Wall Street Prep – Financial Planning & Analysis Modeling Certification (FPAMC)

$499.00 Original price was: $499.00.$48.00Current price is: $48.00.

Wall Street Prep Financial Planning & Analysis Modeling Certification (FPAMC) Course [Instant Download]

1️⃣. What is FPAMC?

Wall Street Prep’s FPAMC is a course that teaches you how to build and analyze financial models for business planning and forecasting.

This program shows you how to create operating models, make financial forecasts, and build interactive dashboards that help companies make better decisions.

The course gives you practical skills to analyze data, create financial projections, and present insights that drive business strategy.

Many finance teams at big global companies use these methods, making this certification valuable for people working in finance or wanting to move into that field.

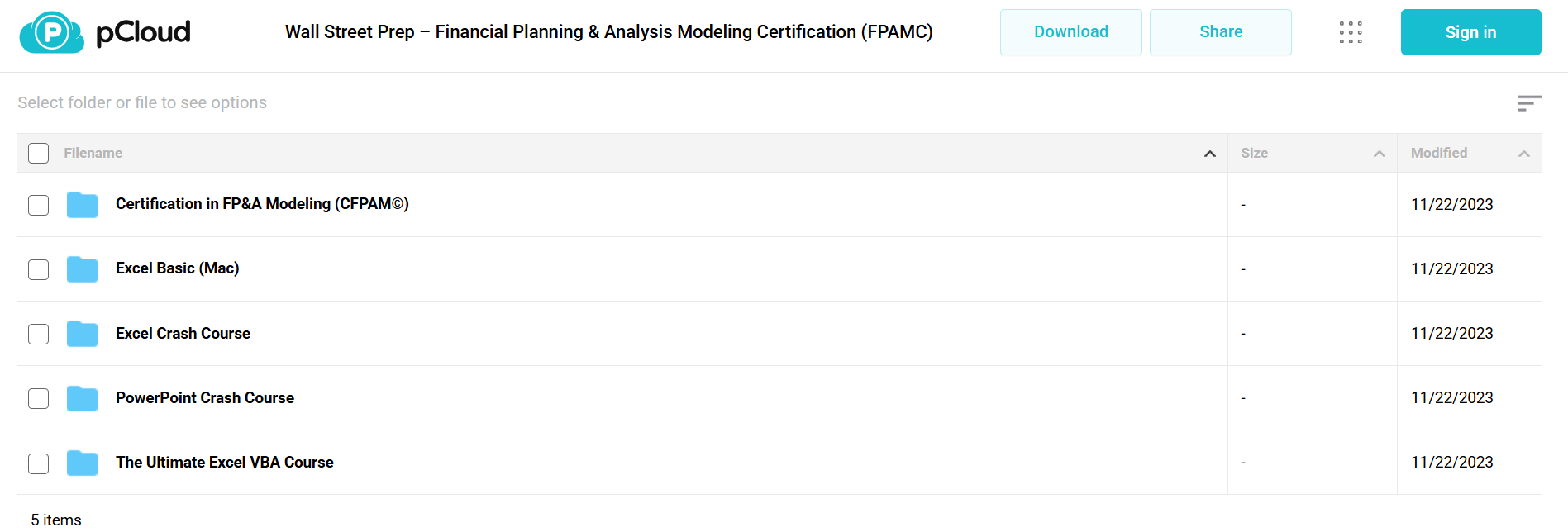

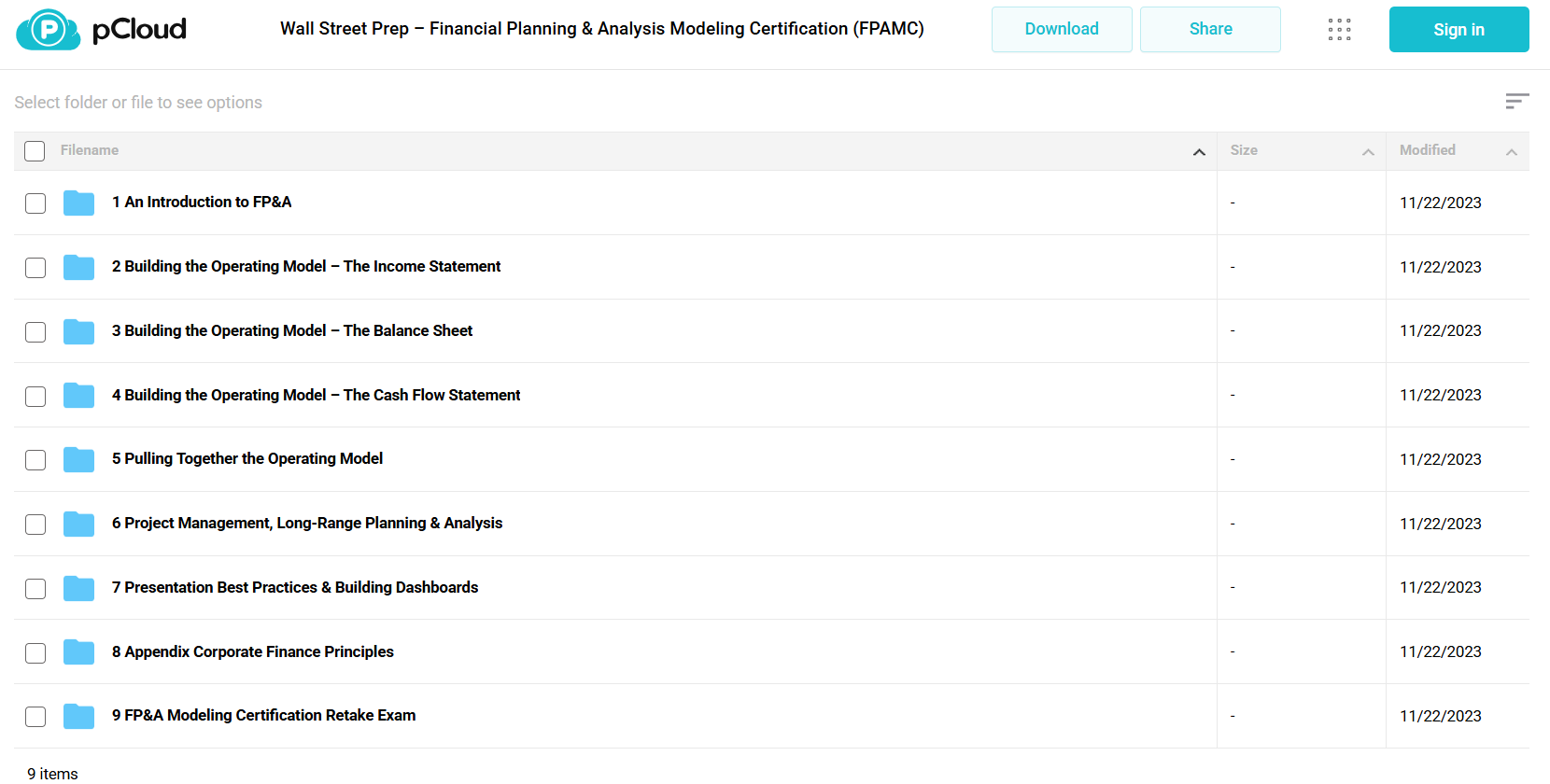

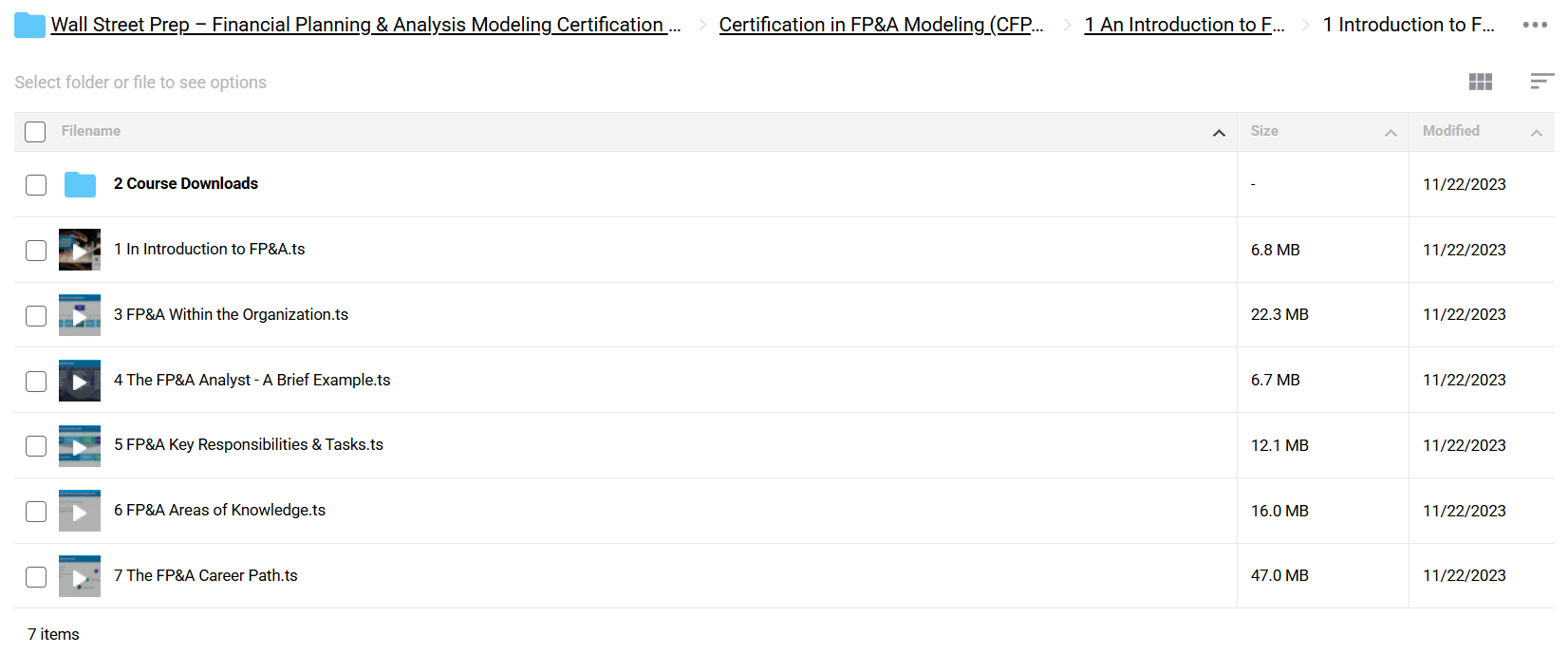

📚PROOF OF COURSE

2️⃣. What you’ll learn in FPAMC:

