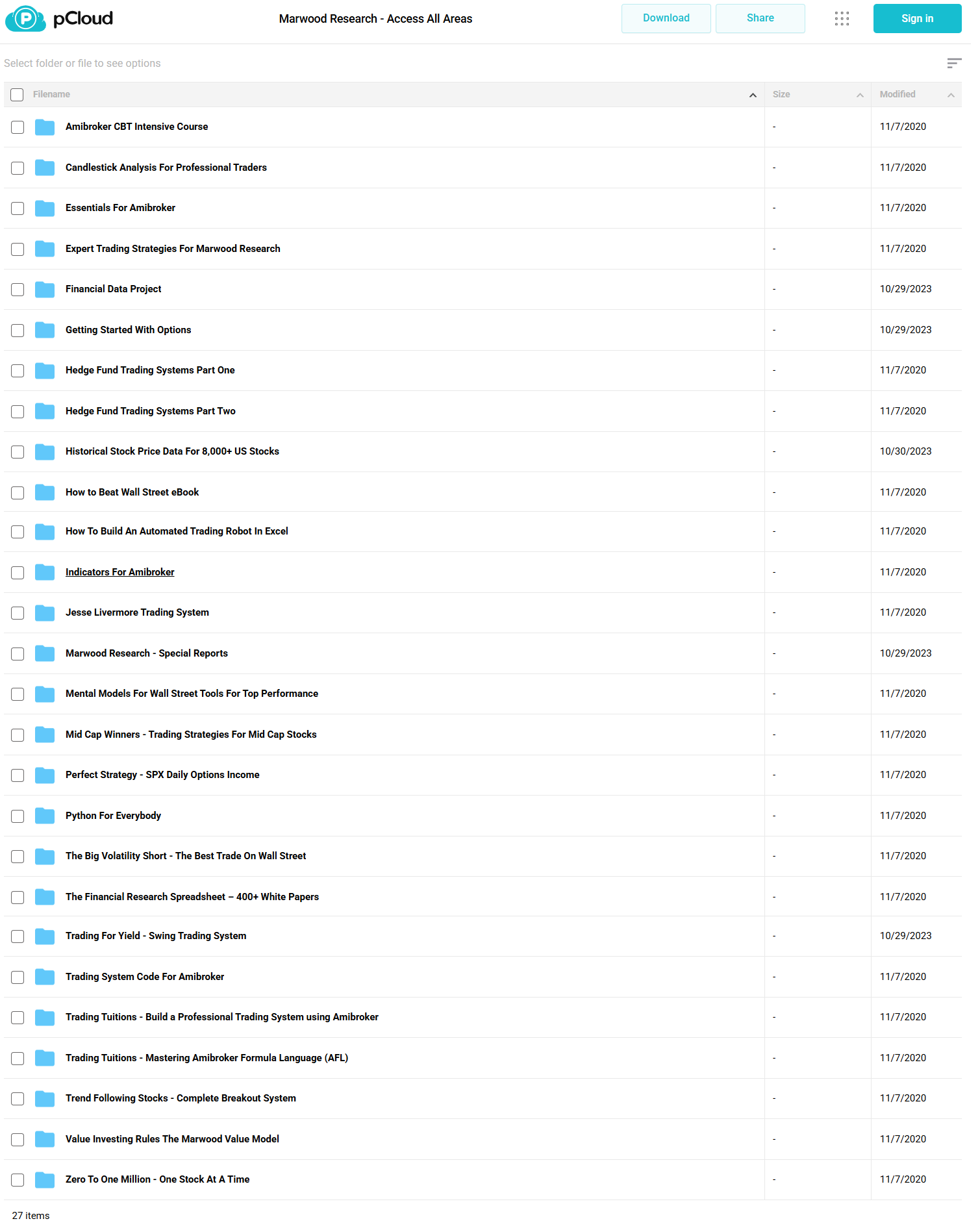

Marwood Research – Access All Areas

$730.00 Original price was: $730.00.$29.00Current price is: $29.00.

Joe Marwood Access All Areas Trading Course [Instant Download]

What is Marwood Research Access All Areas?

Marwood Research – Access All Areas’s Access All Areas teaches you how to trade stocks and ETFs using proven systematic strategies. You get instant access to 40+ trading courses that show you exactly how to build and run profitable trading systems.

The program gives you ready-to-use Amibroker code and Excel templates for each strategy. You’ll learn practical skills from basic chart patterns to automated trading systems you can start using today.

Get new trading strategies every month plus email support to help you succeed. Perfect for both new and experienced traders who want to trade systematically.

📚PROOF OF COURSE

What you’ll learn in Access All Areas Trading Course:

Learn proven ways to trade the markets systematically and make better trading decisions. Here’s what you’ll learn:

- Trading Systems: Build your own strategies using Amibroker and Excel, then test them to make sure they work

- Market Analysis: Read price charts, spot trade setups, and use data to time your trades better

- Risk Control: Learn when to trade bigger or smaller to protect and grow your account

- Trading Automation: Set up your computer to trade for you using Excel and Interactive Brokers

- Options Trading: Trade options smartly and profit from market volatility

- Investment Strategy: Find good stocks to buy using numbers and trends, not guesswork

Whether you’re new to trading or have experience, you’ll learn practical ways to trade systematically using tested methods.

