Dandrew Media – LinkedIn Leaders

$19.00

Sal Buscemi LinkedIn Leaders Course [Instant Download]

1️⃣. What is Sal Buscemi LinkedIn Leaders?

Sal Buscemi LinkedIn Leaders teaches commercial real estate professionals how to find investors on LinkedIn who can fund their deals.

This Wall Street-developed system shows you exactly how to connect with decision-makers, with a proven 55% success rate for securing term sheets or closings.

Created by former Goldman Sachs bankers, the course provides templates and strategies to build your investor network, so you’ll never miss opportunities due to lack of funding.

📚 PROOF OF COURSE

2️⃣. What you’ll learn in LinkedIn Leaders:

LinkedIn Leaders gives you a system for finding real estate funding through strategic networking. Here’s what you’ll learn:

- Deal sourcing mastery: Learn business development strategies that bring consistent success

- Investor targeting: Find active investors currently funding commercial real estate deals

- Profile optimization: Make your LinkedIn profile attract serious capital partners

- Contact strategies: Learn how to start and build relationships with decision-makers

- Loan assumption: Discover how to identify and take over existing commercial loans

- Pipeline development: Create a steady flow of qualified investment opportunities

By the end of this course, you’ll know how to find investors for your deals, giving you an edge in the competitive commercial real estate market.

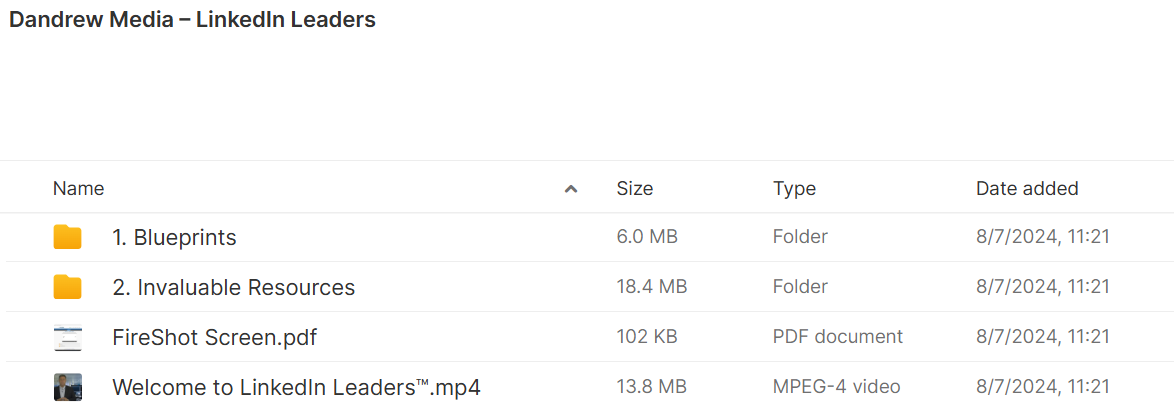

3️⃣. LinkedIn Leaders Course Curriculum:

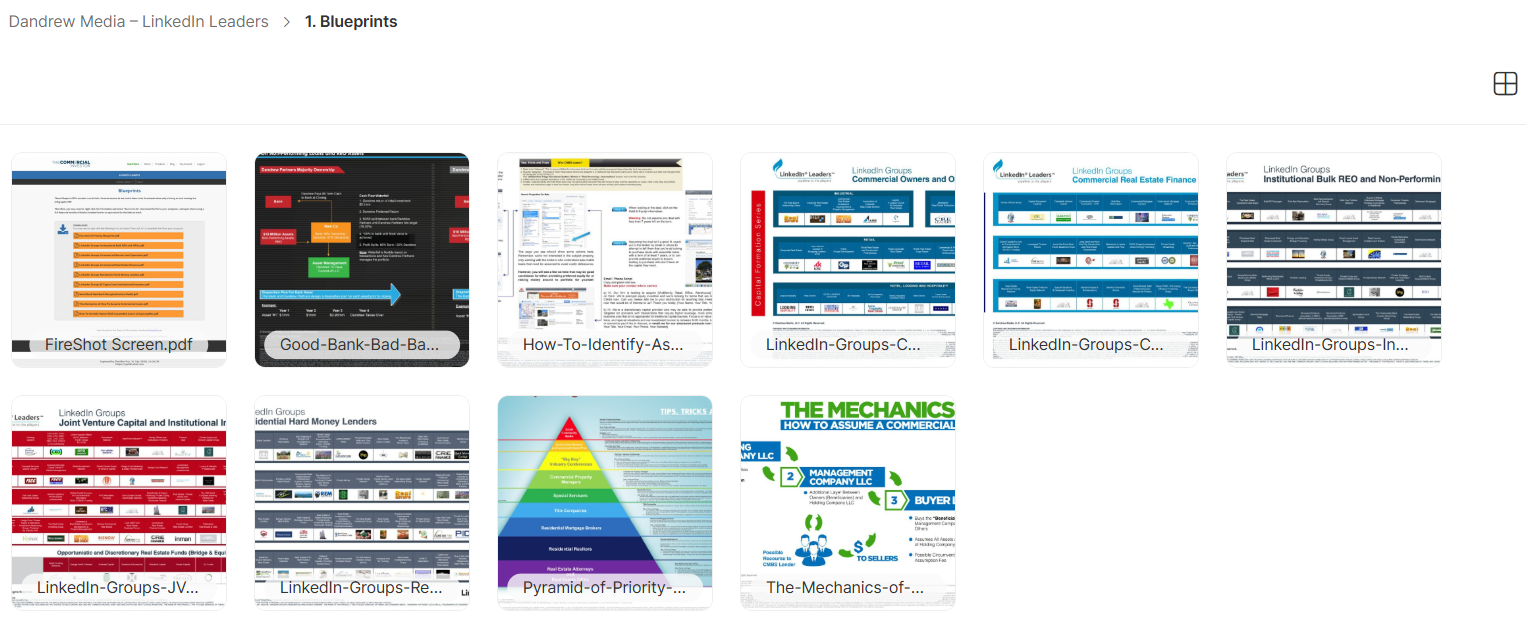

✅ Section 1: Blueprints

This section gives you clear plans and maps for using LinkedIn’s network as a real estate professional. You’ll learn how to find important groups, connect with key decision-makers, and make yourself stand out in specialized real estate circles.

