Linda Raschke – Classic Trading Tactics – Theory and Practice (2020)

$1,699.00 Original price was: $1,699.00.$18.00Current price is: $18.00.

Linda Raschke Classic Trading Tactics Course [Instant Download]

What is Linda Raschke Classic Trading Tactics?

Linda Raschke’s Classic Trading Tactics teaches professional futures and swing trading through a 5-week live training program. You’ll learn proven setups for S&P futures, overnight positions, and technical analysis strategies.

The course combines momentum tactics, market profile concepts, and practical trade execution methods that Linda Raschke developed over 40 years of professional trading.

You start with one week of intensive training, then apply everything in four weeks of live trading sessions. Linda guides you through real market conditions, showing exactly how to execute trades and manage positions.

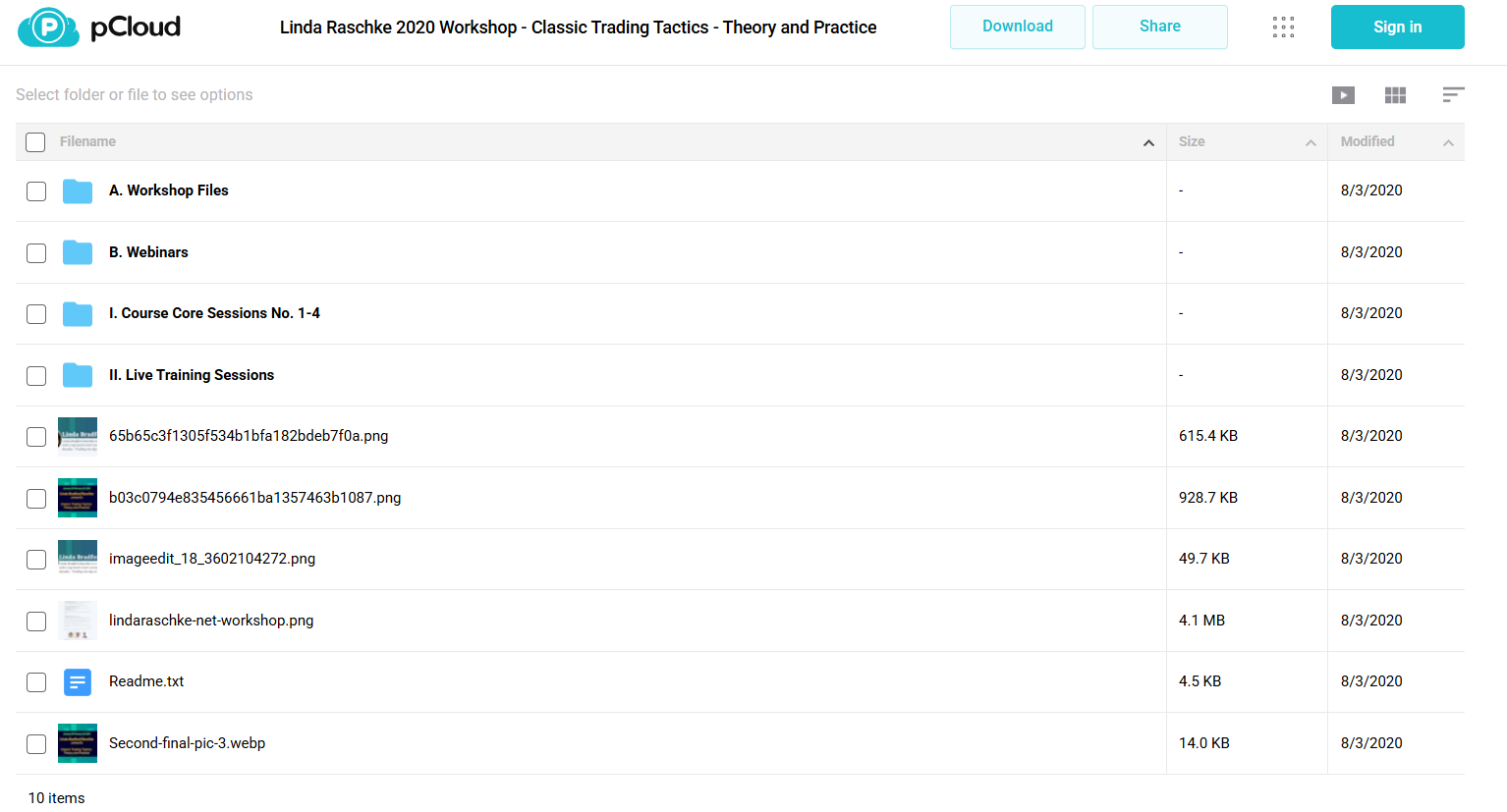

📚 PROOF OF COURSE

What you’ll learn in Linda Raschke Classic Trading Tactics:

This program teaches you professional trading methods that work in real markets. Here’s what you’ll learn in this course:

- Position Trading: Eight specific setups for longer-term trades using technical analysis and market structure

- Swing Trading: Proven overnight trading strategies with 3-5 trade setups each week

- Intraday Trading: Reliable S&P futures patterns and how to use market internals

- Trade Execution: How to handle orders from small to large size

- Position Management: Active techniques to protect profits and control risk

