Bill Bronchick – Lease Options

$594.00 Original price was: $594.00.$43.00Current price is: $43.00.

Bill Bronchick Lease Options Course [Instant Download]

What is Bill Bronchick Lease Options?

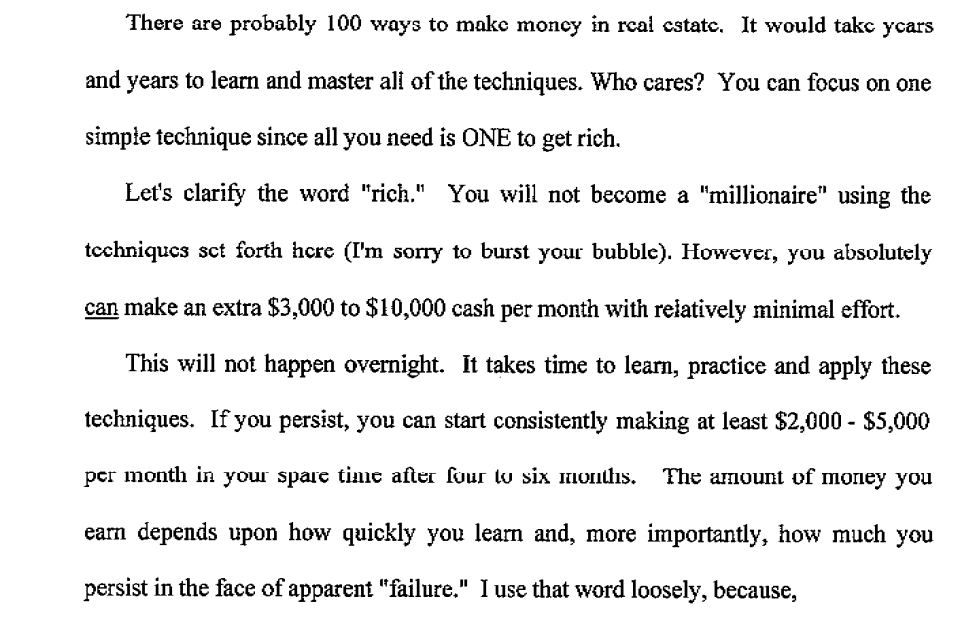

Bill Bronchick Lease Options is a real estate investing course that teaches you how to make money from real estate without buying property or getting loans.

The program shows you how to use lease purchase agreements to control properties and profit from both rental income and option fees. You become the middle person between property owners and tenant buyers.

The system requires little or no money down. You rent properties from owners, then lease them to tenant buyers who want to purchase later. You collect monthly rent and upfront option money.

Based on Bronchick’s 30+ years as a real estate attorney and investor, this course provides proven strategies to make money through sandwich lease options and creative financing techniques.

