Dan Sheridan Manage By The Greeks Class

$68.00 Original price was: $68.00.$19.00Current price is: $19.00.

Dan Sheridan Manage By The Greeks Course [Instant Download]

1️⃣. What is Dan Sheridan Manage By The Greeks?

Dan Sheridan’s Manage By The Greeks teaches you how to master options trading using Delta, Gamma, Theta, and Vega principles.

The course reveals practical techniques for making informed trade adjustments, limiting losses, and maximizing profits in any market condition.

Developed by a former CBOE market maker with 30+ years of experience, this comprehensive program provides real-world strategies for effective position management and risk control in options trading.

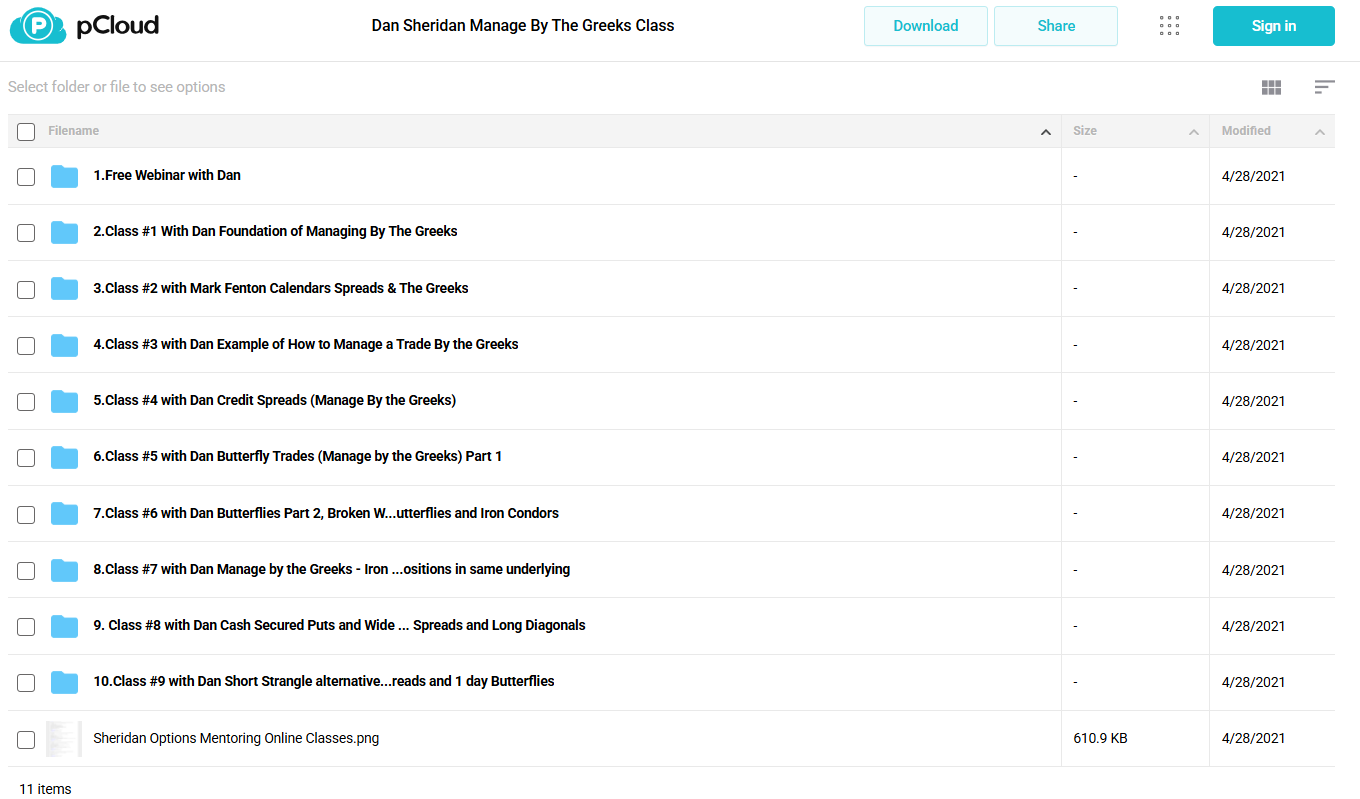

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Manage By The Greeks?