- Trading Psychology: How to stay calm and focused while managing winning and losing trades

By the end, you’ll have a complete trading system that works across different timeframes, from intraday to position trades.

Classic Trading Tactics Course Curriculum:

✅ Section 1: Foundations of Trading

This foundational section establishes core trading concepts and methodologies through Linda Raschke’s Classic Trading Tactics Workshop. Students gain essential knowledge of market dynamics, technical analysis, and trading psychology through comprehensive theoretical and practical instruction.

Module 1.1: Core Trading Concepts

The initial module delivers fundamental trading principles through four intensive sessions. Each session builds upon previous concepts, creating a solid foundation for advanced trading techniques.

- Classic Trading Tactics Workshop Sessions 1-4 (Video, PDF)

- Trade Sheet Explanation (Video)

Module 1.2: Technical Tools and Indicators

This module covers the implementation of technical analysis tools and custom indicators. Students learn to set up and utilize professional-grade trading platforms and analytical tools.

- LBR Tradestation Indicator Tutorial (Video)

- Custom Indicator Package (Technical Files)

- Platform Configuration Guides (PDF)

✅ Section 2: Live Market Analysis

This section provides intensive real-world market analysis through live trading sessions. Students observe and learn from professional traders as they analyze and execute trades in real-time market conditions.

