Learning

Top 5 Tape Reading Courses for Trading

1️⃣. What is Tape Reading?

Tape Reading is a trading technique that analyzes stock price movements and volume. Traders used paper tape from 1860s to 1960s to track stocks, where telegraph wires sent each stock’s symbol, price, and volume data.

Computers and electronic networks replaced this method.

Edward A. Calahan built the first ticker tape in 1867. Thomas Edison improved it in 1871, making trading faster.

Jesse Livermore mastered tape reading to trade momentum. Books like “Tape Reading and Market Tactics” and “Reminiscences of a Stock Operator” teach his methods.

Traders now watch electronic order books. These screens show live trades and pending orders to reveal market moves.

They spot support and resistance by tracking buy and sell orders across exchanges. Level II market data shows this information and powers trading programs.

Trading language still uses old terms like “ticker symbol,” “stock ticker,” and “don’t fight the tape” (follow the market trend).

👉 Read more our Top Tape Reading Courses:

2️⃣. Is Tape Reading different Chart Reading?

Let’s look at tape reading and chart reading. They’re both used in trading, but they’re different.

Here’s a quick comparison to show how they’re not the same.

✅Tape Reading

- Real-time market activity analysis

- Focuses on current trades and orders

- Studies immediate order flow details

- Requires quick trading decisions

- Predicts short-term price moves

✅Chart Reading

- Studies historical price data

- Analyzes past market patterns

- Identifies repeating price trends

- Allows strategic trade planning

- Forecasts longer-term market moves

So, tape reading is about what’s happening in the market, and chart reading is about looking at past trends to guess the future.

Both are useful, and many traders use them together for the best results.

3️⃣. Why Learn Tape Reading?

Tape reading gives traders a real-time edge by showing market moves before they appear on charts.

The technique reveals current market psychology through live buying and selling pressure.

You can see actual supply and demand through Level II data, showing where money flows right now.

Unlike charts that show past moves, tape reading signals market direction as it happens.

This skill helps traders enter and exit trades at better prices while keeping risk low.

Tape reading is essential for day traders who want to catch market moves early.

