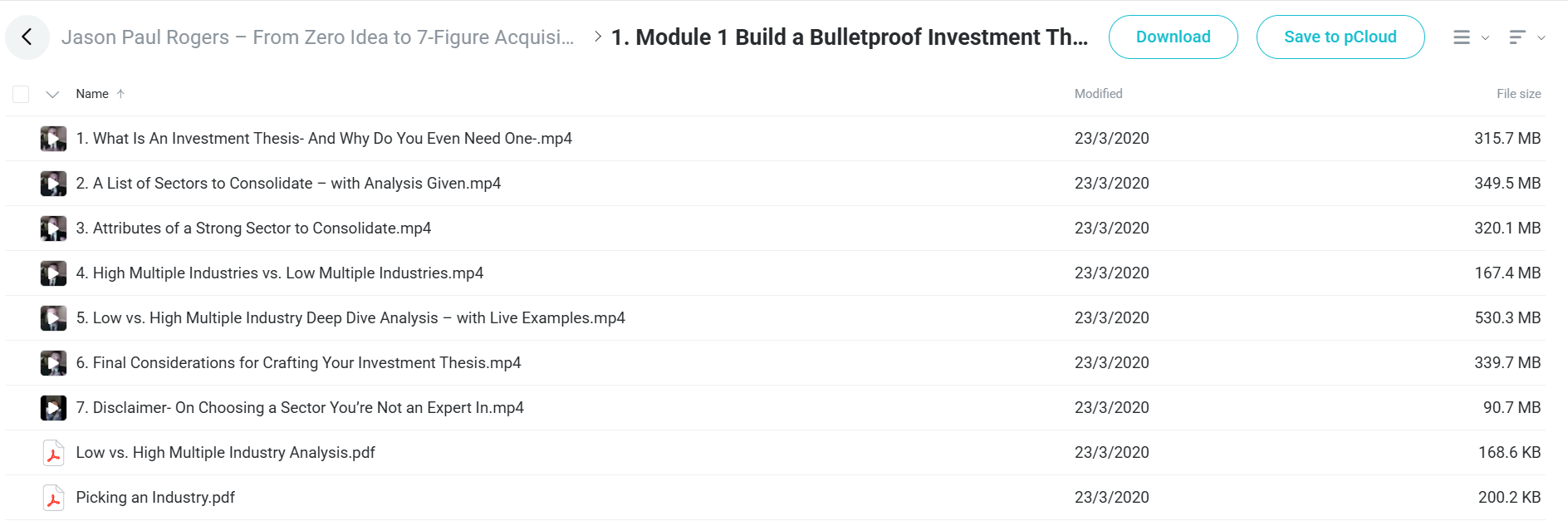

✅ Module 1: Build a Bulletproof Investment Thesis

This module teaches you how to create a clear plan for what kinds of businesses to buy. Jason gives a detailed look at business types that are good for buying and combining, and what makes certain industries better targets than others.

You’ll learn the difference between high-priced and low-priced industries with real examples and tools. The module includes important tips about entering business areas where you’re not an expert, with helpful guides on industry analysis to make smart choices.