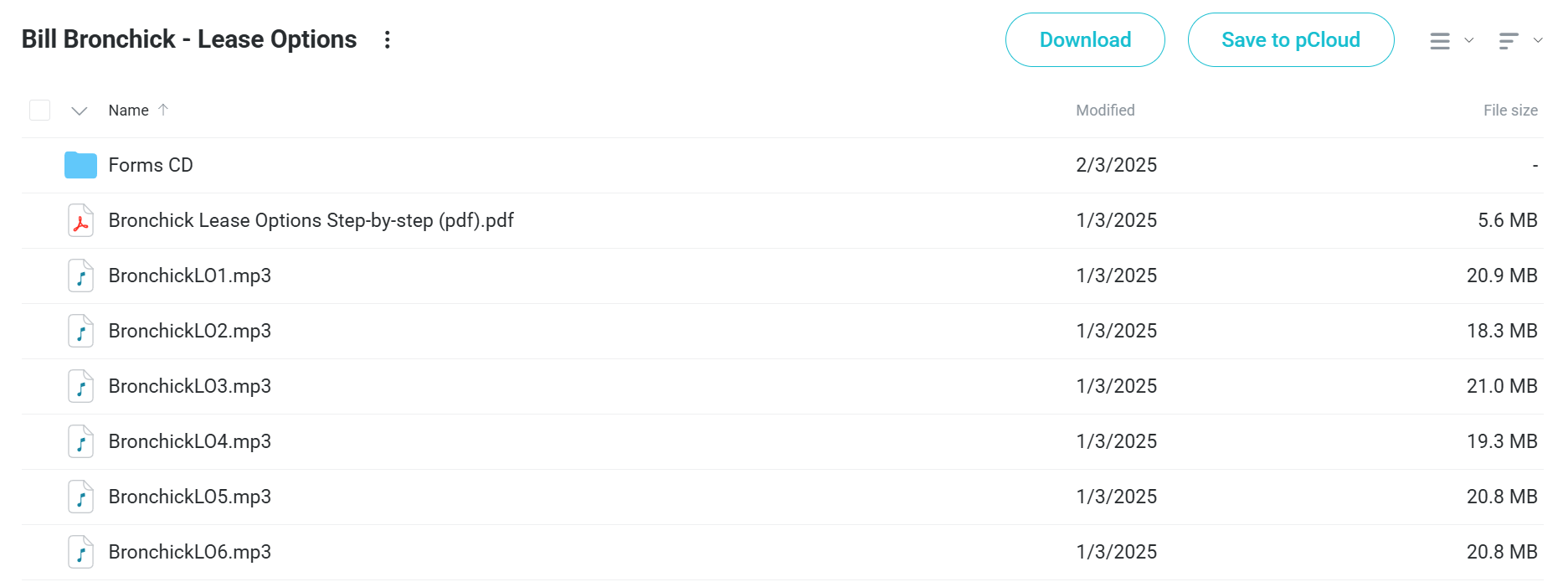

📚 PROOF OF COURSE

What you’ll learn in Bill Bronchick Lease Options Course:

This course teaches you everything to master lease option investing and start making cash flow right away. You’ll learn the complete system from finding deals to closing transactions.

- Deal finding: Find properties perfect for lease option deals in your area

- Negotiation skills: Use proven scripts to get sellers to agree to lease option terms

- Tenant buyer screening: Find and qualify good tenant buyers who will purchase later

- Legal rules: Follow Dodd-Frank regulations and structure deals the right way

- Multiple strategies: Discover 7 different ways to profit with lease options

- Advanced methods: Use lease options for commercial deals, fix and flips, and IRA investing

The course works for beginners with little money and experienced investors wanting new ways to profit from real estate.

Lease Options Course Curriculum:

✅ Module 1: Foundation and Legal Framework

Students begin with understanding the legal setup of lease options and how they are different from regular rental agreements. This starting module covers the basic ideas of controlling property without owning it and the legal protections needed for both investors and property owners.

The module focuses on ways to avoid risk and proper paperwork that protects investors from possible legal problems while keeping profitable deal structures.

✅ Module 2: Deal Structure and Financial Mechanics

This section focuses on the financial planning behind successful lease option deals, including how to figure out option fees, monthly payments, and purchase prices. Students learn to set up deals that help all parties while making the most profit for themselves.

Key lessons include finding fair market values, getting good terms, and creating win-win situations that make property owners want to accept lease option deals over regular sales or rentals.

✅ Module 3: Marketing and Lead Generation

Students discover proven marketing ways for finding motivated sellers and good tenant-buyers in their local areas. The module covers both online and offline marketing methods made specifically for lease option opportunities.

Special attention is given to creating strong marketing messages that attract property owners facing money problems or time limits, while also building a list of possible tenant-buyers.

✅ Module 4: Negotiation and Deal Closing

This practical module teaches students how to have good talks with property owners and set up agreements that protect their interests. Students learn specific scripts and methods for handling common objections and closing deals quickly.

The content includes real-world examples showing how to handle tough situations such as hesitant sellers, competing offers, and complex property conditions.

✅ Module 5: Tenant-Buyer Management

Students learn the important skills needed to qualify, check, and manage tenant-buyers throughout the lease option period. This module covers the mindset of rent-to-own buyers and how to keep good relationships while protecting investment interests.

Key topics include collecting option fees, handling repair duties, and preparing tenant-buyers for buying the property later or ending the contract.

✅ Module 6: Advanced Strategies and Exit Techniques

The final audio module explores advanced lease option strategies including sandwich leasing, assignment methods, and ways to grow your portfolio. Students discover how to use their first success to build larger, more profitable real estate investment businesses.

This section also covers exit plans for different situations, including early contract ending, property value increases, and methods for making the most profit no matter what the market does.