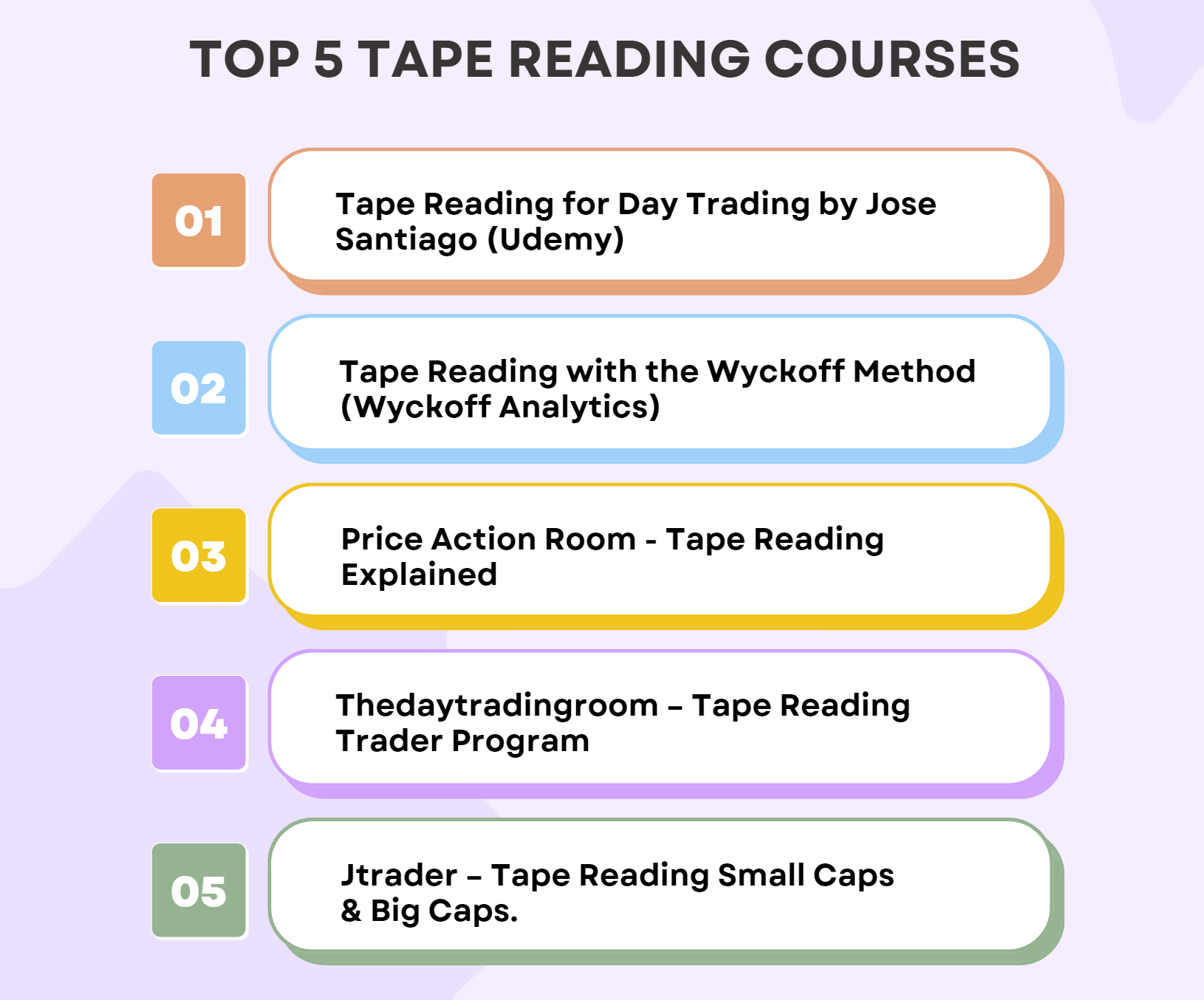

4️⃣. Best 5 Tape Reading Courses

I’ve traded for five years and completed eight tape reading courses. These skills have helped me spot better entries and exits in the market.

I tested these courses for three months and talked with traders who used them. Each course was judged on how well students learn order flow and apply it to real trading.

These five courses stand out for clear teaching and practical strategies that work in today’s markets.

