Day Trader Next Door – Futures Trading Blueprint

$496.00 Original price was: $496.00.$12.00Current price is: $12.00.

Day Trader Next Door Futures Trading Blueprint Course [Instant Download]

1️⃣. What is Day Trader Next Door Futures Trading Blueprint?

Day Trader Next Door Futures Trading Blueprint is a trading course that teaches you how to trade futures markets successfully without any hype.

The course focuses only on what truly works: managing your risk, developing the right trading mindset, and learning to read price movements directly.

Drawing from 15 years of real trading experience, it shows you how to become an independent trader who doesn’t need fancy systems or costly indicators to succeed.

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Futures Trading Blueprint:

The Futures Trading Blueprint gives you practical trading skills you can use right away. Here’s what you’ll learn:

- Trade selection mastery: Find the best trading opportunities using price action and technical indicators

- Risk management framework: Use strategies that protect your account and make recovery easier

- Market behavior analysis: Understand price movements in trending and tight ranging markets

- Trade execution tactics: Learn when to enter and exit trades based on clear technical signals

- Personalized trading plan: Create your own structured approach to trading

- Multiple market application: Use these core skills across different futures markets

This focused course delivers only what you need for trading success, without any fluff or hype.

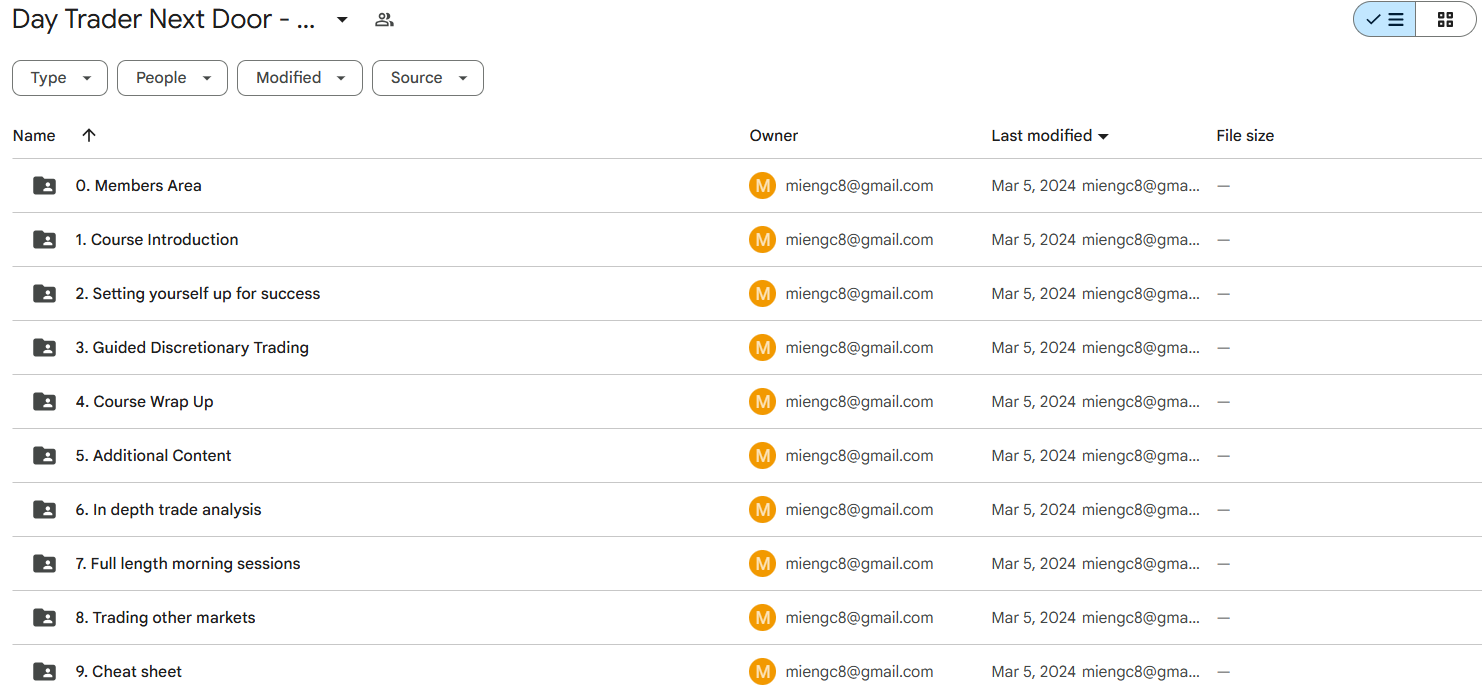

3️⃣. Futures Trading Blueprint Course Curriculum:

✅ Module 1: Course Introduction

This first module welcomes you to the course and shows you how to get started. It tells you what to expect and gives you a clear path for working through all the learning materials to get the most out of your trading education.

✅ Module 2: Setting Yourself Up for Success

This starting module covers the basics of futures trading while showing you a fresh way to think about risk management. You’ll learn how to create your own trade plan, which will guide all your trading decisions. The Trade Plan 2022 document gives you a helpful example to follow when making your own plan.

The module shows why good risk management is the key to trading success, not just finding good entry points. You’ll learn how to make a complete trade plan that fits your personal trading style and money goals.

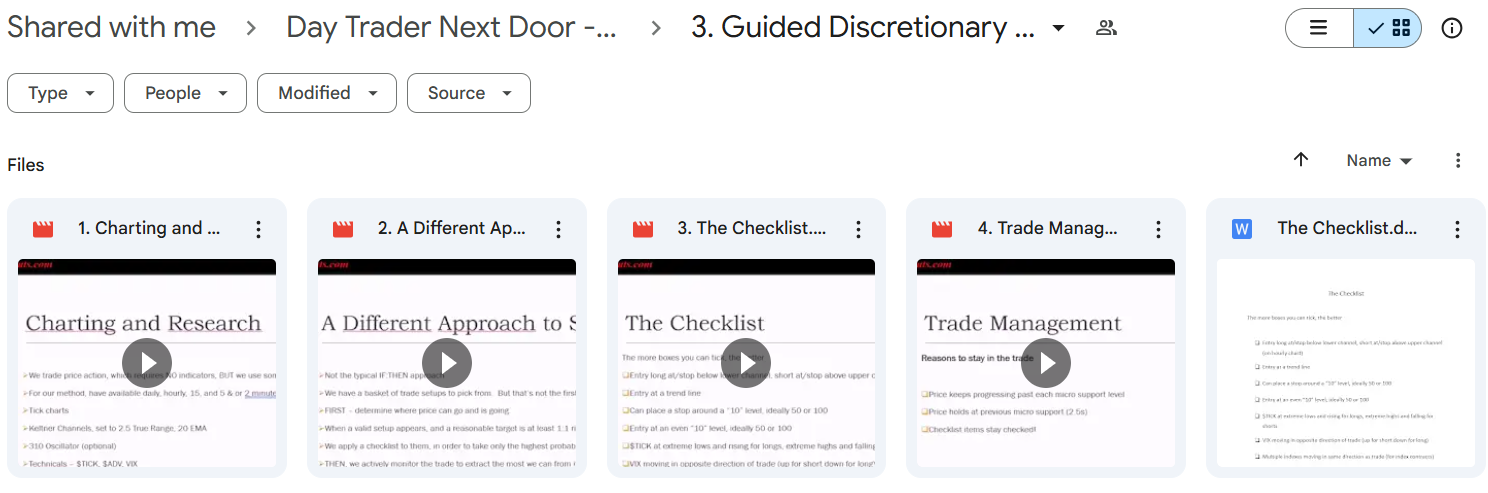

✅ Module 3: Guided Discretionary Trading

This main module gets into the practical side of setting up charts, researching markets, and finding good trading setups. You’ll learn a step-by-step checklist approach to evaluate possible trades and manage your positions for the best results.

The teacher shows a different way to spot trading chances that goes beyond typical trading setups. The Checklist document gives you a simple framework for judging trades, helping you become more consistent. You’ll also learn how to handle trades once you’re in them to maximize profits and cut losses.

✅ Module 4: Course Wrap Up

This short module helps you move from learning to actually trading. It guides you on how to keep growing as a trader after finishing the course, with tips for ongoing improvement.

