Grant Kemp – Seller Financing Essentials

$1,297.00 Original price was: $1,297.00.$22.00Current price is: $22.00.

Grant Kemp Seller Financing Essentials Course [Instant Download]

What is Grant Kemp Seller Financing Essentials?

Grant Kemp Seller Financing Essentials is a real estate investing course teaching you how to buy properties with no money down through creative financing methods.

The program shows you subject-to deals where you take over existing mortgage payments and wrap-around mortgages for maximum profit when selling. You’ll master negotiation techniques that close 75% of deals.

Kemp’s system helps you acquire properties without cash, structure profitable seller financing deals, and build long-term wealth. Based on his $70 million in real estate transactions, this course provides step-by-step methods for successful creative financing investing.

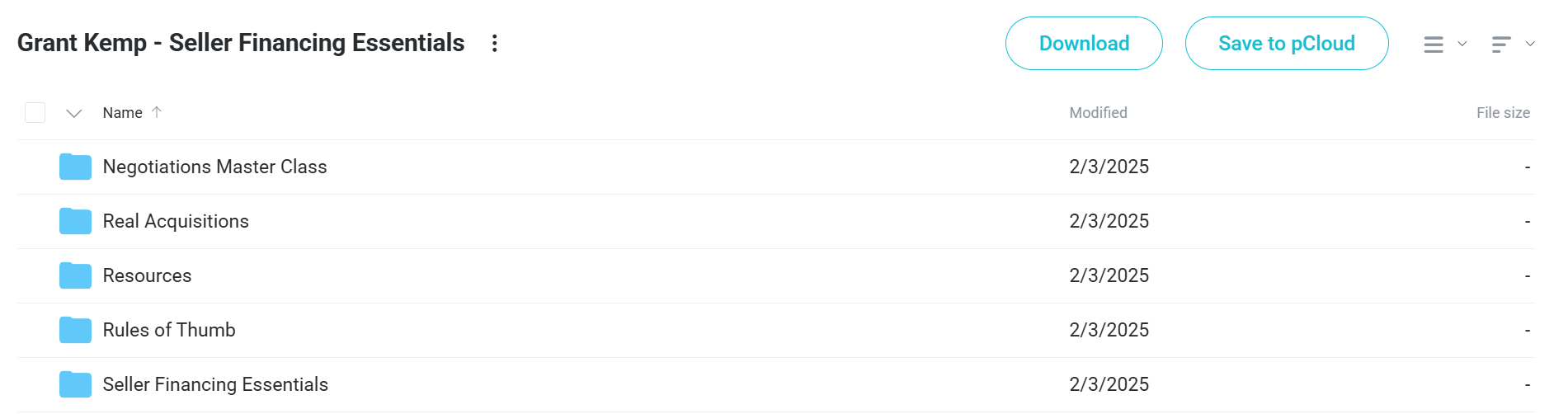

📚 PROOF OF COURSE

What you’ll learn in Seller Financing Essentials:

This comprehensive training teaches everything you need to master creative financing and build a successful real estate investment business. Here’s what you’ll learn:

- Subject-to investing: Acquire properties with no money down using existing mortgages

- Wrap-around strategies: Learn to sell seller-financed properties for maximum profit

- Negotiation mastery: Close deals at over 75% conversion rate using proven techniques

- Property analysis: Master the math behind profitable real estate deals

- LLC protection: Set up legal structures to protect your investment business

- Lead generation: Build systems to find motivated sellers consistently

You’ll also get weekly live Q&A sessions with Grant Kemp for one full year. This hands-on training helps both beginners and experienced investors master seller financing techniques.

Seller Financing Essentials Course Curriculum:

✅ Module 1: Seller Financing Essentials (Core Foundation)

This foundational module establishes the critical knowledge base for seller financing transactions. Students learn to set up proper business structures, understand free-and-clear properties, and master financial calculations using the 10bii calculator.

Key Learning Components

The section progresses from basic legal structures (LLC formation) to property valuation methods and deal analysis fundamentals. Students discover the “backing into the deal” approach and learn to distinguish between known and unknown variables in any transaction.

Advanced Concepts

The module covers subject-to transactions in detail, including due-on-sale clause navigation and insurance considerations. Students learn when to go net negative on deals, front funding strategies, and how to identify quality leads while understanding when to purchase properties sight unseen.

Practical Application

A real-life phone acquisition demonstrates live negotiation techniques, while the whetstone instructional provides hands-on deal analysis practice using actual property scenarios.

