Physical Course – No Cash No Credit 100% LTV Real Estate Cash Flow System

$397.00 Original price was: $397.00.$38.00Current price is: $38.00.

Monica Main No Cash No Credit 100% LTV Real Estate Cash Flow System Course [Instant Download]

1️⃣. What is No Cash No Credit 100% LTV Real Estate Cash Flow System?

Monica Main No Cash No Credit 100% LTV Real Estate Cash Flow System is a real estate program teaching you how to buy cash flowing properties without money or credit.

The course teaches four proven strategies: land trusts to legally control properties, 100% LTV bond funding for large deals, business credit lines up to $100,000, and private investor fundraising techniques.

Main’s system focuses on cash flowing assets like apartment buildings and commercial properties that generate monthly passive income. You learn to build wealth using other people’s money while minimizing personal financial risk.

The program includes complete legal documents, step-by-step training videos, and forms needed to execute these advanced financing methods in real-world deals.

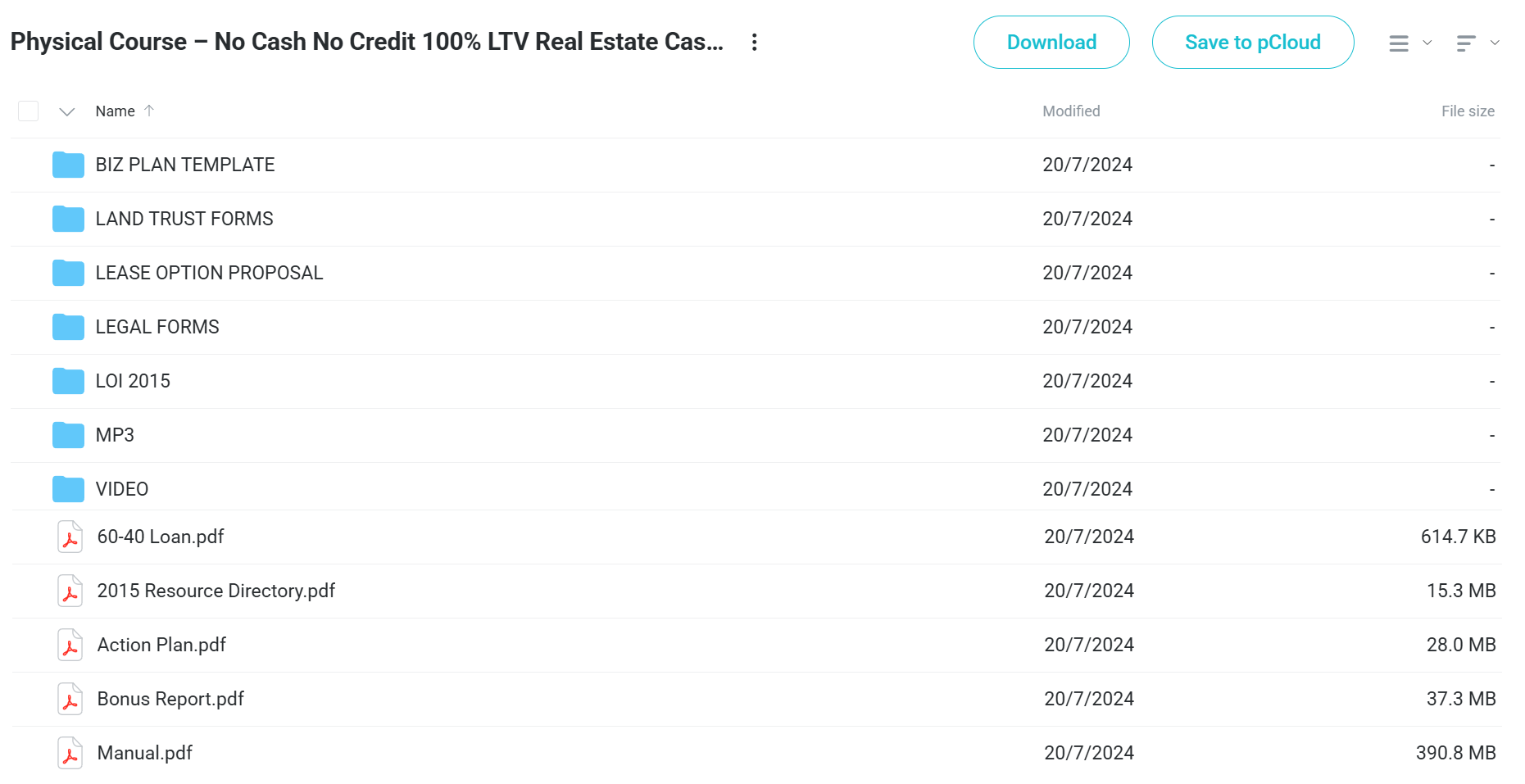

📚 PROOF OF COURSE

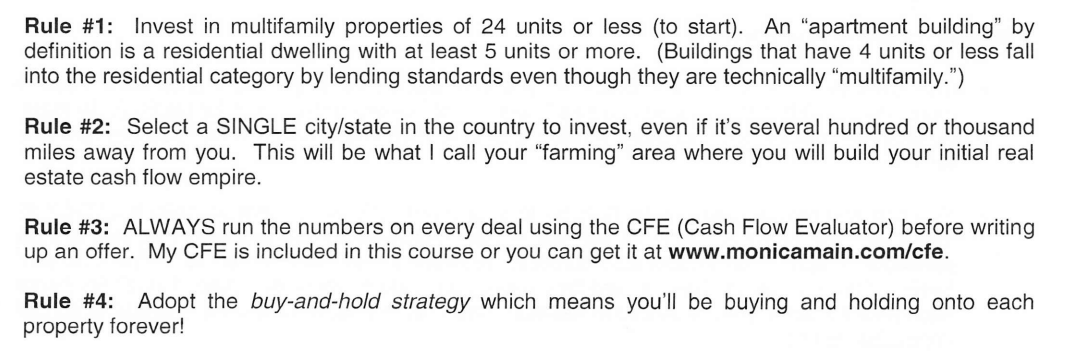

What you’ll learn in this course:

This system teaches you everything to acquire cash flowing properties without personal funds or credit. Here’s what you’ll master:

- Land trust strategies: Learn iron-clad legal methods to take control of properties without traditional financing

- 100% LTV bond funding: Access funding programs for properties over $1 million with complete financing

- Business credit building: Build fast business credit to generate $50,000-$100,000 for real estate deals

- Private investor attraction: Use powerful ads and proposals to raise unlimited cash from private investors