Let’s review each course…

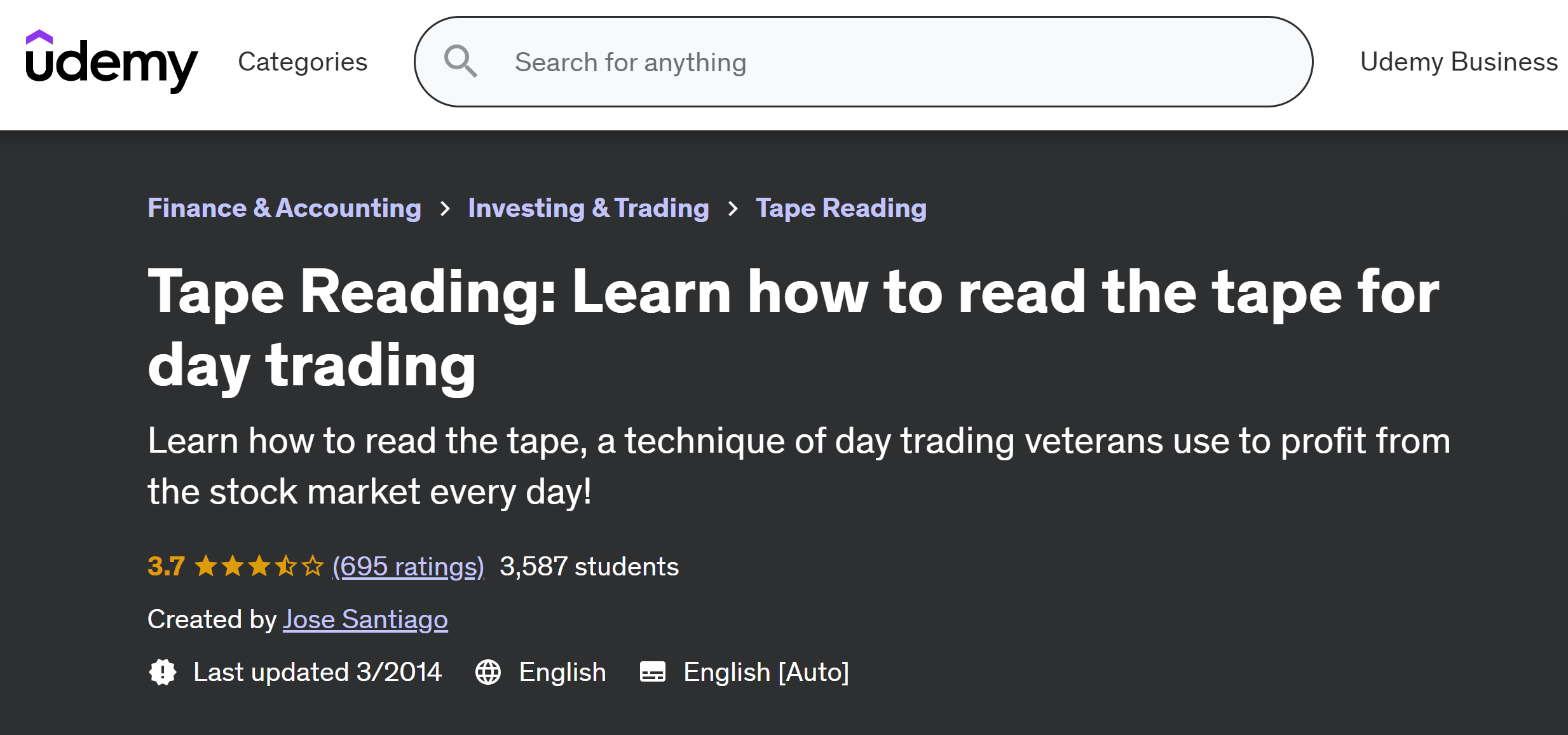

Course No #1: Tape Reading for Day Trading by Jose Santiago (Udemy)

Tape Reading for Day Trading course teaches day traders how to read market flow from basic to advanced levels.

Jose Santiago, a partner at Bidhitter, has traded for 20 years in NYC and Miami prop desks and hedge funds. He’s been featured in Time magazine online and Business Insider.

Course Details:

- Price: $10

- Students: 3,587

- Rating: 3.7 from 695 reviews

- Length: 8+ hours of video

What You’ll Learn from Jose Santiago Tape Reading Course

- Basic tape reading skills

- How to use Level I & II market data

- Finding large orders and algorithm patterns

- Reading buy/sell signals

- Better trade timing and risk control

Course Structure:

- Introduction (43 min)

- Level I & II Basics (21 min)

- Order Flow Patterns (27 min)

- Reading Trades (1hr 43min)

- Large Buy Orders (27 min)

- Large Sell Orders (23 min)

- Sustained Buying (45 min)

- Sustained Selling (41 min)

- Wrap-up (25 min)

- Extra Materials (4hr 33min)

The course uses video, audio, and text to help you learn. You also get access to a tape reading practice archive.

Course No #2: Tape Reading with the Wyckoff Method (Wyckoff Analytics)

Wyckoff Analytics Tape Reading Course that teaches traders how to blend classic tape reading with the Wyckoff Method for better market analysis.

Roman Bogomazov teaches at Golden Gate University and leads WyckoffAnalytics.com. He started Wyckoff Associates, LLC and is respected for his deep market knowledge and teaching skills.

Course Details:

- Price: $750

- Rating: 3.7 from 695 reviews

- Status: Highly Recommended

- Instructor: Roman Bogomazov, with 25+ years of trading experience

Course Structure:

Series 1: Basic Training

- Price bar analysis techniques

- Understanding Wyckoff’s Supply and Demand Laws

- How to read market swings

- Using Point-and-Figure charts

- Understanding volume signals

- Practice drills with feedback

Series 2: Deeper Skills with David Weis and Roman

- Traditional Wyckoff tape reading methods

- Modern Point-and-Figure trading

- How to use the Weis Wave indicator

- Detailed trading bar analysis

- Real market practice sessions

Series 3: Advanced Training with William Reardon

- Day trading and swing trading tactics

- How to trade S&P500 futures

- Trading multiple timeframes

- Live market analysis

- Advanced trading exercises

Why choose Wyckoff Analytics Courses:

- Shows how to analyze price, volume, and time together

- Helps make smarter trading decisions

- Skills work in any market type

- Mixes proven old methods with modern trading

The course uses real market examples, hands-on practice, and expert feedback to build strong trading skills that last.

