Mastertrader – Master Trader Option Strategies Series for Investors and Active Traders

$2,997.00 Original price was: $2,997.00.$37.00Current price is: $37.00.

MasterTrader Option Strategies Series Course [Instant Download]

What is MasterTrader Option Strategies Series?

MasterTrader Option Strategies Series is an options trading course teaching investors how to make money with options without owning stocks.

The program shows you 10 proven strategies including covered calls, credit spreads, and directional trades for bullish and bearish markets. You learn to sell option premium and collect income even when stocks don’t move much.

MasterTrader’s method combines technical chart patterns with volatility timing to maximize profits while reducing risk. The course gives step-by-step guidance to generate monthly income and build wealth through options trading.

📚 PROOF OF COURSE

What you’ll learn in Mastertrader Option Strategies Series:

This options trading course teaches you everything to profit from options with confidence. Here’s what you’ll learn:

- Foundation knowledge: Options terminology, pricing, Greeks, and technical analysis with charts

- Income strategies: Covered calls, naked puts, and credit spreads for monthly cash flow

- Directional trades: Bull and bear spreads, diagonals, and how to pick the right strike prices

- Advanced techniques: Iron condors, straddles, and volatility-based strategies for sideways markets

- Risk management: Position sizing, adjustment strategies, and repair techniques when trades go wrong

- Market timing: Using VIX, implied volatility rank, and gap trading patterns for better entries

The course combines chart patterns with the right option strategies to increase your odds of success. You’ll learn to make money in all market conditions without needing perfect timing.

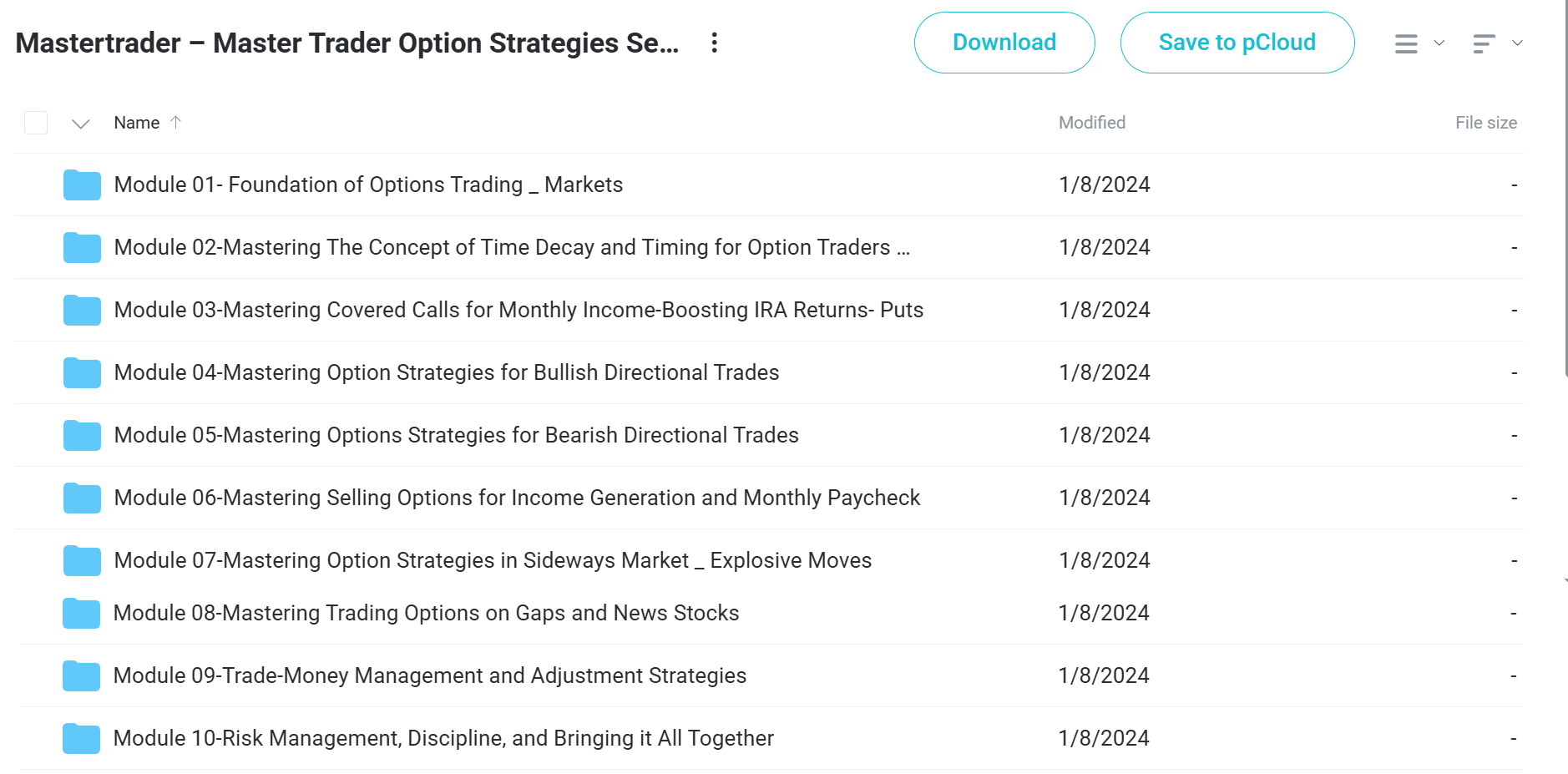

Mastertrader Option Strategies Series Course Curriculum:

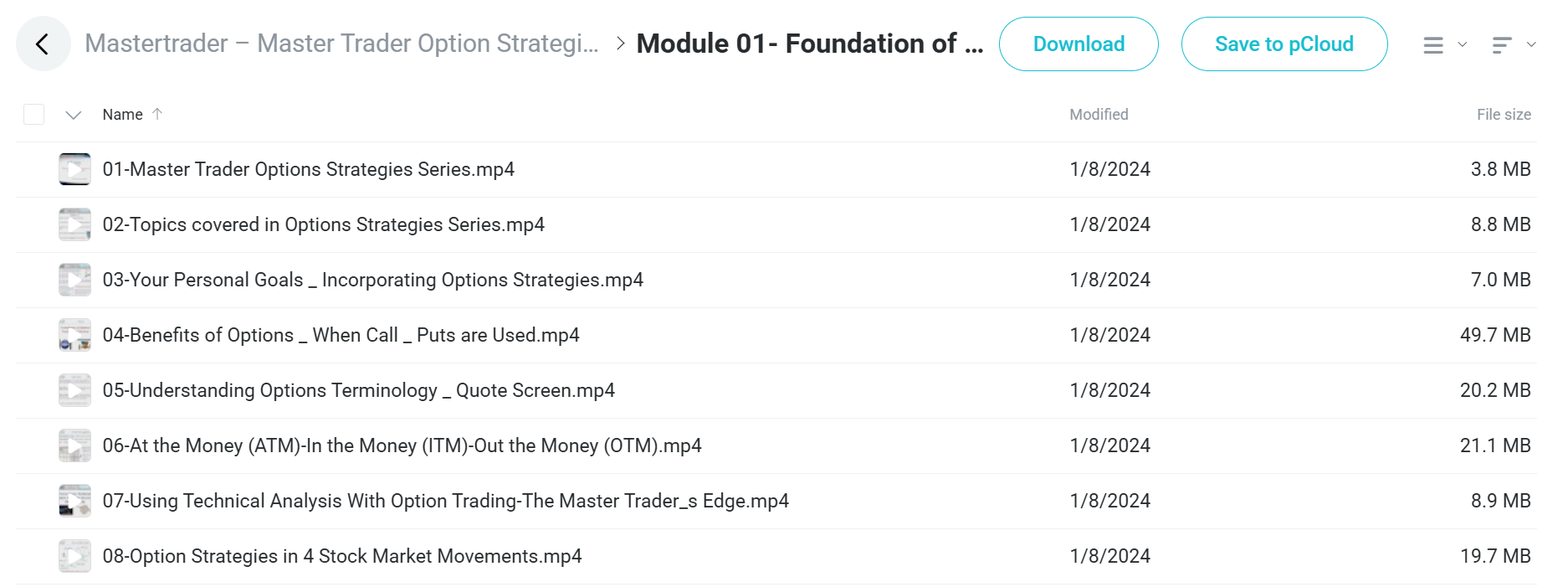

✅ Module 01: Foundation of Options Trading & Markets

Students start with basic options terms and how markets work, learning to read option prices and understand the difference between At-the-Money (ATM), In-the-Money (ITM), and Out-of-the-Money (OTM) options. The module shows how chart analysis gives traders an edge and explains the four main market directions that help choose the right strategy.

Important topics include setting personal goals for using options, knowing when calls and puts work best, and spotting how different market situations require different strategies.

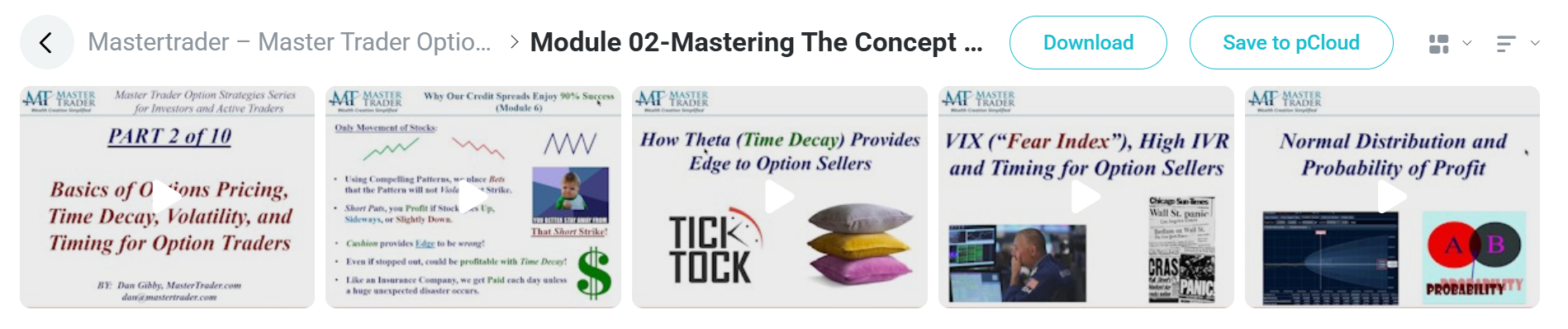

✅ Module 02: Mastering Time Decay and Market Timing

This module explains option pricing through detailed study of “The Greeks” and how time decay creates money-making chances for option sellers. Students learn to read the fear index (VIX) as a market mood indicator and understand probability patterns that affect profit chances.

