Aeromir – Butterfly and Condor Workshop

$799.00 Original price was: $799.00.$12.00Current price is: $12.00.

Aeromir Butterfly and Condor Workshop Course [Instant Download]

What is Aeromir Butterfly and Condor Workshop?

Aeromir Butterfly and Condor Workshop is options trading course that teaches you how to trade options spread strategies like Narrow Iron Condor and Short Butterfly to create consistent profits.

The course covers both 0 DTE (same-day expiration) trading with 70-78% win rates and longer-term strategies, all with tightly controlled risk.

Tom Nunamaker and experts Dan Harvey, Scott Ruble, Amy Meissner, and Bruno Voisin share practical techniques through videos, trading spreadsheets, and six weeks of live trading room access.

📚 PROOF OF COURSE

What you’ll learn in Butterfly and Condor Workshop:

Aeromir’s Butterfly and Condor Workshop teaches you powerful options strategies for consistent profits. Here’s what you’ll learn:

- Key Strategies: Learn the Narrow Iron Condor, Newton’s Cradle, and Rhino Trade from expert traders

- Risk Control: Master hedging methods and position management to protect your account

- Market Reading: Spot good trading conditions and adjust your approach when markets change

- 0 DTE Trading: Use same-day expiration strategies with 70-78% success rates

- Trading Tools: Get spreadsheets that help you analyze trades and find the best entries

- Live Trading: Join daily trading rooms to see these strategies used in real markets

This workshop gives both beginners and experienced traders the skills and tools to trade butterflies and condors with confidence.