The FPAMC teaches you the key skills needed for modern financial planning and analysis. Here’s what you’ll learn:

- Build Operating Models: Create complete financial projections using income statements, balance sheets, and cash flows to understand company performance

- Plan for the Future: Make long-term financial plans with different scenarios to help businesses make better decisions

- Show Data Clearly: Design dashboards and reports that make complex financial information easy to understand

- Master Financial Forecasting: Learn to make both short-term and long-term projections to predict business outcomes

- Understand Corporate Finance: Learn key financial concepts to help guide company strategy

- Excel Best Practices: Build professional financial models using proven methods from industry experts

The course connects real-world practice with important concepts, preparing you for actual FP&A work at any company.

3️⃣. FPAMC Course Curriculum:

This comprehensive curriculum provides a complete foundation in Financial Planning & Analysis (FP&A), combining theoretical knowledge with practical applications. The program spans from basic Excel skills to advanced financial modeling and presentation techniques.

✅ Section 1: Certification in FP&A Modeling (CFPAM©)

Module 1.1: Introduction to FP&A

A foundational introduction covering the core principles of Financial Planning & Analysis. Students learn about FP&A’s role within organizations, key responsibilities, and career progression paths. The module establishes fundamental knowledge necessary for advanced concepts.Module 1.2: FP&A Systems and Tools

Comprehensive coverage of essential tools used in FP&A practice, including Excel best practices, VBA fundamentals, PowerPoint skills, and introduction to data analysis using SQL and Python. This module ensures technical proficiency in industry-standard applications.Module 1.3: FP&A Core Concepts – Accounting

Deep dive into fundamental accounting principles essential for FP&A work. Topics include double-entry accounting, accrual principles, revenue recognition, and financial statement relationships. This module bridges accounting theory with practical financial modeling applications.

