The Harbour Club – Learn How To Buy And Sell Businesses For A Living

$200.00 Original price was: $200.00.$41.00Current price is: $41.00.

The Harbour Club Learn How To Buy And Sell Businesses For A Living [Instant Download]

What is The Harbour Club Buy And Sell Businesses?

Learn How To Buy And Sell Businesses For A Living is a course by The Harbour Club, it teaches you how to buy and sell small to medium-sized businesses without using your own money.

You’ll learn how to find businesses for sale, negotiate with owners, and structure deals using no-money-down techniques. The course focuses on practical M&A methods you can use immediately.

Jeremy Harbour reveals his proven system for acquiring companies, improving their value, and selling them for profit – all without needing startup capital or bank loans.

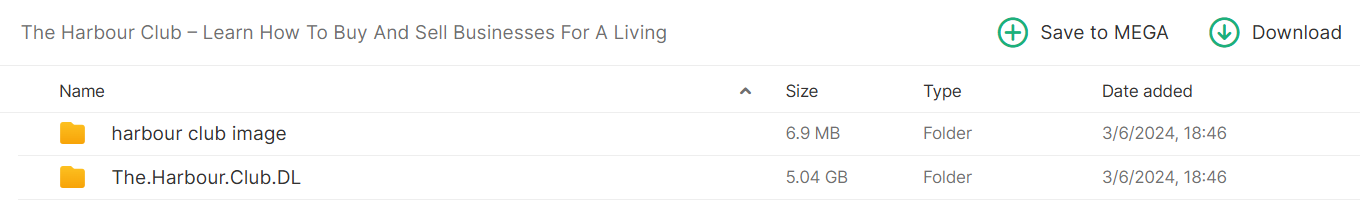

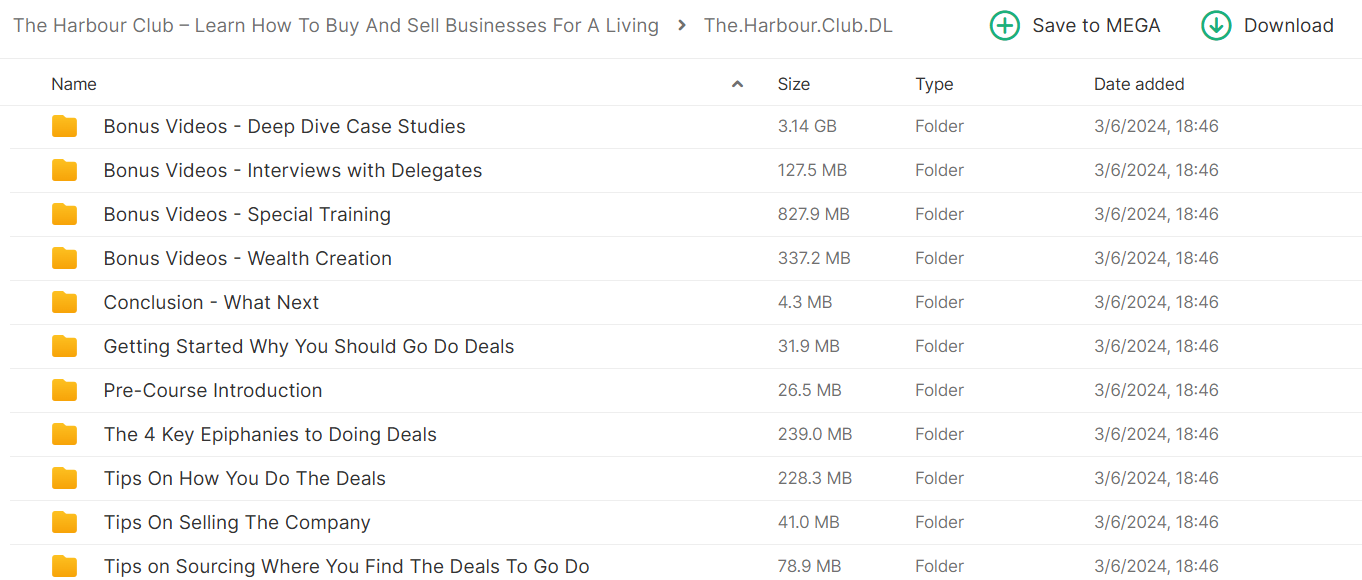

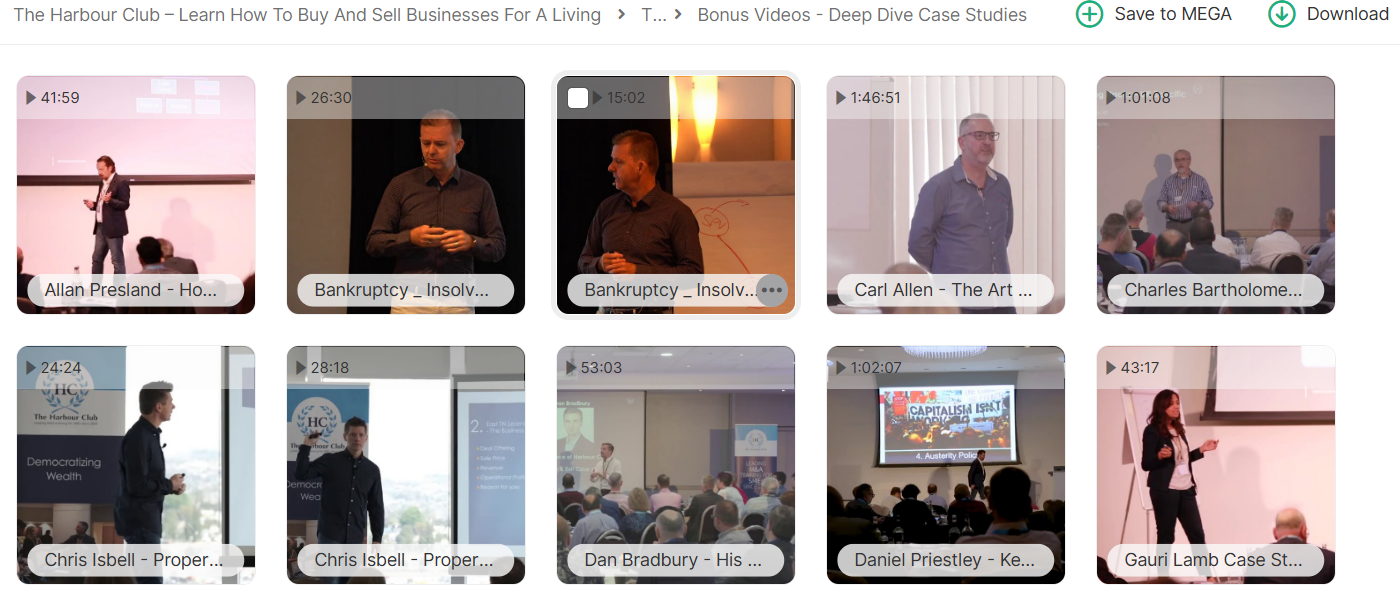

📚 PROOF OF COURSE

What you’ll learn from The Harbour Club Buy And Sell Businesses:

The Harbour Club’s M&A program transforms you into a skilled business buyer and seller. Here’s what you’ll master:

- Deal Sourcing: Find motivated sellers and identify profitable acquisition targets

- Deal Structuring: Master no money down acquisitions and innovative financing methods

- Business Valuation: Learn to evaluate companies and spot growth opportunities

- Negotiation Skills: Develop techniques to close deals successfully

- Exit Strategies: Create and execute profitable exit plans

- Legal Framework: Navigate legal aspects of M&A transactions confidently

By the end of this course, you’ll have the skills and knowledge to buy and sell businesses professionally.

The Harbour Club Buy And Sell Businesses Curriculum:

✅ Section 1: Program Introduction

This foundational section introduces students to the core concepts of business acquisition and deal-making. The curriculum establishes essential mindsets and frameworks for successful deal execution.

Module 1.1: Pre Course Foundations

Introduction to core program concepts and instructor background. Students learn fundamental principles of deal making and business acquisition. (MP4)

- Welcome to Pre-Course (MP4)

- Instructor Background (MP4)

✅ Section 2: Deal Making Fundamentals

This section explores the key realizations necessary for successful deal making. Students learn critical perspectives that shape effective business acquisition strategies.

Module 2.1: Core Business Epiphanies

Fundamental shifts in thinking required for successful deal making. Students learn key insights about business acquisition and value creation. (MP4)

- Strategic Position Analysis (MP4)

- Business Growth Acceleration (MP4)

- Value Creation Principles (MP4)

✅ Section 3: Deal Structure and Execution

