AlgoTrading101 Courses

$499.00 Original price was: $499.00.$24.00Current price is: $24.00.

AlgoTrading101 Course [Instant Download]

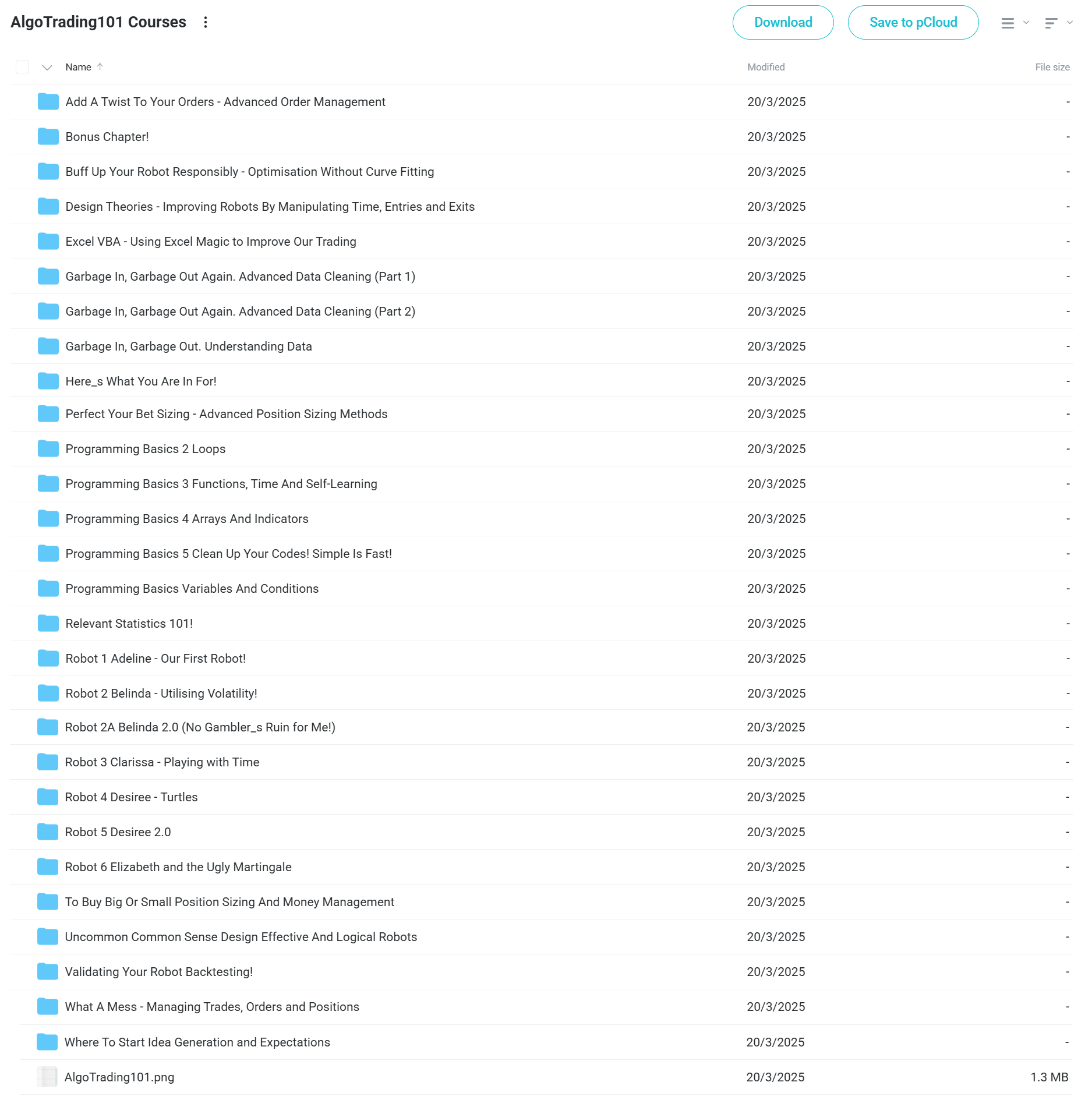

What is AlgoTrading101 Courses?

AlgoTrading101 Courses are algorithmic trading programs that teaches you how to build profitable trading robots that trade automatically without human emotions.