- Property evaluation: Find under-performing properties with massive upside potential for maximum profits

- Legal compliance: Navigate SEC rules and state laws while structuring deals properly

This system removes the traditional barriers of cash and credit requirements, letting you build wealth through real estate using other people’s money.

Course Structure:

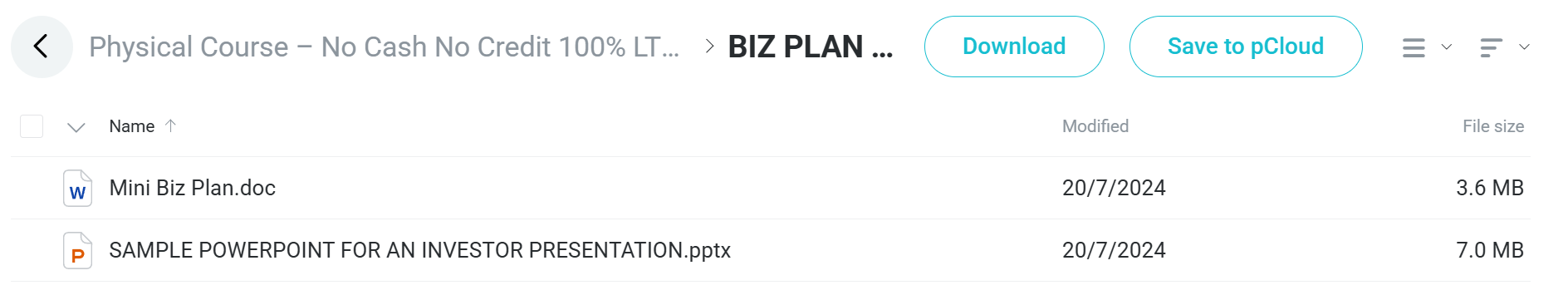

✅ Business Planning and Investor Relations

This module gives you key tools for making professional business plans and investor presentations. Students learn how to organize their real estate business and talk effectively with possible investors to secure funding partnerships.

The Mini Business Plan template offers a simple way to document your investment strategy, market analysis, and money projections. This format helps students quickly create professional paperwork to show to possible partners or lenders.

The Sample PowerPoint for Investor Presentations shows how to create strong visual presentations that highlight deal structures, profit potential, and risk reduction strategies. This template helps students approach investors with professional materials that build trust and interest.

✅ Land Trust Implementation

This big module forms the backbone of the course, teaching students how to use land trusts as a powerful tool for real estate deals and asset protection. Students learn the legal structure, benefits, and how to set up this often-overlooked investment tool.

The “12 Steps to Forming a Land Trust” guide gives a clear, step-by-step process for setting up legally sound land trusts. This document breaks down complex legal steps into simple tasks anyone can follow regardless of past experience.

