Gary Norden – Red Jacket Course: The Norden Method

$2,795.00 Original price was: $2,795.00.$12.00Current price is: $12.00.

Gary Norden Red Jacket Course [Instant Download]

1️⃣. What is Gary Norden Red Jacket Course?

Gary Norden Red Jacket Course teaches professional futures trading techniques used by market makers on the London International Financial Futures Exchange.

The course reveals how to trade using only DOM and tape reading—no charts or technical analysis needed.

Norden’s method focuses on precision order entry, queue position, and understanding value in real-time market conditions. Successful students earn an authentic PECO red trading jacket, symbolizing their mastery of market making skills.

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Red Jacket Course:

The Red Jacket Course teaches you proven market making strategies for today’s electronic futures markets. Here’s what you’ll learn:

- Market making principles: Master the professional standards and first principles that successful traders use

- Order flow mastery: Learn to read DOM and tape to spot trading opportunities that chart traders miss

- Precision entries: Develop skills to get filled first with the best queue position

- Value determination: Understand real-time market value in different market conditions

- High win rate strategy: Use a systematic approach for consistent profits

- Professional exit rules: Master when to scratch trades and manage positions effectively

This complete program builds on the Norden Method with detailed video content. By the end, you’ll trade with the same edge as professional market makers.

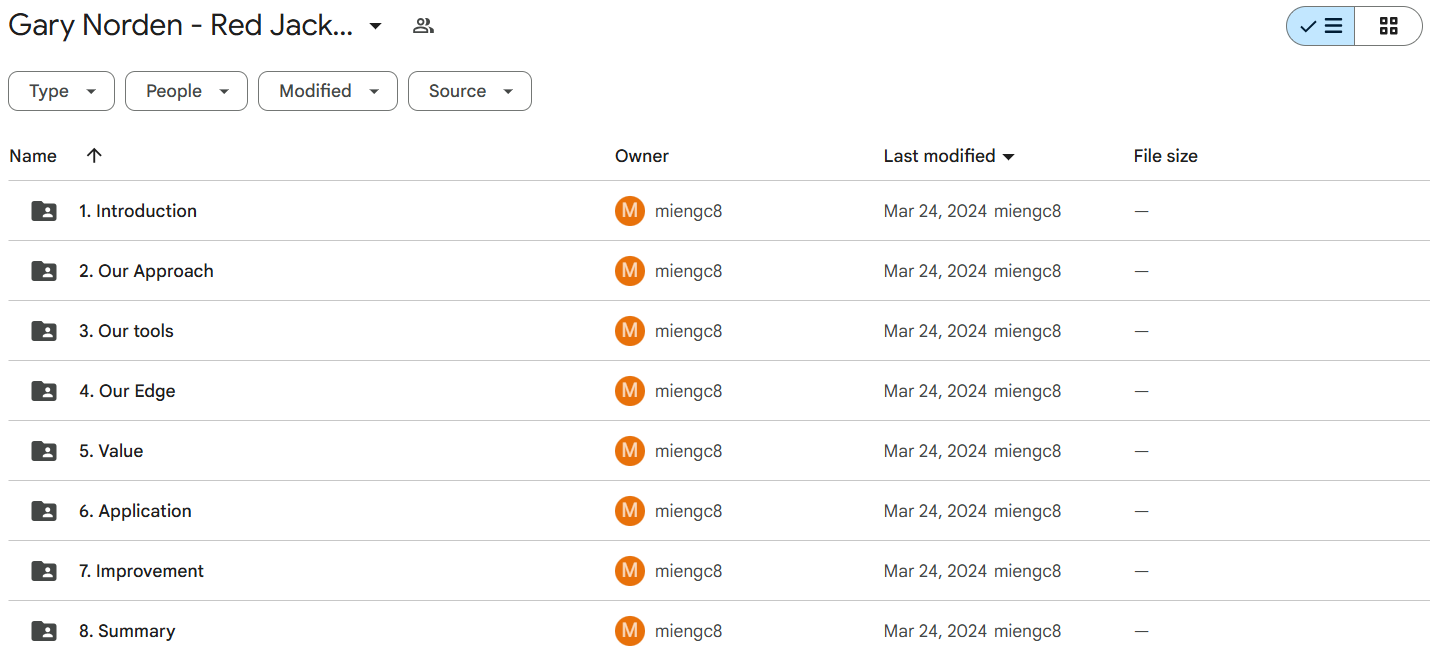

3️⃣. Red Jacket Course Curriculum:

✅ Module 1: Introduction

This opening module establishes Gary Norden’s trading philosophy and explains why market making provides significant advantages over conventional trading approaches. Students are introduced to the foundational concept that professional trading success comes from positioning at the edge of markets rather than following technical analysis patterns.