The courses include 39 chapters with step-by-step coding tutorials, 8 complete trading robots, and advanced quantitative strategies using Python and MQL4 programming.

Lucas Liew’s proven system covers everything from basic programming to live execution, helping you create automated trading systems that work 24/7 in forex and financial markets. No prior coding experience required to start building your first trading robot.

📚 PROOF OF COURSE

What you’ll learn in AlgoTrading101 Courses:

AlgoTrading101 Courses give you complete training in automated trading system development and data analysis. Here’s what you’ll learn:

- Programming basics: Learn MQL4 and Python coding for trading applications

- Robot building: Create and code 8 different trading robots with different difficulty levels

- Backtesting methods: Test strategies using past data and avoid curve fitting problems

- Risk management: Use advanced position sizing and money management systems

- Live trading: Run robots with real money including broker choice and monitoring systems

- Modern strategies: Use web scraping, sentiment analysis, and machine learning for trading

The training starts with basic programming and moves to advanced strategies. You’ll learn practical skills to create, test, and run profitable automated trading systems in real markets.

AlgoTrading101 Courses Course Curriculum:

✅ Programming Basics: Variables And Conditions

Students learn the core programming ideas needed for automated trading. The module covers basic coding rules, variables as building blocks, expressions, operations, and if-then statements crucial for creating trading logic.

The material builds step by step, from simple coding rules to more complex operations, with code examples to practice. A summary helps reinforce learning, making this module perfect for beginners with no coding experience.

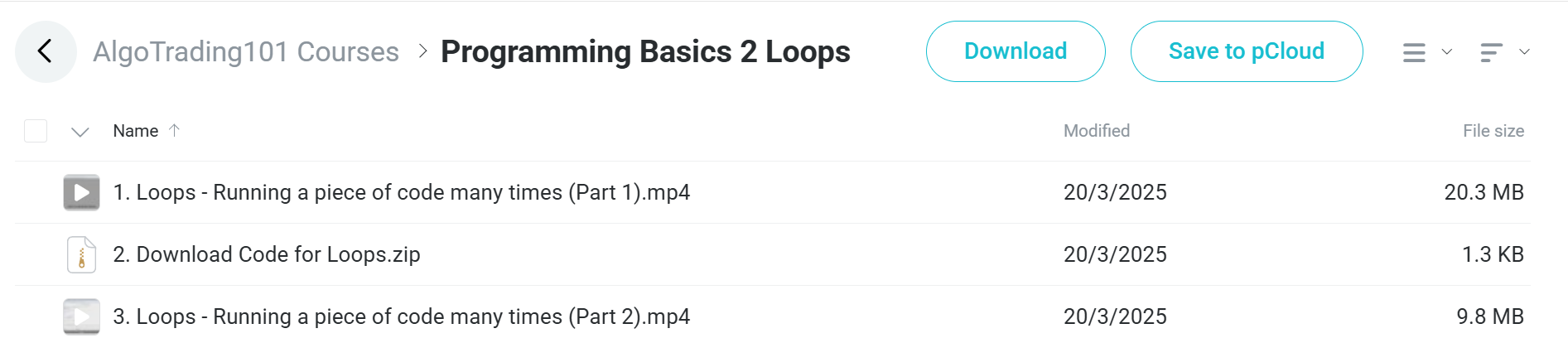

✅ Programming Basics 2: Loops

This short but key module focuses on loops, an important programming concept for automated trading. Students learn how to write code that needs to run multiple times, such as looking through price history or handling several trade orders.

The practical examples with downloadable code help students understand how loops can greatly improve the efficiency and function of their trading programs.

✅ Programming Basics 3: Functions, Time And Self-Learning

The module teaches creating reusable code blocks through functions, which are important for complex trading strategies. Students learn how to fix coding errors, design functions, and handle time/date in trading programs.

Special focus is given to self-learning methods for solving programming challenges and common coding mistakes. The cross function example shows how to spot when technical indicators intersect, a basic skill for many trading strategies.

✅ Programming Basics 4: Arrays And Indicators

This module explains technical indicators by showing the math behind them rather than treating them as “magic numbers.” Students learn how to work with arrays (data tables) and indicator buffers for better data handling.

The lessons cover creating custom indicators, using multiple buffers, and adding self-made indicators into trading strategies. This knowledge helps develop unique technical analysis approaches beyond standard indicators.

