Monica Main – Credit Business and Personal

$597.00 Original price was: $597.00.$54.00Current price is: $54.00.

Monica Main Credit Business and Personal Course [Instant Download]

What is Monica Main Credit Business and Personal?

Monica Main’s Credit Business and Personal is the course that teaches you how to get $50,000 to $500,000 in unsecured business credit lines, even with less-than-perfect credit.

The course shows you exactly how to repair your personal credit score while building separate business credit. You’ll learn which banks offer the best unsecured credit lines and how to qualify for them.

This step-by-step program reveals proven methods to leverage both personal and business credit for maximum funding opportunities. The strategies work for both startups and existing businesses.

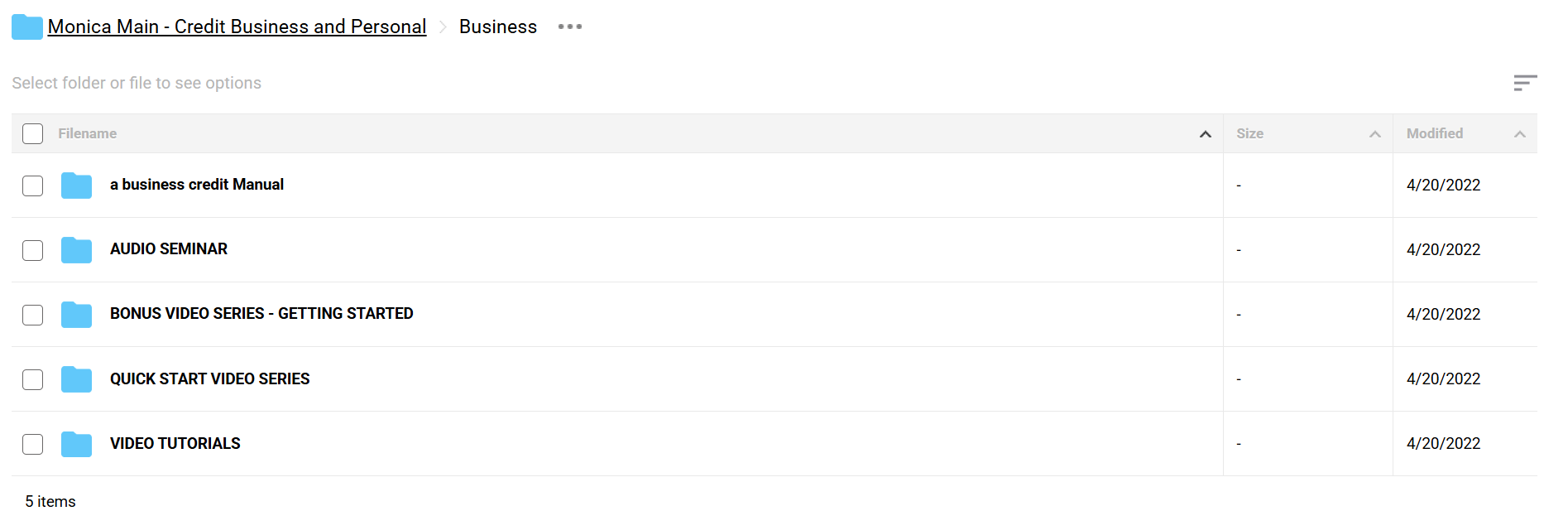

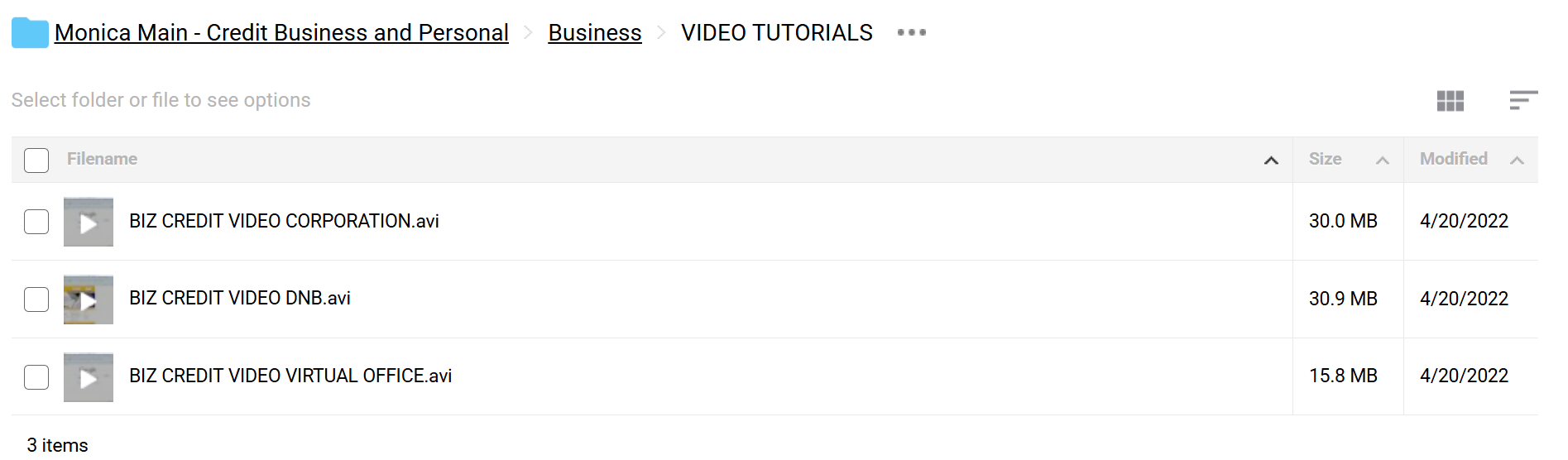

📚 PROOF OF COURSE

What you’ll learn in Credit Business and Personal:

This course shows you how to build strong credit for your personal life and business success. Here’s what you’ll learn:

- Fix Bad Credit: Learn the exact steps to repair and boost your personal credit score fast

- Build Business Credit: Get a proven system to establish strong business credit from scratch

- Get Business Funding: Master how to obtain $50,000 to $500,000 in unsecured credit lines

- Use Credit Wisely: Learn smart ways to use credit for growing your wealth

- Access Top Resources: Get trusted tools and contacts for building your credit

After finishing the course, you’ll know exactly how to use credit to achieve your personal and business money goals.

3️⃣. Credit Business and Personal Course Curriculum:

The Credit Business and Personal course is split into two main sections to help you master both business and personal credit building. Each section includes video lessons, guides, and practical tools to help you succeed. The course curriculum includes:

✅ Module 1: Business

- A Business Credit Manual

- Audio Seminar

- Bonus Video Series – Getting Started

- Quick Start Video Series

- Video Tutorials

✅ Module 2: Personal

- Disc 1

- Disc 2

- Disc 3 Plus Book

- Monica Main Triple A Credit In 90 Days Or Less

- Personal Credit Builder

Every module builds on the previous one, taking you from basic concepts to advanced strategies. By the end of both sections, you’ll have all the skills needed to build strong credit profiles for both your business and personal life.

Who is Monica Main?

Monica Main is a credit expert who teaches people how to build strong personal and business credit. She’s helped over 25,000 students get approved for large business credit lines and improve their credit scores.

As a successful real estate investor and business owner, Monica wrote the popular book “Credit Secrets Revealed.” She uses these same credit-building strategies in her own businesses.

Monica started as a real estate investor, where she learned how to leverage credit for business growth. Now she teaches others how to fix their credit and get business funding, using methods she’s proven in the real world.

Her students have successfully accessed business credit lines from $50,000 to $500,000 using her strategies. She continues to help entrepreneurs and business owners build strong credit profiles that banks approve.

Be the first to review “Monica Main – Credit Business and Personal” Cancel reply

Related products

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Best 100 Collection

![[Bundle] Best 28 Tai Lopez Courses](https://coursehuge.com/wp-content/uploads/2024/01/Bundle-Best-28-Tai-Lopez-Courses-300x300.jpg)

Reviews

There are no reviews yet.