Strategy Quant – Algo Wizard Essentials Course

$199.00 Original price was: $199.00.$18.00Current price is: $18.00.

StrategyQuant Algo Wizard Essentials Course [Instant Download]

What is StrategyQuant Algo Wizard Essentials?

StrategyQuant Algo Wizard Essentials is a quant trading course that teaches you how to create automated strategies without any coding skills.

The course includes step-by-step lessons showing how to build real trading systems using AlgoWizard’s visual interface.

You’ll learn to set up indicators, candlestick patterns, and money management rules through simple drag-and-drop tools. The program transforms your trading ideas into automated systems that run on StrategyQuant X platform.

This training gives you practical skills to develop, test, and optimize trading strategies. By the end, you’ll build complete trading robots without writing a single line of code.

📚 PROOF OF COURSE

What you’ll learn in Algo Wizard Essentials Course:

This course teaches you everything about building quant trading strategies without programming. Here’s what you’ll learn:

- AlgoWizard basics: Navigate the strategy builder and understand main functions

- Strategy creation: Turn trading ideas into automated systems in StrategyQuant X

- Indicator conditions: Use technical indicators to create strategy rules

- Candlestick patterns: Add price action patterns to your strategies

- Multi-timeframe analysis: Build conditions across different charts and timeframes

- Order management: Set up market orders, profit targets, and stop losses

You’ll learn to build complete trading systems from scratch. By the end, you’ll create, test, and optimize automated strategies using AlgoWizard with confidence.