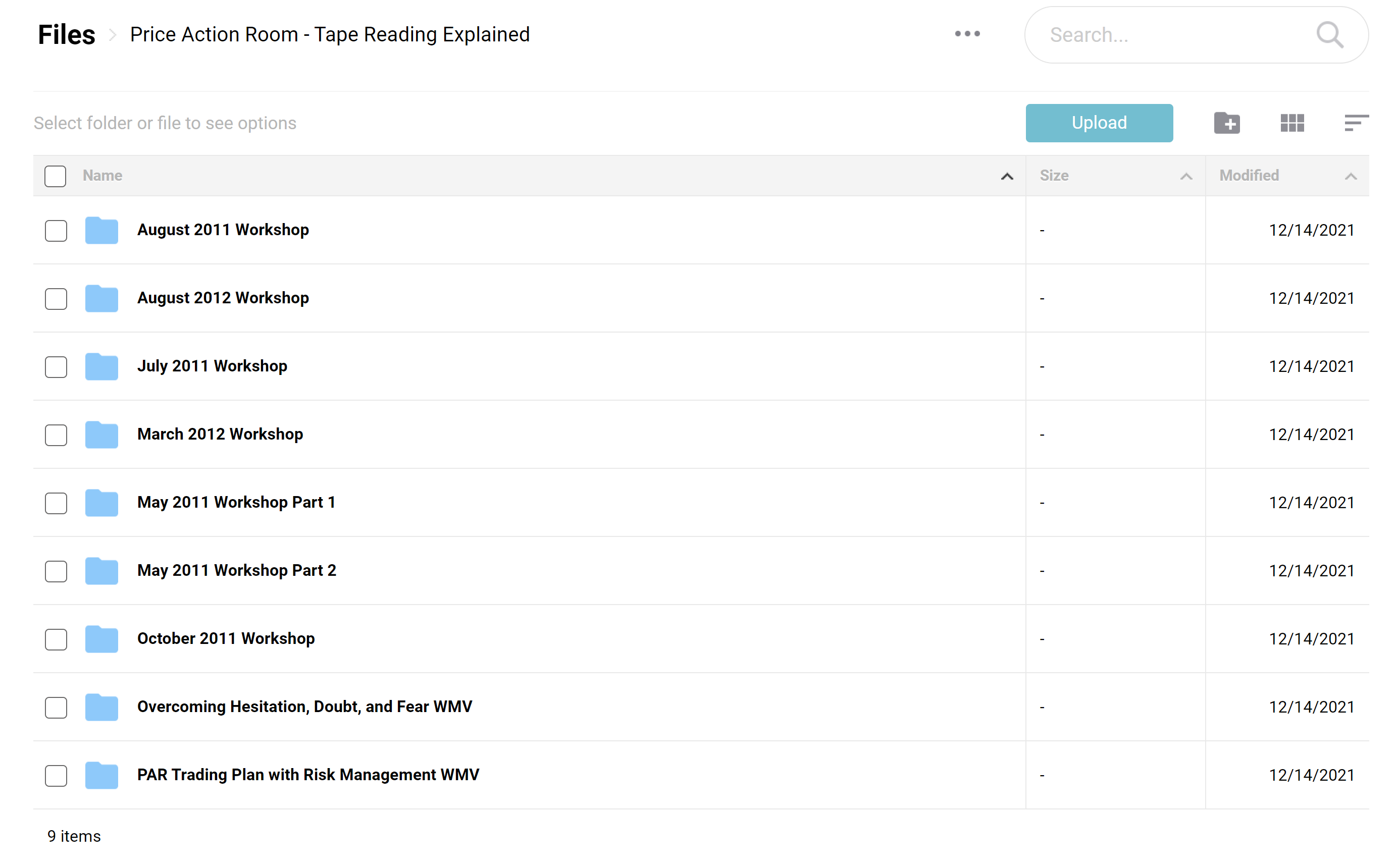

Course No #3: Price Action Room – Tape Reading Explained

This course teaches traders how to spot market opportunities by reading Time & Sales data and DOM (Depth of Market) tools.

