Axia Futures – Trading Decoded Course

$1,900.00 Original price was: $1,900.00.$18.00Current price is: $18.00.

Trading Decoded (1-Week Intensive Course) [Instant Download]

What is Axia Futures Trading Decoded?

Axia Futures’s Trading Decoded is a one-week program. It teaches professional futures trading using technical analysis techniques, market profiling, and order flow techniques.

The course offers 4-5 hours of daily hands-on training. You will learn to analyze the market and develop trading strategies through real-world examples. Students practice on simulation platforms to master trading skills safely before using real money.

Trading Decoded focuses on practical methods used by big traders. It gives you professional knowledge and skills for real market conditions.

The program helps beginners become skilled futures traders. It shares trading methods used by institutions and teaches risk management techniques.

👉 Read more Axia Futures Courses:

- Axia Futures – The Footprint Edge Course

- Axia Futures – Trading with Price Ladder and Order Flow Strategies

- Axia Futures – The Prop Trading Code

- AXIA Futures Central Bank Trading Strategies

- AXIA Futures – Elite Trader Blueprint

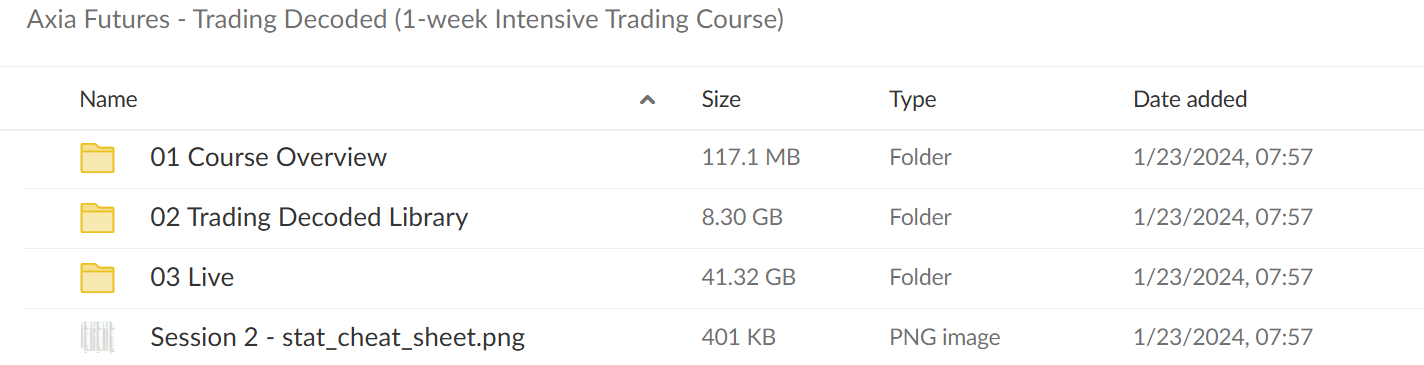

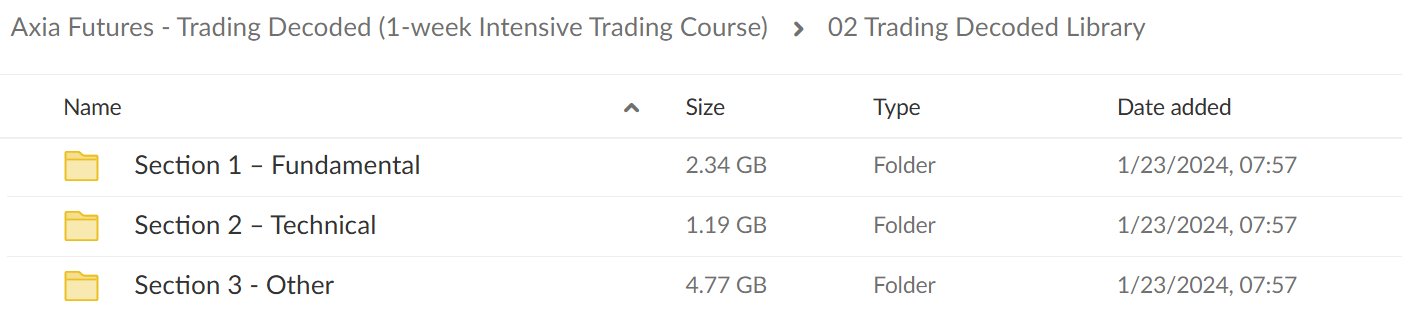

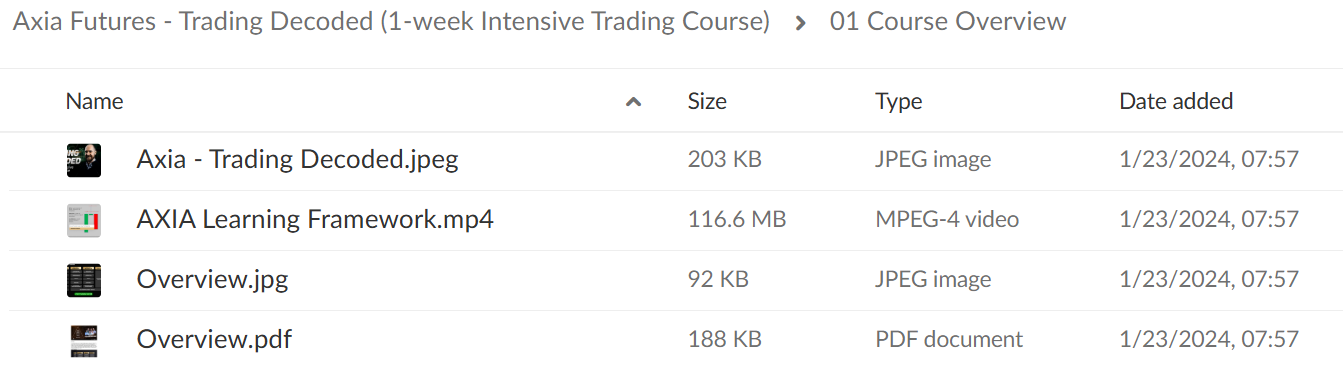

📚 PROOF OF COURSE

What you’ll learn in Axia Futures Trading Decoded?

Trading Decoded shows you proven methods to succeed in futures trading. Here’s what you’ll learn:

- Technical Analysis: Master chart reading and trading patterns

- Market/Volume Profiling: Spot profitable trading opportunities using volume

- Order Flow Trading: Use footprint charts to find the best trade entries

- Risk Management: Protect your capital with proven strategies

- Trade Preparation: Learn pre-market analysis and trade review methods

- Live Practice: Apply skills in simulated trading sessions

This hands-on training gives you the tools to trade futures markets with confidence.

Axia Futures Trading Decoded Course Curriculum:

✅ Section 1: Course Foundation

This introductory section establishes the learning framework and course structure. Students gain a clear understanding of the educational journey ahead through comprehensive overview materials.

AXIA Learning Framework (Video)

Detailed introduction to the educational methodology and learning objectives.

✅ Section 2: Market Fundamentals

Module 2.1: Asset Classes

Comprehensive coverage of major financial markets and their characteristics. Students develop a strong foundation in understanding various trading instruments.

Currencies (Video)

In-depth analysis of foreign exchange markets and trading dynamics.

Commodities (Video)

Detailed exploration of commodity markets and their unique characteristics.

Capital Markets (Video Series)

Complete coverage of stock and bond markets, including market structure and trading principles.

✅ Section 3: Technical Analysis

This section provides comprehensive training in technical analysis tools and methodologies. Students learn to apply various technical indicators for market analysis.