This section covers practical deal structuring and implementation strategies. Students learn proven methods for successful business acquisitions.

Module 3.1: Deal Implementation

Comprehensive coverage of deal structuring and execution strategies. Focus on practical application and common pitfalls. (MP4)

- Agglomeration Strategies (MP4)

- SPV Implementation (MP4)

- Strategic Acquisitions (MP4)

- Agreement Structuring (MP4)

✅ Section 4: Business Sourcing and Exit Strategies

This section focuses on finding acquisition targets and planning successful exits. Students learn effective methods for both sourcing and selling businesses.

Module 4.1: Deal Sourcing

Strategic approaches to finding and evaluating business opportunities. (MP4)

- Customer Analysis Strategies (MP4)

- Network Positioning (MP4)

- Opportunity Identification (MP4)

✅ Section 5: Advanced Case Studies

This section provides in-depth analysis of successful deals and implementations. Students learn from real-world examples and experienced practitioners.

Module 5.1: Deal Analysis

Comprehensive case studies of successful business acquisitions and implementations. (MP4)

- Revenue Scaling Studies (MP4)

- LBO Model Analysis (MP4)

- Business Structure Optimization (MP4)

- Property Division Strategies (MP4)

✅ Section 6: Financial Analysis and Wealth Creation

This section covers advanced financial analysis and wealth building strategies. Students learn practical tools for evaluating and structuring deals.

Module 6.1: Financial Tools

Detailed coverage of financial analysis and modeling techniques. (MP4)

- Balance Sheet Analysis (MP4)

- Financial Statement Evaluation (MP4)

- Cashflow Modeling (MP4)

Module 6.2: Wealth Building

Strategic approaches to long-term wealth creation through business acquisition. (MP4)

- Wealth Creation Fundamentals (MP4)

- Advanced Wealth Strategies (MP4)

- Wealth Implementation (MP4)

The program includes extensive visual resources and reference materials to support learning implementation. (PNG)

What is The Harbour Club?

Jeremy Harbour started The Harbour Club in 2009 to teach SME mergers and acquisitions.

Based in Singapore, he has bought and sold over 100 businesses and advised on more than 200 deals in the past 20 years.

He is also the founder of The Unity Group, a private equity firm helping entrepreneurs grow through strategic acquisitions.

The Harbour Club has trained thousands of students worldwide, building a strong network of successful dealmakers. His work is recognized by major business publications.

Be the first to review “The Harbour Club – Learn How To Buy And Sell Businesses For A Living” Cancel reply

Related products

Business & Finance

Business & Finance

Reviews

There are no reviews yet.