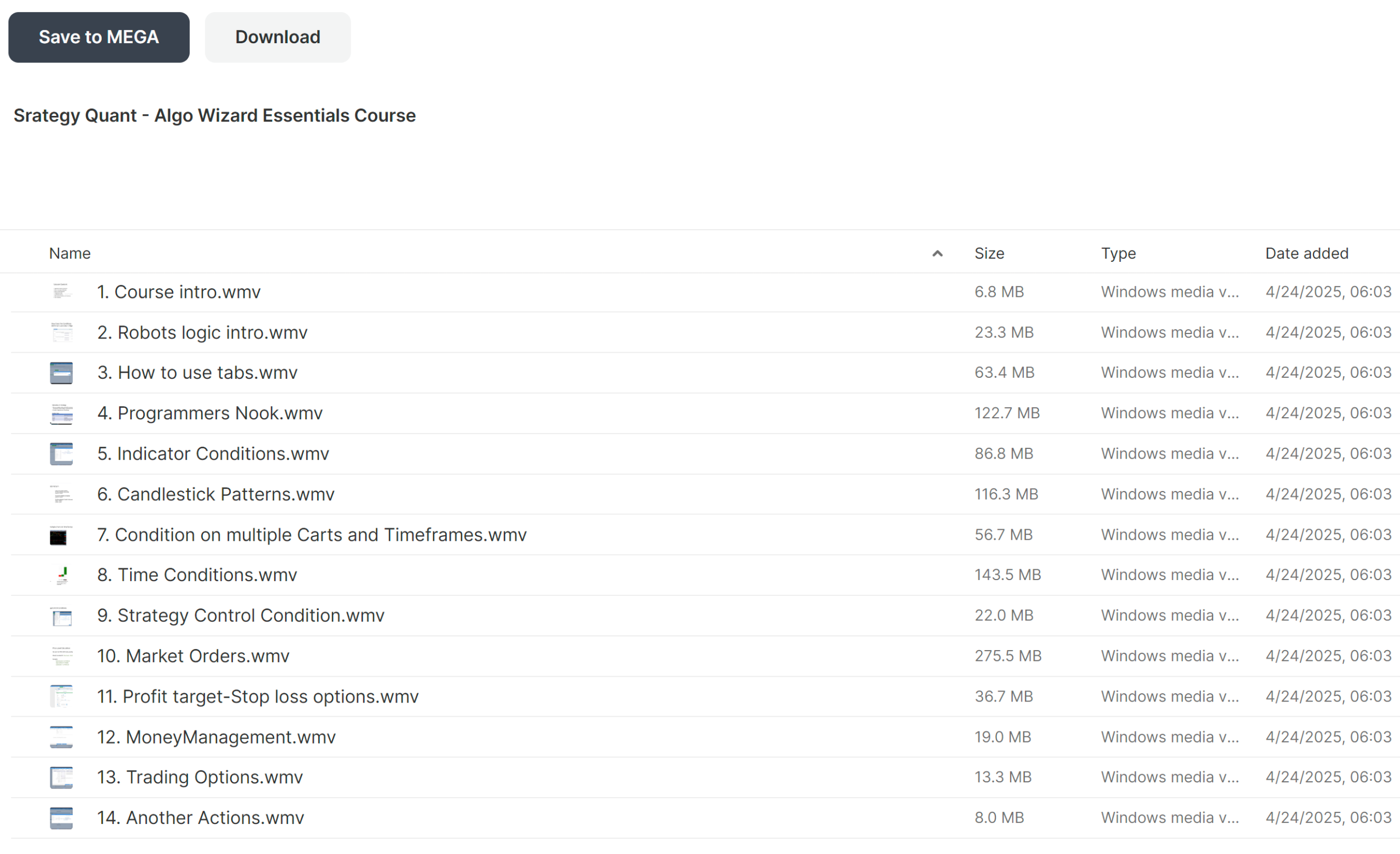

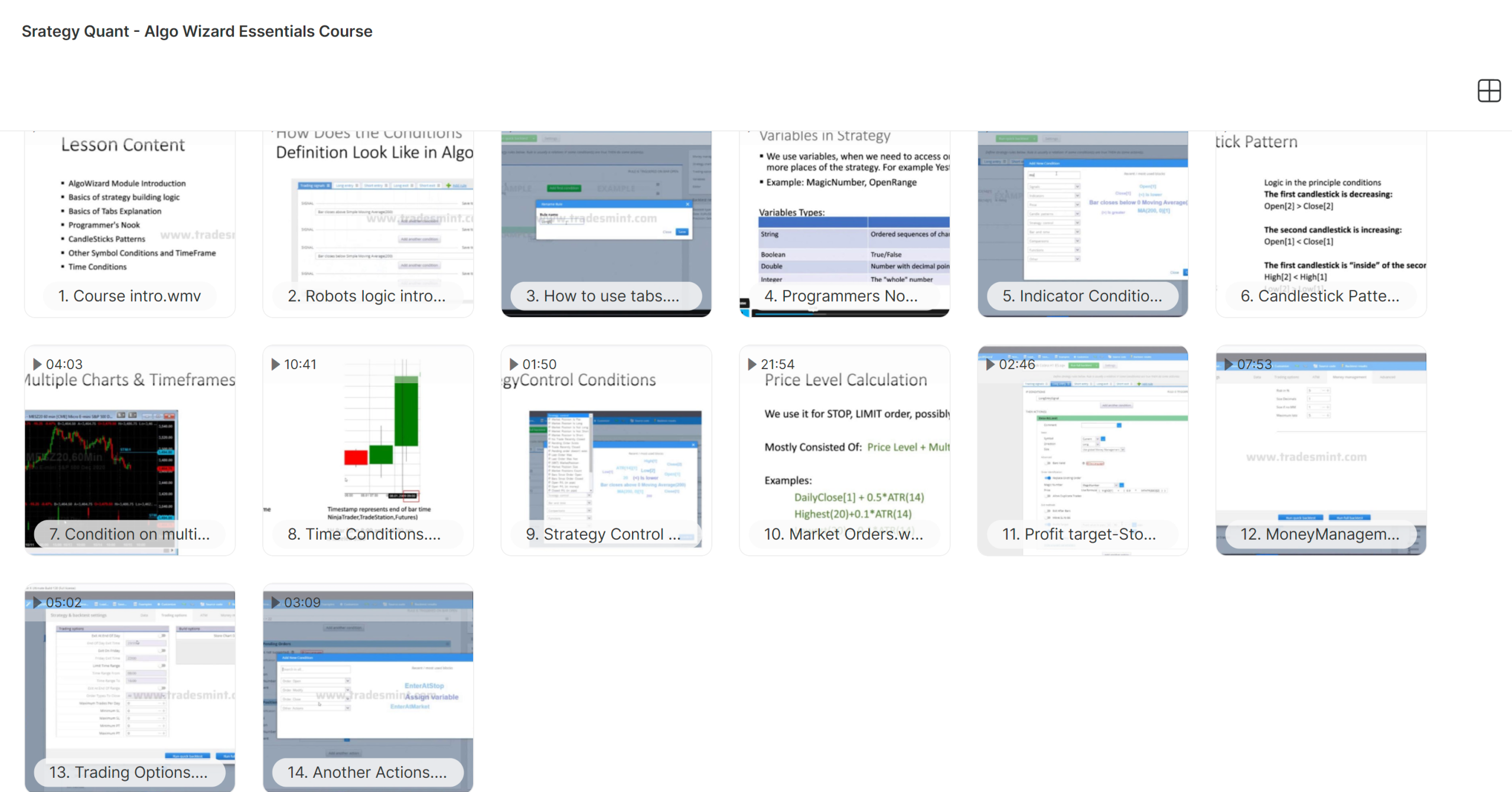

Algo Wizard Essentials Course Curriculum:

✅ Module 1: Course Introduction

Students start their journey into automatic trading with an overview of what they’ll learn and how the course works. This first module introduces the Strategy Quant platform and what it can do.