You’ll learn through both theory and live market practice.

Course Details:

- Publisher: Price Action Room

- Regular Price: $1,695

- Special Price: $22

- Content Size: 11 GB

- Training Length: 70 hours

What You’ll Learn from Price Action Room course

- How to use Jigsaw Time & Sales tool

- Reading Time & Sales data

- Understanding Depth of Market (DOM)

- Live market analysis

- Trade entry and exit timing

- Risk management strategies

This course helps traders improve their market reading skills and make better trading decisions using professional tools.

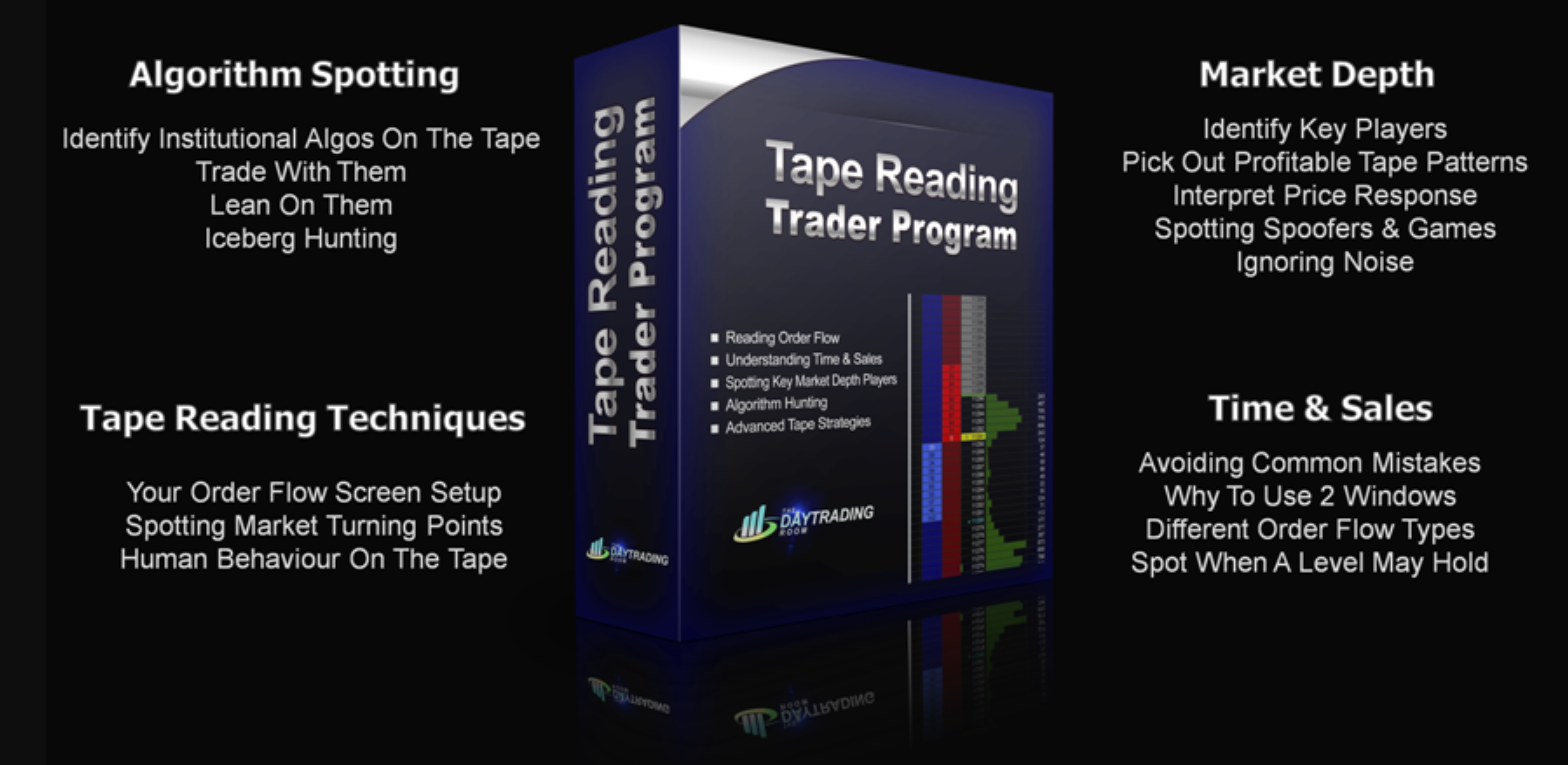

Course No #4: Thedaytradingroom – Tape Reading Trader Program

This 4-hour video course shows traders how to read market order flow for successful scalp trading. You’ll learn how big institutions trade and how to spot their patterns for better entries and exits.