Dan Sheridan’s Manage By The Greeks Class teaches you professional skills to handle options trading effectively. Here’s what you’ll learn:

- Delta management: Master techniques to control price direction risk and make proper adjustments

- Gamma exposure: Learn how to handle rapid price changes in the market

- Theta harvesting: Create strategies to benefit from time decay for steady income

- Vega hedging: Discover ways to protect trades when market volatility shifts

- Position sizing: Apply smart risk management across different trading strategies

- Adjustment techniques: Learn how to turn losing trades into winners

This course makes complex Greek concepts practical and usable, giving you skills to manage trades like the pros on Wall Street.

3️⃣. Manage By The Greeks Course Curriculum:

✅ Section 1: Introduction to Managing By The Greeks

This section introduces you to Dan Sheridan’s approach to options trading through the lens of Greeks. You’ll get a comprehensive overview of the course structure and teaching methodology that has helped thousands of traders transform their approach to options.

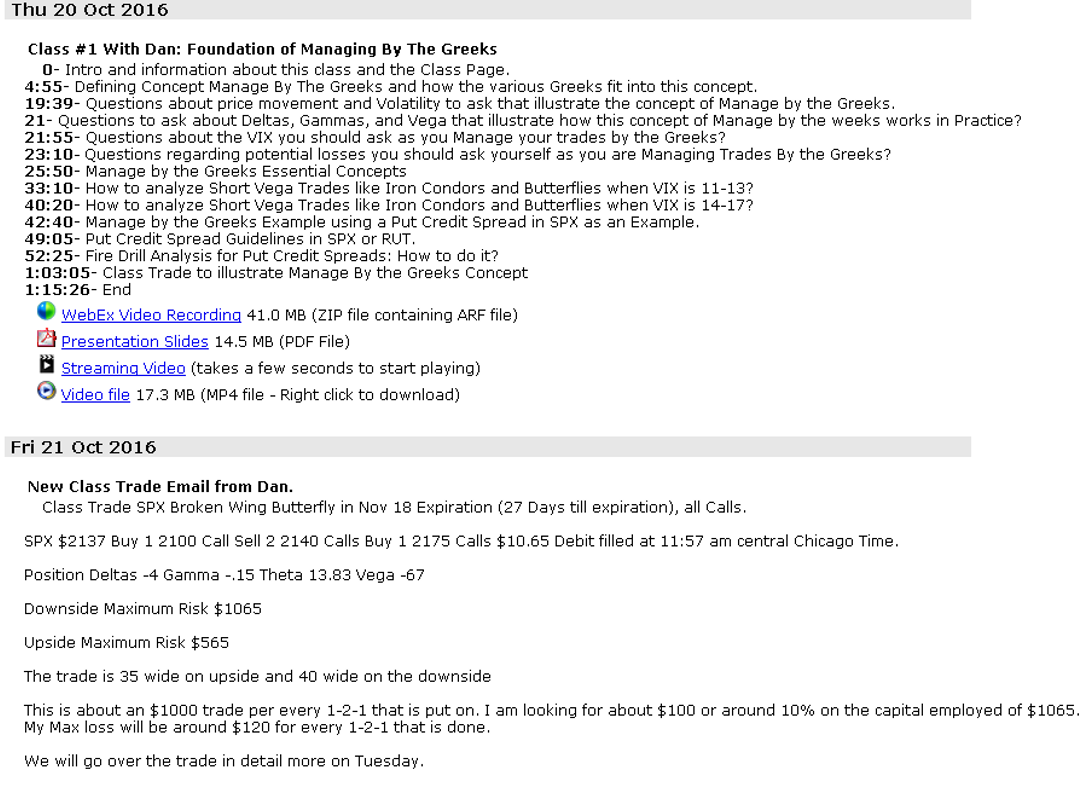

Module 1.1: Free Webinar with Dan

This introductory module gives you a taste of Dan’s teaching style and core concepts of Greek-based trading. The webinar covers fundamental principles that will be expanded throughout the course.