✅ Module 5: Additional Content

This big module builds on the main ideas with real examples and special techniques. You’ll see a detailed trade example, learn advanced chart reading, and discover useful tools like the TICK indicator and price envelope analysis.

You’ll explore different types of trades including “Home run setups” and “One step at a time” approaches for different market situations. Special videos cover topics like contract rollovers, finding support and resistance levels, and creating chart levels that work for your trading style.

✅ Module 6: In-depth Trade Analysis

This focused module breaks down a real trade example with tricky price movements. You’ll see how the course ideas work in actual trading situations where markets aren’t moving in a straightforward way.

✅ Module 7: Full Length Morning Sessions

This practical module shows complete trading sessions from start to finish. By watching sessions from November 2022 and February 2023, you’ll see how an experienced trader works in real time, making decisions and managing trades throughout a morning.

✅ Module 8: Trading Other Markets

This special module shows how to apply the course ideas to crude oil futures. You’ll learn how to adjust the main techniques for this specific market, with a custom checklist for crude oil trading included as a PDF.

✅ Module 9: Cheat Sheet

The final module gives you a simple Excel reference guide. This useful tool sums up key ideas, strategies, and decision frameworks from the course in an easy-to-use format you can quickly check during your trading sessions.

4️⃣. What is Day Trader Next Door?

Day Trader Next Door is a futures trader and teacher known for practical, no-nonsense trading education. With 15 years of trading experience, he gives straightforward, useful advice.

Before trading full-time, he worked as an undertaker and continues as a musician. This background shapes his unique view on market psychology and risk management.

His YouTube channel has over 20,000 subscribers who value his honest teaching and realistic market approach. He never promises quick riches or sells “holy grail” systems.

What makes him different is how he helps students. He answers questions personally and creates extra content based on what students need. His goal is to help traders become independent instead of relying on gurus or costly indicators.

5️⃣. Who should take Day Trader Next Door Course?

The Futures Trading Blueprint is for serious traders who want to master the markets. It’s perfect for:

- Intermediate traders who know market basics but can’t trade consistently

- Method-hoppers tired of switching systems while searching for the nonexistent “holy grail”

- Independent thinkers who want to trade on their own instead of following someone else’s alerts

- Risk-conscious traders looking for proven ways to protect their money

- Long-term focused people committed to building lasting trading skills

This isn’t for complete beginners or those wanting quick riches. The Blueprint takes dedication and practice, but gives you everything needed for long-term trading success.

6️⃣. Frequently Asked Questions:

Q1: What is futures trading?

Futures trading involves buying or selling contracts to exchange assets at a set price on a future date. These contracts cover commodities like oil and gold, or financial instruments like stock indexes. Traders speculate on price movements without owning the actual assets.

Q2: How much money do I need to start futures trading?

Most futures brokers require $2,000-$5,000 minimum to open an account. However, $10,000-$15,000 is recommended for better risk management. Remember that futures use leverage, so you control large positions with relatively small amounts of capital.

Q3: Is futures trading riskier than stock trading?

Futures trading can be riskier due to higher leverage (10-50 times your capital). This amplifies both profits and losses. Futures markets also move faster than stocks and can trade nearly 24 hours a day, creating more opportunities but requiring stricter risk management.

Q4: What should a good futures trading plan include?

A good futures trading plan includes specific entry and exit criteria, position sizing rules, risk limits per trade and per day, and market conditions when you won’t trade. It should also define how you’ll track performance and when to review your strategy.

Q5: How do day traders manage risk in futures markets?

Day traders manage risk by using stop losses on every trade, limiting position sizes to 1-3% of their account per trade, setting daily loss limits (often 5-10% of account), and avoiding holding positions overnight when unexpected news can create large gaps.

Be the first to review “Day Trader Next Door – Futures Trading Blueprint” Cancel reply

Related products

Day Trading

Futures Trading

Best 100 Collection

Trading Courses

Trading Courses

Futures Trading

![[Bundle] Best 4 FutexLive Courses](https://coursehuge.com/wp-content/uploads/2024/08/Bundle-Best-4-FutexLive-Courses-300x300.jpg)

Reviews

There are no reviews yet.