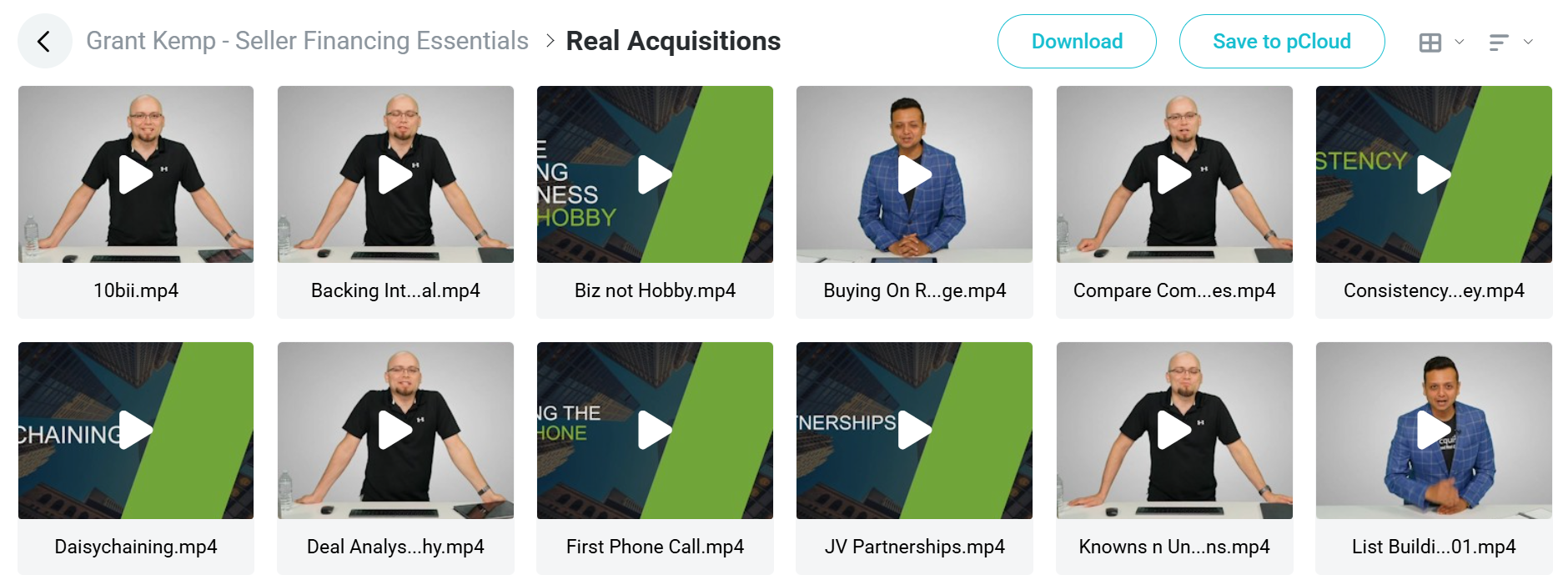

✅ Module 2: Real Acquisitions (Advanced Strategies)

This section bridges theory and practice by focusing on real-world acquisition techniques and business development strategies. Students learn to build systematic approaches to finding and analyzing deals while understanding different investment strategies.

Strategic Decision Making

The module helps students determine their optimal investment path by comparing fix-and-flip, landlording, and wholesaling strategies. It covers rent range buying techniques and teaches the critical philosophy that “it’s not a deal until money hits the account.”

Deal Analysis and Partnerships

Students master comparative market analysis, learn daisy-chaining techniques for multiple property acquisitions, and discover joint venture partnership structures. The section emphasizes consistency in approach and teaches advanced list-building methods for lead generation.

Property Evaluation

Comprehensive training on properly walking properties ensures students can accurately assess potential acquisitions. The module includes first phone call protocols and reinforces the business mindset needed for professional real estate investing.