Marwood Research Course Curriculum:

✅ Section 1: Core Trading Foundations

This section establishes essential trading concepts and analytical frameworks. Students learn systematic trading approaches through both theoretical understanding and practical application.

Module 1.1: Hedge Fund Trading Systems Part One

Learn professional trading system development through six proven strategies. Master moving average crossovers, cherry picking stocks, overnight reversals, and gap trading techniques. Includes complete Amibroker code and backtesting templates.

Module 1.2: Hedge Fund Trading Systems Part Two

Advanced trading concepts covering market psychology, system validation, and portfolio management. Study advanced systems like Follow The Money, Nasdaq Pivots, and ETF trading strategies. Includes implementation guides for both Amibroker and Quantopian.

Module 1.3: Mental Models For Wall Street

Explore critical thinking frameworks for trading success. Learn to apply scientific methods, understand cognitive biases, and develop systematic decision-making processes. Includes practical exercises and real-world applications.

✅ Section 2: Technical Skills Development

This section focuses on the practical tools and technologies used in systematic trading. Students learn to implement trading strategies using industry-standard software.

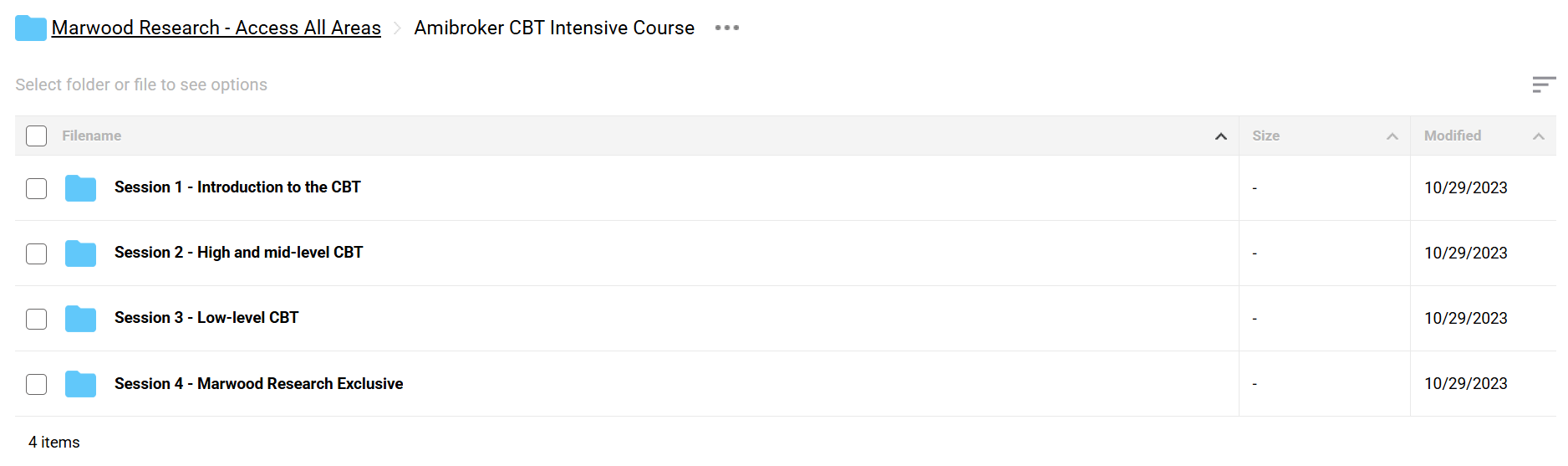

Module 2.1: Mastering Amibroker Formula Language

Comprehensive guide to AFL programming, from basic syntax to advanced functions. Learn to create custom indicators, build trading systems, and automate analysis. Includes hands-on coding exercises and practical examples.

Module 2.2: Excel Trading Robot Development

Step-by-step training in building automated trading systems using Excel and VBA. Learn to connect with Interactive Brokers API, manage orders, and implement position sizing. Includes ready-to-use templates and live trading demonstrations.

Module 2.3: Python For Trading

Essential Python programming skills for traders. Covers data analysis, API integration, and automation techniques. Progress from basic concepts to advanced trading applications.

✅ Section 3: Market Analysis and Strategy

This section teaches advanced market analysis techniques and strategy development. Students learn to identify and exploit market opportunities systematically.

