David Vallieres & Tim Warren – Expert Option Trading Course

$497.00 Original price was: $497.00.$16.00Current price is: $16.00.

David Vallieres & Tim Warren Expert Option Trading Course [Instant Download]

1️⃣. What is Expert Option Trading Course?

Expert Option Trading shows you how to make consistent monthly income using options, whether markets go up, down, or sideways. David Vallieres and Tim Warren teach you their proven system that takes just 15 minutes daily to manage.

The course reveals how to trade options as a real business, not gambling. You’ll learn to use iron condors, vertical spreads, and calendar spreads to generate reliable profits.

You’ll master risk management using “the Greeks” and learn exact entry points, adjustments, and exit strategies. Everything is taught step-by-step with real trade examples.

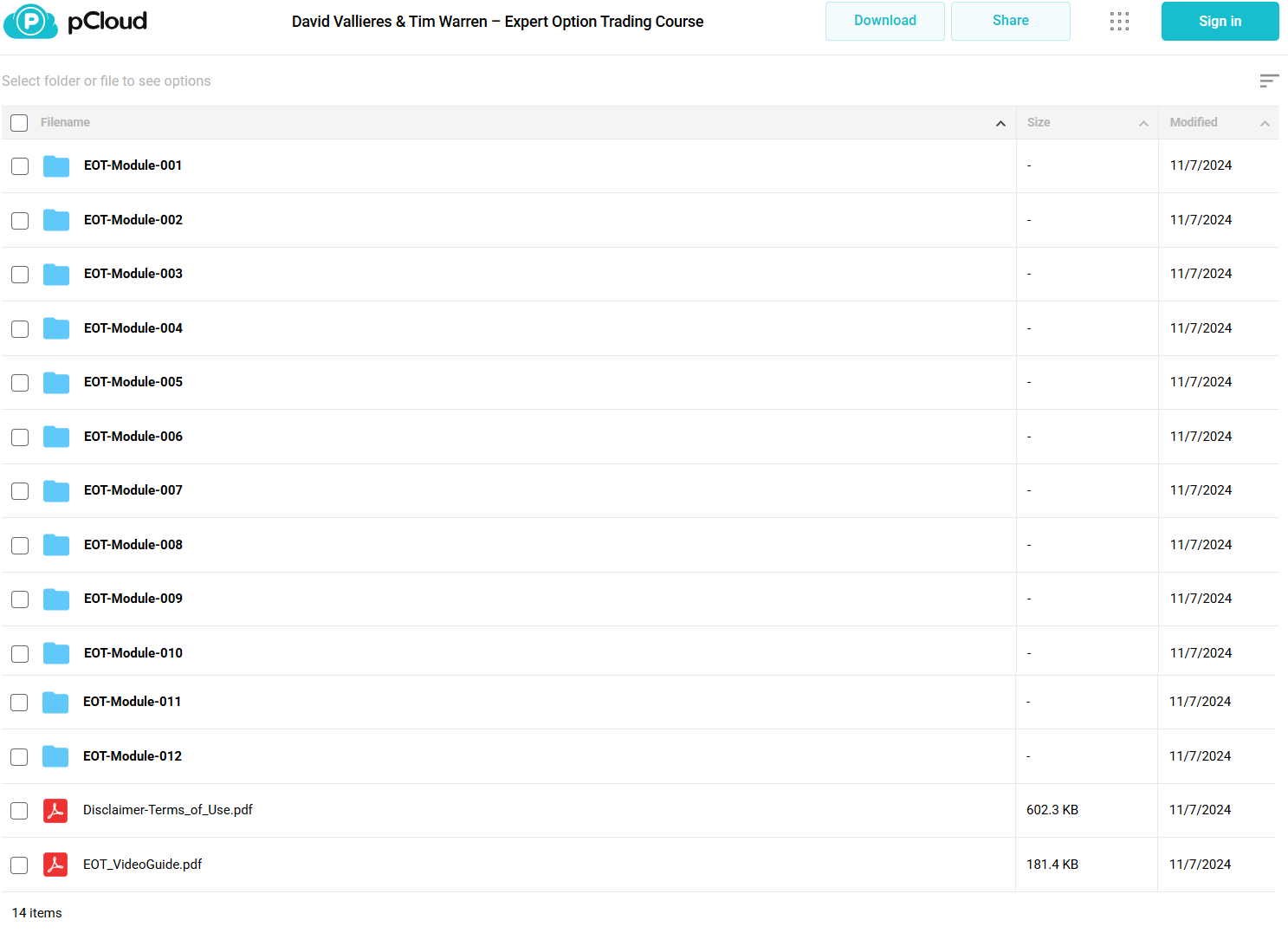

📚PROOF OF COURSE

2️⃣. What you’ll learn in Expert Option Trading:

Here’s exactly what you’ll learn in this proven options trading course:

- Trade Like a Pro: Master the Greeks, Delta, Theta, and other key numbers to make smart trading decisions

- Protect Your Money: Learn when to enter trades, how to limit losses, and techniques to grow your account safely

- Proven Strategies: Use iron condors, vertical spreads, and calendar spreads to profit in any market

- Read the Market: Spot the best trading opportunities using simple, effective analysis methods

- Fix Losing Trades: Turn around trades that go against you with professional adjustment techniques

- 15-Minute System: Follow a step-by-step daily routine that takes just minutes to manage

This course gives you all the tools to run your own profitable options trading business from home.