- 0-MBTGs.mp4 (Video Recording of Free Webinar)

- Sheridan Options Mentoring Online Classes.png (Program Overview Visual)

✅ Section 2: Foundations of Greek-Based Trading

This section establishes the core framework for managing trades using Greek measurements. Dan builds your knowledge from the ground up, ensuring you understand how Delta, Gamma, Theta, and Vega affect your positions in real-world scenarios.

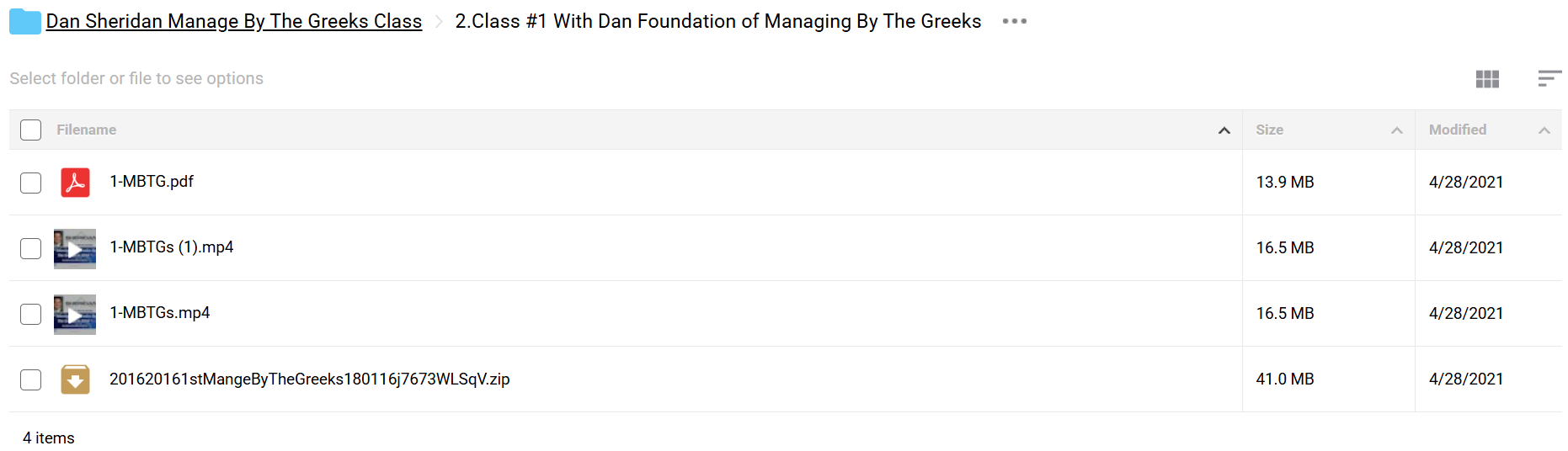

Module 2.1: Foundation of Managing By The Greeks with Dan

Dan introduces the essential Greek measurements and explains how professional traders use them to make decisions. These foundational concepts form the basis for all strategies covered later in the course.

- 1-MBTG.pdf (Comprehensive Lesson Materials)

- 1-MBTGs.mp4 (Primary Video Lesson)

- 1-MBTGs (1).mp4 (Alternative Video Format)

- 201620161stMangeByTheGreeks180116j7673WLSqV.zip (Additional Resources Package)

✅ Section 3: Calendar Spreads Through Greek Analysis

This section explores how to apply Greek measurements specifically to calendar spread strategies. Mark Fenton joins as a guest instructor to provide specialized insights into this popular trading approach.