Students discover how automatic trading removes emotions from trading and helps execute strategies exactly as planned.

✅ Module 2: Robot’s Logic Introduction

This important module explains how trading robots think and make decisions when the market moves. Students learn the basic building blocks of robot logic, like if-then statements and decision trees.

Using real examples, students learn how to turn their trading ideas into clear rules that computers can follow.

✅ Module 3: How to Use Tabs

This module helps students learn their way around Algo Wizard’s workspace. Students master how to use different tabs to manage various parts of building their strategy.

This hands-on session shows how to set up the workspace to make strategy building faster and easier.

✅ Module 4: Programmer’s Nook

Even though you don’t need to code, this module introduces important programming ideas using visual tools. Students learn how to create advanced logic using the platform’s drag-and-drop features.

The content helps traders think like programmers, teaching them to organize complex trading rules in a clear way.

✅ Module 5: Indicator Conditions

This big module covers how to use technical indicators as signals to enter and exit trades. Students explore common indicators like moving averages, RSI, and MACD, learning to use them together.

Students practice making conditions with multiple indicators to reduce false signals and find better trading opportunities.

✅ Module 6: Candlestick Patterns

Students learn to program their strategies to spot candlestick patterns automatically. The module covers well-known patterns from hammers to engulfing patterns and how to code them.

Traders learn to mix candlestick patterns with other technical conditions to create stronger trading signals.

✅ Module 7: Condition on Multiple Charts and Timeframes

Advanced strategies need to check multiple timeframes at once, which this module teaches thoroughly. Students learn to build strategies that confirm signals across different time periods for better accuracy.

The content shows real examples of how daily trends can help filter day trades, showing the power of checking multiple timeframes.

✅ Module 8: Time Conditions

Students learn to program their strategies to trade only during specific hours or market sessions. This module shows how to set time filters to avoid quiet market times or focus on busy trading sessions.

Students master making strategies that run during the best market times, including handling different time zones and market holidays.

✅ Module 9: Strategy Control Condition

This advanced module teaches students to create special conditions that turn strategies on or off automatically. Students learn to set safety rules like maximum daily losses or limits on losing trades in a row.

The content focuses on managing risk through smart controls that help robots adjust to changing market conditions on their own.

✅ Module 10: Market Orders

Students learn about different order types and when to use each one. The module covers market orders, limit orders, and stop orders, explaining the benefits of each type.

Students practice setting up order logic that matches their strategy goals while keeping costs low.

✅ Module 11: Profit target/Stop loss options

This key module teaches systematic ways to manage risk and rewards through exit strategies. Students learn to program profit targets and stop losses that adjust based on market movement.

The content includes trailing stops and breakeven management, teaching traders to protect profits while letting winners run.

✅ Module 12: MoneyManagement

This essential module teaches how to decide position sizes and manage trading capital. Students learn different money management methods, from fixed lot sizes to percentage-based position sizing.

Students also learn advanced ideas like the Kelly formula to help them use their capital in the best way across multiple strategies.

✅ Module 13: Trading Options

This module goes beyond basic settings to cover advanced trading setup options. Students learn to set leverage limits, margin requirements, and account-level risk settings.

The content covers practical things like making sure strategies work with different brokers and follow trading rules.

✅ Module 14: Another Actions

The final module introduces extra features that make strategies work better beyond basic trading logic. Students learn to add features like alerts, position tracking, and performance reporting.

This last section brings together everything learned before, showing how to create complete trading systems with professional features.

What is StrategyQuant?

StrategyQuant creates software for algorithmic trading. Traders worldwide use their tools to build, test, and optimize automated strategies.

The company developed StrategyQuant X, a platform that lets you create strategies without coding. Their AlgoWizard module made it possible for anyone to build complex strategies using visual tools.

StrategyQuant helps thousands of traders, from beginners to professionals. They offer courses, tutorials, and guides to teach algorithmic trading.

The Algo Wizard Essentials Course shows their focus on making trading accessible. The course turns years of knowledge into practical lessons that teach strategy creation step by step.

Be the first to review “Strategy Quant – Algo Wizard Essentials Course” Cancel reply

Related products

Trading Courses

Algo Trading

Trading Courses

Algo Trading

Algo Trading

Algo Trading

Trading Courses

Algo Trading

Reviews

There are no reviews yet.