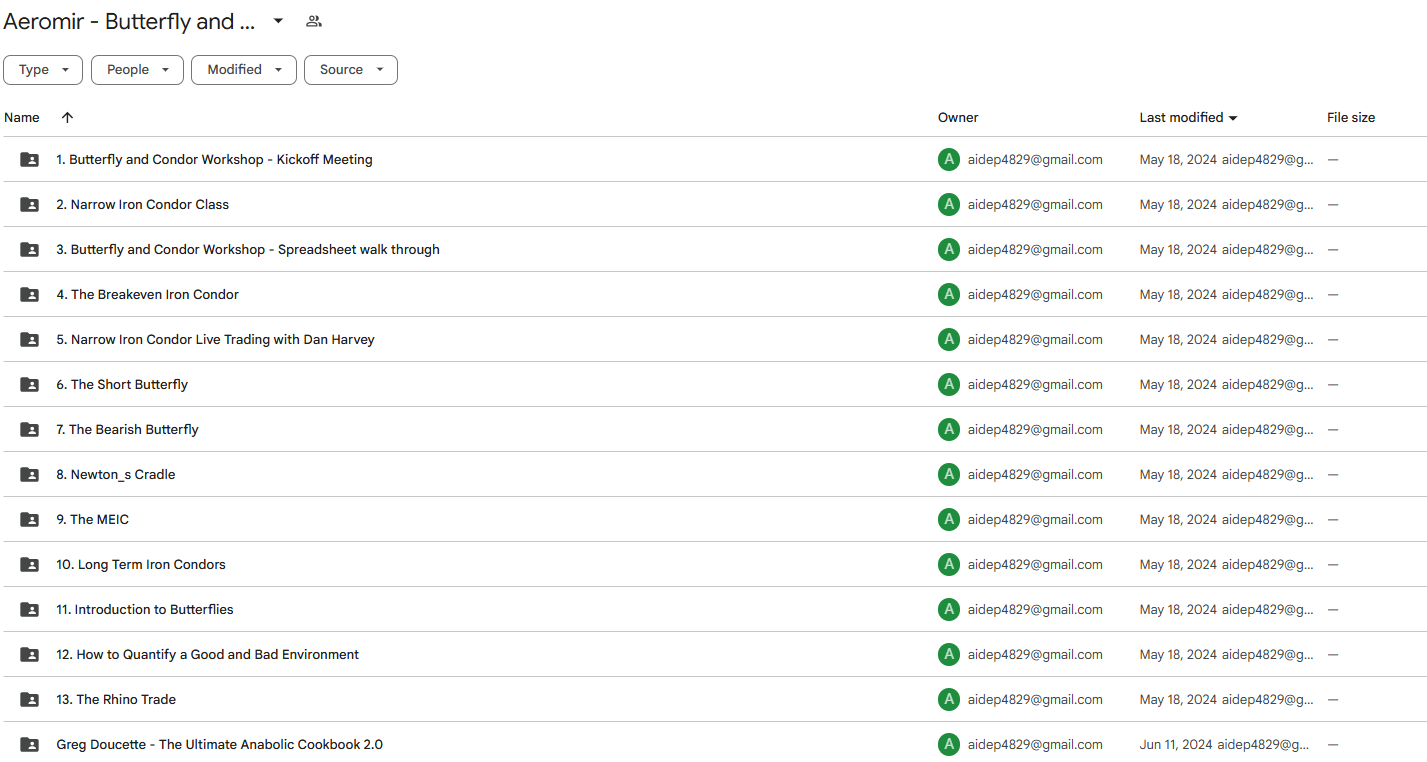

Butterfly and Condor Workshop Course Curriculum:

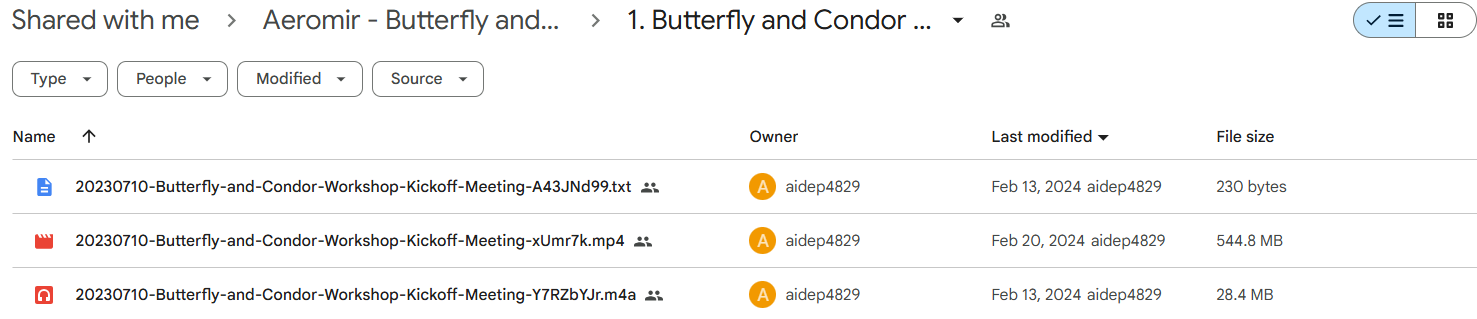

✅ Module 1: Butterfly and Condor Workshop – Kickoff Meeting

This first module lays the groundwork for the workshop and outlines what you’ll learn throughout the course. You’ll get to know butterfly and iron condor options strategies and understand how these multi-part options positions can be used for different trading goals.

The kickoff helps you know what to expect, introducing key terms and basic workings of these option spread strategies.

✅ Module 2: Narrow Iron Condor Class

This module focuses on the narrow iron condor strategy, a limited-risk options position used to make money when a stock stays within a certain price range. You’ll learn how narrow iron condors are built and how they’re different from regular iron condors.

The class comes with PDF guides and meeting links for hands-on learning, helping you understand position sizing, risk control, and when to use narrow iron condors.

