Dan Zanger – CM Price Action Course

$1,995.00 Original price was: $1,995.00.$29.00Current price is: $29.00.

Dan Zanger CM Price Action Course [Instant Download]

What is Dan Zanger CM Price Action Course?

Dan Zanger CM Price Action Course teaches you how to trade stocks using pure price action without indicators.

This trading course shows you exactly where to enter trades, place stops, and how to size positions for maximum profits.

Randy Opper, Dan Zanger’s protégé, reveals the same methods that turned $10,775 into $18 million in less than two years.

The course focuses on reading charts, identifying low-risk buy areas, and executing trades like championship-level investors.

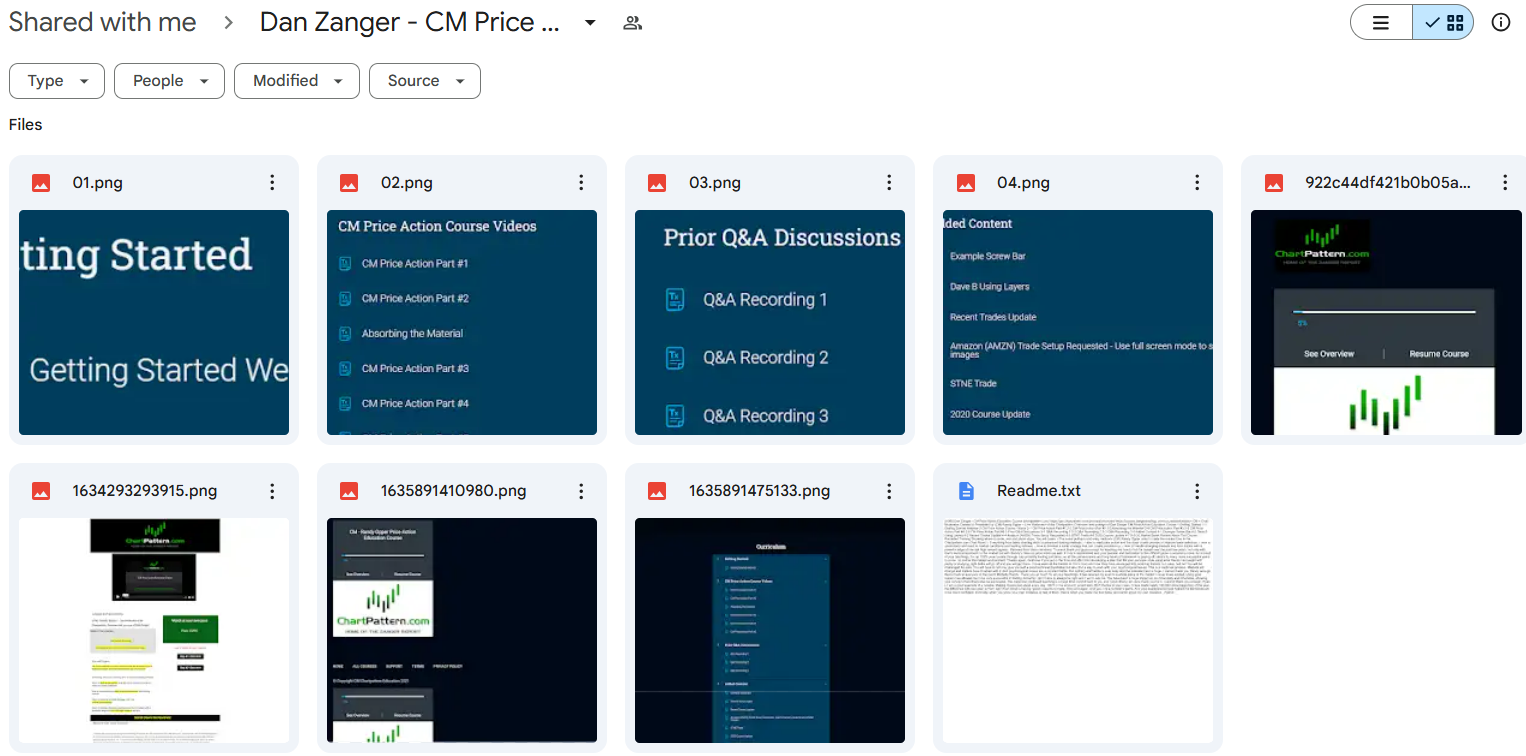

📚 PROOF OF COURSE

What you’ll learn in CM Price Action Course:

The CM Price Action Course improves your trading with strategies from world-record holder Dan Zanger and his protégé Randy Opper. Here’s what you’ll learn:

- Technical analysis mastery: Read price action without indicators

- Strategic entries: Find low-risk buy and sell areas to stop chasing trades

- Risk management: Place stops that protect money while maximizing profits

- Position sizing: Size trades for better returns and account growth

- Chart pattern recognition: Spot Cup and Handle, Falling Wedges, and profitable patterns

- Timing precision: Enter and exit trades at the best prices for consistent profits

This training teaches the same methods used by U.S. Investing Championship traders, helping both new and experienced traders make more money.