Module 3.1: Technical Indicators

Systematic approach to understanding and implementing technical analysis tools.

Candlesticks Basics (Video)

Foundation training in candlestick pattern recognition and interpretation.

Advanced Technical Tools (Video Series)

Comprehensive coverage of VWAP, Fibonacci, Bollinger Bands, and Moving Averages implementation.

✅ Section 4: Trading Technology

This section covers practical implementation of trading tools and platforms.

Metastock Tutorial (Video)

Detailed guidance on using professional charting and analysis software.

Professional Insights (Video)

Expert interview with Andy “Braveheart” providing real-world trading perspective.

✅ Section 5: Live Trading Implementation

This intensive section provides real-time trading experience through structured daily sessions. Each day builds upon previous learning while introducing new concepts.

Module 5.1: Trading Foundations

Day 1 focuses on establishing core trading principles through two comprehensive sessions.

Product Codes Reference (PDF)

Essential trading instrument identification guide.

Module 5.2: Risk Management

Day 2 emphasizes risk control and position management strategies.

Risk Management Guide (PDF)

Detailed framework for implementing effective risk controls.

Module 5.3: Advanced Trading

Days 3-6 progress through advanced trading concepts and practical application.

Trading Resources:

- Loss Maximization Prevention (PDF)

- Statistical Analysis Guide (Image)

- Trading Preparation Framework (PDF)

- Session Debrief Guidelines (PDF)

✅ Section 6: Implementation Support

This section provides ongoing support and practical implementation guidance.

Student Checklist (Video)

Comprehensive guide to daily trading preparation and execution.

Q&A Session (Video)

Interactive problem-solving and strategy refinement session.

The curriculum integrates theoretical knowledge with practical application through a structured progression of concepts. Each section builds upon previous learning while providing real-world trading experience. Students develop both technical expertise and practical trading skills through comprehensive video training, documentation, and live trading sessions.

What is Axia Futures?

Axia Futures is a London-based trading education company established in 2016. They are regulated by the Financial Conduct Authority (FCA), ensuring high training standards.

Their track record shows success in developing professional futures traders. The company combines classroom learning with hands-on practice in modern trading facilities.

Axia’s mission is to build a worldwide community of skilled traders. They focus on practical trading experience, using both real market analysis and trading simulations.

Be the first to review “Axia Futures – Trading Decoded Course” Cancel reply

Related products

Trading Courses

Trading Courses

Trading Courses

Futures Trading

Trading Courses

Trading Courses

Best 100 Collection

![[Bundle] Best 4 FutexLive Courses](https://coursehuge.com/wp-content/uploads/2024/08/Bundle-Best-4-FutexLive-Courses-300x300.jpg)

Reviews

There are no reviews yet.