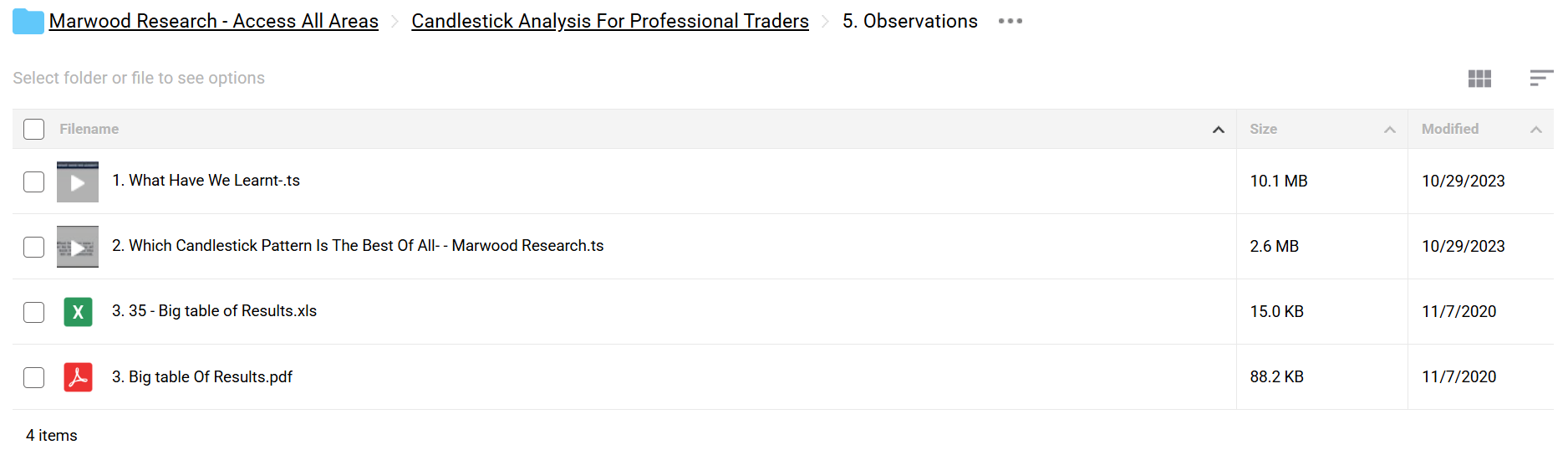

Module 3.1: Candlestick Analysis For Professional Traders

Deep dive into Japanese candlestick patterns and their effectiveness. Learn historical performance metrics and combine patterns with technical indicators. Includes complete trading system based on proven patterns.

Module 3.2: Big Volatility Short Strategy

Master volatility trading with a focus on VIX-based strategies. Learn about ETF mechanics, contango effects, and optimal position sizing. Includes live trade alerts and implementation guides.

Module 3.3: Expert Trading Strategies

Collection of proven trading strategies including Money Flow 3X, Trend Pilot, and Sector Stragglers. Each strategy includes detailed documentation and Amibroker code.

✅ Section 4: Portfolio Management and Risk Control

This section focuses on practical implementation and risk management. Students learn to build and manage trading portfolios effectively.

Module 4.1: Mid Cap Winners

Complete system for trading mid-cap stocks, including value investing principles and swing trading strategies. Learn to identify opportunities in this lucrative market segment.

Module 4.2: Trading For Yield

High-probability swing trading system focused on yield-based strategies. Includes complete trading rules, historical performance analysis, and implementation code.

Module 4.3: Zero To One Million

Long-term wealth building strategy combining systematic investing with position sizing. Learn to grow a small account consistently through disciplined investing.

✅ Section 5: Advanced Trading Applications

This section covers specialized trading approaches and advanced market concepts.

Module 5.1: Options Trading Fundamentals

Essential options trading concepts including basic strategies, implied volatility, and risk management. Learn to create protected positions and income-generating strategies.

Module 5.2: Value Investing Model

Quantitative approach to value investing using ten proven rules. Learn to identify undervalued stocks and implement systematic value strategies.

✅ Section 6: Resources and Support

Module 6.1: Financial Research Database

Access to 400+ academic papers and research materials. Learn from published research and develop new trading ideas.

Module 6.2: Trading System Code Library

Complete collection of Amibroker code for all trading systems. Includes templates, indicators, and full strategy implementations.

Module 6.3: Market Data Resources

Historical price data for stocks, cryptocurrencies, and economic indicators. Essential for system development and testing.

Each section includes comprehensive documentation, practical exercises, and implementation guidance. Students receive ongoing support through email assistance and regular strategy updates.

Who is Joe Marwood?

Joe Marwood is a professional trader and financial market analyst specializing in systematic trading strategies. He gained extensive experience as a futures trader in London and has been actively trading since 2008.

As the founder of Marwood Research, Joe has been developing and teaching trading systems since 2011. He focuses on data-driven decision making and robust system development, helping traders build reliable strategies that work in real market conditions.

His expertise spans multiple areas including:

- Systematic trading strategy development

- Quantitative analysis and backtesting

- Technical analysis and market timing

- Options and volatility trading

- Automated trading systems

Working alongside Peter Titus, an engineer with extensive automated trading experience, Joe has helped thousands of traders develop their systematic trading skills through Marwood Research’s educational platform.

Be the first to review “Marwood Research – Access All Areas” Cancel reply

Related products

Stock Trading

Stock Trading

Stock Trading

Forex Trading

Day Trading

Stock Trading

Stock Trading

Reviews

There are no reviews yet.