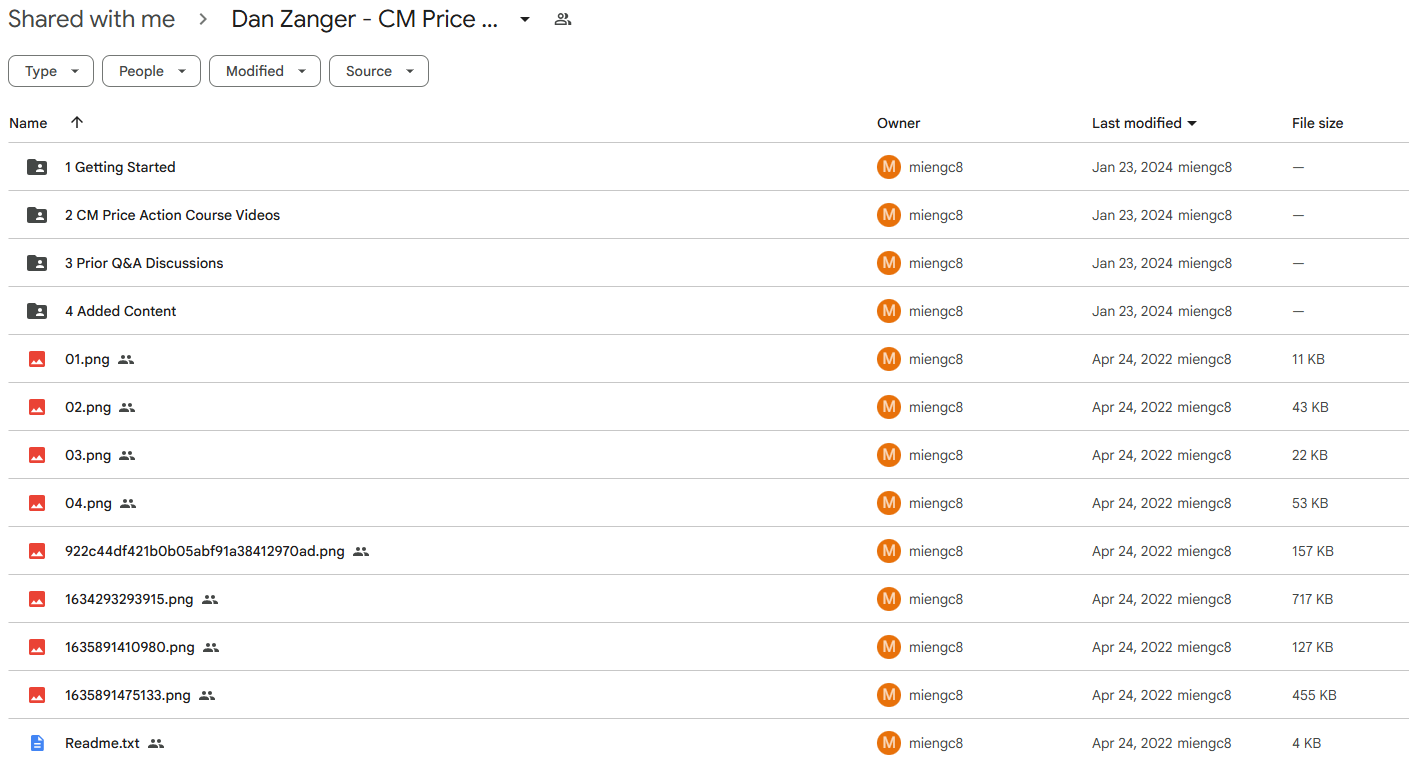

CM Price Action Course Curriculum:

✅ Module 1: Getting Started

This introductory module establishes the foundation of Zanger’s trading methodology through a comprehensive webinar. Students are introduced to core price action concepts, chart reading fundamentals, and the overall course structure to prepare them for the technical material ahead.

Key Components:

The Getting Started Webinar serves as an orientation to Zanger’s trading philosophy and sets expectations for the learning journey. It likely covers his background as a record-setting trader and introduces the chart mastery approach that forms the backbone of his trading system.