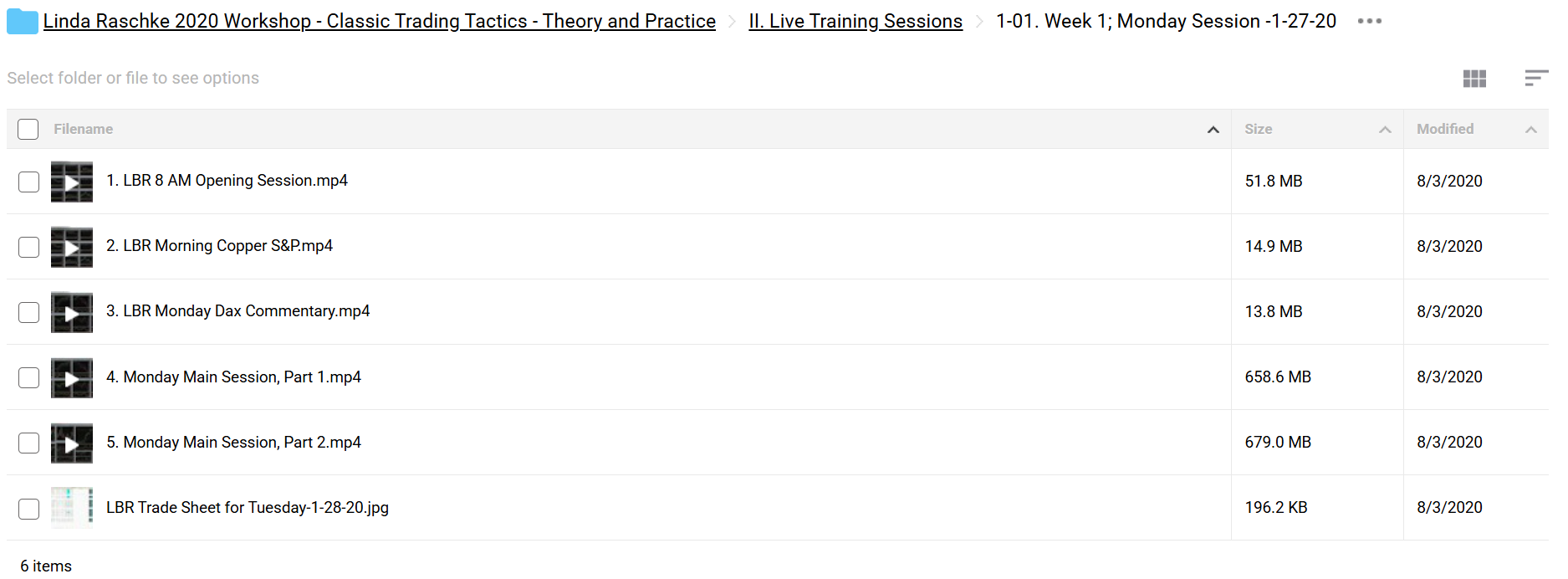

Module 2.1: Morning Trading Sessions

Daily morning sessions focus on market opening strategies and early trading opportunities. Students learn to analyze pre-market conditions and identify potential trading setups.

- Live Morning Trading Sessions (Video)

- Daily Trade Sheets (Image)

- Market Commentary (Video)

Module 2.2: Afternoon Trading Sessions

Afternoon sessions concentrate on intraday trading patterns and market dynamics. These sessions provide detailed analysis of market developments and trading opportunities.

- Live Afternoon Trading Sessions (Video)

- Strategy Implementation Reviews (Video)

- Trading Documentation (PDF)

✅ Section 3: Advanced Trading Techniques

This section delves into specialized trading methodologies and advanced market analysis techniques. Students learn sophisticated approaches to market analysis and trade execution.

Module 3.1: Special Topics

Advanced trading concepts are explored through specialized presentations and expert sessions.