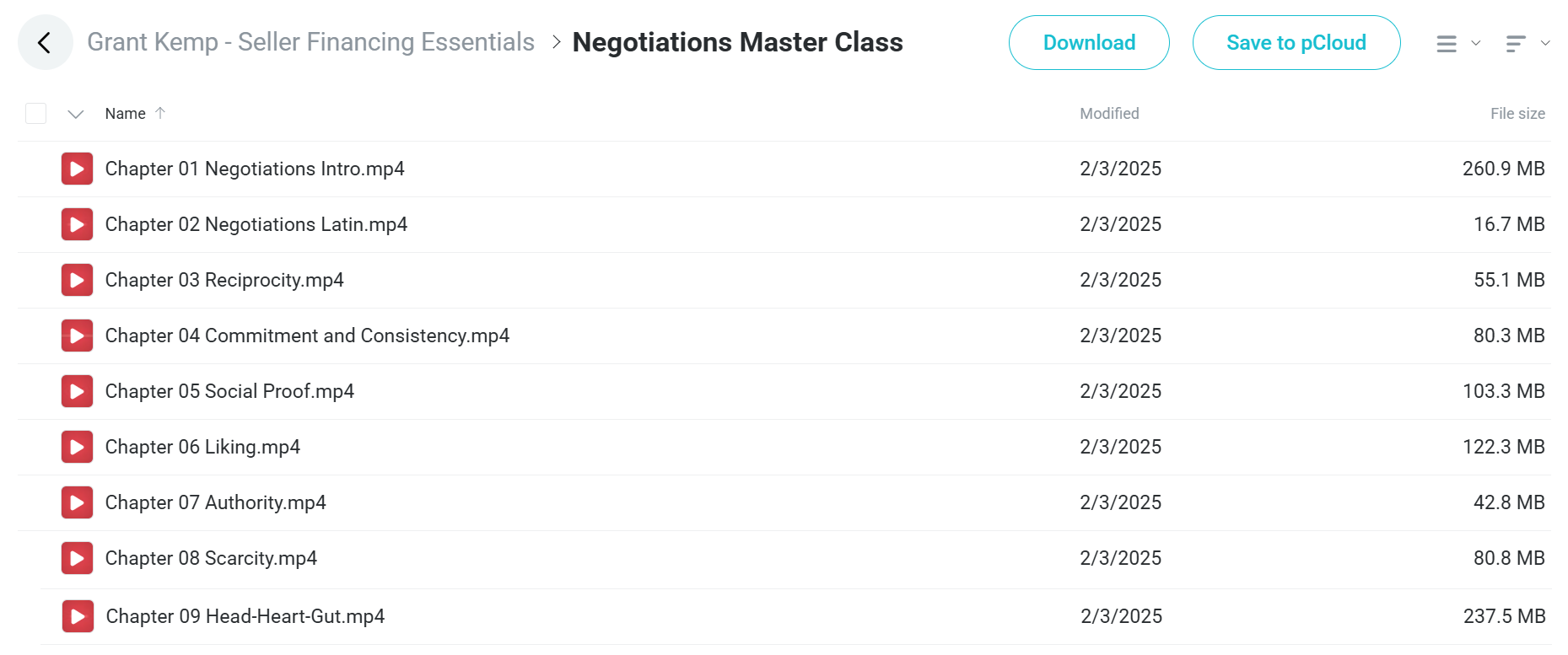

✅ Module 3: Negotiations Master Class (Psychological Foundations)

This specialized section teaches the psychological principles underlying successful real estate negotiations. Students learn Robert Cialdini’s six principles of influence specifically applied to seller financing conversations.

Influence Principles

The training covers reciprocity, commitment and consistency, social proof, liking, authority, and scarcity as negotiation tools. Each principle is demonstrated through real estate scenarios showing how to ethically influence seller decisions.

Advanced Psychology

The “Head-Heart-Gut” approach teaches students to appeal to different decision-making centers in potential sellers. This multi-dimensional strategy significantly increases acceptance rates for creative financing proposals.

Latin Foundations

Understanding negotiation terminology and classical influence concepts provides students with sophisticated language patterns that build credibility and trust during seller conversations.

✅ Module 4: Rules of Thumb (Quick Decision Tools)

This practical module provides rapid evaluation methods for analyzing potential deals in real-time situations. Students learn industry-standard ratios and calculations that enable quick property assessment without extensive analysis.

Core Ratios

The 2X cash rule helps determine minimum cash flow requirements, while the 15% principal guideline ensures adequate equity building. These tools allow rapid deal screening during initial property conversations.

Risk Management

The 82% basis rule protects investors from overpaying, while minimum cash flow requirements ensure sustainable investment returns. These mathematical guidelines provide safety parameters for all acquisition decisions.

Practical Implementation

Students learn to apply these rules during live conversations with sellers, enabling confident decision-making without extensive calculations or delayed responses.

✅ Module 5: Resources and Support Materials

This comprehensive resource library provides all necessary documentation, marketing materials, and reference tools for implementing course strategies. Students receive tested contracts, marketing templates, and analysis spreadsheets.

Documentation Suite

Complete contract packages include subject-to agreements, due-on-sale scripts, and legal forms validated through real transactions. Marketing materials feature handwriting fonts and proven direct mail templates.

Analysis Tools

Professional spreadsheets and PDF resources enable accurate deal analysis and rehab cost estimation. The deal analysis whetstone provides step-by-step evaluation processes for any property type.

Professional Network

Contractor connections and third-party professional referrals help students build their acquisition teams. Recommended reading lists and basis versus strategy guides support continued education and skill development.

Who is Grant Kemp?

Grant Kemp is a real estate investor and educator with over $70 million in real estate transactions. He specializes in creative financing strategies, particularly seller financing and subject-to deals.

Kemp founded CreativeCashFlow.com, a platform teaching investors creative financing methods. His expertise comes from years of buying properties with little to no money using creative techniques.

Grant built his reputation mastering subject-to deals and wrap-around mortgages. He’s known for high conversion rates, closing over 75% of deals he negotiates with sellers.

His teaching focuses on practical strategies that work in today’s market. Grant’s students learn from his real deal experiences and proven systems for finding and closing seller financing deals.

Be the first to review “Grant Kemp – Seller Financing Essentials” Cancel reply

Related products

Real Estate

Real Estate

Commercial Real Estate

Business & Finance

Real Estate

Real Estate

Reviews

There are no reviews yet.