Module 3.1: Calendar Spreads and The Greeks with Mark Fenton

Mark shows how to optimize calendar spreads by monitoring Greek values throughout the trade lifecycle. You’ll learn specific adjustment triggers based on changes in time decay and volatility exposure.

- 2-MBTGs.pdf (Strategy Guide and Reference Materials)

- 2-MBTGs.mp4 (Primary Video Lesson)

- 2-MBTGs (1).mp4 (Alternative Video Format)

- 201620162ndMangeByTheGreeks1800si3Qe0sKYjU4p9.zip (Trading Templates and Examples)

✅ Section 4: Practical Trade Management Applications

This section bridges theory and practice through detailed trade examples. Dan walks through complete trade lifecycles, demonstrating how to apply Greek measurements to make timely adjustments.

Module 4.1: Example of How to Manage a Trade By the Greeks with Dan

Dan presents actual trade scenarios showing entry, management, and exit decisions based on Greek values. These practical examples help you see the decision-making process in action.

- 3-MBTGs.mp4 (Primary Video Lesson)

- 3-MBTGs (1).mp4 (Alternative Video Format)

- 201620163rdManageByTheGreeks1801s722Q7WLes.zip (Trade Examples and Analysis Files)

✅ Section 5: Credit Spreads and Greek Management

This section focuses on implementing Greek-based management with credit spread strategies. Dan shows how to properly assess risk and make appropriate adjustments to these popular income-generating positions.

Module 5.1: Credit Spreads Manage By the Greeks with Dan

Dan demonstrates how measuring Greek values can dramatically improve credit spread performance through strategic adjustments and proper position sizing techniques.

- 4-MBTGs.pdf (Strategy Reference Guide)

- 4-MBTGs.mp4 (Primary Video Lesson)

- 4-MBTGs (1).mp4 (Alternative Video Format)

- 201620164thManageByTheGreeks1804jbeV570x53sM72.zip (Trading Templates and Examples)

✅ Section 6: Butterfly Strategy Implementation

This section explores the butterfly strategy through the lens of Greek management. You’ll learn how this versatile position can be constructed and adjusted based on precise Greek measurements.

Module 6.1: Butterfly Trades Manage by the Greeks Part 1 with Dan

Dan introduces butterfly strategies and explains how to monitor their unique Greek profiles. You’ll learn entry criteria and initial management techniques for this advanced strategy.

- 5-MBTGs.pdf (Butterfly Strategy Guide)

- 5-MBTGs.mp4 (Primary Video Lesson)

- 5-MBTGs (1).mp4 (Alternative Video Format)

- 201620165thManageByTheGreeks1805BiXIp4l926d8c9.zip (Trade Setup Templates)

✅ Section 7: Advanced Butterfly Variations

This section builds on the butterfly foundation by exploring variations and combining them with other strategies. Dan shows how to manage complex positions while maintaining a balanced Greek profile.

Module 7.1: Butterflies Part 2, Broken Wing Butterflies and Iron Condors with Dan

Dan expands on butterfly concepts with advanced variations and demonstrates how to transition between different strategies based on changing market conditions.

- 6-MBTGs.pdf (Advanced Strategy Guide)

- 6-MBTGs.mp4 (Primary Video Lesson)

- 6-MBTGs (1).mp4 (Alternative Video Format)

- 201620166thManageByTheGreeks1901h7d9PPKr77714.zip (Advanced Templates and Examples)

✅ Section 8: Iron Condor Greek Management

This section focuses specifically on iron condor strategies through Greek analysis. Dan teaches how to maintain balance in these popular income strategies even when markets become volatile.

Module 8.1: Manage by the Greeks – Iron Condors and Multiple Positions with Dan

Dan demonstrates iron condor management techniques and explains how to coordinate multiple positions within the same underlying to maintain a balanced overall Greek profile.