Module 1.4: FP&A Core Concepts – Corporate Finance

Advanced exploration of corporate finance principles, including time value of money, NPV analysis, IRR calculations, and growth formulas. Students learn to apply these concepts in real-world financial modeling scenarios.

✅ Section 2: Building the Operating Model

Module 2.1: Income Statement Modeling

Comprehensive coverage of income statement modeling techniques, including revenue forecasting, expense modeling, and headcount planning. The module emphasizes practical applications and best practices in financial modeling.Module 2.2: Balance Sheet Modeling

Detailed instruction on balance sheet modeling, focusing on working capital, fixed assets, and liability forecasting. Students learn to create dynamic, integrated balance sheet models that link with income statement projections.Module 2.3: Cash Flow Statement Modeling

Advanced techniques for cash flow statement modeling, including both direct and indirect methods. This module completes the core financial statement modeling trilogy, ensuring students can build fully integrated three-statement models.

✅ Section 3: Advanced Excel and Technical Skills

Module 3.1: Excel Crash Course

Comprehensive Excel training covering essential functions, formulas, and analytical tools. Topics include lookup functions, pivot tables, and advanced Excel features crucial for FP&A work.Module 3.2: VBA Programming

Advanced Visual Basic for Applications (VBA) training, enabling students to automate routine tasks and create sophisticated Excel applications. The module progresses from basic macros to complex user forms and custom functions.Module 3.3: PowerPoint for Financial Presentations

Professional presentation skills focusing on financial data visualization, slide design, and effective communication of complex financial information. Students learn to create impactful executive-level presentations.

✅ Section 4: Project Management and Strategic Planning

Module 4.1: Project Management Best Practices

Essential project management techniques tailored for FP&A professionals. Covers planning, execution, and monitoring of financial projects and initiatives.Module 4.2: Strategic and Long-Range Planning

Advanced concepts in strategic financial planning, including scenario analysis, sensitivity testing, and long-range forecasting. Students learn to develop and present comprehensive financial plans aligned with strategic objectives.

✅ Section 5: Data Analysis and Reporting

Module 5.1: Dashboard Development

Techniques for creating effective financial dashboards and automated reporting solutions. Focus on data visualization, KPI tracking, and executive-level reporting.Module 5.2: Analysis and Presentation

Advanced analytical techniques and presentation skills, ensuring students can effectively communicate complex financial information to various stakeholders.

The program concludes with comprehensive examinations for each major section, culminating in the CFPAM© certification. Students must demonstrate proficiency in all core areas through practical assignments and final examinations.

4️⃣. What is Wall Street Prep?

Wall Street Prep is a top financial training company created by former investment bankers. They provide training to major banks, companies, and universities worldwide.

Their courses are built by experts who actually work in finance, bringing real job experience to their teaching. Over 25,000 professionals in 47 countries have completed their training.

Wall Street Prep partners with Wharton Online and teaches practical skills you can use right away in your finance career. Their hands-on approach has made them a trusted name in financial modeling training.

5️⃣. Who should take Wall Street Prep Course?

This FP&A certification helps you build practical financial modeling and analysis skills. The course is perfect for:

- Financial Analysts who want to get better at building models and forecasting business outcomes

- FP&A Professionals ready to learn advanced planning methods and create different business scenarios

- Controllers and CFOs looking to improve how they analyze and present financial data

- Accounting Professionals moving into financial planning and analysis roles

- Business Professionals who need to work with financial models and understand company numbers

Whether you’re just starting out or already working in finance, this program gives you the skills and certification needed for FP&A work. You’ll learn at your own pace with real-world examples and practical exercises.

6️⃣. Frequently Asked Questions:

Q1: What is the key to building a strong financial model?

Q2: What are the common mistakes in financial modeling?

Q3: What skills are essential for professional FP&A?

Q4: How can scenario analysis improve financial planning?

Q5: What is the role of FP&A in strategic decision-making?

Be the first to review “Wall Street Prep – Financial Planning & Analysis Modeling Certification (FPAMC)” Cancel reply

Related products

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Reviews

There are no reviews yet.