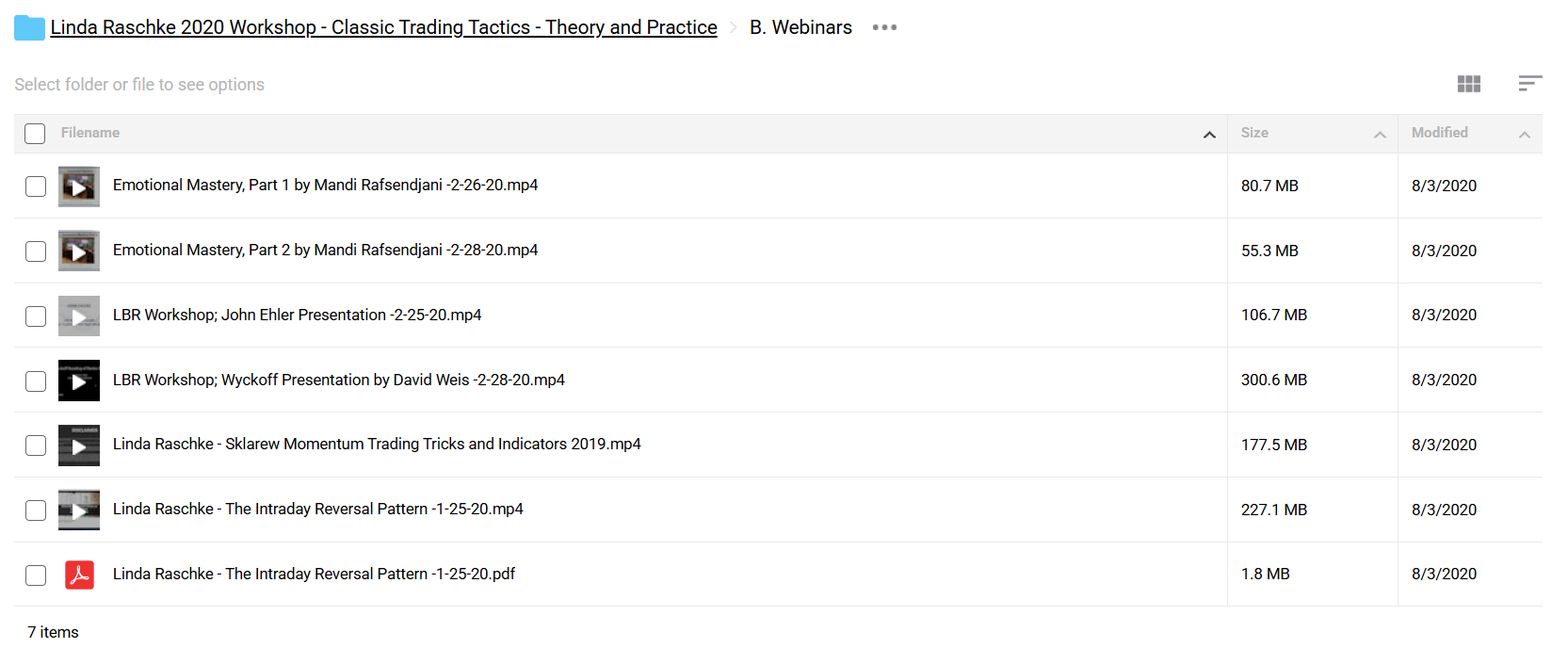

- Wyckoff Trading Presentation (Video)

- Momentum Trading Techniques (Video)

- Intraday Reversal Patterns (Video, PDF)

Module 3.2: Trading Psychology

This module addresses the critical psychological aspects of trading through focused sessions on emotional mastery and discipline.

- Emotional Mastery Sessions (Video)

- Habit Formation Techniques (PDF)

- Risk Management Protocols (PDF)

✅ Section 4: Professional Trading Integration

The final section focuses on integrating all learned concepts into a cohesive trading approach. Students learn to develop and maintain a professional trading operation.

Module 4.1: Market Reading Skills

Advanced market analysis techniques are presented through comprehensive documentation and practical examples.

- Market Theory Applications (PDF)

- Professional Trading Guidelines (PDF)

- Expert Trader Interviews (Audio)

Module 4.2: Trading Operations

This module covers the practical aspects of professional trading operations and risk management.

- Trade Management Guidelines (PDF)

- Risk Control Protocols (PDF)

- Performance Analysis Methods (PDF)

The curriculum includes supplementary resources such as recommended trading books, platform-specific technical files, and detailed trading documentation to support ongoing learning and development.

Who is Linda Raschke?

Linda Raschke is a professional trader with over 40 years of experience. She started in 1981 as a market maker in equity options at the Pacific Coast and Philadelphia Stock Exchange.

She founded LBR Asset Management in 1992 as a Commodity Trading Advisor (CTA). Her hedge fund ranked 17th out of 4,500 funds for five-year performance by BarclaysHedge.

Linda wrote two well-known trading books: “Street Smarts: High Probability Short-Term Trading Strategies” and “Trading Sardines.” She has taught professional traders in 22 countries and was featured in “The New Market Wizards.”

She specializes in futures trading, swing trading, and technical analysis. She served as president of the American Association of Professional Technical Analysts and remains a respected voice in trading education.

Be the first to review “Linda Raschke – Classic Trading Tactics – Theory and Practice (2020)” Cancel reply

Related products

Futures Trading

Forex Trading

Futures Trading

Trading Courses

Swing Trading

Trading Courses

Futures Trading

Futures Trading

Reviews

There are no reviews yet.