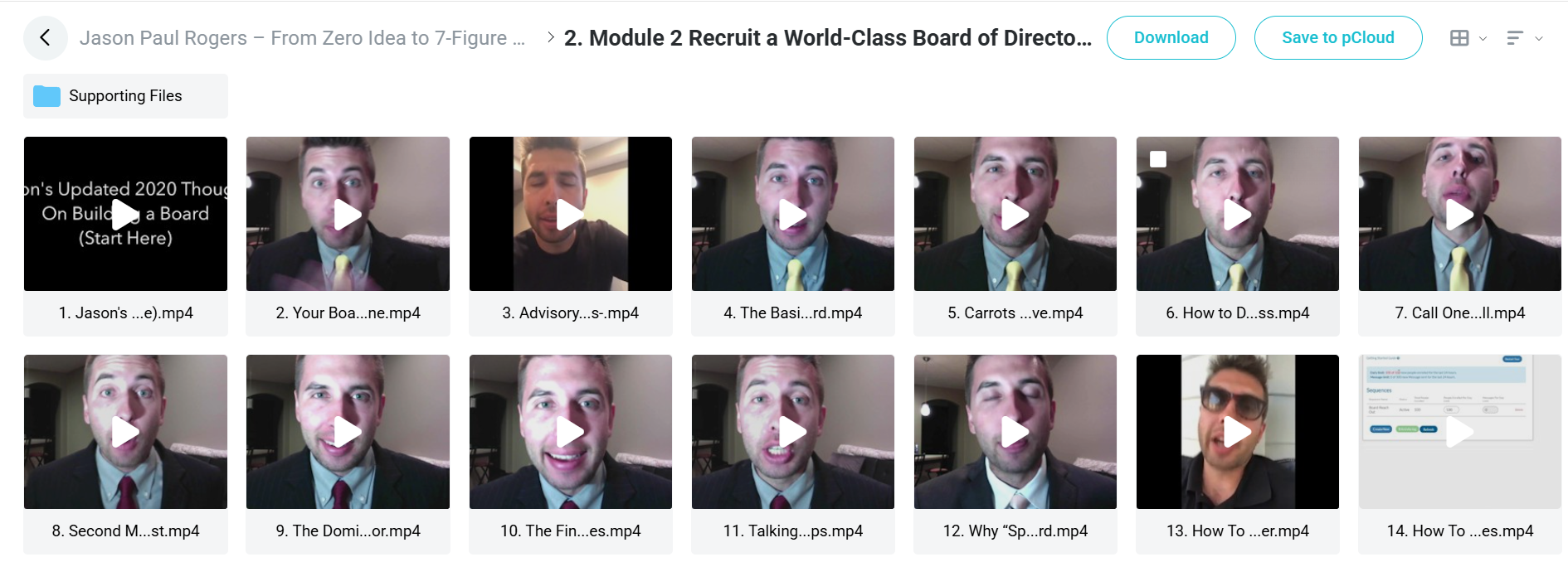

✅ Module 2: Recruit a World-Class Board of Directors & Advisors

This big module covers how to build a strong team of advisors or board members. Jason explains the differences between advisory boards and formal boards of directors and gives you ready-to-use scripts for attracting top-quality people.

The content walks you through each step: first contact, first and second meetings, final talks, and sharing ownership. The module includes updated LinkedIn methods for 2020, examples of ownership tables, and complete message templates for every part of finding and securing board members.

✅ Module 3: Recruit an Elite Accounting Firm

This module makes it easy to understand how to get top accounting help. Jason explains the different levels of accounting firms (Big 4, National, Regional, Local) and covers the three main accounting services businesses need: taxes, audits, and checking business books.

You get ready-to-use phone and email scripts for contacting accounting firms, ways to use your board connections to get meetings, and advice on handling first meetings. The module includes real examples like a KPMG engagement letter and practical tips on choosing how to pay for services.

✅ Module 4: Recruit World-Class Legal Support

This small but important section teaches you how to get good legal help for buying businesses. Jason outlines the different types of law firms and helps you decide between business structures (LLC vs. C-Corp) and how to ask law firms to work for a success fee.

The module includes scripts for meetings with top law firms and tips for making the most of in-person legal meetings. You learn how to figure out what legal help you need and pick the right legal partner for your goals.

✅ Module 5: Cultivate Hot Off-Market Deal Flow

This hands-on module reveals ways to find businesses to buy before they’re publicly listed for sale. Jason shares methods for finding motivated sellers, building and managing a list of leads, and setting up systems to find deals automatically.

You get phone scripts, email templates for contacting business owners and brokers, and guidance on building a team to help find deals. The module includes special resources like lists of retirement areas for those targeting age-related businesses and templates for asking sellers for financial information.