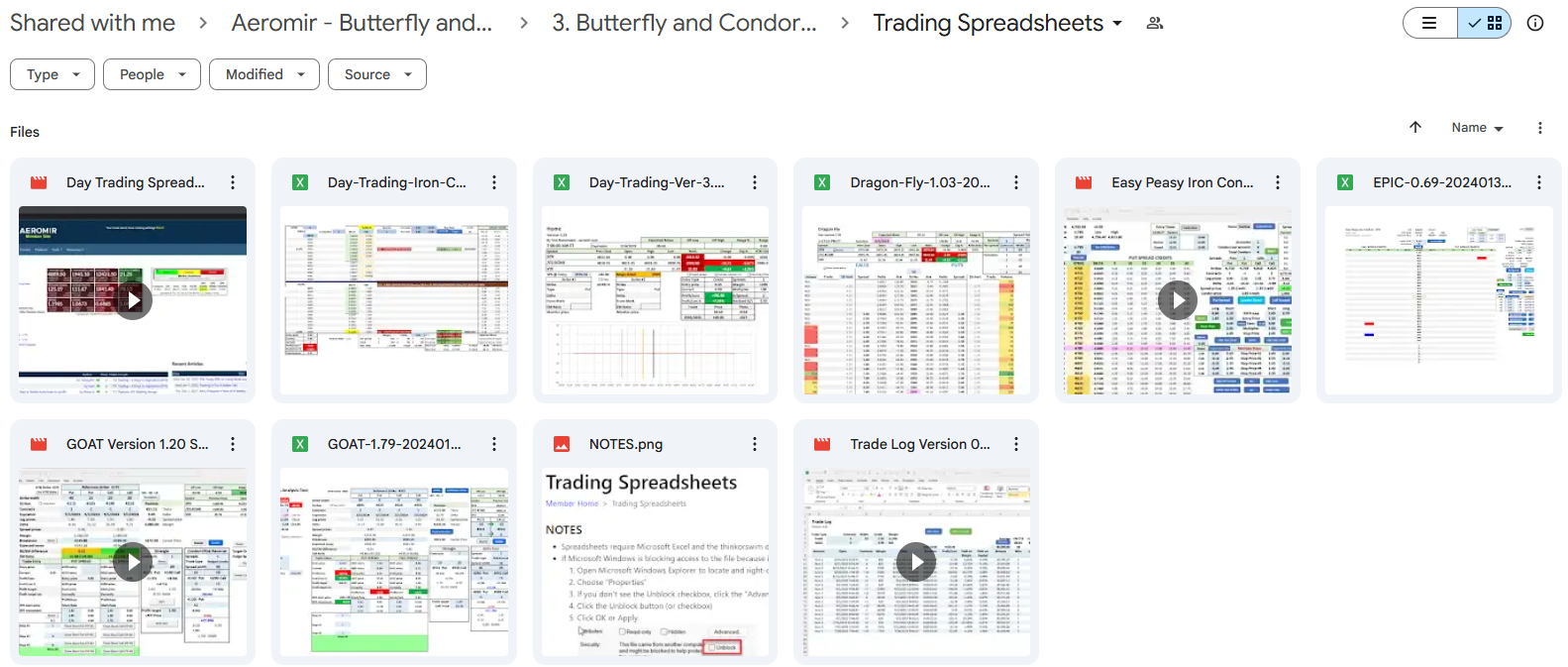

✅ Module 3: Butterfly and Condor Workshop – Spreadsheet Walk Through

This hands-on module shows you various trading spreadsheets made to analyze and improve butterfly and condor strategies. It features tools like the Day Trading spreadsheet, Dragon Fly calculator, Easy Peasy Iron Condor (EPIC) spreadsheet, and the GOAT trading system.

The spreadsheet guides show you how to figure out risk-reward ratios, pick the best strike prices, and track how well your trades are doing. The Trade Log tool helps you keep good records of your trading.

✅ Module 4: The Breakeven Iron Condor

This module teaches a special iron condor type designed to reach breakeven more easily than regular approaches. It includes detailed articles by John Einar Sandvand that explain the breakeven iron condor method and how to use it.

You’ll learn how this approach offers a potentially better risk-reward balance through careful strike selection and position management that makes it more likely to break even when markets are tough.

✅ Module 5: Narrow Iron Condor Live Trading with Dan Harvey

This practical module shows real-time use of narrow iron condor strategies with trader Dan Harvey. You’ll watch actual trades being placed, adjusted, and managed in live markets, complete with results and performance analysis.