Course Details:

- Publisher: Thedaytradingroom

- Regular Price: $199

- Special Price: $22

- Length: 4 hours of focused training

What You’ll Learn:

- Advanced tape reading techniques for daily trading

- How to organize your trading screens for quick decisions

- Ways to spot market shifts using supply and demand signals

- Reading Time & Sales data for trade clues

- Profitable tape patterns that work in real trading

- How large traders react to price moves

- Creating low-risk scalp trades with high success rates

Trading Skills You’ll Develop:

- Reading Market Depth to find big players

- Understanding institutional trading patterns

- Recognizing key market turning points

- Making fast, smart scalping decisions

- Managing risk on quick trades

- Setting up your screens for efficient trading

This course helps scalp traders understand and use order flow data to trade more effectively in today’s markets.

Course No #5: Jtrader – Tape Reading Small Caps

Jtrader Tape Reading Small Caps teaches traders how to read market flow in small cap stocks, which are more volatile and offer unique trading opportunities.

The founder brings 20 years of trading experience to this practical training.

Course Details:

- Publisher: JTrader

- Regular Price: $299

- Special Price: $45

- Focus: Small Cap Market Trading

What You’ll Learn from Jtrader Tape Reading Course:

- How small cap stocks move differently

- Reading tape patterns for early signals

- Spotting uptrends and downtrends

- Finding market reversal points

- Managing positions for better profits

- Avoiding common trading mistakes

Trading Application: The course shows how to use tape reading specifically for small cap trading. You’ll learn to spot opportunities in these volatile markets while protecting your capital.

This training helps traders understand and profit from small cap stock movements using proven tape reading methods.

5️⃣. What’s the Best Tape Reading Course for You?

After using tape reading daily for five years and testing these courses in real trading, here’s my honest take on choosing the right one for your needs.

For Beginners: “Tape Reading 101” gives you the foundation. When I started, this course helped me understand basic order flow and market pressure. It’s easy to follow and builds confidence step by step.

For Active Day Traders: Jose Santiago’s Udemy course stands out. I use his techniques daily for futures trading. The Level II data section particularly improved my trade entries. His real market examples show exactly what to look for.

For Advanced Learning: The Wyckoff Method course transformed my trading. It’s pricier, but learning to read institutional buying and selling patterns was worth every penny. My win rate improved noticeably after applying these concepts.

For Quick Learning: Thedaytradingroom’s program is concise but powerful. I completed it in a weekend and started using the scalping techniques immediately. Great for busy traders who want practical skills fast.

My Personal Tips:

- Start with basic courses even if you’re experienced

- Practice each concept in a demo account first

- Join trading communities to share ideas

- Keep a trading journal to track your improvement

- Review course materials regularly – you’ll notice new details each time

Remember, successful tape reading comes from practice. Choose a course that matches your trading style and schedule, then commit to mastering its concepts.

What’s your experience with these courses? I’m curious to hear what worked for you.

6️⃣. Frequently Asked Questions about Tape Reading:

Q1: Does Tape Reading Still Work?

It helps spot market moves early and many profitable traders rely on it daily.

Q2: What is Level 2 Tape Reading?

This method provides deeper insight into market sentiment by showing the executed trade prices and the prices traders are willing to trade at.

Q3: What are the Strategies for Tape Reading?

– Identifying large orders.

– Understanding the speed of market movements.

– Recognizing patterns in the order flow.

These strategies help traders make informed decisions about when to enter and exit trades based on the immediate dynamics of the market.

Q4: What is Wyckoff Tape Reading?

Q5: Does Tape Reading Help Day Trading?

Day traders use it to find better entry and exit prices, spot trend changes early, and understand if a price move is genuine or likely to reverse.