Learning

How to Do Real Estate Wholesaling in 2024

Real estate wholesaling is an intelligent way to make money in a property without needing much cash. It’s about finding suitable property deals and then passing them on to investors for a profit.

In this guide for 2024, we’ll show you how to do real estate wholesaling step by step in a way that’s easy to understand and implement.

1️⃣. What is Real Estate Wholesaling?

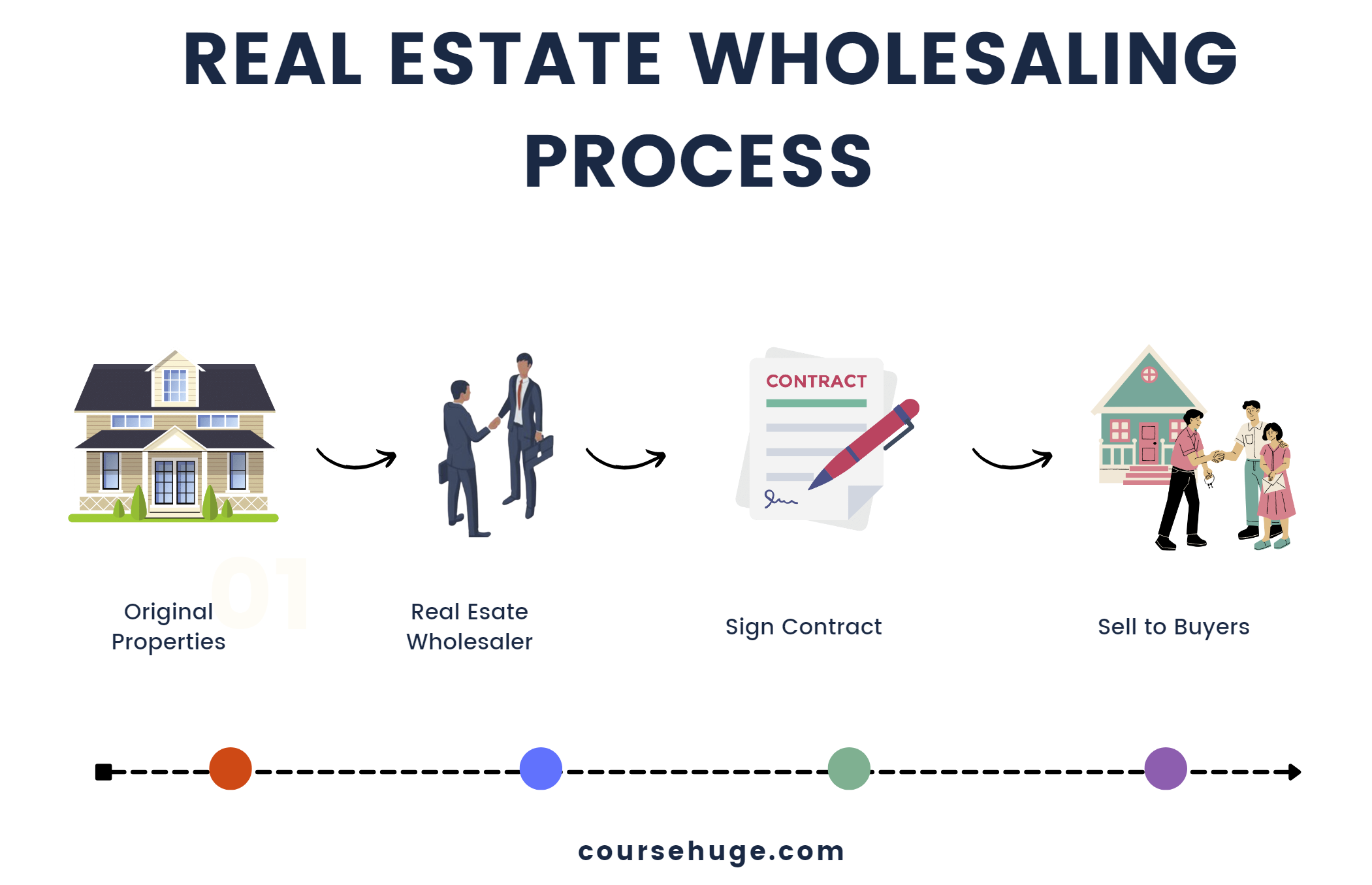

Wholesale real estate is a straightforward way to earn money in the property market, and it doesn’t require a significant initial investment. The process begins with a wholesaler identifying a house on the market for a low price. This could be because the house needs repairs or the owner wants to sell quickly. The wholesaler then agrees to buy the home, creating a contract with the seller and making a small earnest money deposit to demonstrate their commitment.

The next step involves the wholesaler looking for a buyer, typically an investor interested in properties that can be fixed up, sold, or rented out for a profit. Once the wholesaler finds an investor, they negotiate a new deal, selling the contract to the investor at a price higher than the original agreement with the seller.

The final stage is where the wholesaler profits. The profit is the difference between the price at which the wholesaler secured the contract and the price at which they sell it to the investor. This profit margin is usually around 5% to 10% of the house’s price, making it a lucrative venture for those who can effectively find and negotiate these deals.

Key Characteristics of Real Estate Wholesaling:

- No Renovations Required: Unlike property flipping, wholesalers do not renovate the property.

- Short-term Strategy: This approach focuses on quick transactions rather than long-term investments.

- Middleman Role: Wholesalers act as intermediaries between sellers and investors.

In short, wholesale real estate is about finding a good deal on a house, making a contract to buy it, and then selling that contract to someone else for a higher price. It’s an intelligent way to enter the real estate market without spending much money upfront.