- 7-MBTGS.mp4 (Primary Video Lesson)

- 7-MBTGS (1).mp4 (Alternative Video Format)

- 201620167thManageByTheGreeks190237s2Xd7d40MTk8.zip (Trade Analysis Files)

✅ Section 9: Cash Secured Puts and Diagonal Spreads

This section covers additional income-generating strategies from a Greek perspective. You’ll learn how to implement and manage these approaches with a focus on controlling risk through Greek measurements.

Module 9.1: Cash Secured Puts and Wide Credit Spreads and Long Diagonals with Dan

Dan explores additional income strategies with detailed Greek analysis of each approach. You’ll learn how to select the right strategy based on market conditions and your Greek exposure targets.

- 8-MBTGs.pdf (Strategy Implementation Guide)

- 8-MBTGs.mp4 (Primary Video Lesson)

- 8-MBTGs (1).mp4 (Alternative Video Format)

- 201620168thManageByTheGreeks19078j31e6Z3x5b145.zip (Trade Setup Resources)

✅ Section 10: Alternative Income Strategies

This final section introduces creative alternatives to traditional high-risk strategies. Dan presents safer approaches that maintain Greek balance while generating consistent income.

Module 10.1: Short Strangle Alternatives and One Day Butterflies with Dan

Dan concludes the course with advanced concepts including risk-defined alternatives to naked option selling and short-term butterfly applications for specific market scenarios.

- 9-MBTGs.pdf (Advanced Strategy Guide)

- 9-MBTGs.mp4 (Primary Video Lesson)

- 9-MBTGs (1).mp4 (Alternative Video Format)

- 201620169thManageByTheGreeks19016r6g4u60486B.zip (Advanced Strategy Resources)

4️⃣. Who is Dan Sheridan?

Dan Sheridan is an options trading expert with over 30 years of experience. He started as a market maker at the Chicago Board Options Exchange (CBOE) with Mercury Trading under Jon and Pete Najarian.

At CBOE, Dan trained many successful traders, including Pete Najarian who later hosted CNBC’s “Fast Money.” This teaching experience shaped his future focus on trader education.

In 2004, Dan left the trading floor to start Sheridan Risk Management. His company teaches individual traders options strategies, combining theory with real-world applications from his trading pit experience.

“Manage Your Trades By The Greeks” is one of Dan’s key courses. It shows how to use Delta, Gamma, Theta, and Vega in real trading. His method focuses on risk management and strategic adjustments based on these indicators.

Sheridan Risk Management also offers a Pro Plan with live trading sessions, pre-recorded classes, and a trading community. This helps develop well-rounded traders.

Free webinars are available on Dan’s website and YouTube for those wanting to sample his teaching style before taking a full course.

5️⃣. Who should take Dan Sheridan Course?

Dan Sheridan’s Manage By The Greeks course helps traders improve their options trading with professional risk management techniques. This course is for:

- Intermediate options traders who know basic strategies but have trouble managing positions when markets move against them.

- Advanced traders wanting to improve their adjustment techniques using Greek measurements instead of guessing.

- Former directional traders moving to more advanced income strategies with proper risk controls.

- Full-time options traders needing a clear system to manage positions across multiple stocks.

- Risk-conscious investors looking to protect their portfolios using professional hedging methods.

This program is perfect if you want to go beyond basic options concepts and use the same tools that professional market makers use. If you’re new to options, you might want to start with Dan’s Options 101 course instead.

6️⃣. Frequently Asked Questions:

Q1: How can I master options trading?

Q2: What is the role of Delta in options trading?

Q3: How does Gamma impact options trading?

Q4: What is Theta, and why is it important?

Q5: How does Vega affect an options trade?

Be the first to review “Dan Sheridan Manage By The Greeks Class” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Anton Kreil – Professional Options Trading Masterclass (POTM)

Options Trading

Options Trading

Options Trading

Options Trading

Reviews

There are no reviews yet.