The session gives valuable insights into how decisions are made during trading, when to adjust trades, and practical risk management used by experienced traders using the narrow iron condor strategy.

✅ Module 6: The Short Butterfly

This module covers the short butterfly strategy, which makes money from big price movements in either direction. Unlike regular butterflies that work best when prices are stable, short butterflies do well during times of high price swings.

You’ll learn how to build short butterfly spreads, when to use them, and how to manage risk when you expect significant price changes in the stock or index you’re trading.

✅ Module 7: The Bearish Butterfly

This module focuses on butterfly spread setups made for falling markets. You’ll learn how to structure these multi-part options strategies to profit from downward price movement while keeping risks clearly defined.

The bearish butterfly gives you an alternative to simple puts when you think prices will fall, offering potentially better risk-reward through careful strike selection and position sizing.

✅ Module 8: Newton’s Cradle

This advanced module introduces the Newton’s Cradle options strategy, named after the desk toy with swinging metal balls. The strategy seems to involve connected options positions designed to work together in specific market conditions.

You’ll learn how this clever approach transfers energy (or risk/reward) across different strike prices or time frames to create more adaptable trading positions that can handle changing market conditions.

✅ Module 9: The MEIC

This module explores the MEIC (likely “Modified Easy Iron Condor”) strategy with teacher Tammy Chambless. It includes detailed guides on building your own testing system to check how well the MEIC approach works in different market conditions.

You’ll learn how to change the standard iron condor with specific tweaks that may improve how it performs, with focus on using past data to prove it works.

✅ Module 10: Long Term Iron Condors

This module looks at iron condor strategies that last longer than the usual 30-45 days. You’ll learn how to adjust strike selection, position sizing, and management for iron condors held over longer periods.

The course covers the benefits and challenges of longer-dated options, including how time decay works differently, how implied volatility affects them, and how to use your money efficiently when trading long-term iron condors.

✅ Module 11: Introduction to Butterflies

This starter module gives a complete overview of butterfly spreads, how they’re built, and how they work. You’ll learn how these three-part options strategies can create good risk-reward setups in specific market conditions.

The lesson covers different butterfly types, the best market conditions to use them, and the math behind their profit and loss patterns, giving you key knowledge for the more advanced butterfly types taught later.

✅ Module 12: How to Quantify a Good and Bad Environment

This practical module teaches you how to assess market conditions to decide which butterfly and condor strategies to use. It provides number-based methods to evaluate volatility levels, trend strength, and other market factors.

You’ll learn specific indicators and key levels that help determine when to use particular strategies, when to stay out of the market, and how to adjust position size based on your market assessment.

✅ Module 13: The Rhino Trade

This big module covers the special “Rhino” options strategy, with many presentations from 2015 to 2023 showing how this approach has changed over time. It includes group discussions with several traders who have used and improved the strategy.

The Rhino Trade seems to be a signature strategy with several versions (including the “White Rhino”) that has been developed over years, with detailed slides showing its evolution and performance results.

What is Aeromir?

Aeromir is a veteran-owned trading education company in Colorado Springs. Founded by Tom Nunamaker, they teach options trading strategies to traders worldwide.

Tom, a former military officer and engineer, brings his math skills and disciplined approach to options trading. He built Aeromir after creating systematic trading methods that work consistently.

The company focuses on defined-risk options strategies, especially butterfly and condor spreads. Their teaching uses clear rules instead of guesswork, helping traders control risk while finding multiple ways to profit.

Aeromir only works with instructors who have proven trading records and open methods. Each teacher specializes in different options strategies, creating a complete learning experience.

Their daily live trading rooms show strategies working in real markets. Students watch actual trades being placed, managed, and closed. Aeromir supports traders with practical knowledge, useful spreadsheet tools, and ongoing community help.

Be the first to review “Aeromir – Butterfly and Condor Workshop” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Reviews

There are no reviews yet.