The time decay curve becomes a key idea, showing students how to position themselves well as options get closer to expiring. Basic probability rules help traders figure out realistic profit chances for their strategies.

✅ Module 03: Covered Calls and Puts for Income Generation

Students learn covered call strategies as slightly bullish trades while learning to make monthly income from stocks they already own. The module covers ways to lower the cost of stocks and best strike choices during high fear periods, especially around earnings reports.

Covered puts are taught as slightly bearish alternatives. Risk charts help see profit and loss scenarios, while real examples show how pro traders use these income strategies in retirement accounts.

✅ Module 04: Bullish Directional Trading Strategies

This module teaches students to spot good conditions for bullish trades and pick the right call buying chances using chart patterns. Long call examples show real-world use, while strike picking methods help get the most profit.

Advanced strategies include bull call spreads for using less money and bull diagonal spreads that combine time and direction benefits. Students learn to balance cost, profit potential, and success chances across different bullish methods.

✅ Module 05: Bearish Directional Trading Strategies

Students learn to spot bearish market conditions and use put buying strategies with proper strike price picking methods. Bear put spreads are taught as money-saving alternatives to simple put purchases, with many examples showing when to enter and exit.

Bear diagonal spreads provide advanced bearish positioning that benefits from both price movement and time decay. Step-by-step entry strategies teach students how to enter complex positions bit by bit to get better prices.

✅ Module 06: Options Selling for Consistent Income

This big module focuses on making income through steady options selling, covering the steps pro traders use to find the best selling chances. Naked put selling becomes a main strategy for making monthly income while possibly buying stocks at wanted prices.

Bull put spreads offer limited-risk income alternatives, while naked call selling and bear call spreads provide bearish income chances. Many detailed examples show real-world use across different market conditions and fear levels.

✅ Module 07: Sideways Markets and Volatility Plays

Students learn sideways market strategies, learning when and how to use short straddles and strangles for income during low fear periods. Long straddles and strangles are taught as big move strategies for high fear situations.

Iron condors provide limited-risk sideways strategies, while iron butterflies offer exact plays for stocks expected to stay near specific price levels. These strategies teach students to profit no matter which direction the market goes when used correctly.

✅ Module 08: Trading News, Earnings, and Gap Opportunities

This special module teaches students to make money from market-moving events, including earnings reports and analyst changes that create fear chances. Gap trading strategies are split into pro and beginner methods, with detailed examples showing proper timing and execution.

High fear rank (IVR) patterns help find the best entry points for different strategies. Students learn to tell the difference between profitable news-driven chances and potential trap situations that can lead to big losses.

✅ Module 09: Trade Management and Position Adjustments

Students learn smart money management methods that separate pro traders from beginners, including position sizing rules and risk sharing principles. Active adjustment strategies teach how to change positions as market bias changes, including rolling strikes and expiration dates.

Iron condor step-by-step methods and repair strategies provide tools for managing losing positions. The module focuses on when to take profits, cut losses, and adjust positions to keep making steady profits over time.

✅ Module 10: Psychology, Discipline, and Integration

The final module deals with the mental challenges of options trading, giving frameworks for staying disciplined during both winning and losing streaks. Students develop personal trading plans that include risk management rules and profit targets based on their individual goals.

Knowledge testing through real trade reviews helps students apply learned ideas to actual market scenarios. SPY examples show strategy use during major market moves, while closing thoughts provide guidance for continued growth beyond the course.

What is MasterTrader?

MasterTrader is founded by Dan Gibby and Greg Capra, two trading experts with 50+ years combined experience. They created the “Techno-Fundamentals” approach that combines Market Internals, Inter-Market Analysis, and Technical Analysis.

Dan Gibby is co-founder and Chief Options Strategist with over 25 years in equity and options trading. He was Head of Corporate Proprietary Trading for a global firm that grew to 100+ offices and 1,500 traders worldwide, trading over 3 billion shares monthly.

Gibby worked with Greg Capra since 1998 at Pristine’s Advanced Trading Room, creating educational content for traders. He presented over 100 trading seminars across North and South America and spoke at major trading expos.

Both founders consult for money managers and wealthy investors on option strategies to generate monthly income. Their expertise focuses on technical analysis, market internals, and volatility for options trading.

Be the first to review “Mastertrader – Master Trader Option Strategies Series for Investors and Active Traders” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Reviews

There are no reviews yet.