✅ Programming Basics 5: Clean Up Your Codes! Simple Is Fast!

Students learn ways to improve and streamline their trading programs for better performance. The module covers MT4’s global variables, efficient coding principles, and methods to reduce processing load such as “Once a Bar” execution.

Advanced topics include different ways to organize code (Include vs. Import), using Dynamic Link Libraries, and ensuring code reliability. This module helps turn working but slow code into professional-grade trading programs.

✅ Robot 1 Adeline – Our First Robot!

This module moves from theory to practice as students build their first complete trading robot. After learning about markets and chart reading basics, students create “Adeline,” a simple trading strategy.

The lessons introduce the concept of “shift” in MT4 programming and establish a testing method with three different approaches. This hands-on application puts previously learned programming concepts into a working trading system.

✅ Robot 2 Belinda – Utilising Volatility!

Building on the previous robot, this module introduces trading strategies based on market movement size. Students learn to measure market volatility and use it as a key input for trading decisions in the “Belinda” robot.

The coding and testing process shows how to adapt strategies to different market conditions based on price movement sizes. This is a big step up from the more basic strategies in earlier modules.

✅ Robot 2A Belinda 2.0 (No Gambler’s Ruin for Me!)

This module improves the previous robot with smart position sizing methods. Students learn to create dynamic sizing models that adjust based on account balance and risk settings.

Special attention is given to handling different currencies correctly, addressing a common challenge in live trading. This upgrade adds important risk management features to the trading system.

✅ Robot 3 Clarissa – Playing with Time

The “Clarissa” robot introduces seasonal and time-based trading strategies. Students learn to work with dates and times to create programs that take advantage of repeating patterns in financial markets.

Through step-by-step coding and testing, the module shows how to implement and evaluate time-based trading rules. This approach opens a new dimension of analysis beyond price-based indicators.

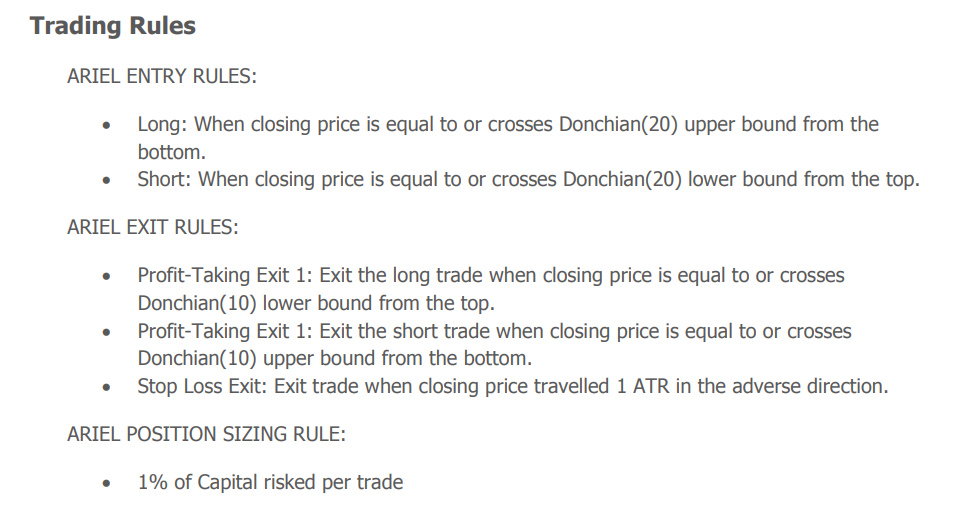

✅ Robot 4 Desiree – Turtles

This module explores the famous Turtle Trading system, which historically turned beginners into successful traders. Students build “Desiree,” a trend-following strategy based on Donchian Channels.

The detailed four-part coding and testing process covers creating the needed indicators and implementing the complete trading logic. This is one of the most thorough strategy implementations in the course, bringing together multiple concepts learned earlier.

✅ Add A Twist To Your Orders – Advanced Order Management

This advanced module focuses on clever order execution techniques. Students learn about immediate trade execution, hidden stop losses and take profits to avoid being targeted by market makers, and various trailing stop methods.

The content includes breakeven stops and five different types of trailing stops, with detailed coding demonstrations. These techniques help protect profits and reduce losses in live trading.