3️⃣. Expert Option Trading Course Curriculum:

✅ Section 1: Foundation of Options Trading

Begin your journey with a comprehensive introduction to options trading fundamentals. Learn the core concepts that will form the basis of your trading business.

Module 1.1: Introduction to Trading Master the basics of options trading through two detailed video sessions that establish the groundwork for your trading journey. Understand the business approach to trading that sets this course apart.

Module 1.2: Trade Analysis Explore essential trading concepts and analysis techniques. Learn how to evaluate trades and understand market dynamics through practical demonstrations.

✅ Section 2: Technical Framework

Develop your technical understanding of options trading through advanced concepts and practical applications.

Module 2.1: The Greeks Mastery Learn how to use Delta, Theta, and other Greek metrics to make informed trading decisions. Includes both video instruction and a comprehensive guide for reference.

Module 2.2: Trade Selection Strategy Practice selecting trades across multiple markets including EEM, ADSK, DIA, SPY, and IWM. Each video demonstrates specific selection criteria and execution strategies.

✅ Section 3: Portfolio Management

Transform theoretical knowledge into practical trading skills with comprehensive portfolio management techniques.

Module 3.1: Portfolio Construction Learn the art of building a balanced options portfolio that manages risk while maximizing potential returns.

Module 3.2: Platform Mastery Master the ThinkorSwim platform, your essential tool for successful options trading.

✅ Section 4: Advanced Trading Techniques

Elevate your trading skills with professional-level concepts and strategies.

Module 4.1: Greek Management and VIX Understand advanced Greek management, VIX implications, and crucial expiration week strategies through five detailed video lessons.

Module 4.2: Trade Adjustments Master various adjustment techniques for different market scenarios, including specific strategies for IWM and SPY trading.

✅ Section 5: Profit Optimization

Learn to maximize returns while managing risk effectively.

Module 5.1: Profit Management Master techniques for closing positions profitably, including specialized strategies for iron condors, calendars, and theta decay trades.

Module 5.2: Market Analysis Understand the bigger picture of market movements and their impact on your trading decisions.

✅ Section 6: Wealth Building Strategies

Advanced concepts for expanding your trading success.

Module 6.1: Advanced Strategies Learn sophisticated trading approaches including gamma scalping, stock selection, and position management through detailed daily updates.

Module 6.2: Theta Scalping Master the specialized technique of theta scalping for additional profit opportunities.

✅ Section 7: Bonus Content

Extra resources to enhance your trading expertise.

Module 7.1: Inside Days Trading Learn this powerful trading strategy through comprehensive video instruction and detailed guide materials.

Module 7.2: Extreme Trading Master advanced trading techniques for capturing exceptional market opportunities.

Each section includes practical exercises, real-world examples, and detailed video instruction to ensure thorough understanding and application of concepts.

4️⃣. Who are David Vallieres & Tim Warren?

David Vallieres brings 23 years of options trading experience to this course. Unlike many instructors, he’s not a former market maker or industry insider – he’s a retail trader who developed his strategies through real-world testing and application.

His approach focuses on treating trading as a business, using systematic processes and risk management to generate consistent profits. David has been teaching online business since 1999, helping thousands achieve financial independence.

Tim Warren complements David’s expertise with his own successful trading career, bringing additional insights and strategies to the course. Together, they’ve created a comprehensive program that combines their decades of trading experience.

5️⃣. Who should take Expert Option Trading Course?

This course works for:

- New Traders who want to learn options trading step by step

- Stock Traders ready to add options strategies to their toolkit

- Busy Professionals looking to build extra income in their spare time

- Regular Investors who want better returns using proven methods

- People Planning Retirement who need steady monthly income

Whether you’re just starting or have some experience, you’ll learn everything needed to trade options like a pro.

6️⃣. Frequently Asked Questions:

Q1: How can I make a consistent monthly income from trading?

Consistent monthly income comes from structured strategies, risk management, and diversification. Traders use income-based strategies like covered calls, credit spreads, and iron condors to generate steady profits.

Q2: What is the best advanced options trading strategy?

Advanced traders often use iron condors, butterfly spreads, and gamma scalping to optimize returns while minimizing risk. The key is to manage volatility and adjust positions when necessary.

Q3: How much capital do I need for options trading?

You can start with as little as $500-$1,000, but more capital provides better flexibility. Risk management is crucial, and position sizing should align with your trading plan.

Q4: How do I protect myself from losses in options trading?

Risk management techniques like stop-loss orders, hedging, and position sizing help limit potential losses. Knowing when to exit a trade is just as important as entering it.

Q5: Can I trade options while working a full-time job?

Yes! Many traders use swing trading and income-generating strategies that require minimal daily monitoring. Setting up alerts and having a structured plan can help you trade efficiently with a busy schedule.

Be the first to review “David Vallieres & Tim Warren – Expert Option Trading Course” Cancel reply

Related products

Trading Courses

Trading Courses

Options Trading

Trading Courses

Forex Trading

Forex Trading

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Reviews

There are no reviews yet.