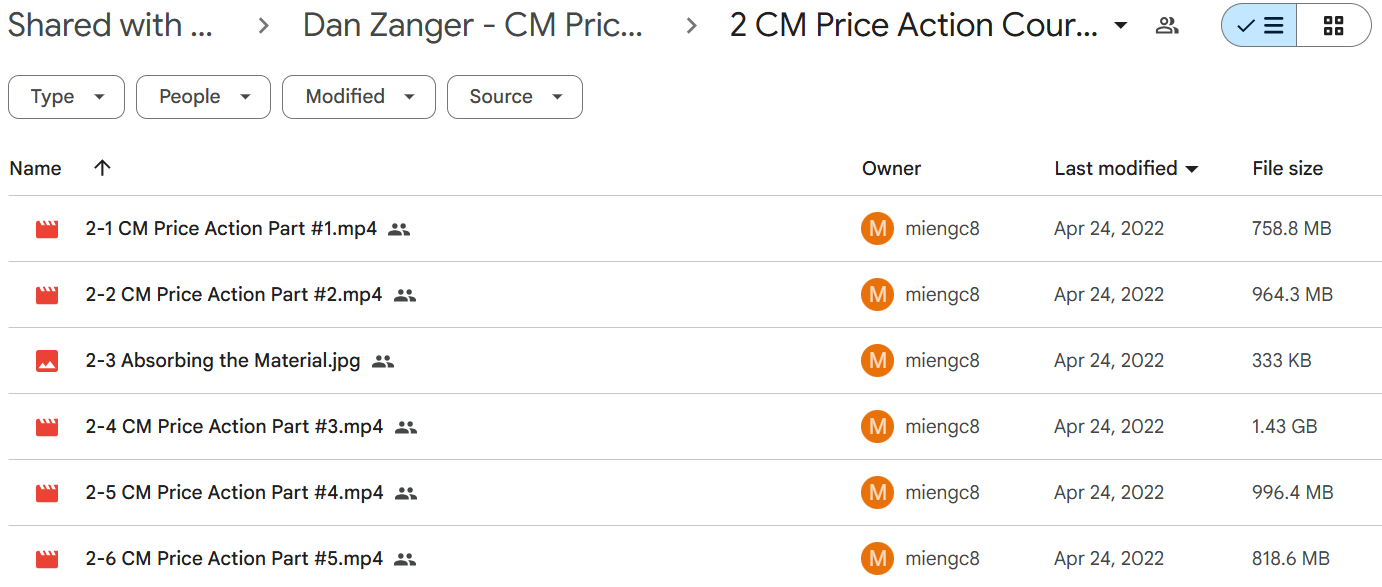

✅ Module 2: CM Price Action Course Videos

The core curriculum is delivered through five sequential video lessons that systematically build Zanger’s complete price action trading methodology. This module presents the essential chart patterns, entry/exit strategies, and technical indicators that comprise Zanger’s trading approach.

Key Lessons:

Parts 1-2 likely establish fundamental chart patterns and price action principles, while Parts 3-5 advance into more sophisticated setups and execution strategies. The “Absorbing the Material” resource suggests emphasis on internalizing these techniques through deliberate practice rather than mere passive consumption.

✅ Module 3: Prior Q&A Discussions

This module contains three recorded question-and-answer sessions where common challenges and specific trading scenarios are addressed. These recordings offer practical application of the core concepts and troubleshoot typical obstacles traders encounter when implementing Zanger’s methods.

Value Addition:

The Q&A recordings provide real-time problem-solving and demonstrate how Zanger applies his techniques to specific market situations. These sessions likely address nuanced aspects of trade management, risk assessment, and pattern variation that arise during actual trading.

✅ Module 4: Added Content

This supplemental module features specialized trade examples, case studies, and market reviews that demonstrate the practical application of Zanger’s methodology. It includes specific stock analyses (AMZN, STNE), technique demonstrations like the “Screw Bar” pattern, and contemporary market applications.

Practical Applications:

The trade examples (Amazon, STNE) showcase how Zanger’s methods apply to specific securities, while the “Using Layers” video demonstrates advanced chart analysis techniques. The module also includes timely course updates and market reviews (2020 Update, Market Break Review) to show how the methodology adapts to changing market conditions.

Who is Dan Zanger?

Dan Zanger holds the world record for stock market gains, turning $10,775 into $18 million in less than two years during the late 1990s.

His success story has been featured in Fortune Magazine and other major financial publications.

Zanger specializes in finding explosive stock moves through chart patterns. He focuses on Cup and Handle formations, Falling Wedges, Ascending Triangles, and Bull/Bear Flags.

He shares his knowledge through Chartpattern.com, offering resources to help traders use technical analysis. The CM Price Action Course is his collaboration with Randy Opper, who moderates the Chartpattern Chat Room and learned directly from Zanger.

Their course teaches Zanger’s proven trading strategies in a step-by-step system for traders of all experience levels.

Be the first to review “Dan Zanger – CM Price Action Course” Cancel reply

Related products

Stock Trading

Forex Trading

Stock Trading

Day Trading

Stock Trading

Stock Trading

Stock Trading

Reviews

There are no reviews yet.