Key Lessons:

Gary’s personal welcome sets expectations for the course while explaining the critical shift in mindset from traditional retail trading to professional market making techniques that can potentially yield higher win rates and consistent profitability.

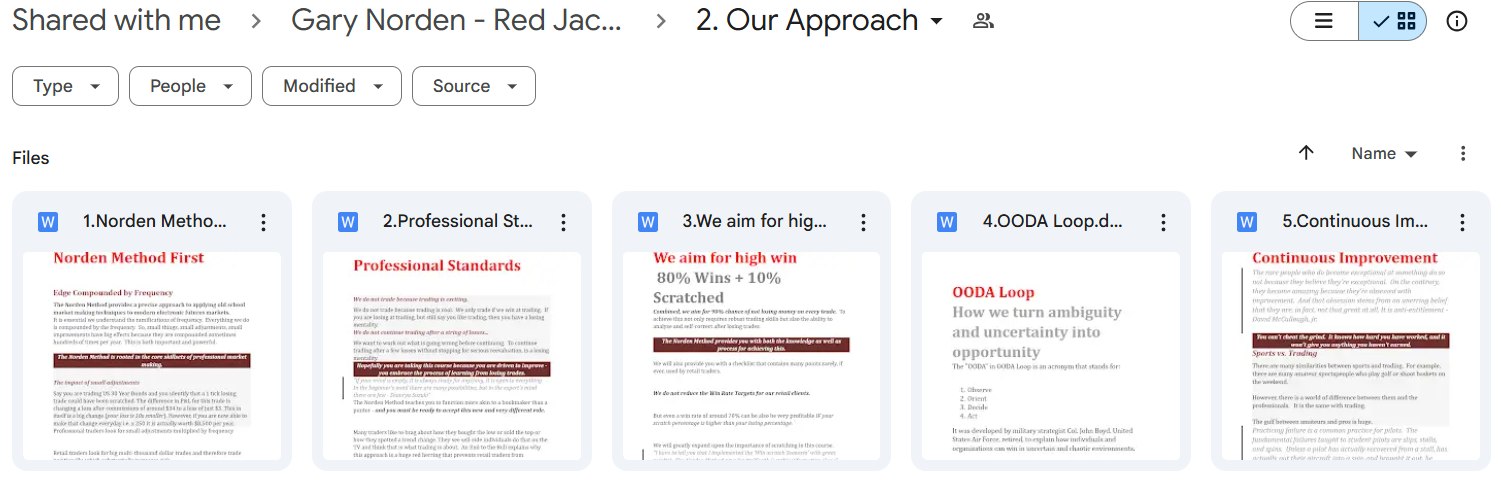

✅ Module 2: Our Approach

The second module outlines the core principles that define the Norden Method, emphasizing professional standards, high win-rate objectives, and practical frameworks like the OODA Loop (Observe, Orient, Decide, Act). This section establishes the disciplined mindset required for successful implementation of market making techniques.

Key Lessons:

Students learn about first principles of the Norden trading method, professional trading standards, and the continuous improvement philosophy that underpins long-term success. The OODA Loop framework teaches traders to rapidly process market information and execute decisions with precision and discipline.

✅ Module 3: Our Tools

This module contrasts the Norden Method with conventional approaches by rejecting chart-based technical analysis in favor of DOM (Depth of Market) and tape reading. Students learn why these tools provide superior market insights and how to leverage watchlists and news while understanding that every trade’s outcome affects overall performance.

Key Lessons:

The critical departure from chart-based trading to DOM and tape reading represents a fundamental shift in how traders perceive and interact with markets. Students learn to extract actionable information from order flow rather than lagging visual patterns on charts.

✅ Module 4: Our Edge

An extensive module revealing the specific advantages of the Norden Method, covering due diligence, precision order entry, queue positioning, and understanding how trading frequency compounds results. Video demonstrations illustrate concepts like effective queue position and avoiding larger traders who might adversely impact execution.