✅ Perfect Your Bet Sizing – Advanced Position Sizing Methods

This module presents smart approaches to position sizing beyond basic percentage risk rules. Students explore the “sizing trilemma” concept and learn to implement Kelly Criterion for theoretically best bet sizing.

Advanced topics include adaptive position sizing based on market movement, win rates, and other factors. The module provides three comprehensive sizing methods with benefits for different market conditions and trading styles.

✅ Buff Up Your Robot Responsibly – Optimisation Without Curve Fitting

This critical module addresses how to improve trading strategies without creating unrealistic expectations through curve fitting. Students learn about what to aim for, genetic algorithms, and the limits of MT4’s optimization tools.

The lessons cover in-sample and out-of-sample testing, parameter space analysis, and methods for breaking apart the optimization process. These techniques help develop robust strategies that can perform well in future market conditions.

✅ Design Theories – Improving Robots By Manipulating Time, Entries and Exits

This theory module examines key design principles for trading robots. Topics include accounting for trading costs, timeframe selection impacts, stop loss philosophy, and whether entries or exits matter more for trading performance.

Students learn about adaptive components in strategies and how to handle different market behaviors (long/short bias). These concepts inform higher-level strategy design decisions beyond specific coding techniques.

✅ Garbage In, Garbage Out. Understanding Data

This module stresses the vital importance of data quality in automated trading. Students learn about different data sources, storage methods, and approaches to data management and cleaning.

Practical demonstrations show how to handle “dirty data” that could lead to misleading backtest results. The module also addresses the danger of trading on bad price ticks and how to avoid market scammers through proper data checking.

✅ Garbage In, Garbage Out Again. Advanced Data Cleaning (Part 1)

This follow-up module covers more advanced data management techniques. Students learn about offline testing with multiple MT4 instances, creating custom timeframes, and understanding differences between backtest results from different data sources.

The lessons address the gap between backtesting and live trading results, even with seemingly clean data. Special attention is given to understanding 1-minute intrabar dynamics in backtesting.

✅ Garbage In, Garbage Out Again. Advanced Data Cleaning (Part 2)

The final data management module tackles advanced issues like time zone differences between data providers and brokers. Students learn to modify dates and times in their datasets and implement a complete framework for data cleaning.

Through a three-part approach to the “Mega Data Cleaning Framework,” the module provides step-by-step procedures for ensuring data quality throughout the automated trading process.

✅ Excel VBA – Using Excel Magic to Improve Our Trading

This extra module introduces Excel VBA programming for trading analysis. Starting with a trading game demonstration, students learn to set up Excel for VBA development and master essential techniques for cell and sheet referencing.

The lessons cover VBA syntax, variables, data types, operators, conditionals, and worksheet functions. These skills enable powerful off-platform analysis and strategy development that complements MT4-based programs.

✅ Relevant Statistics 101!

This short module focuses on essential statistical concepts for evaluating trading algorithms. Students learn about statistical significance, the law of large numbers, and determining minimum sample sizes for meaningful backtest results.

The practical application of these concepts helps avoid common mistakes in strategy assessment and provides a foundation for objective performance evaluation.

✅ Bonus Chapter!

This extra module provides additional resources and ready-to-use trading robots. Students receive access to 10 gigabytes of data and various trading robots including Ariel (Turtle strategy), Blair (Candlestick Formation), Cary (Breakout), and others.

The module includes instructions on how to use these robots effectively and provides the “Falcon Template” as a foundation for future robot development. The full syllabus overview helps students connect these bonus materials with the main course.

What is AlgoTrading101?

AlgoTrading101 is an online learning platform founded by Lucas Liew in 2014. The platform teaches algorithmic trading and financial programming to over 30,000 students in 160+ countries.

Lucas Liew started trading at 17 and worked at a trading firm and hedge fund. He taught financial programming to GIC, one of the world’s largest investment funds.

Lucas has been featured on Investopedia and is a top writer on algorithmic trading on Quora. He manages Leonhart Capital with an 8-digit portfolio of his own money.

He has years of experience teaching MQL4, MATLAB and VBA programming. Students can code their first trading robot on day one of the course.

Be the first to review “AlgoTrading101 Courses” Cancel reply

Related products

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Algo Trading

Reviews

There are no reviews yet.