2️⃣. Step-by-Step Guide to do Real Estate Wholesaling in 2024:

Step #1. Conduct Market Research:

- Identify Potential Areas: Look for neighbourhoods showing signs of growth or regeneration. Areas with new developments or improving infrastructure are often promising.

- Analyze Property Types and Values: Understand what properties are in demand. Are families looking for homes, or are there more demands for apartments? Also, monitor property prices and trends in your chosen area.

- Use Data to Your Advantage: According to the National Association of Realtors, 90% of home buyers searched online during their home-buying process. Leverage online tools and databases to gather information.

Step #2. Build a Strong Network:

- Connect with Industry Players: Relationships with real estate agents, experienced investors, and fellow wholesalers are invaluable. They can provide insights and leads that you might need help finding elsewhere.

- Engage in Real Estate Communities: Attend local real estate events, join online forums, and participate in social media groups. These platforms are not only great for learning but also for connecting with potential partners and buyers.

Step #3: Find Good Deals for Real Estate Wholesale:

In real estate wholesaling, finding a good deal is critical. It’s all about getting the right property at the right price. This can make the difference between a profitable deal and a missed opportunity. Let’s look at some simple tips to find these great deals:

Tip 1: Target Distressed Properties:

- Focus on properties priced below market value, usually because they require repairs or the owner needs to sell quickly. These properties present an opportunity for profit after renovation.

- Look for signs like long-term listings, neglected maintenance, or properties in foreclosure.

- According to a 2023 real estate market analysis, distressed properties often sell for about 20% to 40% below their actual market value, making them ideal for wholesaling.

Tip 2: Utilize Various Sources:

- Expand your search beyond personal networks. Use online real estate platforms like Zillow, Realtor.com, and Redfin, which offer comprehensive listings and market insights. As per Zillow, 36% of home buyers 2023 found their homes online, highlighting the importance of these platforms.

- Check public records for properties with liens, defaults, or pending foreclosures. These are often indicators of motivated sellers.

- Attend real estate auctions, both online and in-person, where properties are often sold at lower prices.

Tip 3: Leverage Local Real Estate Agents:

- Collaborate with local real estate agents who have in-depth knowledge of the area. They can provide leads on properties that must be added to the market.

- Real estate agents can also offer valuable insights into the local market conditions and potential resale value of properties.

Tip 4: Use Direct Marketing Techniques:

- Consider direct mail campaigns targeting homeowners in desirable areas. A study showed that direct mail response rates can be as high as 5%, making it a viable strategy to reach potential sellers.

- Utilize online advertising on social media platforms and real estate forums to reach a broader audience.

Tip 5: Network with Local Contractors and Property Inspectors:

- Contractors and inspectors often know properties need repair before they hit the market.

- They can provide referrals and help estimate repair costs for potential wholesale deals.

By implementing these strategies, you’re more likely to find properties that you can secure at a low enough price to ensure a profitable sale to an investor.

Step #4. Secure and Negotiate the Deal:

- Negotiate with Sellers: Aim to secure a contract at a price below the current market value. This is where your negotiation skills come into play.

- Include an Assignment Clause: Ensure your contract has a clause that allows you to transfer the contract to another buyer. This is crucial in wholesaling.

Step #5. Find an Investor and Assign the Contract:

- Reach Out to Your Investor Network: Present the deal to potential investors. Highlight the property’s potential value and the profit margin.

- Assign for a Higher Price: Once an investor shows interest, assign the contract to them at a price higher than your agreement with the seller. Your profit is the difference between these two prices.

Step #6. Close the Deal:

- Smooth Transaction: Work with a title company or attorney to ensure the transaction goes smoothly and all legal aspects are covered.

- Finalize the Sale: Ensure all paperwork is in order and the contract transfer to the investor is completed legally and efficiently.

3️⃣. Pros & Cons of Real Estate Wholesaling:

PROS

- Low Initial Investment: Unlike traditional real estate investing, wholesaling only requires minimum capital. You’re not buying properties; you’re selling contracts.

- Quick Profits: Wholesaling can lead to faster earnings than other real estate strategies. Since you’re not holding onto properties, you can turn profits quickly once you find a buyer.

- Learn Real Estate Market: It’s a great way to learn about the real estate market, negotiation skills, and property valuation without the risks of owning property.

- No Need for Repairs: Since you’re not purchasing the property, you don’t have to worry about the costs and efforts involved in repairing or renovating it.

CONS

- Market Dependence: Your success heavily relies on market conditions and trends. Finding buyers and profitable deals in slow markets can take time and effort.

- Requires Strong Networking: Building and maintaining a network of buyers and sellers is crucial. Without solid connections, finding and closing deals can be complex.

- Legal and Ethical Considerations: You must know your area’s legal aspects of wholesaling. Also, maintaining ethical practices is crucial for long-term success.

- Income Inconsistency: Unlike a regular job, income from wholesaling can be unpredictable and varies from month to month, depending on the number and success of your deals.

Real estate wholesaling in 2024 is about being informed, connected, and proactive. By following these steps and staying committed to ethical practices, you can successfully navigate the world of real estate wholesaling. Remember, every successful wholesaler started with a first deal, so take that first step today!

3️⃣. Frequently Asked Questions

Q1: Is Real Estate Wholesaling Legal?

Q2: Do I Need a Lot of Money to Start Wholesaling in Real Estate?

Q3: How Do I Find Properties to Wholesale?

Q4: Can Real Estate Wholesaling Be Done Part-Time?

Q5: Where Can I Learn Real Estate Wholesaling?

– Joe McCall – Wholesaling Lease Options 2.0:

– REWW Academy – Real Estate Wholesaling Mastery

– REI Trainers – PRE-Wholesaling Houses

– Khang Le – Wholesale to Millions