Key Lessons:

Students learn practical techniques for gaining edge through precision entry (demonstrated through video), understanding queue position correlation, and recognizing the critical importance of quick fills. The compound effect of frequency in trading is explained as a key performance multiplier when combined with proper technique.

✅ Module 5: Value

This core module shifts from mechanics to market understanding, teaching students to recognize true value beyond price movements. Through numerous video demonstrations, students learn how value changes in different market conditions and how to capitalize on these changes regardless of price action.

Key Lessons:

Students learn to debunk traditional concepts of highs, lows, and price levels while understanding counterintuitive concepts like buying the high/selling the high and buying the low/selling the low. Video demonstrations show practical applications of value recognition in both slow and fast market conditions.

✅ Module 6: Application

The most comprehensive module focusing on practical implementation of the Norden Method across various market conditions. Students learn critical skills from setting up trades and managing scratches to adjusting for volatile markets, recognizing different order flow patterns, and implementing post-fill checklists.

Key Lessons:

This section provides detailed instruction on getting filled on the first attempt, knowing when to pull orders, distinguishing between choppy and trending markets, and recognizing one-way versus two-way order flow. Students also learn exit rules, position sizing, and techniques for trading during extreme volatility.

✅ Module 7: Improvement

This module focuses on sustainable trading success through preparation, purposeful practice, and performance assessment. Students learn how to prepare for trading sessions, practice effectively, and objectively evaluate their performance using appropriate metrics.

Key Lessons:

The Trading Stats Review video demonstrates how to analyze personal trading data to identify strengths, weaknesses, and opportunities for improvement. This module emphasizes that trading mastery requires continuous refinement through structured preparation and honest self-assessment.

✅ Module 8: Summary

The final module synthesizes the entire course content and provides clear next steps for continued growth as a trader using the Norden Method. Students receive guidance on how to integrate all previous modules into a cohesive trading approach.

Key Lessons:

The summary consolidates the methodology while the Next Steps document outlines how to continue developing proficiency with the Norden Method beyond the course completion.

4️⃣. Who is Gary Norden?

Gary Norden is a trader and educator with over 30 years in financial markets. Starting at 18, he became the youngest trader at Yamaichi Securities in London.

Gary held senior trading positions at NatWest Markets and ING Markets. In the mid-1990s, he worked as a ‘local’ options market maker on LIFFE, wearing the iconic red jacket of self-funded traders.

He authored books like “Technical Analysis and the Active Trader” and “An End to the Bull,” challenging conventional trading wisdom and promoting sustainable trading based on real market dynamics.

As creator of The Norden Method™, Gary turned his professional trading experience into a complete educational program. He also co-directs NN² Capital hedge fund and consults for financial firms.

Gary stays active in the trading community through social media, sharing insights with traders worldwide. His approach focuses on reading real-time market conditions instead of predictive models or technical analysis.

5️⃣. Who should take Gary Norden Course?

The Red Jacket Course is designed for serious traders who want to develop professional futures trading skills. This course is for:

- Aspiring professional traders who want to learn real market making techniques used on trading floors.

- Technical analysts looking to move beyond chart patterns to understand order flow.

- Experienced traders seeking higher win rates and more consistent results.

- Day traders struggling with entries and exits who need a more precise method.

- Futures traders who want to understand market structure and improve execution.

This program is perfect if you’re tired of common trading approaches and ready to use professional methods. The course takes dedication to master but gives you a clear path to trading like a market professional.

6️⃣. Frequently Asked Questions:

Q1: What is professional futures trading?

Q2: How does the electronic futures market work?

Q3: What are the main advantages of trading futures electronically?

Q4: How do traders analyze the electronic futures market?

Q5: What are the key risks in professional futures trading?

Be the first to review “Gary Norden – Red Jacket Course: The Norden Method” Cancel reply

Related products

Forex Trading

Futures Trading

Best 100 Collection

Futures Trading

Day Trading

Futures Trading

Futures Trading

Futures Trading

TRADEPRO ACADEMY – Futures Day Trading and Order Flow Course

![[Bundle] Best 4 FutexLive Courses](https://coursehuge.com/wp-content/uploads/2024/08/Bundle-Best-4-FutexLive-Courses-300x300.jpg)

Reviews

There are no reviews yet.