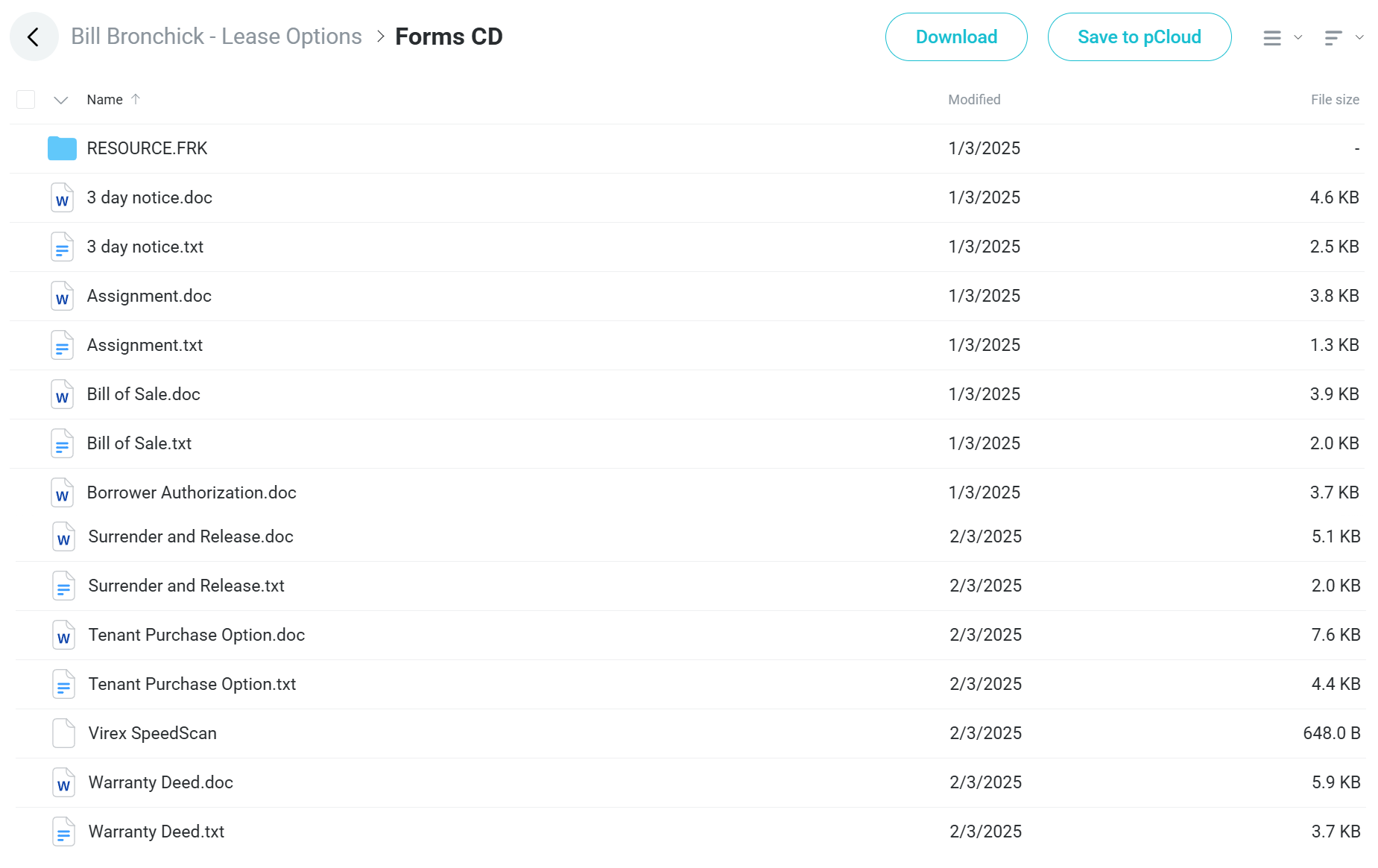

✅ Legal Documentation and Forms Library

The course includes a complete library of professionally written legal forms and contracts needed for lease option deals. Each document comes in both Word format for changes and text format for easy reference.

Important forms include lease option agreements, assignment contracts, disclosure statements, and various notices required for legal compliance. The step-by-step PDF guide provides detailed instructions for properly using each document type.

Students also receive special marketing materials including broker flyers and deposit receipts, along with protective legal documents such as borrower authorizations and CYA disclosures that reduce liability risks.

Who is Bill Bronchick?

Bill Bronchick is a real estate attorney and investor with over 30 years of experience. He has completed thousands of real estate deals across the United States.

As a practicing attorney, Bronchick knows real estate law and creative financing inside out. He combines legal knowledge with hands-on investing to teach safe and profitable techniques.

Bronchick has trained thousands of people to make money through real estate investing. His legal background keeps all strategies within the law and protects investors from legal problems.

He speaks at real estate conferences nationwide, sharing his proven methods for generating cash flow through lease options and other creative strategies.

Be the first to review “Bill Bronchick – Lease Options” Cancel reply

Related products

Lease Options

Lease Options

Reviews

There are no reviews yet.