“50 Reasons to Use a Land Trust” shows the many benefits of this legal structure, including privacy protection, limited liability, and easy transfer of ownership. This resource helps students understand when and why to use this strategy.

The module includes many legal templates including Trust Agreements, Amendments, Appointments, and Interest Assignments. These documents save students thousands in legal fees by providing ready-to-use forms that can be adjusted for different states and situations.

The special “Installment Sale Contract for Land Trust” teaches students how to set up seller financing within a land trust, creating win-win deals that benefit both buyer and seller while maximizing cash flow.

✅ Creative Acquisition Strategies

This module focuses on different ways to get properties using minimal personal resources. Students learn how to structure offers that appeal to motivated sellers while protecting the investor’s interests.

The Lease Option Proposal documents show students how to approach sellers with win-win solutions that provide immediate cash flow while securing future buying rights. This strategy allows investors to control properties with minimal upfront money.

The Letters of Intent (LOI) section provides templates for making professional first offers on properties. The guide explains how to use these templates effectively to start talks with sellers in various situations.

✅ Legal Structure and Protection

This section provides the legal foundation for building a lasting real estate investment business. Students learn how to set up proper business entities and protect their investments and personal assets.

The collection of legal forms includes partnership agreements, LLC operating agreements, and confidentiality agreements needed for building a legally sound business structure. These documents help students set up proper business entities that separate personal and investment activities.

✅ Advanced Investment Techniques

This module reveals special strategies for finding and buying deals through various channels. Students learn how to find properties through online platforms, bank-owned listings, and targeted neighborhood searching.

The “100 LTV Strategies Revealed” video provides the core ideas of the course, detailing multiple methods for buying properties with 100% financing. This overview ties together the various strategies taught throughout the program.

“Basics of Finding Deals Online” teaches students how to use digital platforms to find motivated sellers and underpriced properties before competitors. This video includes specific websites, search methods, and communication strategies.

“Farming Property Deals” explains how to target specific neighborhoods for buying opportunities. Students learn how to become neighborhood experts who can find and secure deals before they reach the open market.

✅ Financing Fundamentals

This module covers key aspects of financing real estate investments without using traditional loans. Students learn how to use alternative funding methods and improve their financial position.

“Personal Credit Secrets” provides strategies for improving personal credit scores to maximize future borrowing options. This resource helps students fix and enhance their credit even if they’re not using it for immediate purchases.

“Secrets to Business Credit” teaches how to build business credit separate from personal credit. Students learn how to access business funding sources that don’t depend on personal guarantees or credit checks.

The “60-40 Loan” document outlines a specific financing structure where investors can buy properties with partners who provide the down payment while keeping controlling interest. This strategy allows students to grow their portfolio without using personal money.

✅ Implementation Resources

This final section provides practical tools and references to help students use what they’ve learned. The focus is on taking immediate action and accessing ongoing support resources.

The “Action Plan” document provides a step-by-step plan that takes students from course completion to their first successful deal. This timeline-based approach prevents feeling overwhelmed and focuses efforts on high-impact activities.

The “2015 Resource Directory” offers a list of service providers, websites, and tools specific to creative real estate investing. This guide helps students quickly find the support services needed to execute their investment strategy.

The comprehensive Manual connects all course concepts into a complete system. This document serves as the main reference point that brings together the various strategies and techniques into a unified approach to creative real estate investing.

Who is Monica Main?

Monica Main is a self-made entrepreneur and real estate investor with over 20 years of experience. Her mission is helping people start from scratch to become multi-millionaires.

She started real estate investing in 2001, focusing on apartment buildings and passive income cash flow properties. Main learned through real experience, including early challenges with lease-option deals.

These early setbacks taught her the importance of legal protection in real estate deals. This led to her discovery of land trust strategies, which became key to her no-cash-no-credit methods.

Main believes anyone can succeed in real estate investing with the right step-by-step blueprint. She has written multiple books including “Apartment Building Millionaire” and “The Scratch Millionaire.”

She teaches practical strategies that help investors build wealth without traditional financing requirements, focusing on using other people’s money to acquire cash flowing properties.

Be the first to review “Physical Course – No Cash No Credit 100% LTV Real Estate Cash Flow System” Cancel reply

Related products

Real Estate

Real Estate

Real Estate

Best 100 Collection

Real Estate

Investment Management

Dave Van Horn – Wealth Building with Defaulted 2nd Mortgages

Business & Finance

Real Estate

![[Bundle] Best 28 Tai Lopez Courses](https://coursehuge.com/wp-content/uploads/2024/01/Bundle-Best-28-Tai-Lopez-Courses-300x300.jpg)

Reviews

There are no reviews yet.