✅ Module 6: How to Value Businesses in Your Sector

This practical module teaches you how to figure out what businesses are worth. Jason shows how to quickly assess business value, find out what businesses typically sell for in different industries, and make good offers based on financial numbers.

Through real examples of multi-million dollar deals in the Midwest and North Carolina, you learn to analyze promised versus actual financials and spot problems like false tax returns. The module includes Excel spreadsheets for different industries and a complete checklist for investigating businesses.

✅ Module 7: How to Negotiate the Price & Terms with Sellers

This strategic module focuses on effective bargaining with business owners. Jason explains the surprising idea that “the best negotiators don’t negotiate” and gives practical techniques for building good relationships with sellers to get better deals.

You receive templates for NDAs, purchase agreements, and offer letters, plus guidance on using economic conditions to your advantage. The module covers seller financing strategies and includes real stories from Jason’s own deal-making experiences.

✅ Module 8: How to Sell Your Deals to Banks & Get Your Acquisitions Financed

This complete financing module shows the process of getting bank loans to buy businesses. Jason provides detailed guidance on approaching local banks, handling bank meetings, and negotiating good loan terms.

You learn important financial terms to impress bankers, get phone scripts and email templates for contacting banks, and strategies for getting financing even with bad credit. The module includes a sample loan package and a process for finding the right banks when deals are ready.

✅ Module 9: Everything You Need to Secure an SBA 7(a) Loan for Your Acquisition

This US-focused module gives a complete plan for getting SBA financing. The content includes real examples of SBA loan requirements from American banks and all needed forms including personal finance statements, borrower information forms, and resume templates.

Jason provides a simple introduction to the SBA 7(a) program basics and extra resources to make the application process easier. This module gives you everything you need to get government-backed loans for buying businesses in the United States.

✅ Module 10: How to Raise Private Equity (Cash) the Right Way

This advanced funding module covers ways to raise money from private investors. Jason explains how to set up investment funds, deliver good pitches, and successfully close deals with investors.

You receive real examples of investor update emails, first contact messages, and a complete investor presentation. The module includes Jason’s “Jedi Strategy” for fundraising and practical advice on where to find investors and when raising money makes sense for different deals.

✅ Module 11: Transitioning to Ownership, Operations, & Scaling

This final core module bridges the gap between buying and successfully running businesses. Jason guides you through closing day procedures, the critical first week of ownership, and long-term growth strategies to increase business value.

The module includes practical documents like LLC agreements and interview templates. You learn about hiring key leaders (CFO, COO, CEO) and get guidance on the first year of ownership and beyond to prepare for eventually selling the business.

✅ Bonus Modules

The course includes three valuable bonus sections: recorded calls showing real business buying conversations, basic success principles for business owners, and website development guidance. These modules provide real-world examples of the concepts in action, personal growth strategies, and online presence tips for business buyers.

Who is Jason Paul Rogers?

Jason Paul Rogers is an entrepreneur who built wealth through buying businesses instead of starting them. He runs Brighter Living Properties in Charleston, South Carolina, owning companies in skilled trades and real estate.

Rogers bought two million-dollar companies in just 15 months without money, fancy degrees, or business experience. He used creative financing with seller financing, SBA loans, and private equity.

After losing everything in the 2008 crisis, Rogers rebuilt by buying existing businesses instead of starting new ones, finding this created wealth much faster.

Since 2016, Rogers has taught his buying strategy to thousands of students in 47 countries. He shares knowledge through his YouTube channel, podcast, and website.

Rogers also started The Medici Society in 2020, a club for wealthy people funding solutions to world problems, and created The Page Fund for real estate investing.

Be the first to review “Jason Paul Rogers – From Zero Idea to 7-Figure Acquisition” Cancel reply

Related products

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Scott Carson – Note Buying Blueprint – Note Genius Suite [Real Estate]

Business & Finance

Reviews

There are no reviews yet.