The Pyramid of Priority Infographic helps you focus your networking efforts on the connections that matter most. This smart approach saves you time when building your professional network on LinkedIn.

You’ll learn practical skills about taking over commercial loans through “The Mechanics of How To Assume Commercial Loans” and finding properties with assumable loans on LoopNet. These skills give you quick ways to access better financing for commercial deals.

The blueprint section shows you how to access five key LinkedIn group types: Commercial Owners and Operators, Commercial Real Estate Finance, Institutional Bulk REO and NPNs, JV Capital and Institutional Investors, and Residential Hard Money Lenders. Each guide shows you where the important people gather online.

The Good-Bank-Bad-Bank Recapitalization Model teaches you about restructuring finances for troubled properties or improving your portfolio. This knowledge helps you talk intelligently with investors and finance professionals.

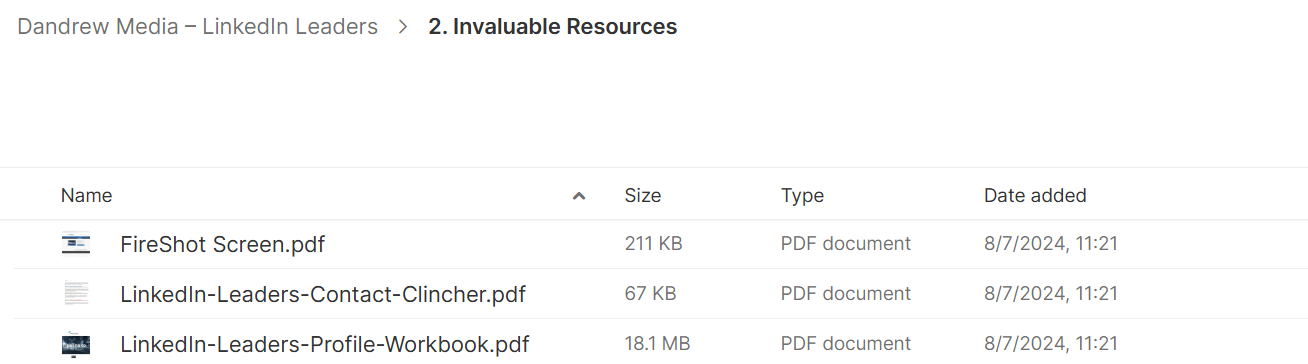

✅ Section 2: Invaluable Resources

This section gives you practical tools to make your LinkedIn efforts more effective. The resources focus on making your profile better, improving how you communicate, and building relationships specifically for real estate professionals.

The LinkedIn Leaders Profile Workbook walks you through improving your profile step by step. You’ll learn how to write attention-grabbing headlines, create engaging summaries, show relevant experience, and highlight skills that appeal to real estate connections.

The Contact Clincher gives you templates and examples for reaching out to people, following up, and building relationships. You’ll learn message strategies that get more responses and turn connections into real professional relationships and possible deals.

The Welcome video introduces you to the course and explains the LinkedIn Leaders approach. This helps you understand how all the parts of the course work together as one system.

4️⃣. Who is Sal Buscemi?

Sal Buscemi owns Dandrew Media, which teaches real estate investing, and Dandrew Partners, which offers bridge financing for commercial properties.

Buscemi worked at Goldman Sachs as an investment banker. This Wall Street background helps him understand how investors think and decide which deals to fund.

He started Dandrew Media to teach both beginners and experienced investors about finding opportunities in real estate. His courses show practical ways to find deals and use financial models like those used by big institutions.

Buscemi has created several training programs that help people connect with investors. His LinkedIn Leaders course solves a major problem in real estate: finding the right investors to fund good deals.

5️⃣. Who should take Sal Buscemi Course?

LinkedIn Leaders is for commercial real estate professionals who want more investor connections. This course helps:

- Commercial brokers who want to find financing for clients and earn extra fees.

- Real estate syndicators looking to connect with investors for their deals.

- Property developers needing funding sources for new projects.

- Investment intermediaries who connect deals with capital partners.

- Real estate professionals moving from residential to commercial investing.

If you’re losing deals because you can’t find financing or want to be known for connecting money with opportunities, LinkedIn Leaders gives you the tools to succeed.

6️⃣. Frequently Asked Questions:

Q1: How do I find real estate investors on LinkedIn?

Q2: What’s the success rate of finding investors through LinkedIn?

Q3: How do I approach investors on LinkedIn without seeming pushy?

Q4: Which LinkedIn groups are best for real estate deal sourcing?

Q5: How often should I post about deals on LinkedIn?

Be the first to review “Dandrew Media – LinkedIn Leaders” Cancel reply

Related products

Real Estate Marketing

Photography

Real Estate Marketing

Reviews

There are no reviews yet.